CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

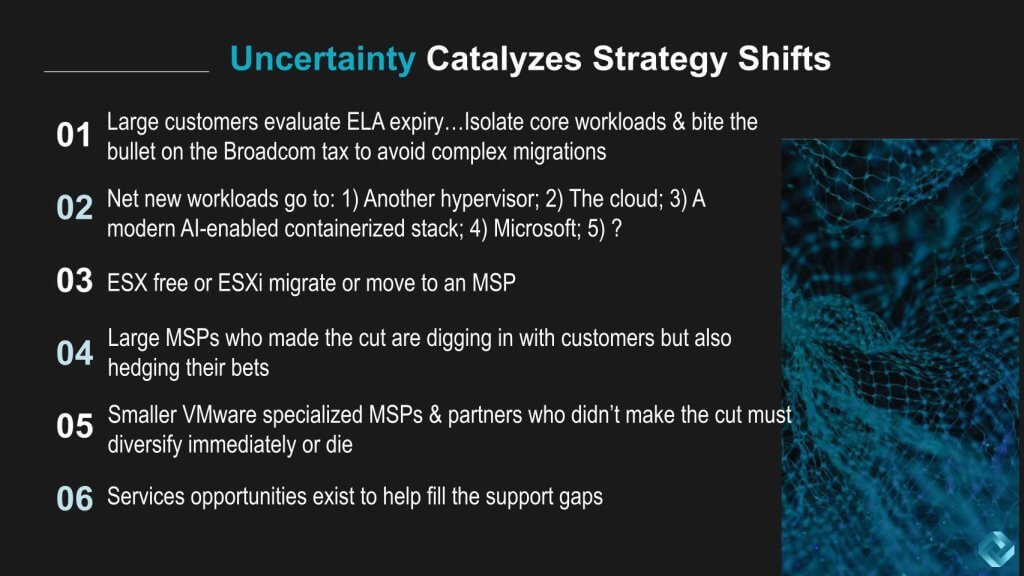

Customers and partners are pivoting to address Broadcom Inc.’s swift changes to its VMware packaging, pricing and partnership programs. Our data suggests customers and managed service providers have moved beyond the emotional shock phase to implementing their options in earnest.

Our advice to large VMware customers has been to evaluate your enterprise license agreement expiration and work backwards from that timeframe. Isolate core workloads that can take advantage of the full VMware Cloud Foundation stack, pay the Broadcom tax and avoid complex and risky migrations for this portion of your estate.

For noncore workloads, either seek MSP assistance or move off VMWare to one of three broad options, including: 1) horizontally to a mature and functional hypervisor; 2) the public cloud; or 3) a modern containerized stack capable of supporting your AI initiatives and maximizing optionality. Finally, we believe MSPs and other partners, whether they’ve made the cut or not, should be diversifying revenue streams as either a hedge on future changes or, in some cases, as a survival tactic.

In this Breaking Analysis, ahead of VMware Explore Aug. 27-29, we review the VMware landscape more than eight months after Broadcom closed the deal. We’ll share eye-opening Enterprise Technology Research data that shows how quickly customers are moving portions of their estate off VMware, with data on where they’re moving. We’ll review the options and suggest a framework for buyers, MSPs and partners moving forward. We’ll also explain why the apparent defection of a large number of customers is consistent with Broadcom’s plan to narrow the focus and increase revenue.

As we wrote back in May of 2022, just after the announced $61 billion acquisition, VMware fit Broadcom’s model of a durable business that Broadcom could revamp. Since the close of VMware, the strategy has been clear: Streamline operations, cut costs and narrow focus to achieve the high operating margins consistent with Broadcom’s other business units. Broadcom wasted no time to implement substantial cost reductions, employee layoffs, a simplified portfolio and revenue growth targets that have been set.

The fundamental product strategy Broadcom has initiated involves reducing the number of individual products customers can purchase, packaging those bespoke offerings into a few core bundles and forcing customers to take the full package. This means customers must evaluate which workloads can truly benefit from all that functionality and migrate the less valuable workloads off VMware.

