AI

AI

AI

AI

AI

AI

Microsoft Corp. is adding a new generative artificial intelligence copilot assistant that extends its Microsoft Copilot for Microsoft 365 to help finance teams to get their everyday work done.

Microsoft Copilot for Finance is a new role-based generative AI assistant now in public preview, joining Copilot for Sales and Copilot for Service now in general availability. Like the other two copilot assistants, Copilot for Finance includes Copilot for Microsoft 365, which is a powerful AI assistant that resides within all of the company’s popular productivity apps.

“Copilot for Finance works alongside you, embedded in the Microsoft 365 apps you use every day — Excel, Outlook, Teams and more — to make financial processes like collections and forecasting analysis more seamless and automated,” said Emily He, corporate vice president of business applications marketing at Microsoft.

Copilot for Finance focuses on the work that finance teams are embedded in day to day, the company said, drawing on the essential context of enterprise data and context such as financial sources. That includes traditional Enterprise Resource Planning systems such as Microsoft 365, SAP and the Microsoft Graph.

Finance teams find themselves making strategic decisions constantly impacting company resources every day and they constantly need to do research based on vast amounts of documents. According to a 2020 report from the American Productivity and Quality Center, 62% of workers find their time sucked up in transaction processing and review cycles.

With an AI-powered assistant such as Copilot for Finance at their side, He explained, it’s well-versed in what finance professionals need to get their job done by augmenting workflows and reducing time spent on repetitive actions.

Examples include having analysts conduct variance analysis in Excel using natural language prompts to review anomalies or risks. That can help explain insights to company leadership on how finance models are meeting, exceeding or falling short of planned outcomes.

It can turn raw data in Excel into full presentations including visuals and reports with text and graphs that need only minor editing that can be shared in Outlook and Teams. It also can connect data from Outlook, Teams and Excel together to provide a summary of customer account details such as balance statements from invoices to expedite collections processes as well.

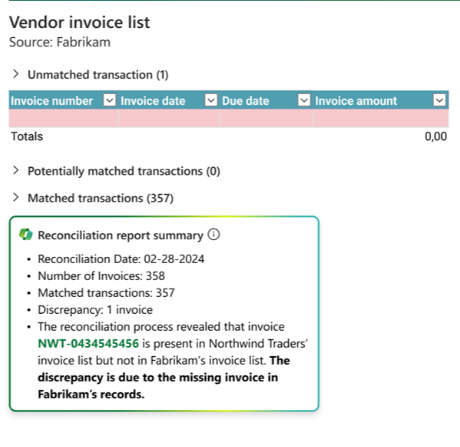

AI-generated reconciliation summaries can be used to discover missing invoices and other discrepancies without long searches. Image: Microsoft

“With the ability to both pull insight from and update actions back to existing sources, Copilot for Finance empowers users to stay in the flow of work and complete tasks more efficiently,” said He.

In essence, Copilot for Finance is designed to unburden finance workers from the oceans of data that they encounter every day and break down information across the multiple applications that they work between to get insights and guidance as they go.

“Finance organizations need to be utilizing generative AI to help blend structured and unstructured datasets,” said Kevin Permenter, International Data Corp.’s research director of financial applications. “Copilot for Finance is a solution that aggressively targets this challenge. Microsoft continues to push the boundaries of business applications by providing AI-driven solutions for common business problems. Copilot for Finance is another powerful example of this effort.”

Microsoft’s own finance teams piloted the new AI assistant internally, testing its value with its own teams to see how well it could help finance workers. According to one planning and analysis worker it brought time spent reconciling data per week down from one to two hours to 10 minutes. The company said that by trialing its own product, it believes the impact of its capabilities is clear.

“The accounts receivable reconciliation capabilities help us to eliminate the time it takes to compare data across sources, saving an average of 20 minutes per account,” said Gladys Jin, senior director of finance global treasury and financial services at Microsoft. “Based on pilot usage, this translates to an average of 22% cost savings in average handling time.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.