INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Since the generative artificial intelligence awakening, we’ve said consistently that Nvidia Corp. and Broadcom Inc. are the No. 1 and No. 2 AI plays in tech. Since peaking in mid-December of last year, Broadcom shares have been under pressure, down on sympathy with other semiconductor stocks and the general confusion about the economy, tariffs, inflation, jobs, geopolitics, debt and more.

Broadcom’s fiscal first-quarter results were impressive and support our base case for the company. They also calmed some investor concerns, at least for now. At one point the night after the earnings print, Broadcom’s stock was up 15% from its previous close, and finished up nearly 9% on Friday, despite a down day in tech.

Market transitions such as the one we’re in now often bring confusion and market volatility as the new high-growth sectors are not big enough to offset the slowdown in the larger declining markets. Nvidia doesn’t have this problem because it is at the mainspring of the new wave.

Broadcom is facing a similar but different situation in that its traditional businesses are ones that are extremely durable. Moreover, we see two relatively new dynamics coming into play for Broadcom: 1) Multiple high-volume hyperscalers are coming to Broadcom to enable their custom AI accelerators; and 2) Broadcom’s VMware strategy is working, lifting the company to new software heights.

In this Breaking Analysis, we pivot off of Broadcom’s Q1 earnings to revisit our thesis on the company. That premise has centered on the idea that connectivity both within the XPU complex and across distributed clusters remains a massive opportunity for Broadcom, combined with a radically new strategy for VMware that is delivering results much in the way as we projected.

We initiated our Broadcom coverage in earnest on Breaking Analysis about three years ago, triggered by the VMware acquisition. Several of our research notes are shown below, tracking the company’s semiconductor and expanding software business. Let’s start by looking at how Broadcom applied its ethos to VMware.

Broadcom’s acquisition strategy for VMware — initiated several years ago — has been executed in almost exact alignment with leadership’s publicly stated plans. Initially, industry observers were skeptical about Broadcom’s ability to “tame the VMware beast,” given VMware’s historically broad portfolio and aspirational visions. The subsequent narrowing of VMware’s focus, increased attention to core products, and elevated pricing strategy all confirm that Broadcom is following a well-defined operational model.

Specifically, we expected Broadcom to focus research and development to prioritize core value areas, shed non-performing assets and push customers toward bundled subscription offerings. Though this tactic has created frustration among longtime VMware users accustomed to perpetual licensing structures, it has also driven measurable gains in revenue and profitability. This shift forces customers onto higher-value contract models, which in turn boosts average deal sizes. Notably, many critics attribute the changes to “price hikes,” although Broadcom characterizes them as “increased value.”

There is legitimate merit to Broadcom’s assertions, despite the forced move to bundling. We documented this on theCUBE with Broadcom’s Drew Nielsen last summer at VMware Explore. We found the economic analysis to be fair and defensible, with the fundamental and controversial assumption that customers go “all in” on the VCF bundle.

In our opinion, one of Broadcom CEO Hock Tan’s defining traits is a high “do:say” ratio. By closely examining past statements, we find that Broadcom’s strategic moves consistently align with Tan’s predictions. Our research suggests that customers — though often uncomfortable with the forced transition to subscription and bundled packages — benefit from a company that reliably executes on its roadmap. This level of predictability resonates with financial stakeholders, despite short-term challenges in the customer and partner ecosystems.

Broadcom’s operational philosophy was highlighted last year at MWC, better known as Mobile World Congress, during discussions with the company’s semiconductor chief, Charlie Kawwas. The consistent message emphasized Broadcom’s ability to drive durable business outcomes and navigate new frontiers such as AI, all while applying the same methodical, profit-oriented approach. We believe these insights reinforce a unified corporate ethos — one that systematically applies proven processes to each new acquisition and market challenge.

Though critics may continue to voice concerns about Broadcom’s vision for VMware’s combined offerings and licensing approaches, our research indicates that Broadcom’s results and track record of fulfilling stated goals cannot be dismissed. Customers that have long enjoyed perpetual licenses are being pushed toward subscriptions, often experiencing sticker shock in the process. Nonetheless, our data suggests that many of these organizations are willing to absorb the transition if they see tangible returns and ongoing product innovation.

In our view, this dynamic underscores the importance of aligning cost structures with demonstrated value. Despite market chatter about negative customer experiences, Broadcom’s consistent execution has validated its strategic plan and strengthened its reputation on Wall Street. We believe the transition to a subscription-based model — though abrupt for some — reinforces Broadcom’s broader ambition of extracting higher margins and focusing on profitable, core technology areas.