The following additional commentary is noteworthy:

Key points:

Bottom line: Broadcom is executing its plan with precision, focusing on efficiency, revenue growth and maintaining high operating margins, setting the stage for a more streamlined and profitable VMware. The impact to customers has been to rationalize their VMware portfolios, keeping only those workloads on VMware that can take advantage of the full stack and moving noncore workloads off VMware to avoid paying for unnecessary features. Many partners are disaffected. Having built years of VMware expertise, they’ve had to shift their business models to identify new revenue streams that are not reliant on VMware and do so quickly.

The swift and sweeping changes implemented by Broadcom have sent shockwaves through VMware’s longstanding user community. Once one of the most vibrant ecosystems in the tech industry, the VMware customer and partner base is now facing a mandate to change as Broadcom reshapes the company’s focus.

Key points:

Bottom line: Broadcom’s changes, while disruptive, are aligned with its strategy of focusing on high-value customers and modernizing VMware’s offerings, though this has come at the cost of community and partner ecosystem stability. Moreover, VMware is behind in the artificial intelligence race. Its advantage is it’s a leading on-premises offering but its AI innovation and tooling must close the gap with public cloud providers.

Central to Broadcom’s VMware strategy is VMware Cloud Foundation, which consolidates VMware’s offerings into a simplified, high-margin product set. This shift underscores Broadcom’s intent to position VCF as the cornerstone of its VMware portfolio.

Key points:

Bottom line: Broadcom has streamlined VMware’s product offerings into three main packages: Essentials, Standard and VCF. Though these packages have been kept distinct, VCF is the focal point, consolidating key features such as high-end vSAN, Kubernetes and log management into an all-encompassing bundle.

Despite this, even the Standard package omits several critical components, such as lifecycle management for upgrades as an example. Broadcom’s strategy is clear: VCF represents the pinnacle of VMware’s offerings, with separate SKUs such as VMware Live Recovery and private AI solutions as add-ons for those needing more advanced capabilities. Essentially, Broadcom is positioning VCF as the go-to solution for enterprises, with the Standard and Essentials packages serving more limited needs.

By streamlining VMware’s offerings into the VCF stack, Broadcom is positioning itself to compete directly with public cloud providers, targeting the top tier of enterprise customers and giving them a viable on-premises offering. The fallout has been to open the lower end of the market to alternatives that are aggressively trying to compete for account control during the transition period.

Fun fact: Since it announced the acquisition of VMware in May of 2022, Broadcom’s market cap has more than tripled.

As Broadcom refines its VMware strategy, competitors are seizing the opportunity to attract disenchanted VMware customers. This shift has created momentum for alternative hypervisors and cloud solutions, signaling a new era of competition in the virtualization market.

As we indicated in the opening summary, customers have several options to migrate those workloads where the return on investment of spending up for the VCF bundle is unattractive. These include: 1) migrating workloads to a functional hypervisor; 2) moving work to the public cloud; or 3) stepping up modernization efforts to prepare for the AI wave.

Currently we see Nutanix Inc.’s Acropolis Hypervisor or AHV as a primary beneficiary of No. 1, as it is offering a functional stack and an easy migration path. Nutanix has spent the better part of the last five years perfecting KVM and making it their own, with an emphasis on ease of use with many integrations and “pushbutton” management features. Nutanix also has in our view some of the best migration tools to move from VMware to Acropolis.

Because VMware apps are either running on Windows or Linux, Microsoft Corp. and Amazon Web Services Inc. are the primary beneficiaries of No. 2 above. Remember VMware Cloud on AWS was the first major cloud announcement by VMware, followed by other partnerships with Microsoft Azure, Google Cloud, Oracle Corp. and IBM Corp.

