SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

SECURITY

Shares in F5 Inc. rose more than 10% in late trading today after the application security firm reported earnings and revenue beats in its fiscal 2024 fourth quarter and forecast a better-than-expected first-quarter revenue outlook.

For the quarter that ended on Sept. 30, F5 reported adjusted earnings per share of $3.67, up from $3.50 per share in the same quarter of the previous year, on revenue of $747 million, up 5.7% year-over-year. Both figures were ahead of the $3.45 per share and revenue of $730.39 million expected by analysts.

By sector, F5 reported software revenue of $228 million in the quarter, up 19% year-over-year, global services revenue of $388 million, up 2%, and systems revenue of $130 million, down 3% year-over-year.

Gross profit in the quarter was $603 million, up from $566 million the year prior, and operating profit was $191 million, up from $172 million.

For the full fiscal year, F5 reported adjusted earnings per share of $13.37, up from $11.70 per share in fiscal 2023, on revenue of $2.82 billion, up from $2.81 billion the year prior. Software revenue came in at $735 million, up 11% year-over-year, while global services revenue rose 4%, to $1.54 billion, and systems revenue fell 20%, to $537 million.

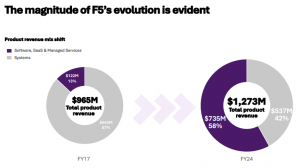

The headline software growth figures that delivered F5’s strong figures were part of a switch in 2017 started by the company to move towards a subscription model from its previous software licensing model. In that time, subscription revenue has grown from 20% of total software revenue to 85%. Recurring revenue also now accounts for 76% of F5’s total revenue versus 52% in 2017.

The headline software growth figures that delivered F5’s strong figures were part of a switch in 2017 started by the company to move towards a subscription model from its previous software licensing model. In that time, subscription revenue has grown from 20% of total software revenue to 85%. Recurring revenue also now accounts for 76% of F5’s total revenue versus 52% in 2017.

“In fiscal year 2024, despite a challenging macro backdrop to the start of the year, we achieved revenue at the high end of our guidance, surpassed our software growth expectations and maintained rigorous operational discipline, culminating in double-digit earnings per share growth for the year,” François Locoh-Donou, F5’s president and chief executive officer, said in the earnings release.

“In a relatively short period of time, we have substantially reshaped F5 from a hardware-centric, single-product company into a security and software leader in today’s hybrid multicloud world,” Locoh-Donou added. “Our transformation has redefined F5’s role beyond the data center, increasing our value to customers, diversifying our revenue and expanding our total addressable market.”

For its fiscal 2025 first quarter, F5 expects to deliver adjusted earnings per share of $3.29 to $3.41 on revenue of $705 million to $725 million. At the midpoint, the adjusted earnings outlook was below the $3.37 per share expected by analysts, but revenue was well ahead of an expected $706 million.

For the full year, the company expects to deliver adjusted earnings per share growth of 5% to 7% versus fiscal 2024 and revenue growth of 4% to 5%.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.