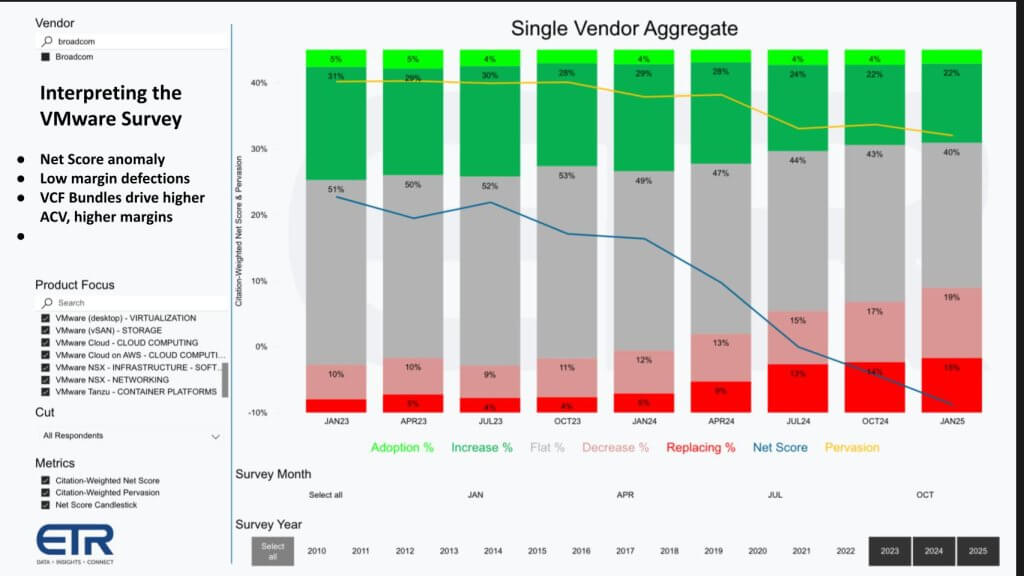

Our research indicates that VMware’s licensing and pricing changes — initiated under Broadcom’s stewardship — have triggered noticeable market backlash, which is reflected in the Enterprise Technology Research data. This data illustrates customer sentiments and spending intentions across several hundred VMware accounts, spanning various product lines.

In our view, the most striking evidence of this negative reaction lies in the shift in Net Score — a metric similar to a Net Promoter Score except Net Score applies to spending intentions. Below we show the ETR methodology applied to VMware.

Net Score tracks the percent of more than 700 VMware customers in the ETR survey within the following categories as shown above:

Collectively, we see Net Score, which subtracts the red from the green and is reflected in the blue line, dipping from the mid-20s into negative territory, suggesting that VMware is experiencing real pressure in the market. The pervasion metric — VMware’s percentage of overall customers in the ETR survey — also declined, reinforcing the narrative that some organizations are walking away from or reducing their VMware footprints.

One would look at these results and come to the conclusion that VMWare is in real trouble. But that conclusion is not correct.

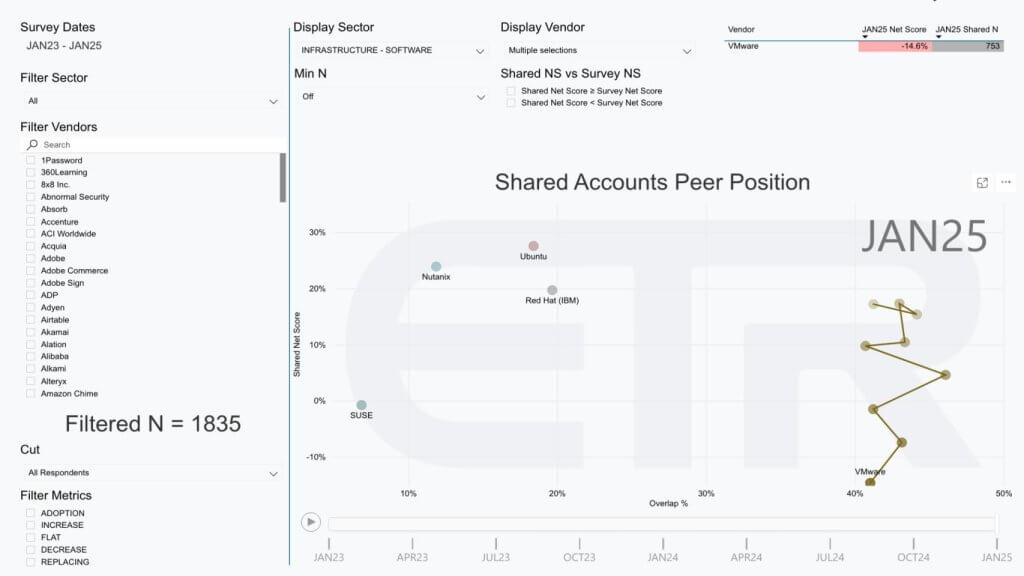

On the chart above the vertical axis is Net Score or spending momentum, what we just explained in the previous chart, and you can see the dot plots for VMware over time. VMware’s Net Score went from around 20% down to the negative territory. It kept steadily tumbling since January of 2023. We’ve plotted Nutanix, Ubuntu, and Red Hat, picking three target platforms that potentially people would migrate to. We left Microsoft out because it always skews the data.