Customers of these cloud-based VMware services are now faced with a decision as Broadcom’s changes have limited the utility of these services. As such a move to cloud native from these platforms is compelling if you’re already there (for example, moving to EC2 on AWS from a bare-metal instance set up specifically to support VMware). Same for Microsoft and Google if you’re running VMware in the cloud. There are some licensing considerations, but the cloud vendors and partners can help. Moreover, it’s an opportunity to get AI-ready.

Red Hat/IBM is winning the race for No. 3, which requires more planning and time but is strategically the most interesting path because in our view because it preserves optionality. Specifically, by moving workloads to OpenShift Virtualization, customers can run workloads in any cloud and on-premises, which at the same time tapping into a modern stack that is at the forefront of AI given IBM’s AI prowess.

OpenShift, has subsumed the functionality of Red Hat Virt (which was its KVM stack) and those functions and features have been put into OpenShift (leveraging KubeVirt) to help manage bare-metal infrastructure. It is a compelling full stack alternative to VMware in our view.

A viable path for customers running OpenShift is to look at the bare metal version of OpenShift now, or one of the cloud-based versions. So if you’re running VMware on one of the clouds and OpenShift is right next door, you could actually have that same type of experience using OpenShift.

Other players

On the chart above we put a question mark on Dell’s VxRail because the once-leading hyperconverged infrastructure stack is losing momentum with the new pricing and packaging from Broadcom. But it’s unclear if Dell can swing an alternative deal with Broadcom given that Michael Dell is the largest individual shareholder of Broadcom stock.

Hewlett Packard Enterprise Co. is in the mix and we believe is using Ubuntu in its offerings, while SUSE SA, with Rancher and Harvester, remains a player in the virtualization space. A lesser-known company Proxmox Server Solutions GmbH, has share of voice on Reddit, despite its small size and limited support.

In addition, there appears to be momentum building around Apache CloudStack, particularly within the cloud service provider and MSP markets. Originally part of the OpenStack ecosystem, CloudStack has evolved independently and is now being adopted by those seeking a mature, VMware-alternative platform with strong community support. As a result, some commercial versions of Apache CloudStack are gaining traction, making it a notable player to watch in the virtualization and cloud markets.

The following additional commentary is noteworthy:

Key points:

Bottom line: The growing dissatisfaction with VMware’s new pricing and packaging is driving customers toward alternative hypervisors and cloud solutions, with Nutanix, Azure Stack HCI and OpenShift leading the momentum.

