CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Broadcom Inc.’s acquisition of VMware Inc. is proceeding almost exactly as we expected when the deal was announced in May 2022.

Much of the media and competitor narrative is focused on the increased license fees Broadcom is imposing and the urgency of migrating off VMware. But customer conversations and recent data suggest that while migrations are happening, the real story is that VMware’s more narrow focus and cost discipline are allowing Broadcom to integrate VMWare into its highly successful business model.

Specifically, we see two seemingly countervailing trends that are both possible to be true: 1) Customers are actively moving many low value workloads off VMware; and 2) Most mission-critical work is staying put, allowing Broadcom to dramatically increase the contribution from its software business and deliver a roadmap for customers that will often be more cost-effective than migrating.

In this Breaking Analysis, we share results from the latest Enterprise Technology Research spending data and provide our latest thinking on the often discussed and frequently maligned VMware acquisition; and why it’s a win for customers, competitors and Broadcom specifically.

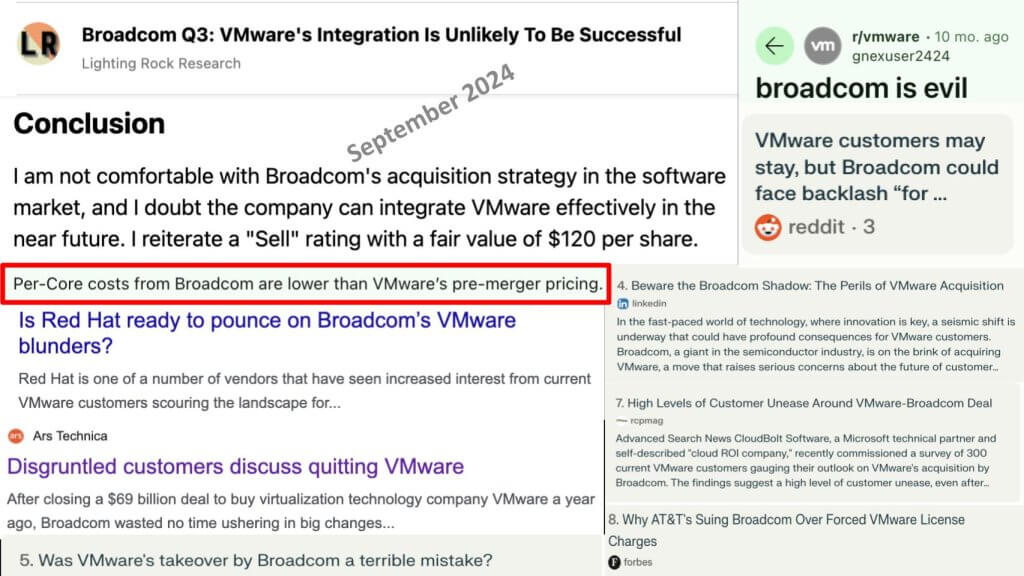

It’s easy to find negative sentiment in the press, social media and reddit threads about the changes Broadcom has imposed with respect to ending perpetual licenses and limiting the bespoke options across the VMware portfolio.

Many headlines underscore the negative sentiment toward Broadcom’s moves. But the company has been unapologetic and, quite the opposite, optimistic with customers, strongly marketing the economic benefits of going all-in on the VMware Cloud Foundation bundle.

One notable comment in a Reddit thread highlighted above in red is that by some measures, costs are actually lower than pre-acquisition. At first blush, this is hard to swallow given the price increases that customers have seen when their its time to renew their maintenance agreements.