One would look at this data and think it’s really bad news for VMware, but the reality is that this doesn’t reflect revenue — it’s an account-based metrics.

In our opinion, these trends reflect a combination of higher costs, forced migrations to subscription bundles, and significant shifts in VMware’s operating model post-acquisition. VMware’s large installed base suggests that Broadcom is comfortable with the negative impact of abrupt pricing changes, reduced flexibility and low margin customer defections. The evidence shows that many customers continue to invest in VMware solutions, suggesting that the company retains a measure of loyalty, albeit forced, and a core foundation on which it can rebuild.

Going forward, we believe it will be critical for VMware to strike a balance between monetization and customer satisfaction. This means a continued investment in core functionality and innovation, including supporting AI workloads with what VMware terms “Private AI” — that is, on-premises workloads.

In our view, the driving rationale behind Broadcom’s evolving business model is shown below and describes the pressures facing traditional hardware infrastructure — specifically server, storage and networking. These segments are increasingly squeezed by advances in silicon, cloud economics and software, which continue to take value from the middle of the stack.

As a result, Broadcom has systematically repositioned itself, participating more aggressively in two key value-creation areas:

Last year at MWC 2024, Kawwas underscored the crucial role of networking in AI workloads. When scaling beyond single XPUs, interconnecting massive clusters becomes paramount. According to Kawwas, the inability to scale up to thousands of XPUs effectively — without the right networking strategy — diminishes performance and efficiency. In our view, Broadcom’s approach highlights its capacity to integrate hardware and software solutions that address the full scope of AI’s demands.

[Kawwas explains the changes to connectivity required by AI workloads.]

When you talk AI, everything has changed because with AI, you have these elephant workloads that cannot run on a single processor, whether it’s a GPU, TPU, NPU, the flavor of the day, let’s call them for the next 15 minutes XPUs. If you take these XPUs, and you take some of these elephant workloads, you can’t run them on a single XPU. You can’t even run them on eight CPUs or XPUs or GPUs, you have to now scale into the thousands today, thousands of these. In order to do that, you’ve transcended now a single system where you’ve scaled up. Now you have to scale out to many, many of these systems and racks, and you have to interconnect them. And guess what? If you don’t have the right network strategy and connectivity strategy, this will not work, this will not scale up. – Charlie Kawwas, Broadcom

The conversation around AI also surfaces a notable duopoly in the networking space with only two company’s truly able to excel at connectivity within the chip and across large-scale clusters:

We believe competition will intensify as AI expands beyond traditional data center workflows, but the massive market for flexible, high-performance network fabrics is booming. Though each player differentiates via proprietary versus more open approaches, the rapidly growing size of the AI market suggests headroom for both to thrive.

Overall, we believe Broadcom’s strategy of balancing semiconductor innovation with infrastructure software is well-positioned to address the next wave of high-performance, AI-driven workloads. The one area we’ve felt was lacking for VMware has been its lack of a clear data strategy. It appears VMware generally will leave the data piece to its customers and others in the ecosystem to sort out.