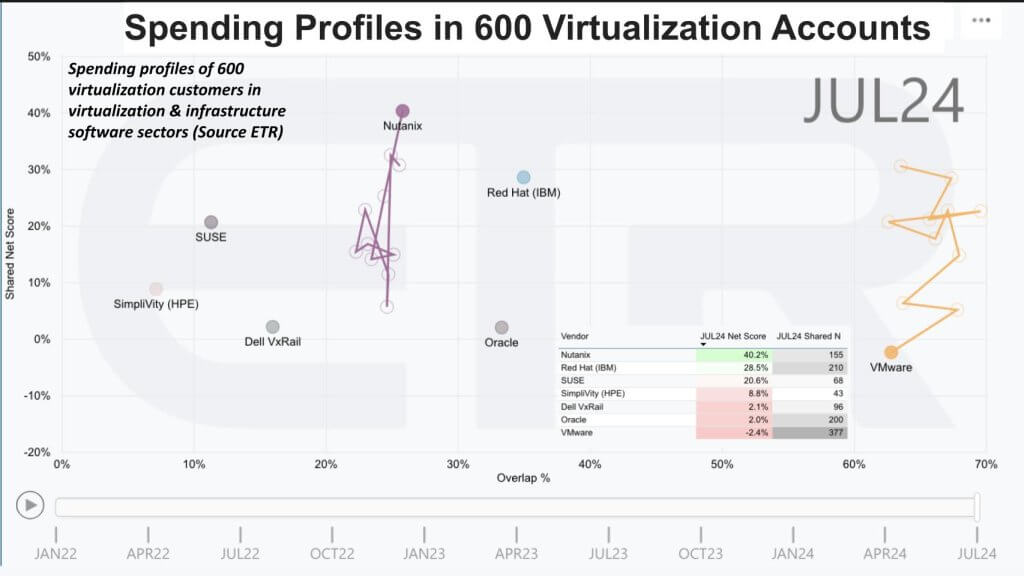

Let’s get into some of the spending data from ETR. Not often do we see momentum shifts that are as dramatic as we show below. The data represents the spending profiles in 600 virtualization accounts. We’re showing some of the vendors within the infrastructure software and virtualization sectors.

The vertical axis is Shared Net Score within those 600 virtualization accounts. Net Score is a measure of spending momentum. The horizontal axis is the overlap within those 600 accounts, meaning the penetration in those accounts. So the higher you are, the more spending velocity there is on your platform, and the farther you are to the right, the larger the penetration. Anything over 40% on the vertical axis is considered highly elevated momentum.

Two things jump right out: 1) Nutanix had a Net Score that was under 10% several quarters ago and it has shot up to the 40% mark; and 2) VMware is the exact opposite. And this makes sense because essentially what Broadcom’s doing is narrowing down the account base and focusing. Because the ETR methodology is an account-based methodology, it makes VMware appear to be decelerating.

But ETR’s survey doesn’t capture average contract values and calculate revenues. Broadcom’s earnings reports do and will reflect a different story. We know Broadcom is going to extract more dollars out of its accounts, but it’s going to do so with fewer accounts.

Red Hat/IBM is very well-established in the market. Oracle has a large presence. You can see VxRail. If we had double-clicked on VxRail, you would’ve seen it much higher further back in time, and we’ll show you some data on VxRail which looks similar to VMware’s trajectory. SimpliVity with HPE is one of its plays. And of course SUSE actually has pretty decent momentum.

In the wake of VMware’s strategic shifts, Nutanix and Dell are positioning themselves as a formidable partnership. With Nutanix providing a robust and mature hyperconverged infrastructure solution and Dell offering extensive distribution channels, this alliance is poised to capture significant market share in our view.

Key points:

Bottom line: Broadcom’s moves to dramatically improve VMware’s focus and profitability leave a juicy opportunity for companies with lower margin profiles than Broadcom. The Nutanix-Dell partnership is emerging as a significant challenger in the virtualization market, poised to gain ground as VMware’s focus narrows.

Recent ETR spending data reveals a dramatic shift in the virtualization market. VMware’s purposeful shrinking of its account base hands opportunities to alternatives and shows sharply rising momentum of alternatives such as Nutanix.