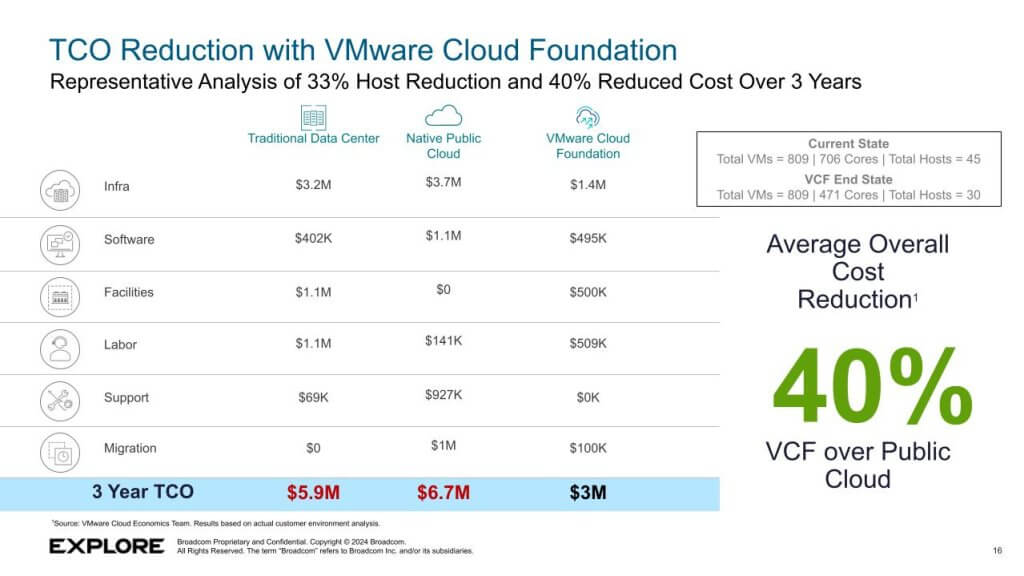

To its credit, Broadcom has done extensive total-cost-of-ownership and economic analysis that appears quite defensible. The caveat is a key assumption in the calculations is customers go all-in on VMware Cloud Foundation or VCF. As shown in the chart below, relative to traditional data center costs and public cloud, VCF is “less expensive.”

[VMware Note: This is a representative analysis only. There is no discounting applied to any of these numbers in this representative model. Native Public Cloud Numbers come from list pricing available on public websites].

The chart above shows a head-to-head comparison with traditional data centers comprising bespoke software, public cloud and VCF. What it doesn’t show is an “As-is” and a “To-be” relative to existing customer installations. Nonetheless, in an interview on theCUBE in August of this year we dug into this issue with Drew Nielsen, who leads cloud economics analysis at Broadcom. We pressed on the assumptions and methodology VMware analysts used in this chart.

[Watch the full discussion on VMware economics here.]

Our bottom line is despite near term license cost increases, we found the long-term economic analysis to be compelling in the sense that it will capture the attention of senior executives. It’s a classic Broadcom playbook as applied to VMware:

Whether you buy the pitch or not, before trying to do a wholesale migration of VMware, you’d be wise to do your own economic impact analysis.

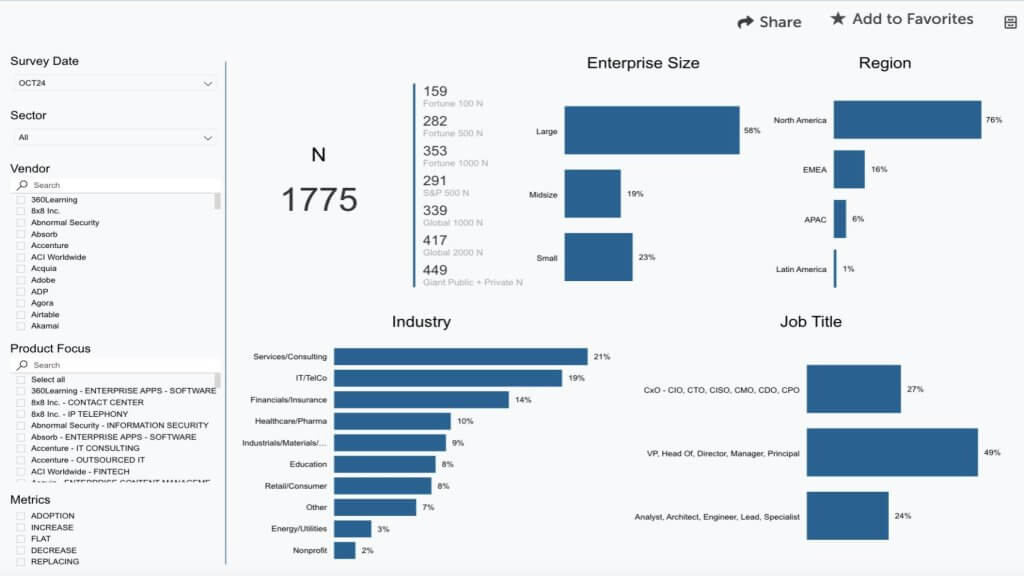

In October of this year, ETR updated its latest Technology Spending Intentions Survey. The demographics are shown below.

The survey has a substantial N with a bias toward North American respondents. As shown above, ETR captures a nice mix of C-level titles, mid-level managers and practitioners in the survey.