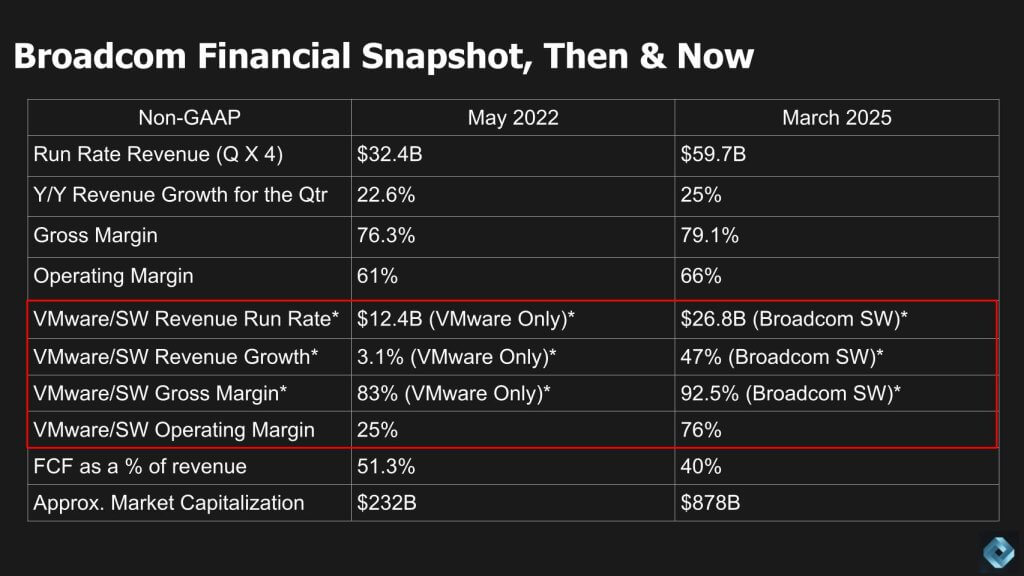

In reviewing Broadcom’s performance from May 2022 to March 2025, the numbers paint a vivid picture of how the VMware acquisition has fundamentally altered the company’s profile. The most striking theme is the accelerating shift toward software:

Our analysis indicates that, while some legacy VMware customers are exiting due to price hikes or dissatisfaction with forced subscriptions, Broadcom remains focused on high-value customers willing to adopt its full VMware Cloud Foundation (VCF) stack. According to Broadcom, approximately 70% of its top 10,000 customers have migrated to VCF, driving improvements in gross and operating margins. Those customers no longer aligned with Broadcom’s direction are effectively being pruned from the portfolio.

Beyond VMware, Broadcom continues to leverage the surge in AI-driven workloads:

One of the few negatives in Broadcom’s financial picture is free cash flow as a percentage of revenue, down from over 50% to around 40%. Management attributes the decline to several factors:

Despite these headwinds, investors appear willing to tolerate near-term pressures in light of Broadcom’s operating discipline and rapid revenue expansion.

Critics often liken Broadcom to a private equity firm, arguing it narrows R&D investment and focuses on near-term extraction. However, from our perspective, Broadcom employs a deliberate approach to concentrate R&D on core technologies (for example, Tomahawk switches, SerDes, custom silicon for hyperscalers). While it curtails broad experimentation, it invests heavily in targeted areas with strong returns — contributing to robust margins and a notable market valuation surge.

Looking ahead, Broadcom’s strong orientation toward software, AI and custom silicon positions it to regain the trillion-dollar market-cap mark if current momentum continues. The TAM expansion signaled by Tan ($60 billion to $90 billion excluding the four new design wins), coming from hyperscaler demand for XPUs and AI infrastructure, further bolsters the bullish case.

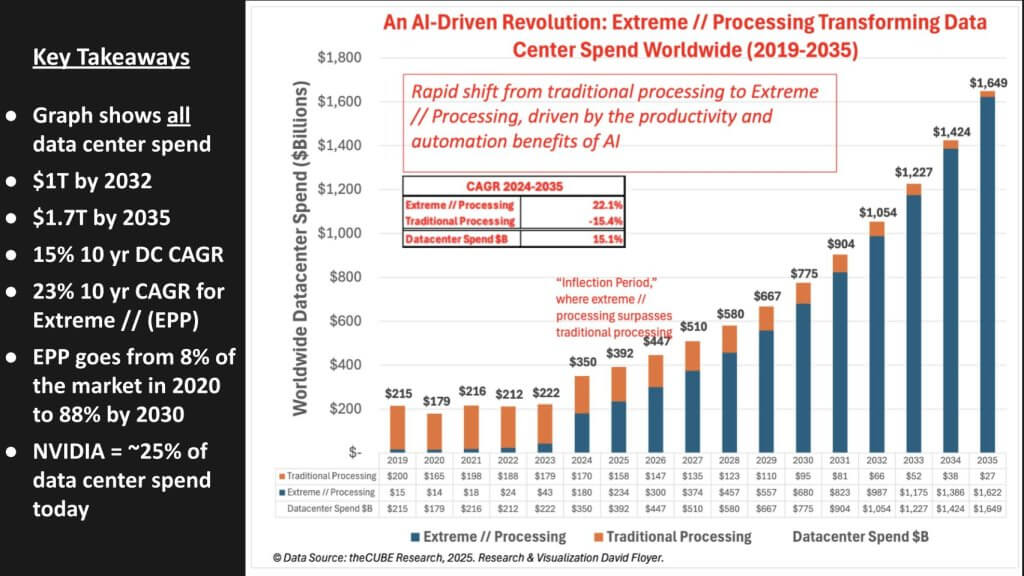

The chart above, developed by David Floyer, depicts total data center spending worldwide — including servers, storage, networking, power and cooling, and also hyperscale infrastructure. After years of relative flatness and even contraction in 2020, the market has entered a super cycle fueled by “extreme parallel processing” or EPP, or what Nvidia CEO Jensen Huang often calls accelerated computing.

