BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

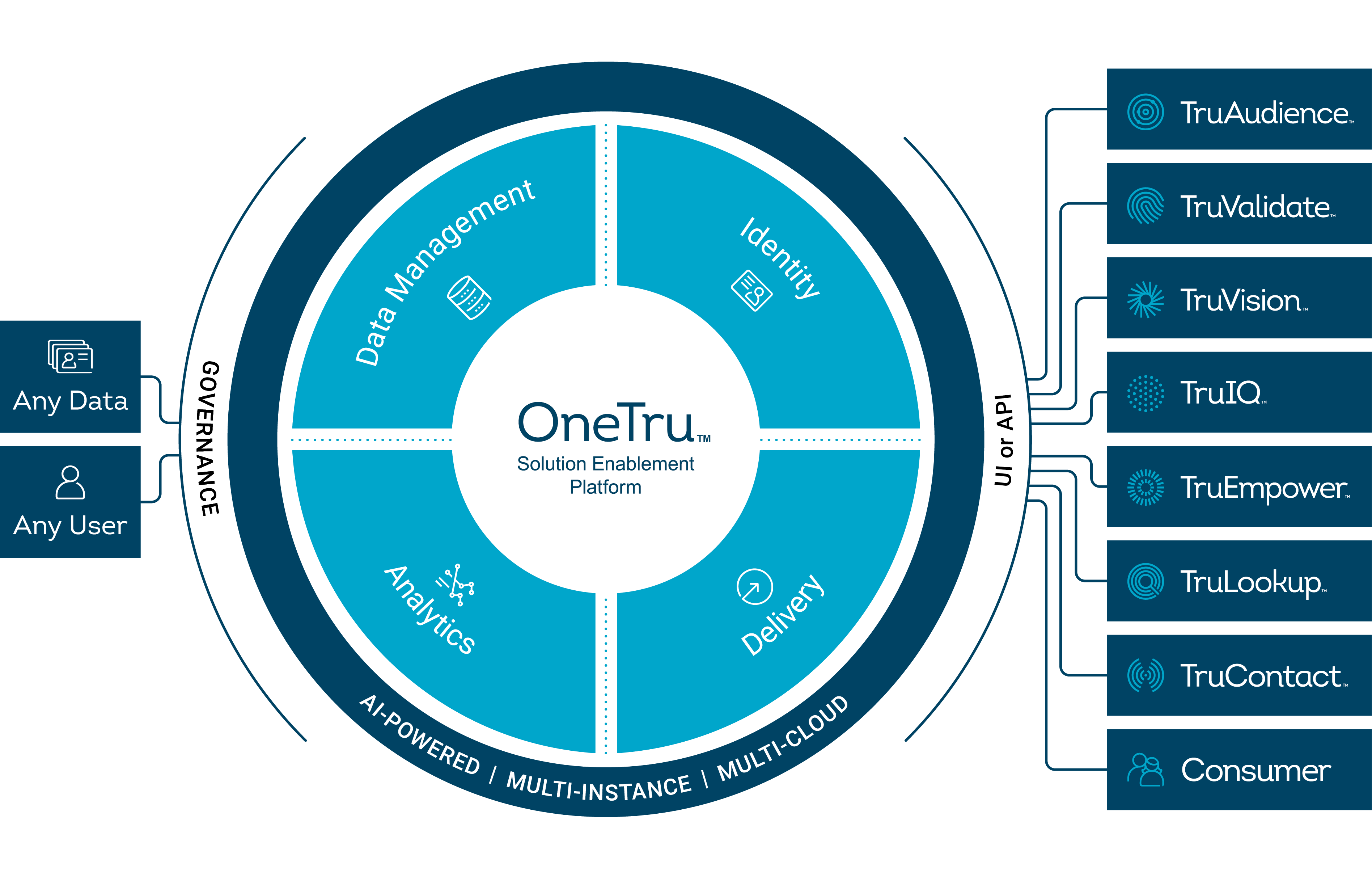

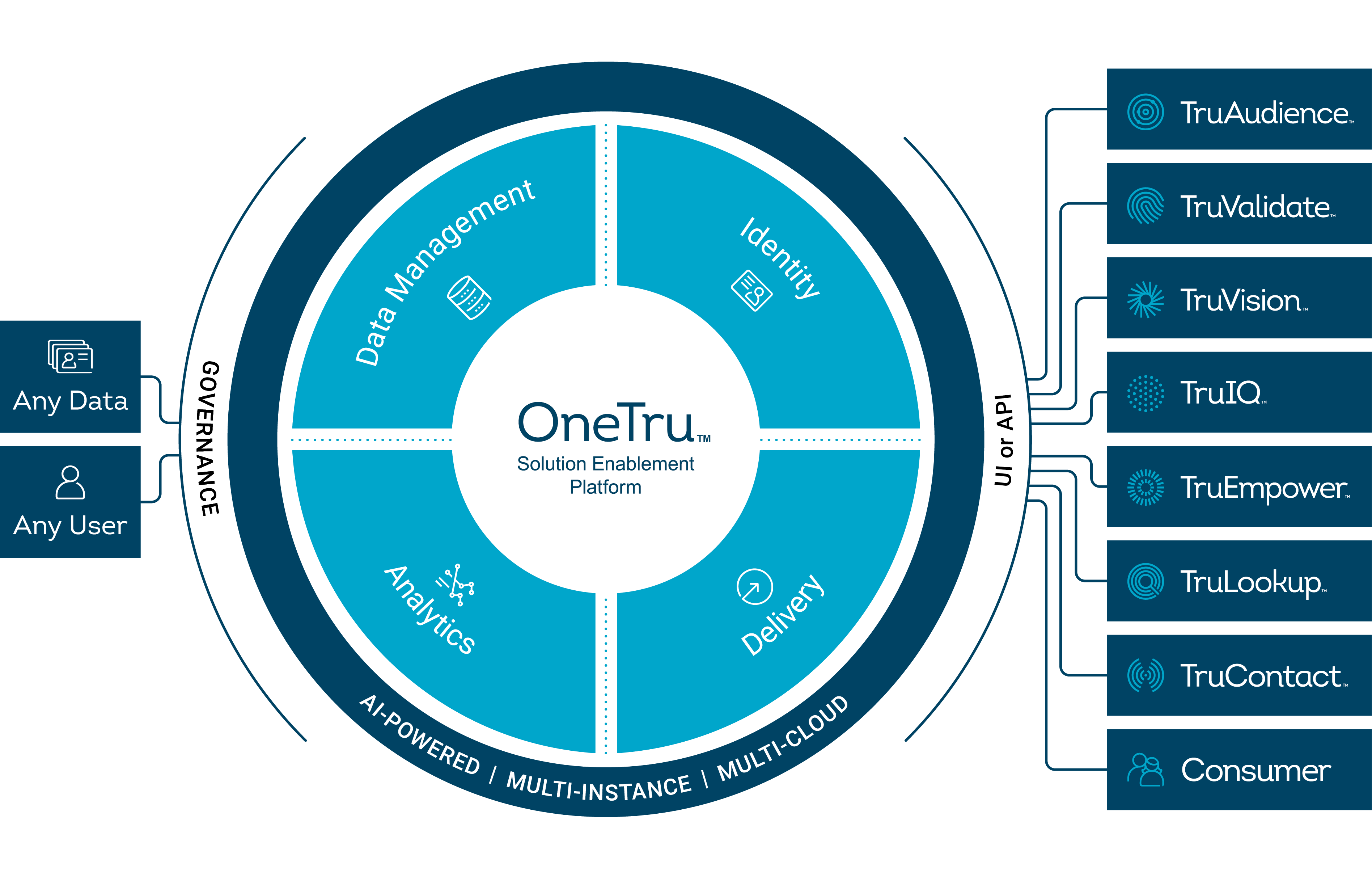

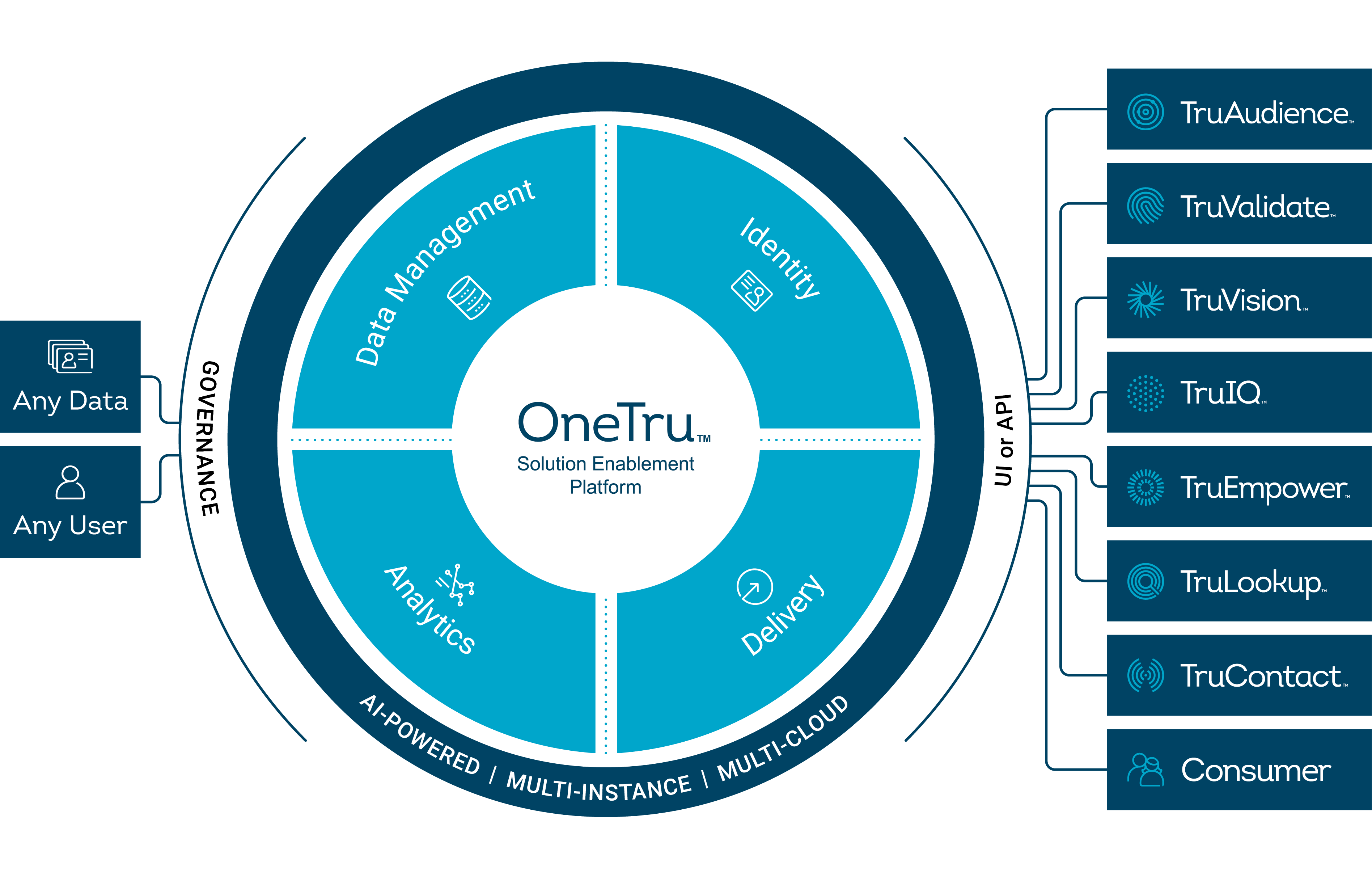

A year after announcing plans to build what is called a solution enablement platform to support its expansion into data and analytics services, credit reporting company TransUnion LLC says its transition is nearly complete and its OneTru platform is paying off both internally and for business customers.

In recent months, TransUnion’s alternative lending bureau has used OneTru to introduce new credit risk products that enrich lenders’ existing underwriting scores. Its marketers are using the TruAudience identity-driven marketing line of products to create more persistent views of customer identities for planning, executing and measuring marketing efforts.

The TruValidate fraud prevention service has improved fraud capture rates and reduced false positives while helping one financial institution increase its fraud capture rates by 162%. A U.S. credit card issuer cut its offer timeline from 45 to 21 days using TruIQ Data Enrichment.

All these services are enabled by the unified OneTru platform.

“We’ve seen a more than 50% productivity boost from migrating legacy products to run on top of the platform,” said Venkat Achanta, chief technology, data & analytics officer.

