AI

AI

AI

AI

AI

AI

Cerebras Systems Inc., a startup that sells a wafer-sized chip for artificial intelligence applications, today filed to go public.

The move is not unexpected. Cerebras submitted a confidential draft version of the filing to the Securities and Exchange Commission in July. Last week, Bloomberg reported that the company hopes to raise between $750 million and $1 billion in its initial public offering at a valuation of up to $8 billion.

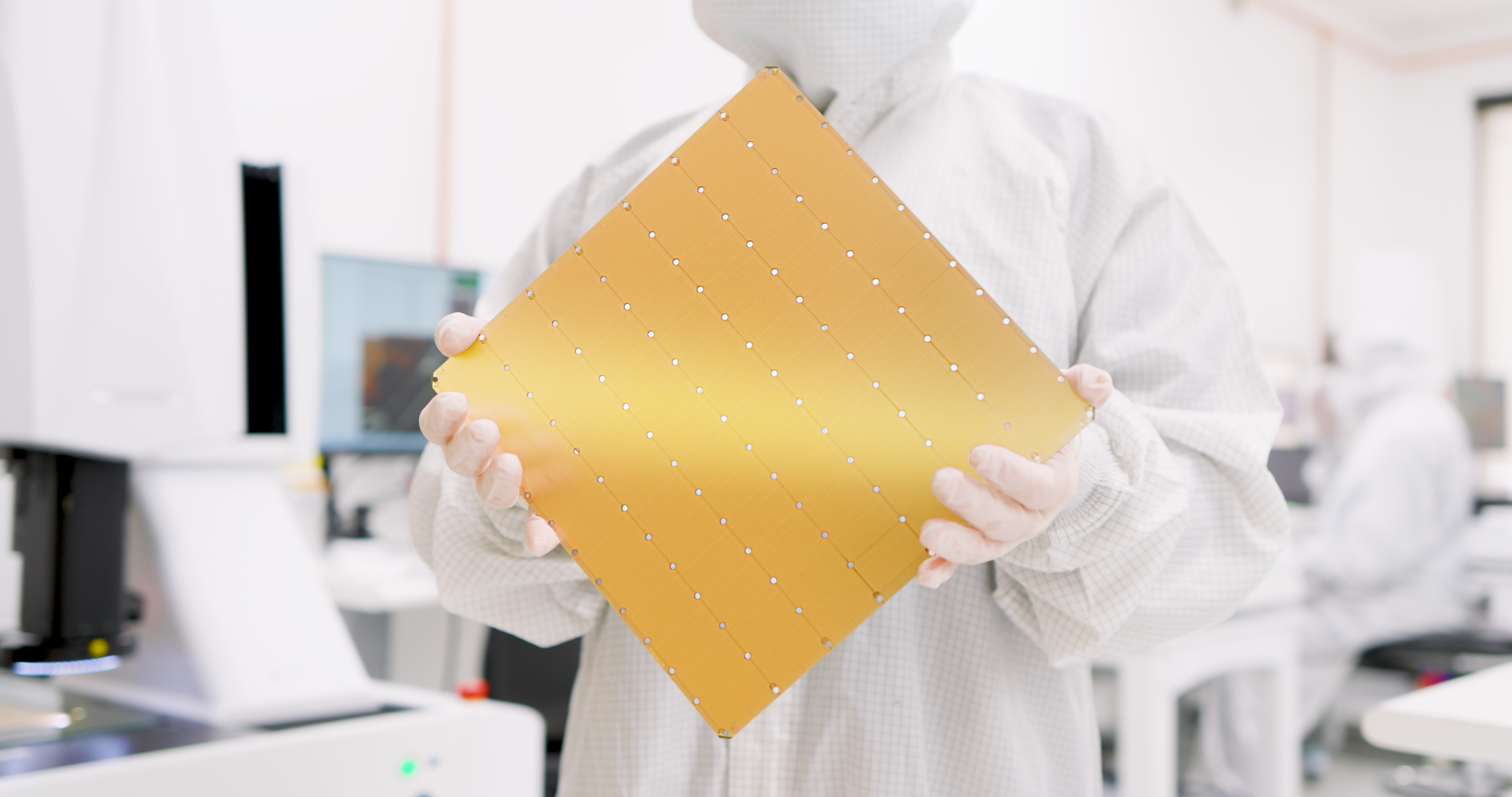

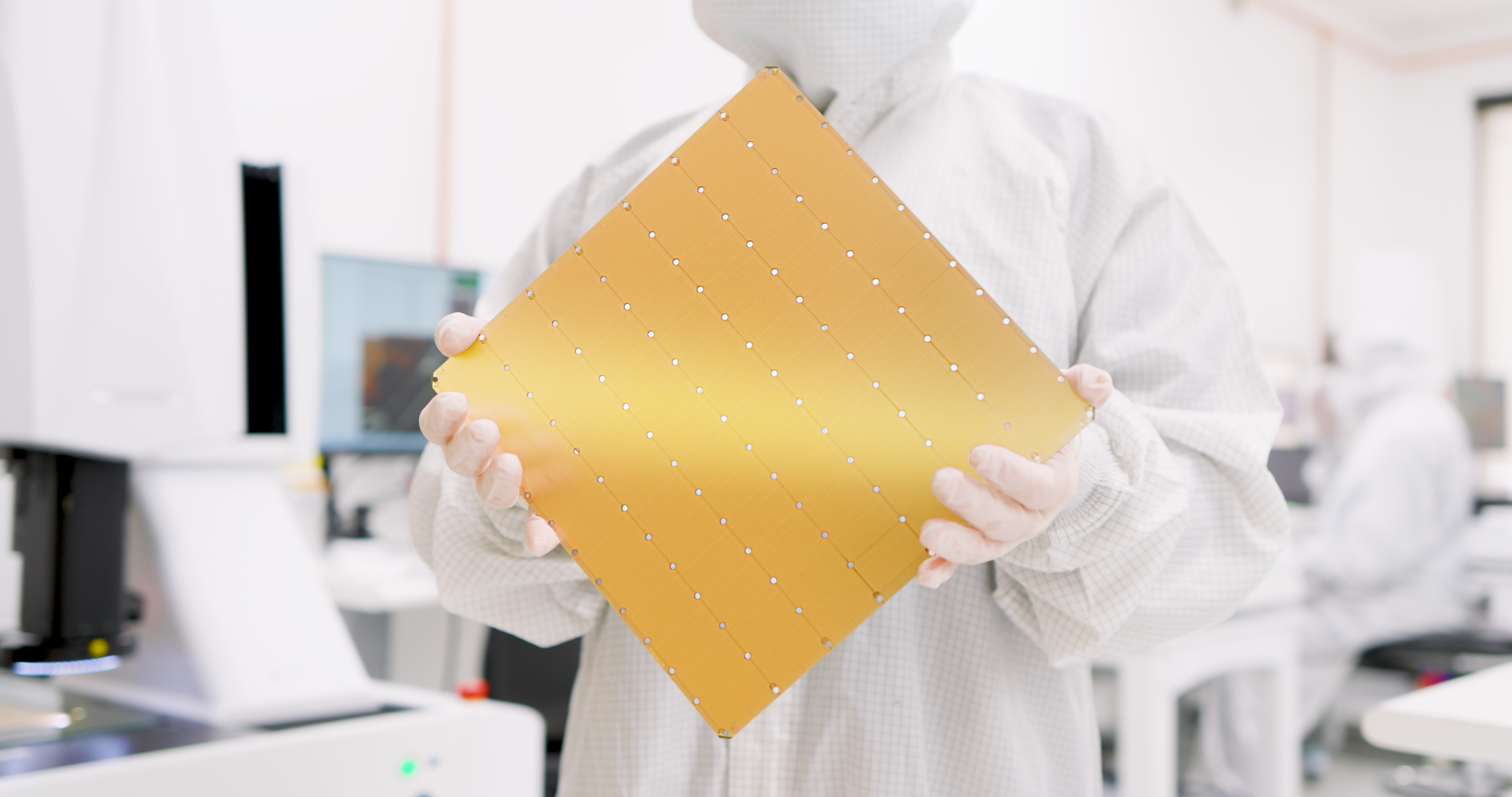

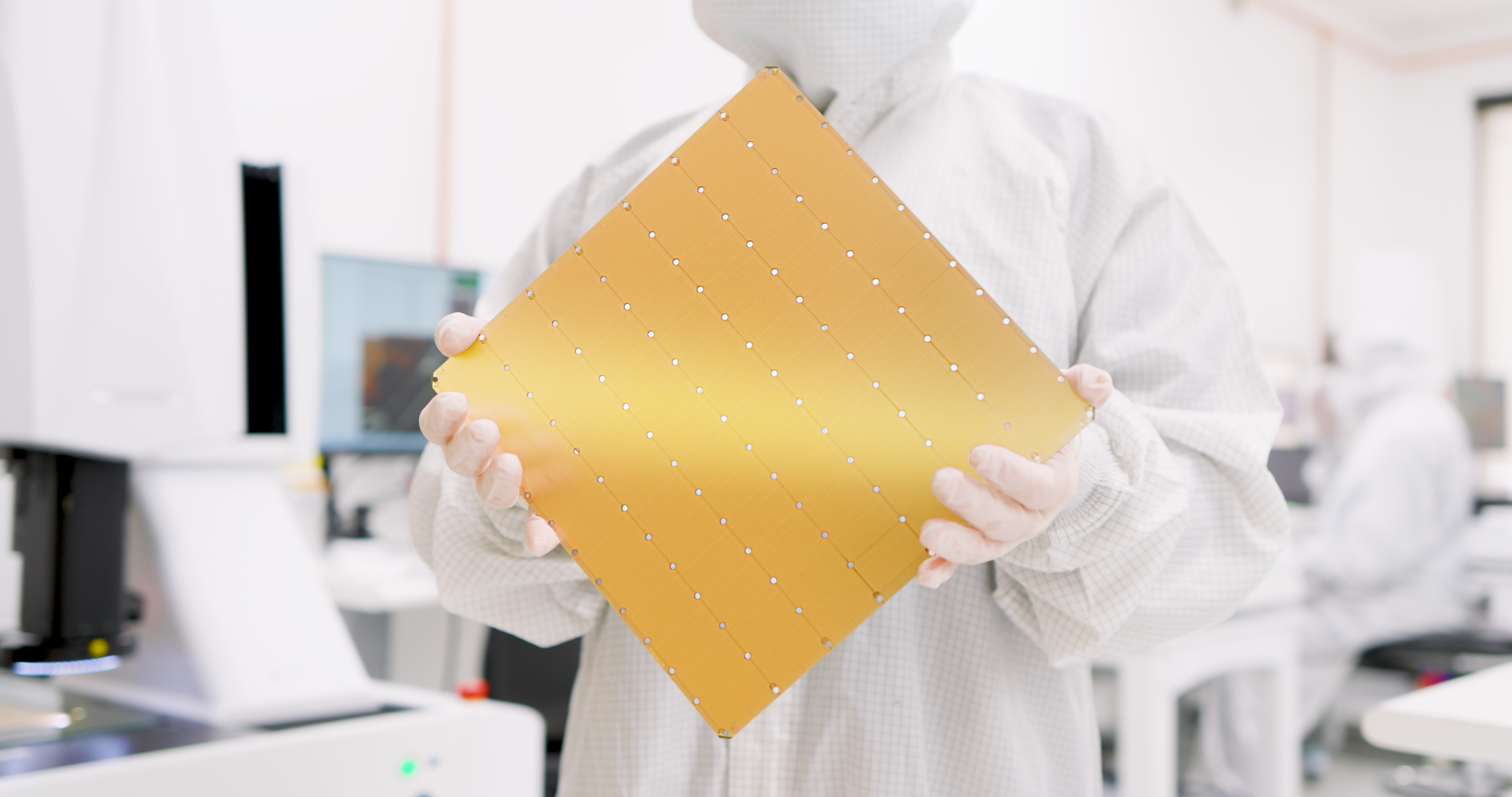

Cerebras’ flagship product is an AI chip called the WSE-3 that features four trillion transistors. Those transistors are organized into nearly 1 million cores and 44 gigabytes of high-speed SRAM memory. According to Cerebras, the chip has about 50 times more cores and 880 times more memory than the largest commercially available graphics card.

The company says that the WSE-3 can help customers train AI models faster than would be possible using traditional chips. Moreover, it’s promising to unlock power-efficiency improvements.