Overall, the data center market is entering an era where parallel processing becomes the default architecture for emerging workloads, driving unprecedented growth and reshaping vendor strategies. From an investor perspective, companies enabling EPP — particularly in the areas of specialized compute, high-speed networking and AI acceleration — stand to capture significant new value as the market rockets toward a trillion dollars and beyond.

Broadcom and Nvidia in our view are two of the most well-positioned “picks and shovel” companies that will benefit from the growth of this market.

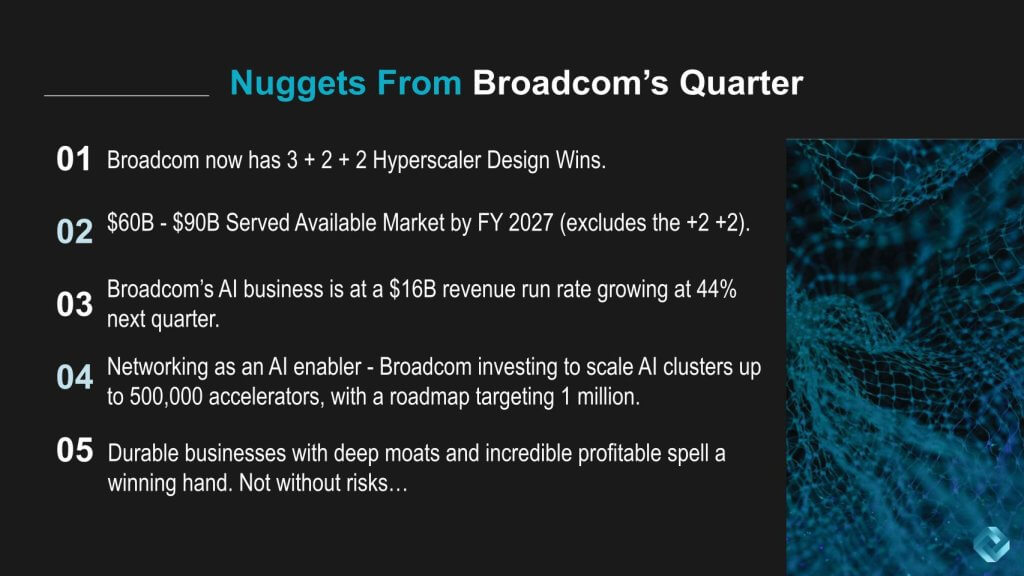

Broadcom now counts three primary hyperscalers (Meta, Google, ByteDance) plus two additional disclosed, plus two more unnamed design wins. In our view, these design wins anchor Broadcom’s strategy of mixing custom and merchant silicon, complemented by a robust software business. Broadcom’s durable approach — projects lasting 10 years or more — mirrors its history of building deep moats and reliable profit engines.

The company highlights a $60 billion to $90 billion SAM by 2027 for its AI-related offerings, excluding the potential upside from the newly added “+2” hyperscalers. According to company statements, Broadcom’s AI business currently operates at a $16 billion run rate, growing at 40% to 50% (with a notable 77% spike in the latest quarter). These figures underscore a trajectory that could elevate Broadcom to a scale comparable to other top AI enablers such as Nvidia.

Despite Broadcom’s positive momentum, regulatory questions loom. Hock Tan has been queried on how AI export restrictions and technology diffusion rules might impede sales to Chinese hyperscalers (for example, ByteDance and Alibaba). Though Broadcom can partially tailor its silicon to comply with controls (for example, down-tuning certain features), it ultimately cannot dictate geopolitical policy. The company’s ability to navigate these evolving restrictions will be crucial for sustaining future growth.

Broadcom stands out as a durable, highly profitable enterprise, enjoying both near-term gains in AI networking and longer-term expansions of its custom silicon customer base. Though there are real risks — especially around export controls and an uncertain geopolitical environment — the company’s diversified approach, deep moats and robust margin profile suggest a compelling story for investors. Whether one is bullish, bearish or neutral likely depends on risk tolerance for regulatory issues and belief in Broadcom’s capacity to execute on its design wins.

What do you think? Is Broadcom’s software strategy forcing you to rethink your on-prem infrastructure partners? Or are you staying the course and sticking with VMware, defecting or taking a hybrid approach?

Let us know.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.