Consolidating tens of petabytes of data gathered over more than 20 years on a single platform has been challenging, requiring TransUnion to invent many technologies and tactics it used for security, data governance and identity resolution.

TransUnion’s Achanta says OneTru has boosted productivity up to 50%. Photo: TransUnion

“We collect data from tens of thousands of sources,” Achanta said. “No commercial tool could scale to meet our compliance processes.”

Data migration has been a one-customer-at-a-time process, requiring dual platforms and a set of tools the company’s data scientists developed to apply artificial intelligence to scrubbing and tagging.

With much of that work now completed, TransUnion is focused on lining customers up for its analytics, risk management, customer engagement, marketing and other packaged services.

One is the new TruIQ Analytics Studio. It enables data scientists to build analytic models using pre-populated code templates. “Over 700 data scientists have used the same tools we use to build models on top of the platform,” Achanta said.

The company has especially high hopes for TruValidate, a real-time adaptive machine learning model that identifies patterns and blocks fraud attempts before any consumer interactions take place. It links structured data like traditional offline identities with unstructured data, like behavioral information, device properties and geographic location, to pinpoint fraud attempts earlier and more accurately.

“We have every bank, fintech and credit union as customers,” Achanta said. “Every business-to-consumer company is worried about fraud.” TransUnion’s latest State of Omnichannel Fraud Report found that 53% of adults in 18 countries and regions were targeted in fraud schemes from August to December last year.

In rolling out new services to customers, TransUnion has adopted what it calls a “Customer Zero” approach, in which new capabilities are tested internally before being released as products. “If we can meet the needs of our own uses cases, we can better open the platform to others,” Achanta said.

With its renewed focus on selling services to financial institutions, the company is looking at making its platform composable and flexible so customers integrate data from any source they wish.

“The composable platform will be something you can deploy in your private cloud within your security context and with your customer data,” Achanta said. “We’re looking to support streaming data with unlimited deployment options, not just a hosted service.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.