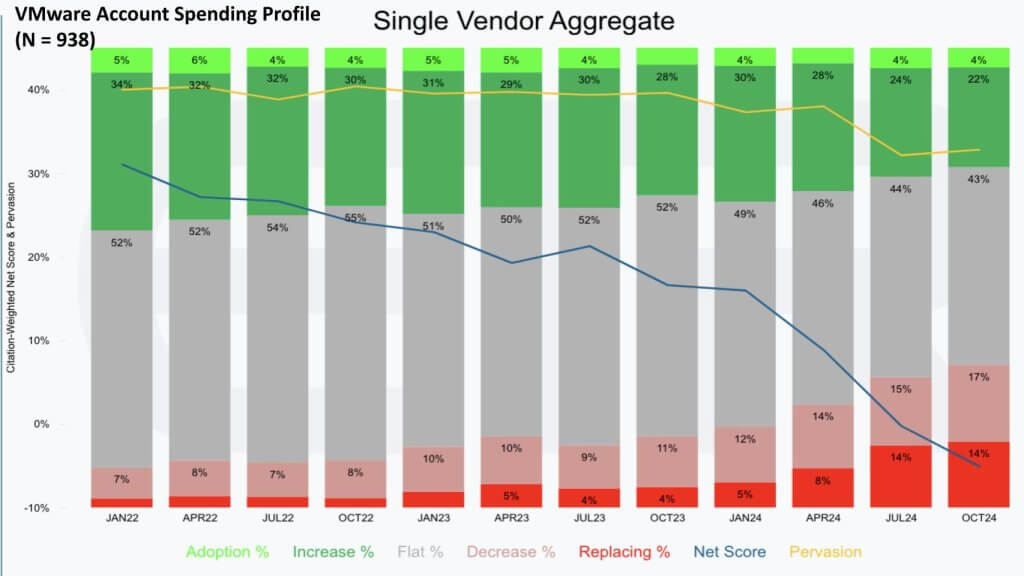

The chart below highlights the Net Score granularity over time. Net Score is ETR’s proprietary spending methodology that measures momentum within accounts. The method looks at the percent of customers pursuing specific spending patterns (i.e. new adoption, spending more, spending flat, spending less, replacing or containment).

The blue line, which is decelerating dramatically, is calculated by subtracting the percent of customers replacing and spending less from those adding plus those spending more. It’s an important way to measure spending velocity on a platform. The caveat is it doesn’t measure amount spend, only the direction across accounts.

The N in the data above is substantial at 938 VMware accounts and normally one would conclude that this picture spells bad news for VMware. But Broadcom’s strategy of narrowing the account focus and increasing contract values is not reflected.

We know from conversations with Broadcom and customers that three trends are ubiquitous across the VMWare landscape:

The previous TCO analysis we described above assumes customers go all in on VCF. We know from customer conversations that the VCF bundle is not the predominant procurement model today and fewer than 20% of customers pre-acquisition were all-in on VCF. Rather, vSphere bundles, perpetual licenses and enterprise license agreements are much more common. As such, to the extent Broadcom can convince customers to stay, the company has significant upside to its VMware business.

This strategy was highlighted on the last earnings call by Broadcom Chief Executive Hock Tan, who stated:

The transformation of the business model of VMware continues to progress very well. In fact, last week, we held a well-attended VMware Explore Conference in Las Vegas, our first as a combined company. This event was all about promoting VMware Cloud Foundation, or VCF, which is the full software stack that virtualizes an entire data center and creates a private cloud environment on-prem for enterprises. The success of this strategy is reflected in our performance in fiscal Q3.

Many narratives from the media and competitors suggest that customers are angry, they’re migrating and calls for help are numerous. All of these are true based on our assessment. At the same time, research shows that customers are not migrating their entire estates. This is the win-win we cited in our opening premise.

Customers have several choices, including hyperscalers and Microsoft Corp. in particular with AVS (Azure VMware Solution); Nutanix Inc., Red Hat Inc., open-source alternatives such as OpenStack and KVM, and Proxmox Server Solutions GmbH. Dell Technologies Inc., Hewlett Packard Enterprise Co. IBM Corp. and Lenovo Group Ltd., along with their partners are happy to help.

Many customers have told us they like AVS as an option because its a managed private cloud offering from Microsoft that essentially bundles VCF including key elements such as vSAN. From a licensing perspective, customers can acquire VCF from Microsoft or bring their own VCF licenses. The managed-service aspects are compelling for many customers and allow firms to basically eliminate VMware admin staff.

The Microsoft Azure option that Broadcom allows is a dramatic shift from the previous VMware cloud strategy. Readers of this series may remember, at one point VMware tried to compete directly with AWS. When that strategy failed, the company pivoted and made AWS a preferred partner with VMware Cloud on AWS, which gained significant traction. VMware also cut deals with other hyperscalers and cloud providers but AWS was its preferred option.

Despite all the talk of migrations, our conversations with customers suggest: 1) A very large proportion of customers (more than half) either have no plans to migrate or will leave large portions of their estate on VMware; and 2) The main strategy is to isolate VMware workloads and put new workloads elsewhere.