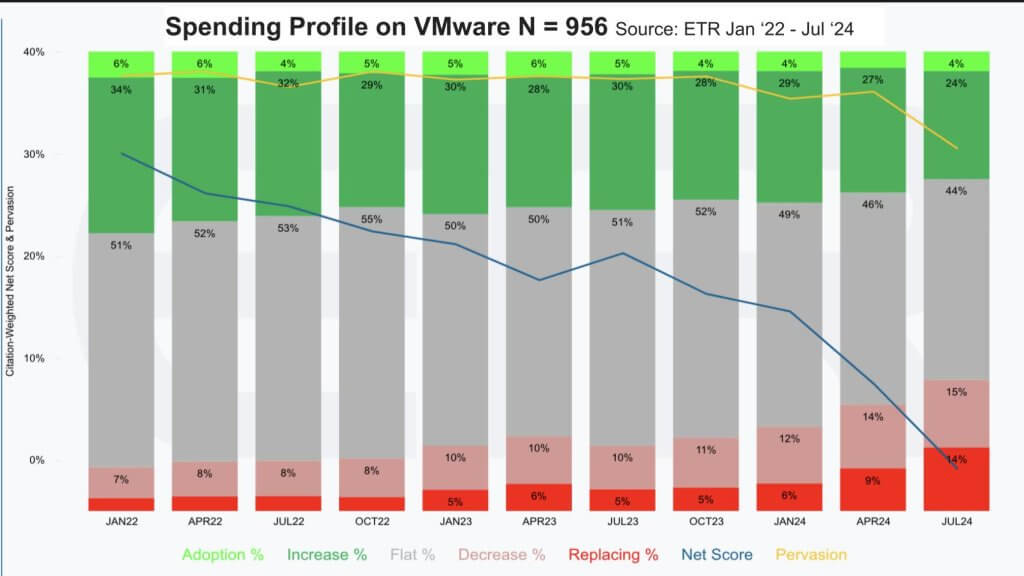

The chart below shows the spending profile on VMware from ETR. We have 956 VMware customers in the data set that we can examine. This astounding pattern is rarely seen. Normally you’d look at this and say, “Wow, this company is in trouble. ” But that’s not the case here with Broadcom and VMware, and we’re going to explain why.

The data above shows the Net Score methodology and granularity. Net Score is ETR’s proprietary methodology that shows how those 956 VMware customers are spending. The lime green is the percentage of those 956 customers that are new to the platform, which in this case is a somewhat surprising 4%, which could be a division of an existing customer — perhaps not a new logo to VMware but a new footprint. The forest is the percentage of customers that are spending 6% or more. And you can see that’s contracting by 10% from January 2022. The gray is flat spend at plus or minus 5%.

What’s most stark is the two reds. The pink is down 6% or worse. That’s 15%, more than double from 2022. Then the red is churn, which has gone from low single digits to 14%. Those customers are leaving the platform or putting it in isolation. The combined reds have gone from under 10% in January 2022 to nearly 30% in the July survey.

Subtract the red percentages from the greens and you get that blue line, which is Net Score. VMware’s Net Score has gone from a very respectable 30% back in January of 2022 a couple of months prior to the announcement that Broadcom was buying VMware, all the way down to essentially 0%.

The yellow line above is pervasiveness in the data set. It is a proxy for account share. Not share of wallet, but percentage account penetration. Broadcom’s clear strategy is fewer customers, more revenue per customer, and more revenue and profit overall.

However, the landscape is shifting as smaller accounts and certain sectors within the MSP and CSP markets begin to drift away from VMware. The market is seeing a trend where larger CSPs are subleasing or white-labeling VMware licenses to smaller CSPs, attempting to grow within the ecosystem. Despite these efforts, challenges remain, especially for channel partners heavily reliant on VMware services. As the number of accounts diminishes, even as prices rise, there’s little excitement or momentum left for them. Those that remain seem resigned to accept the “Broadcom tax,” acknowledging that for some, there may be no alternative but to continue paying for VMware services.

Key points:

Bottom line: The virtualization market is undergoing a significant transformation, with spending patterns indicating a decline in the number of direct VMware accounts and rising penetration for competitors. This is precisely what Broadcom expected and wants – fewer customers, more revenue per customer and more profit.

