CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Canva Inc., the company behind the popular graphic design platform of the same name, is expected to hold a secondary stock sale that will value it at $26 billion.

The Information reported the upcoming deal today, citing people familiar with the matter. A secondary sale is a transaction in which a company’s shareholders sell stock while the company itself doesn’t raise any funding. According to today’s report, Canva will allow “longtime employees and investors” to sell more than $1 billion worth of shares.

The company is said to be laying the groundwork for the deal just six months after closing a smaller secondary sale. According to The Information, that transaction was also carried out at a $26 billion valuation. Canva stock was worth $40 billion following its most recent funding round, a $200 million raise that closed in 2021.

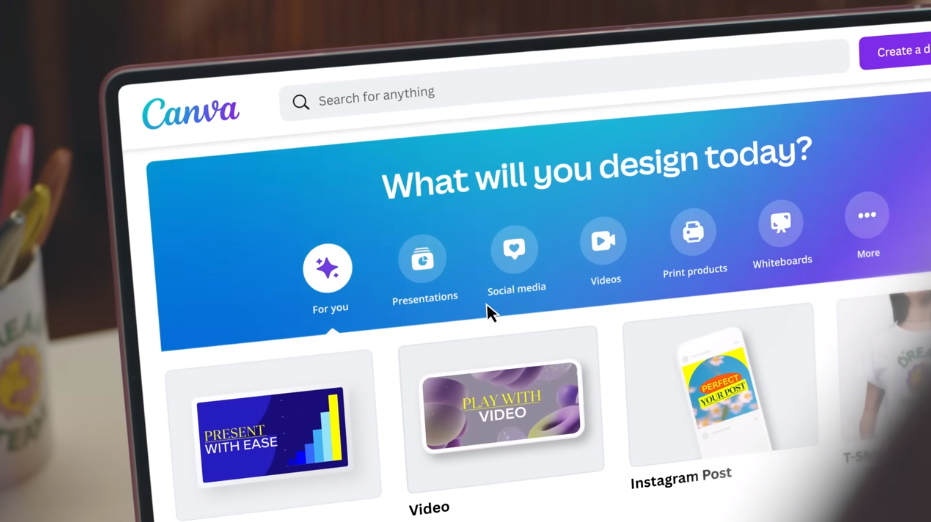

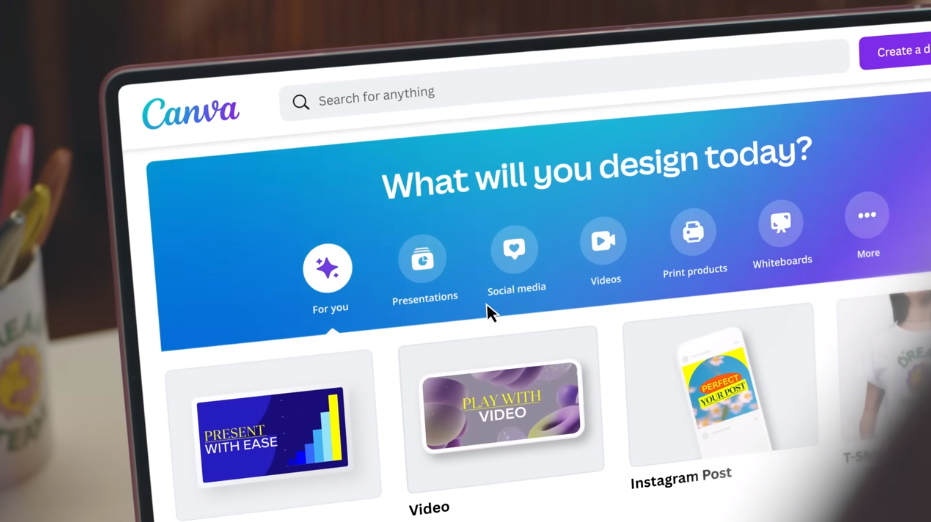

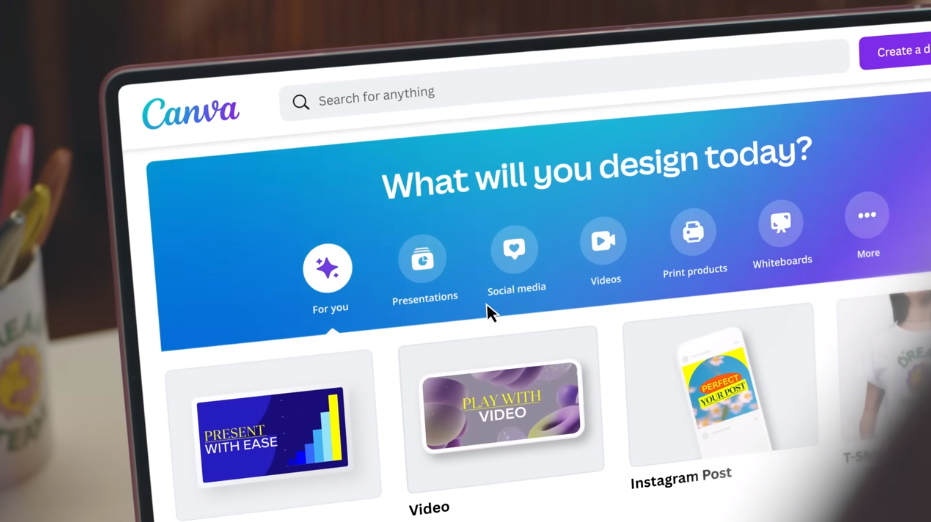

Australia-based Canva provides a platform that enables users to craft designs for documents, presentations and other files. A drag-and-drop interface makes it possible to create visual assets with no need for graphic design expertise. To simplify the user experience further, Canva provides a library of more than 120 million prepackaged design elements such as images and fonts. The company also recently enhanced its AI capabilities to offer a new suite of brand management features and tools.

The company claims that its platform has more than 170 million users in 190-plus countries. Last month, Canva disclosed that its user base includes workers at more than 90% of the Fortune 500.

The company generates revenue by selling two paid versions of its design platform. The first is mainly geared toward individuals, and the other is called Canva for Teams and targets organizations. The latter offering enables workers to exchange visual assets via shared folders and includes controls for ensuring new designs adhere to a company’s internal best practices.

At the time of its last funding round three years ago, Canva disclosed that its annualized revenue was on track to reach $1 billion by the end of 2021. According to TechCrunch, the company’s annualized revenue stood at $1.7 billion as of last month.

The blockbuster secondary sale Canva is said to be planning will enable its investors to cash out their shares in a time when other exit opportunities are likely few and far between. During the past year, the tech industry saw only a handful of initial public offerings. The Australian Financial Review recently reported that Canva is not expected to list its shares until 2025 or 2026.

The big-ticket Canva stock secondary sale is one of several said to be in the works. In mid-December, reports emerged that SpaceX Corp. was negotiating a secondary sale with investors at a $180 billion valuation. OpenAI, meanwhile, is expected to let employees and other investors sell shares at a $86 billion valuation through an upcoming tender offer.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.