CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Shares in Smartsheet Inc. rose over 13% in late trading today after the management platform provider reported strong earnings and revenue beats in its fiscal 2025 first quarter.

For the quarter ended April 30, Smartsheet reported adjusted earnings per share of 32 cents, up from 18 cents per share in the same quarter of the previous fiscal year, on revenue of $263 million, up 20% year-over-year. Both were ahead of the 27 cents per share and $258.2 million expected by analysts.

Smartsheet’s revenue surprise was driven by strong growth, with the company seeing subscription revenue increase 21% year-over-year to $249.1 million. Annual recurring revenue was up 19% year-over-year to $1.056 billion, the average annual recurring revenue per domain-based customer was up 16% to $9,906 and those customers are sticking around, with Smartsheet reporting a dollar-based net retention rate of 114%.

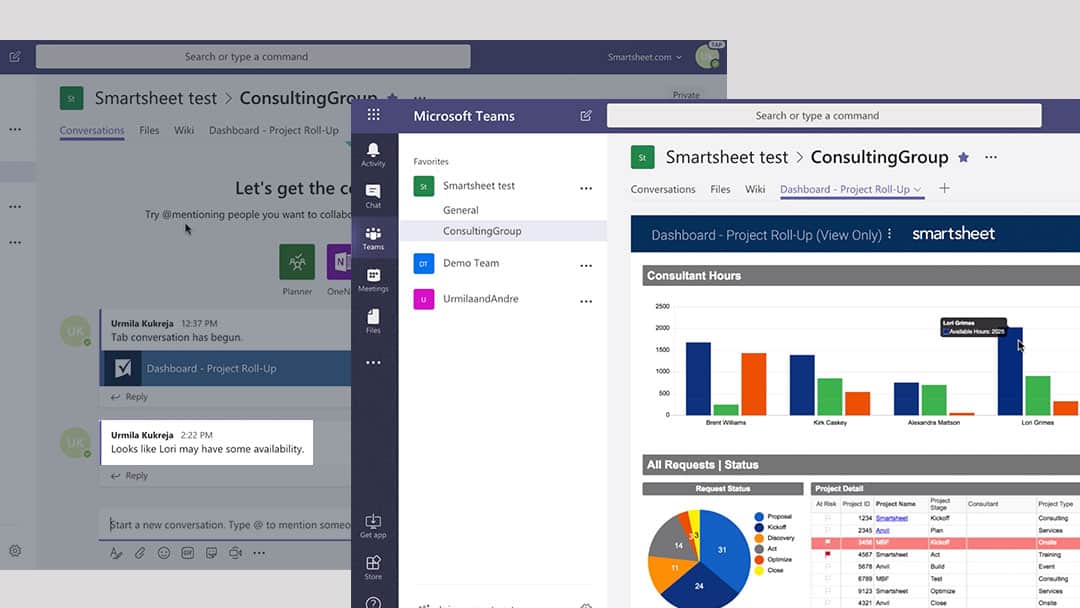

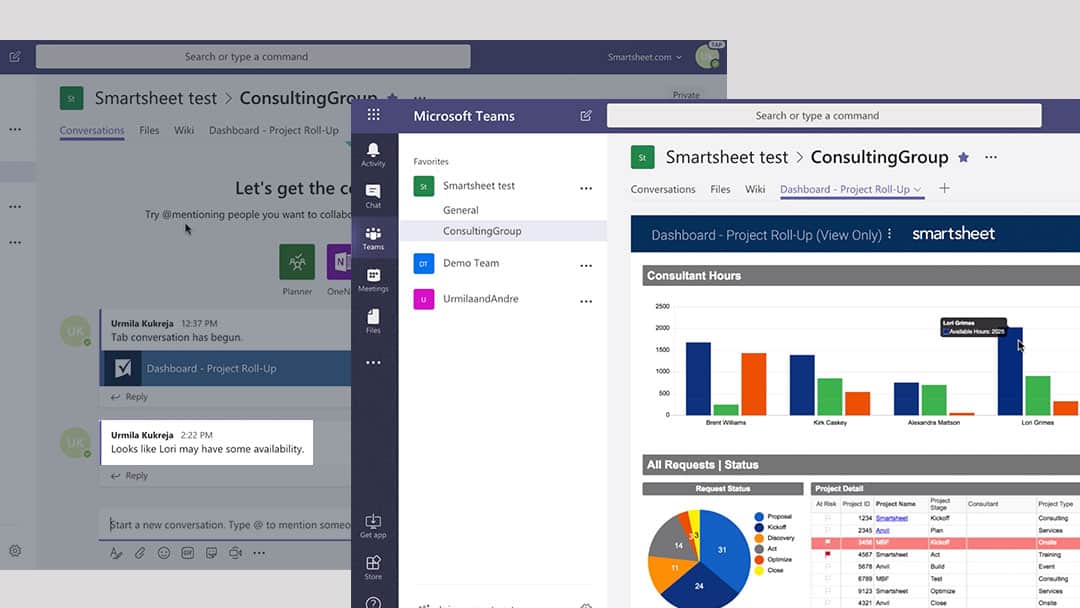

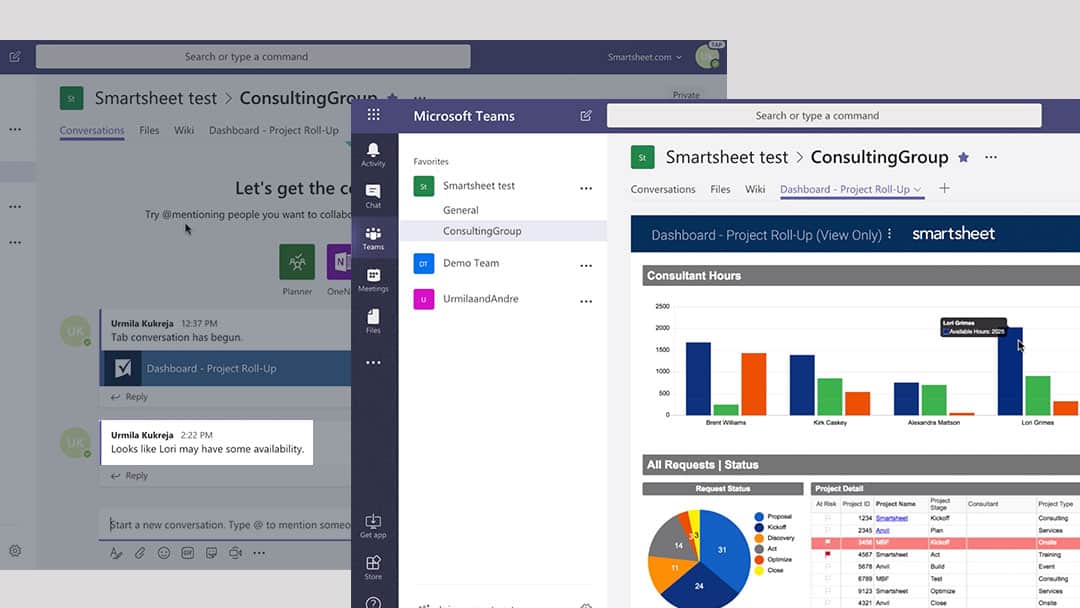

Highlights in the quarter included Smartsheet introducing a new feature called Timeline View that helps customers visualize and plan their work more effectively. Smartsheet also launched two new workload tracking features, Workload Heatmap and Workload Schedule, to assist managers in understanding team assignments, identifying over-allocations and making informed staffing decisions.

The company has also announced a share repurchase program authorizing the repurchase of up to $150 million of its outstanding Class A common stock.

“We continue to see significant demand from our enterprise customers and now have 72 customers with annualized recurring revenue over $1 million, an increase of 50% year over year,” Mark Mader, chief executive officer of Smartsheet, said in the company’s earnings release. “This will be a pivotal year for Smartsheet. We believe the combination of new product innovations, the upcoming launch of our modern pricing and packaging model, and a reinvigorated go-to-market strategy positions us for long-term, durable growth.”

For its fiscal 2025 second quarter, Smartsheet expects adjusted earnings per share of 28 to 29 cents on revenue of $273 million to $275 million. Analysts were expecting 25 cents and $274.42 million.

For its full fiscal year 2025, the company said that it expects adjusted earnings per share of $1.22 to $1.29 on revenue of $1.116 billion to $1.121 billion. Analysts had forecast figures of $1.11 per share on revenue of $1.116 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.