INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Shares of chipmakers GlobalFoundries Inc. and NXP Semiconductors NV rose today after they posted third-quarter profit numbers that topped analyst expectations.

Both companies generate the bulk of their revenue by supplying processors for three industries: the automobile, mobile device and internet of things segments. However, their business models diverge significantly. GlobalFoundries makes chips based on blueprints provided by its customers, while NXP manufactures processors that it designs in-house.

GlobalFoundries operated as Advanced Micro Devices Inc.’s in-house chip manufacturing unit until a 2009 spinout. The company’s production lines are several generations behind the latest semiconductor manufacturing process, but lend themselves well to a range of processor projects. GlobalFoundries makes wireless networking chips for Broadcom Inc., flash storage devices and a variety of other products.

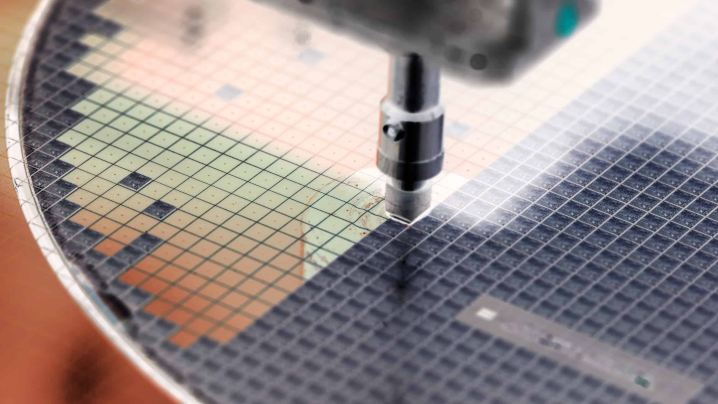

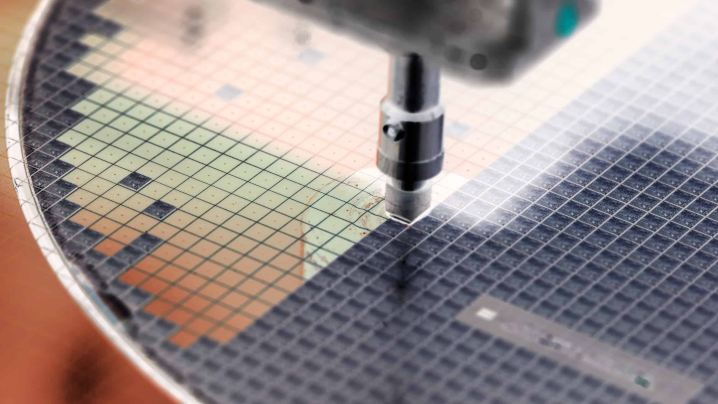

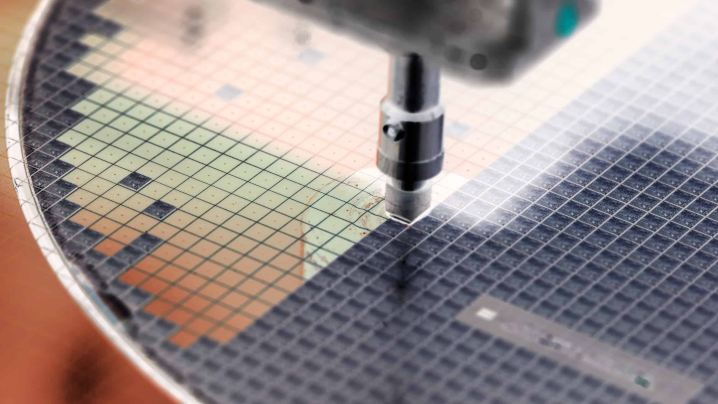

The company tracks customer demand in terms of 300-millimeter silicon wafers. A single 300-millimeter wafer, which measures about 11.8 inches across, can be turned into upwards of several hundred chips depending on the project. GlobalFoundries shipped 575,000 wafers in the third quarter ended Sept. 30 compared with 637,000 a year earlier.

The lower demand decreased the company’s revenue by 11% to $1.852 million during the third quarter, in line with analyst expectations. The mobile industry remained GlobalFoundries’ largest market, accounting for 42% of its sales. The company’s connected device chip business generated 20% of revenues, while automobile chips accounted for an additional 17%.

The sales slump impacted GlobalFoundries’ earnings to a smaller extent than analysts had expected. The company generated an adjusted net income of $308 million in the third quarter, which amounts to adjusted earnings of 55 cents per share. The consensus analyst estimate projected 50 cents per share.

“In the third quarter, GF’s dedicated teams across the world delivered financial results at the upper end of the guidance ranges we provided in our August earnings release,” said Chief Executive Officer Thomas Caulfield.

Despite the chip industry slowdown, GlobalFoundries is actively enhancing its manufacturing infrastructure to prepare for the expected recovery in semiconductor demand. During the third quarter, the company inaugurated a $4 billion fab in Singapore that took three years to build. The facility will expand GlobalFoundries’ manufacturing capacity by about 450,000 wafers per year.

The new fab is set to make, among other products, wireless networking chips based on GlobalFoundries’ new 9SW RFSOI manufacturing process. The company detailed the process a few weeks before the fab’s inauguration. According to GlobalFoundries, 9SW RFSOI will facilitate the development of 5G chips that are 10% more compact and 20% more efficient than previous-generation silicon.

It may take some time for the company’s manufacturing investments to translate into revenue growth. GlobalFoundries’ latest guidance projects revenues of $1.825 billion and $1.875 billion for the current quarter, less than the $1.89 billion analysts were expecting. In contrast, the company’s adjusted earnings forecast of 53 to 64 cents per share surpassed the consensus estimate.

Netherlands-based NXP is best known as a maker of vehicle chips, which account for about half its revenues. The former Koninklijke Philips NV unit’s processors can be found in motors, infotainment modules and driver assistance systems. It also makes chips for other markets including the data center networking segment.

NXP’s revenues in its fiscal third quarter ended Oct. 1 amounted to $3.43 billion, 0.3% less than a year earlier. Nevertheless, the company managed to top the consensus estimate of $3.4 billion. NXP disclosed that it has about 25,000 customers in the automobile sector and other markets.

“Revenue trends in our Mobile, Industrial & IoT and Automotive end-markets all performed in-line or better than anticipated, while our Communication Infrastructure & Other end market was slightly below our expectations,” said CEO Kurt Sievers.

Despite the revenue decline, the company managed to improve its profitability during the quarter. NXP’s net income rose to $792 million in the three months ended Oct. 1 from $750 million a year earlier. That translated into earnings of $3.7 per share, well ahead of the $3.61 projected by analysts.

NXP’s fourth-quarter outlook missed revenue projections but included a better-than-expected profit forecast. The company anticipates earnings of $3.65 per share on $3.4 billion in revenue. Analysts, meanwhile, were expecting earnings of $3.61 per share and $3.43 billion in sales.

Like GlobalFoundries, NXP is actively investing in growth initiatives to prepare for the chip demand recovery that major industry players are expecting. During the third quarter, it teamed up with Taiwan Semiconductor Manufacturing Co. Ltd. and two other companies to launch a new manufacturing venture. The venture will build a fab in Dresden to supply processors for customers in the automotive and industrial sectors.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.