Why is Broadcom’s change in cloud strategy significant? After years of hand-wringing, navel-gazing and market confusion, legacy VMware affected a strategy that relied on partnerships with cloud players, sharing the wealth. This made sense during the “cloud-first” era and supported customer wishes to run VMware in the cloud.

Broadcom has killed this strategy for the following reasons:

Historically, Broadcom’s software operating margin is above 70%. We believe that over time, VMware operating margins will follow suit and be nearly as high as most SaaS firms’ gross margin.

Several industry surveys indicate a large percentage of customers are looking to migrate off VMware. On an account basis, it’s perfectly reasonable that a large percentage are looking to move some workloads as indicated in the ETR spending data above. Interpreting that earlier data, 75% of customers indicate their VMware spend is flat to down. We’ve seen surveys that even show nearly 50% of customers are looking to migrate some workloads.

The natural reaction is to conclude that Broadcom has made a big mistake shelling out $69 billion for VMware.

But migrations are hard and almost always more expensive than staying put. It’s true that in legacy markets like VMware, the risk of lock-in and price-gouging are real threats. Broadcom’s calculus is to construct a strategy where customers get more value by staying with the platform. Their promise is, despite the new packaging, crackdown on perpetual licenses and more revenue they’re extracting, the company will:

Taking into account change management, business process disruption, application portfolio impacts, skills required, error rates and the effort to abstract away the complexity of migration pain, in many cases the juice as they say isn’t going to be worth the squeeze.

By our estimates, 20% to 30% of current VMware workloads can be migrated relatively easily. Leaving a large proportion of workloads that either won’t move or will take several years to migrate.

It seems counterintuitive that Broadcom, by completely altering VMware’s packaging, pricing and partnership strategy, would be a win for anyone other than Broadcom. But the reality is the world needs a viable on-prem alternative to public clouds. Initiatives such as Project Monterey, the Nitro-like functionality VMware continues to pursue, are necessary to keep pace with cloud innovators. Here’s the logic behind our thinking:

For customers. You are going to pay more for Broadcom to pursue a streamlined roadmap. The downside is the checks your write to Broadcom will be larger but at the same time you won’t have the latest VMware acquisition du jour jammed down your throat; and you ideally won’t have to deal with a collection of less than ideally integrated and offerings. Not all workloads are going to yield better ROI and lower TCO over the long run so you should perform a workload rationalization exercise and decide what to keep on VMware, what to migrate, which workloads to kill immediately that aren’t delivering any value and what to let die through attrition. You may find that this exercise helps pay for the Broadcom hit.

For competitors. Broadcom’s non-GAAP operating margins are historically above 60% and four to six times better those of most virtualization competitors/partners (e.g. Dell, Nutanix, Red Hat/IBM, HPE and so on). Microsoft is the obvious exception. As such, the business Broadcom is pushing away is likely at least as profitable for these firms as their existing business. It can drive new top line revenue and open up new vectors of growth in a market that previously was untouchable with VMware’s historical model.

For Broadcom and its investors. A price of $69 billion is hefty. It brings new debt to Broadcom that has to be managed, especially with today’s higher interest rates. But VMware is on track to hit $4 billion in quarterly revenue and $8.5 billion in adjusted EBITDA. Originally Broadcom promised the latter result within three years of the acquisition but is on track to achieve or exceed that goal in FY 2025.

Back-of-napkin math: Broadcom’s valuation is roughly 25 to 30 times adjusted EBITDA. At an $8.5 billion EBITDA target, that’s between roughly $200 billion to $250 billion in incremental market value in less than the promised three-year timeframe. Of course, valuations can fluctuate but that’s at least a threefold return in valuation terms to shareholders in a couple of years.

Take into consideration that Broadcom’s commentary on its earnings calls and anecdotally in the field speaking with customers suggests that VMware is a long-term play that will pay significant dividends in the future.

Our belief is that much of the trade press negative narrative is misplaced. While competitors to VMware are undoubtedly seeing activity, the conclusion that this spells bad news for Broadcom and VMware is also misguided.

Our advice to customers remains the same:

Moreover, customers should spend ample time understanding VMware’s AI roadmap. We’ve always had concerns in this regard due to VMware’s lack of a coherent data play. “Good” data is increasingly becoming the No. 1 obstacle in executing successful AI strategies and it’s unclear how VMware helps in this regard. We don’t fully understand the company’s strategy and ecosystem partners approach when it comes to data that feeds AI.

On balance, however, we believe Broadcom is executing ahead of expectations on its VMware progress and is establishing the basis for a long-term platform asset that will be an industry force for the next decade and perhaps beyond.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.