INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Shares of the chipmaker Advanced Micro Devices Inc. traded lower in late trading today after the company slightly disappointing fourth-quarter earnings results and offered a forecast that came up light.

The company’s stock fell more than 6% in the extended trading session, as investors ignored a positive update regarding the early adoption of its newest artificial intelligence chip.

AMD reported earnings before certain costs such as stock compensation of 77 cents per share, matching Wall Street’s target. Revenue for the period rose 10%, to $6.17 billion, just ahead of the Street’s target of $6.12 billion. Meanwhile, AMD’s net income ballooned to $667 million, up from just $21 million a year earlier.

Looking to the first quarter of fiscal 2024, AMD said it forecast sales of around $5.4 billion, plus or minus $300 million. That’s significantly lower than the $5.73 billion analyst target.

Company officials admitted that several of its major business units, including its personal computer chips, are likely to see revenue declines during the current quarter. Also, data center revenue is likely to be flat, as AI chip sales will barely manage to offset the expected decline in server chips.

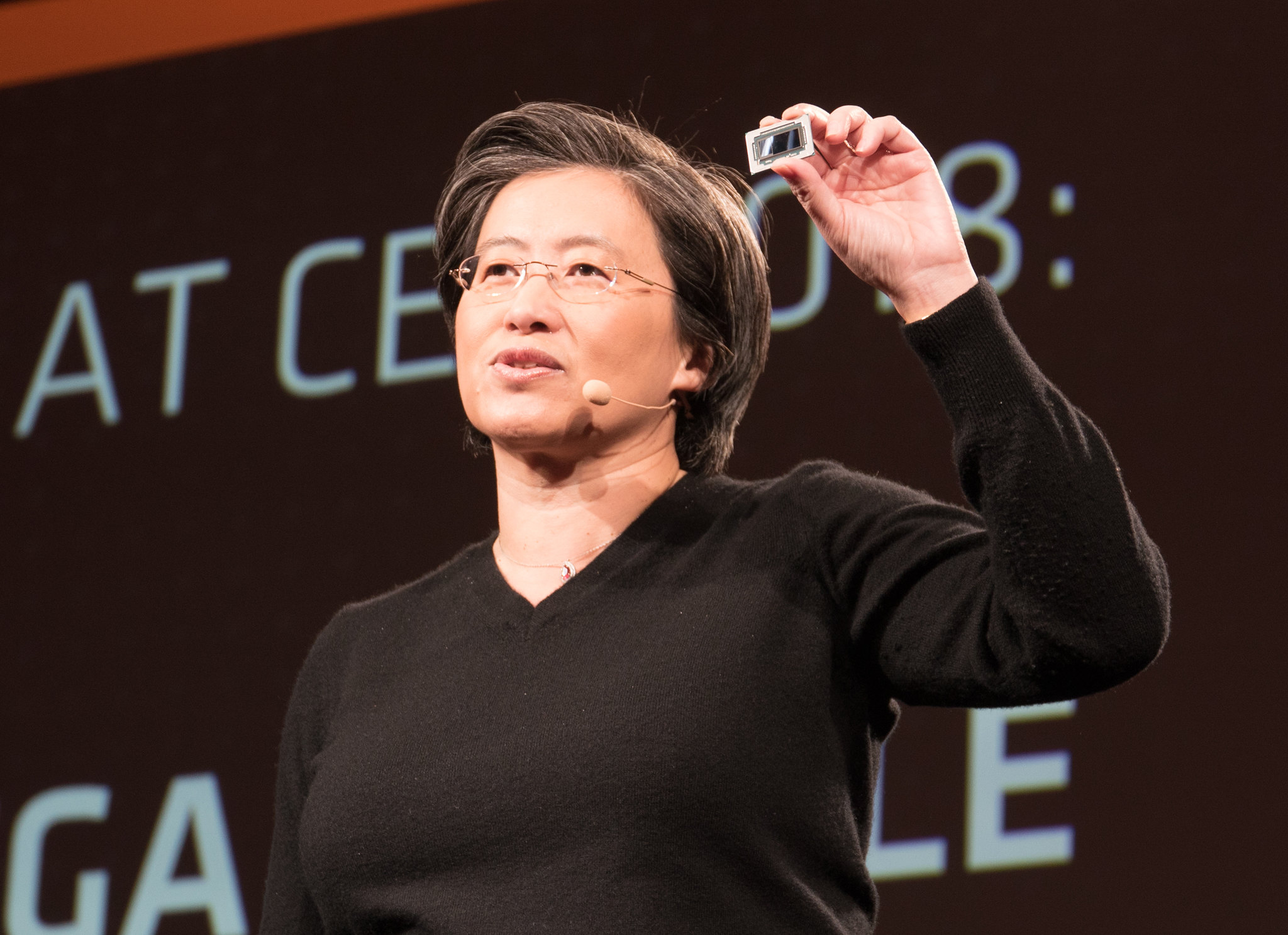

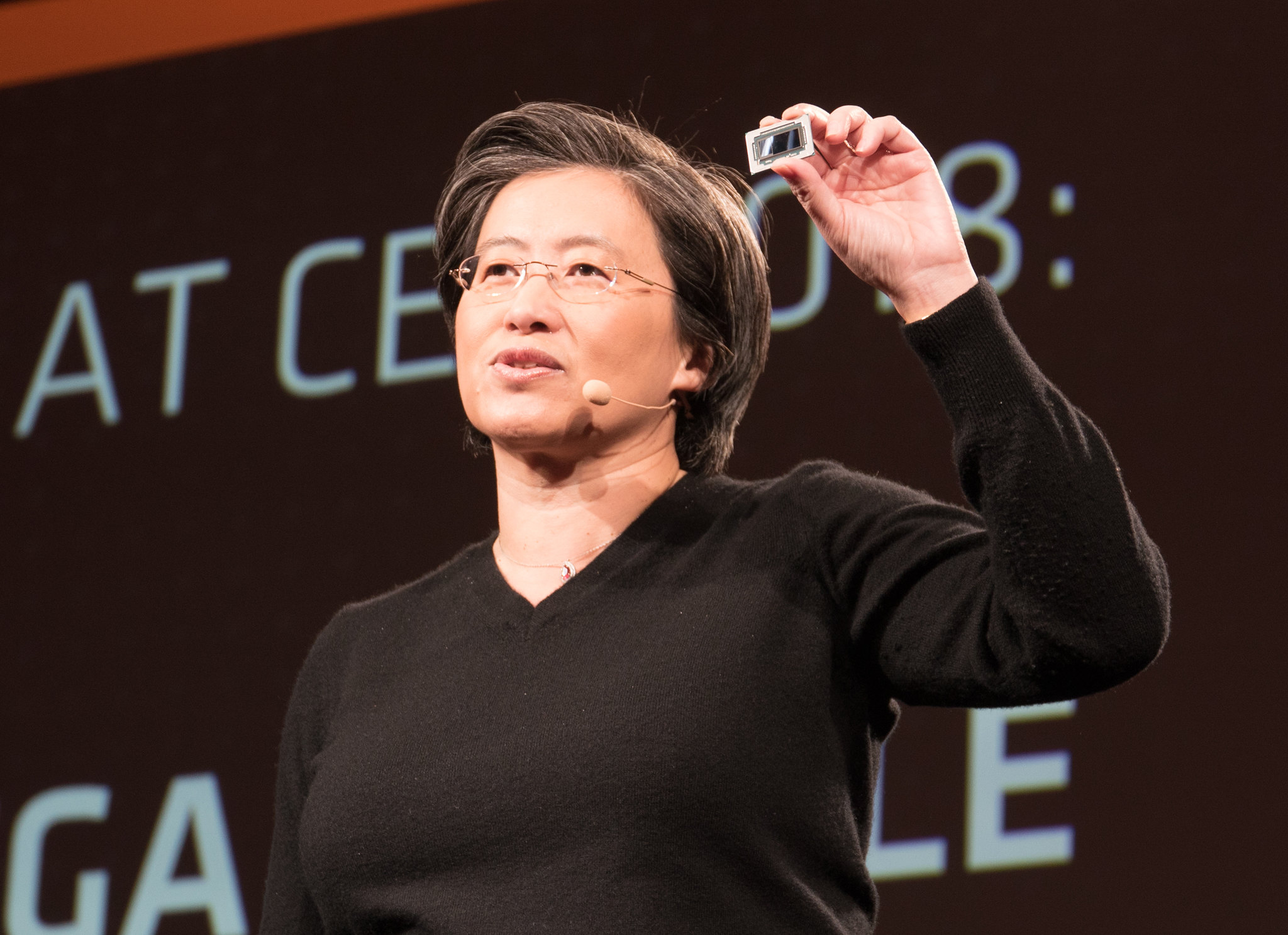

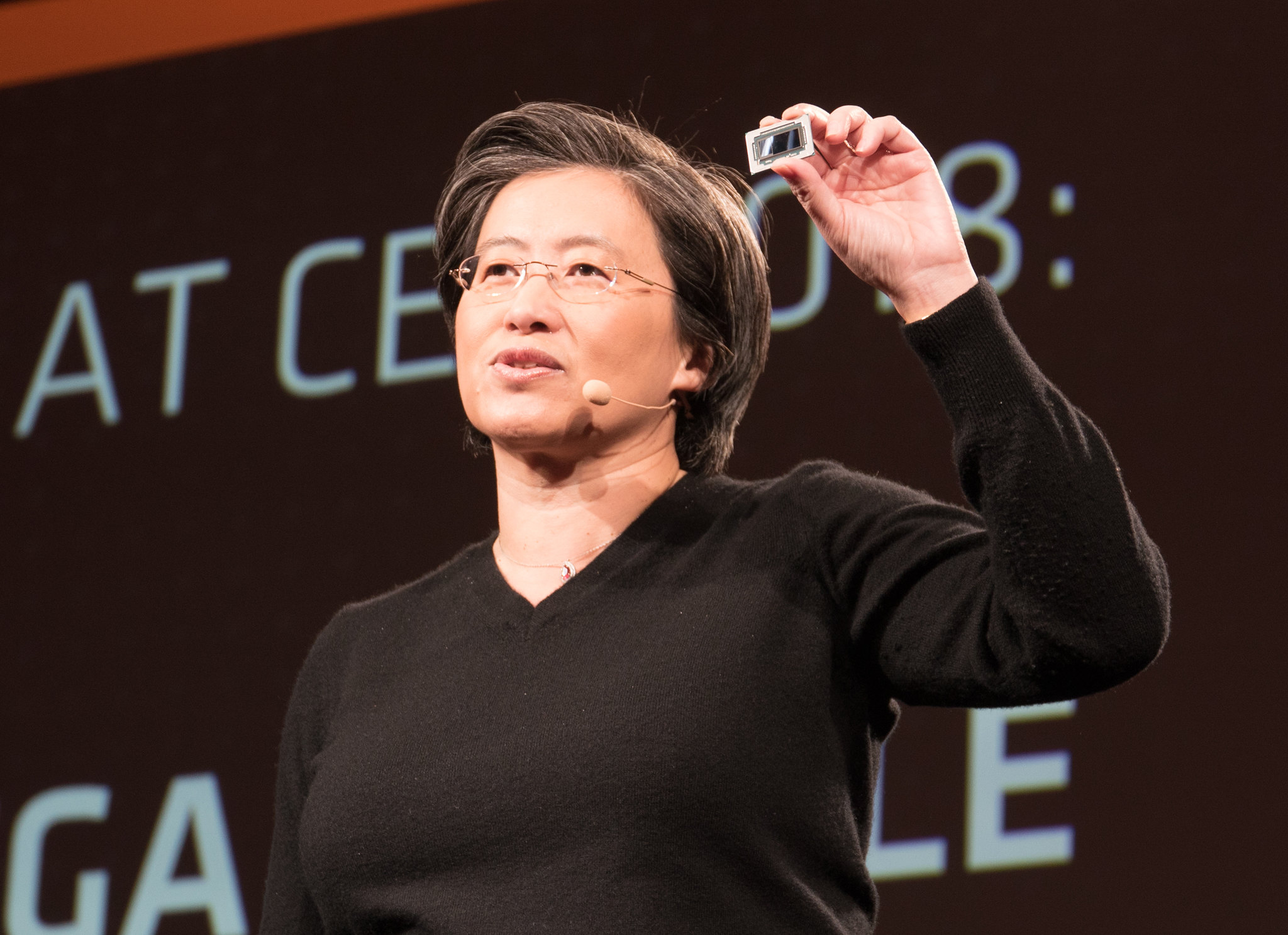

AMD Chief Executive Lisa Su (pictured) told analysts on a conference call that the company expects the demand environment to “remain mixed” throughout the entire fiscal year.

