BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

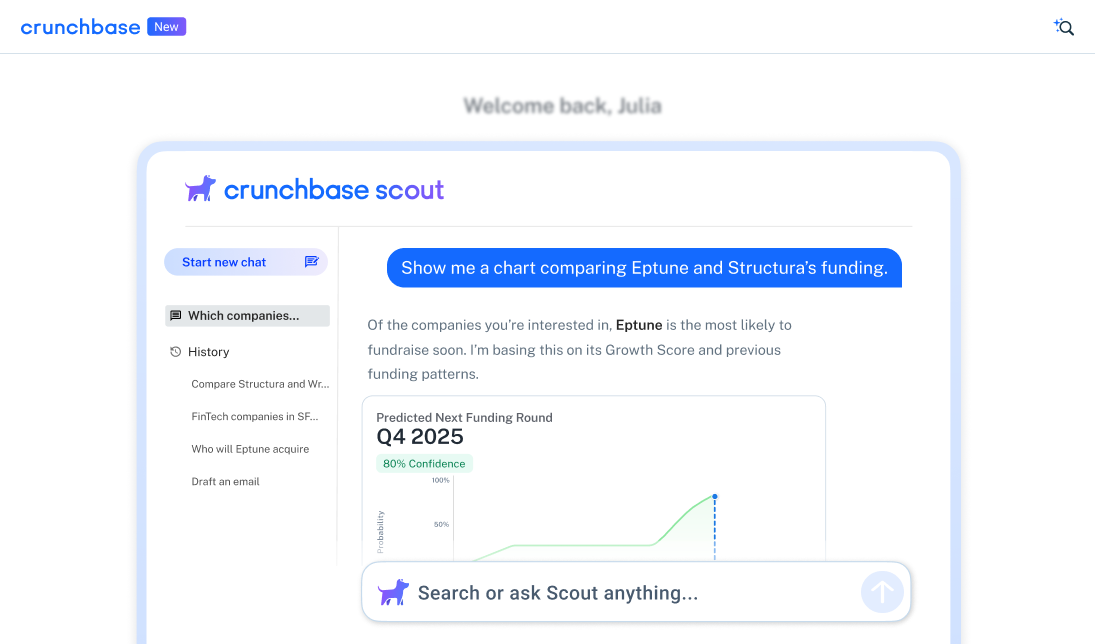

Market intelligence company Crunchbase Inc. today announced that it’s relaunching as an artificial intelligence-powered prediction engine that it claims will revolutionize how investors, founders and innovators think about market insights on private companies.

Crunchbase was founded in 2007 as a company database service as part of the tech site TechCrunch before being spun off as a separate company in 2015. Over the years, Crunchbase has established itself as a leading source of company data, but with today’s announcement, the company is repositioning itself away from historical data to live, predictive intelligence that provides a dynamic and forward-looking view of the market.

“The historical data industry as we know it is dead,” said Chief Executive Jager McConnell, adding that companies still relying on static data are “already obsolete.”

“Crunchbase is not just adapting — we’re leading this transformation,” McConnell said. “Our AI doesn’t just capture what happened yesterday; it predicts what’s coming tomorrow so customers can stay ahead of the market.”

The company’s new AI-powered solution predicts trends and major milestones across millions of private companies. It does so by integrating vast amounts of data from the internet, government filings, direct input from knowledgeable investors and employees, data partners, an internal team of experts and aggregated usage data from Crunchbase’s 80 million active users.

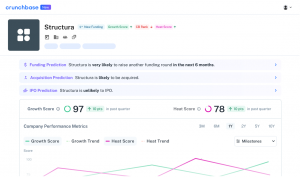

The AI analyzes billions of market signals to uncover actionable patterns with accuracy, according to the company, whether identifying emerging startups and unicorns or predicting acquisitions and investments. It says internal testing of fundraising predictions was shown to have 95% precision and 99% recall.

The AI analyzes billions of market signals to uncover actionable patterns with accuracy, according to the company, whether identifying emerging startups and unicorns or predicting acquisitions and investments. It says internal testing of fundraising predictions was shown to have 95% precision and 99% recall.

Operating at large scale, the AI updates millions of data points quarterly through automated systems, contributors and an engaged user base. The AI converts unstructured data into actionable insights, helping users identify high-potential startups and emerging trends with precision.

The new Crunchbase differentiates itself from existing players through its AI models, extensive dataset and active user engagement. Crunchbase says its AI proactively forecasts which startups are likely to secure funding, scale, or become acquisition targets. The approach not only enhances decision-making for venture capitalists and investors but also provides startups with clearer pathways to funding and growth, it added.

With the new service, venture capitalists, founders and innovators can now use Crunchbase’s predictive AI to navigate uncertainty, identify opportunities and outpace competitors.

Crunchbase not only tracks venture capital deals but is also venture capital-backed, having raised about $100 million in funding over five rounds, including $50 million in July 2022. Investors include Alignment Growth, OMERS Ventures Management Inc., Mayfield Fund and Emergence Capital Partners.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.