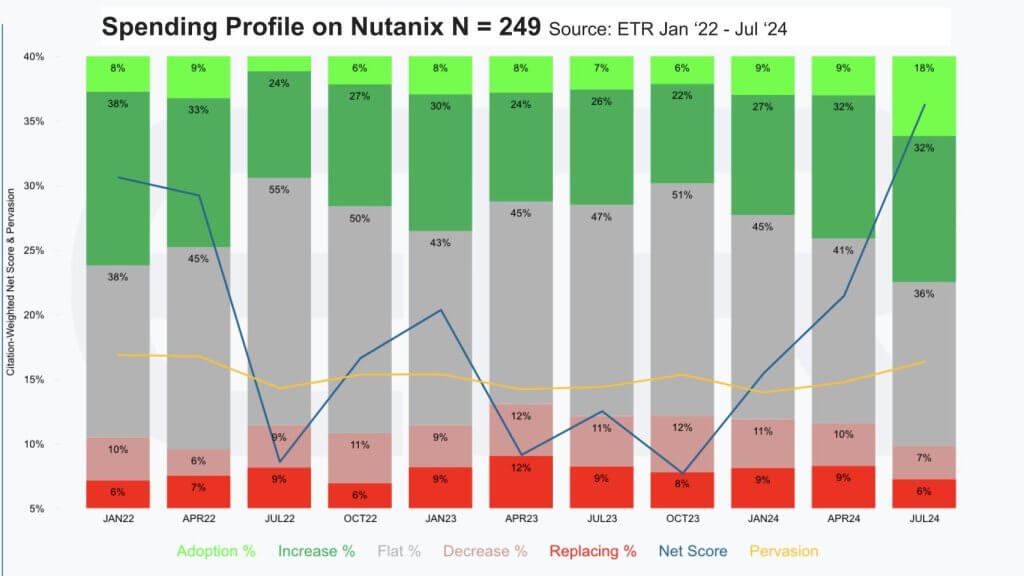

Above we show ETR survey data for 249 Nutanix accounts. Same as the previous chart, the green is good, the red is bad, the gray is flat, subtract the red from the green, you get that blue line. Nutanix was in a knife fight for account control prior to Broadcom buying VMware. And then all of a sudden November 2023, people start to realize, “Wow, we have to make some decisions and make some moves.” Look at the Nutanix Net Score above. The blue line rockets up from basically the low single digits or mid-single digits all the way up toward that 40% mark we talked about earlier. And you can see that yellow line, Pervasion in the data set bumping up.

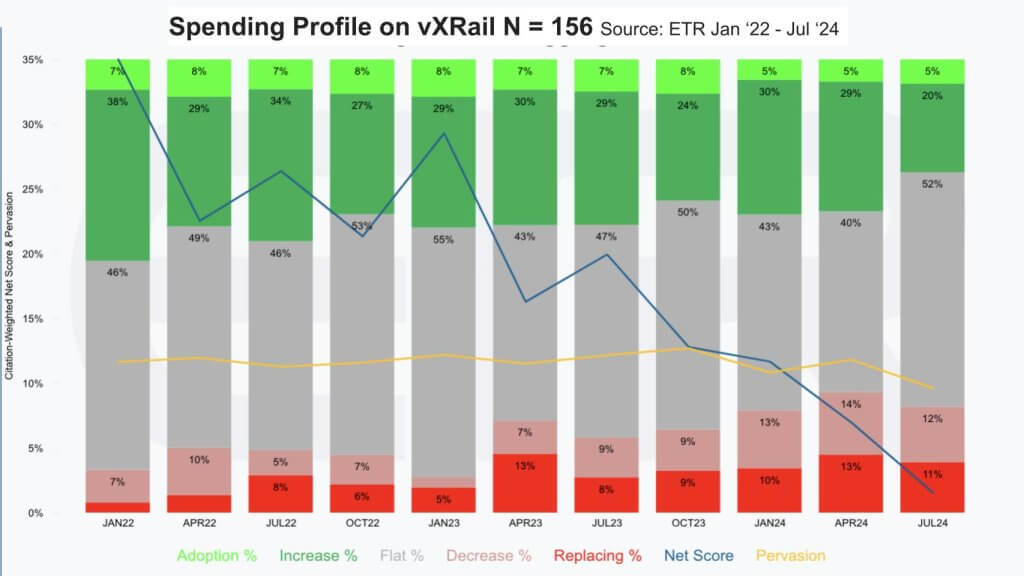

The next chart below shows the spending profile from 156 VxRail accounts. Look what happens. The blue line just tanks. The red’s going up. The green is shrinking because vSAN is no longer offered as a standalone product that Dell can bundle as a bespoke HCI offering. And that’s why Dell and Nutanix are getting together to form what is going to be a very powerful combination in our view. Nutanix has the solution, Dell has the distribution channel, they’ve got the customer base and are poised to win share.