Advanced AI models typically run on multiple graphics processing units. In both training and inference projects, those GPUs must regularly exchange data with one another. The speed at which information travels between the individual chips directly affects the overall AI cluster’s performance: the faster a piece of data reaches a GPU, the sooner that processing can begin.

Data movement also factors into computing clusters’ power consumption. Transferring information between GPUs consumes a significant amount of electricity, particularly in large AI environments with upwards of thousands of chips.

Cerebras’ WSE-3 makes AI clusters more efficient by reducing data movement. The chip’s high transistor count allows it to run large AI models that would otherwise have to be spread across multiple graphics cards. When an entire neural network runs on a single WSE-3, there’s no need to move data between GPUs deployed in different parts of a server rack.

The company ships the WSE-3 with a compute appliance called the CS-3 that is about the size of a mini fridge. The system combines a single WSE-3 with cooling equipment, power delivery modules and other auxiliary components. Customers can deploy up to 2,048 CS-3 appliances in a single AI cluster.

Cerebras has not yet turned a profit but is experiencing rapid revenue growth. From 2022 to 2023, its sales more than tripled to $78.7 million. Its momentum continued into 2024, helping it generate $136.4 million during the first six months of the year alone.

Those sales, however, are quite concentrated so far. The New York Times noted that 87% of Cerebras’ first-half revenue was from UAE-based AI company G42.

In today’s IPO filing, the chipmaker detailed that it plans to maintain that revenue growth by acquiring more customers and enhancing its technology. The latter effort will place an emphasis on developing “new products and form factors.” The filing pointed to Cerebras’ recently launched cloud service for inference workloads as another potential source of revenue growth.

The chipmaker plans to list its shares on the Nasdaq under the ticker symbol “CBRS.” Citigroup and Barclays are the leader underwriters.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.