Although AMD is probably best known for its central processing units that rival chips from Intel Corp. in the personal computer market, the company also manufactures graphics processing units, where its main competitor is Nvidia Corp. The rise of generative AI has led to intense demand for GPUs, and Nvidia has so far dominated that market, rising to become the world’s most expensive chipmaker in terms of its total market capitalization.

AMD wants a piece of that pie and last year announced the launch of its new MI300X Instinct AI accelerator chip, which will challenge Nvidia’s H100 GPUs. Investors hope that the chips will drive significant growth in the company’s data center business, and they were rewarded with some good news today, as AMD said they will drive $3.5 billion in data center sales this year.

“In cloud, we are working closely with Microsoft, Oracle, Meta and other large cloud customers on Instinct GPU deployments powering both their internal AI workloads and external offerings,” Su told analysts on the call.

The data center business had a strong quarter, with revenue rising 38% from a year earlier, to $2.28 billion. That segment is now by far the company’s biggest, thanks to what it said was “strong growth” in Instinct GPU sales. But even so, the unit fell shy of Wall Street’s target of $2.29 billion in sales, because of shrinking demand for AMD’s regular CPU server chips.

Traditionally, AMD’s largest business segment was always its client computing unit, which makes CPUs for PCs and laptops. However, that business has been in decline recently, with PC sales stuck in a rut for the best part of two years following a COVID-19-era boom. The good news is that its fortunes appear to be changing, as AMD said the client group generated $1.46 billion in sales during the quarter, up 62% from a year earlier.

On the other hand, gains in the PC business were offset by the disappointing performance of AMD’s gaming segment, which makes semicustom processors for consoles such as the Xbox and PlayStation 5. According to the company, revenue in this division fell 17% due to what it said was slower console sales. Officials warned that the segment will likely see a “significant” double-digit revenue decline in the current quarter, too.

Finally, AMD’s embedded segment, which is focused on networking chips, generated $1.1 billion in sales, down 24% from the same period last year.

Constellation Research Inc. analyst Holger Mueller said that while things are looking brighter for AMD, the situation is still far from great. “With only one of its four major business segments growing, it’s clear that AMD faces growth and cost challenges,” the analyst said. “However, investors will be pleased to see the growth in its client computing segment, which brings hope of a turnaround. But questions remain over where the growth will come from in 2024 beyond its expected gains in the data center segment.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.