Key points:

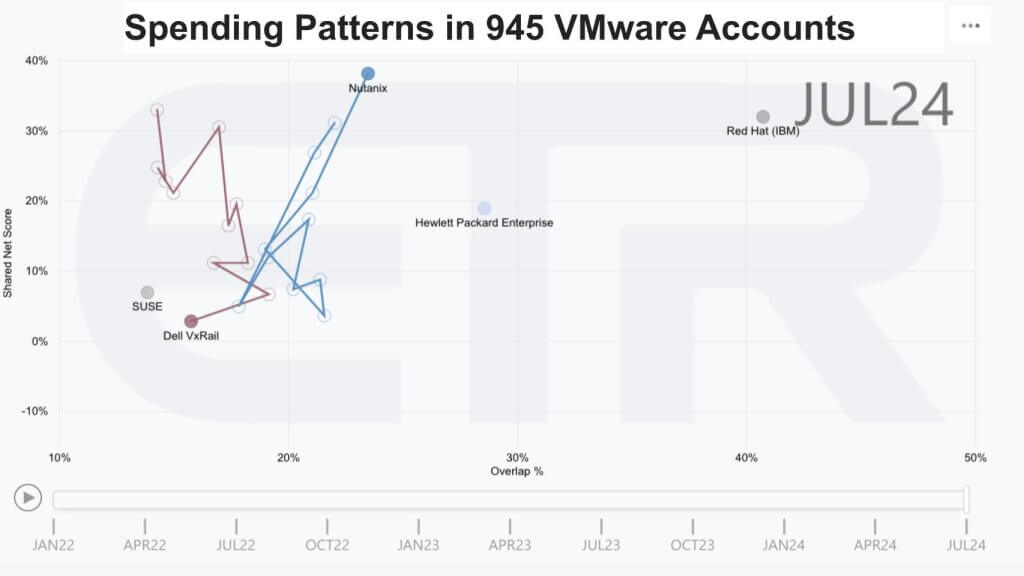

To put a final point on the competitive positions of firms within VMware accounts, we show the following data from ETR. As before, we show Net Score on the vertical axis and account penetration on the horizontal plane.

In these 945 VMware accounts, we just chose a few of the names competing to emphasize the opportunity. You can say as VxRail goes down, Nutanix goes up, making that Dell/Nutanix partnership very interesting. SUSE is in the mix as a niche player. Hewlett Packard Enterprise with its offerings has a strong case to make, and Red Hat/IBM is in a very strong position with good momentum.

As VMware customers weigh their options, many are grappling with the “Broadcom tax” — the increased costs associated with staying within the VMware ecosystem. For some, this means paying significantly higher prices, while others are considering alternatives to avoid the financial burden.

Large enterprises currently leveraging VMware must carefully evaluate the expiration dates of their ELAs and strategize accordingly. The “Broadcom tax” is a reality that many customers will have to face, with significant price increases making it imperative to assess the value of staying within the VMware ecosystem versus migrating to alternatives. Keep migrations simple is our main advice. Pay the tax where the cost of business disruption outweighs the price increases. Consider carefully the impact to your firm’s productivity of ripping and replacing core workloads and take emotion of the decision.

Key points:

Bottom line: The post-acquisition landscape presents a challenging environment for VMware customers, partners and service providers. Though remaining within the VMware ecosystem under Broadcom’s leadership will be costly, migration poses its own risks. The key to navigating this transition lies in careful planning, strategic diversification and leveraging emerging service opportunities to mitigate the impact of Broadcom’s sweeping changes.

What are you doing with your VMware estate? We’re always here for you and happy to help you navigate the transition. Let us know how we can assist. And visit theCUBE Research, theCUBE and SiliconANGLE at VMware Explore Aug. 27-29 in Las Vegas, where we’ll be covering the event with news, interviews and analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.