APPS

APPS

APPS

APPS

APPS

APPS

Earned wage access startup Tapcheck Inc. said today it’s looking to expand on-demand pay access to millions of new workers after raising $225 million in funding.

The money comes from a $25 million Series A extension round led by existing investor PeakSpan Capital, plus a $200 million credit facility provided by Victory Park Capital.

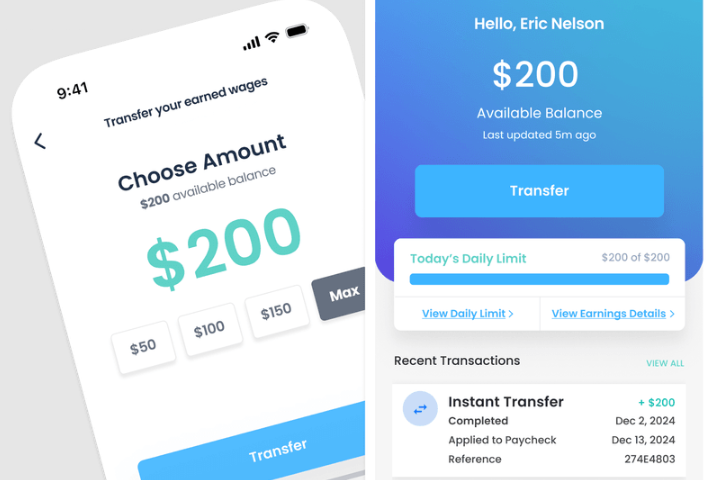

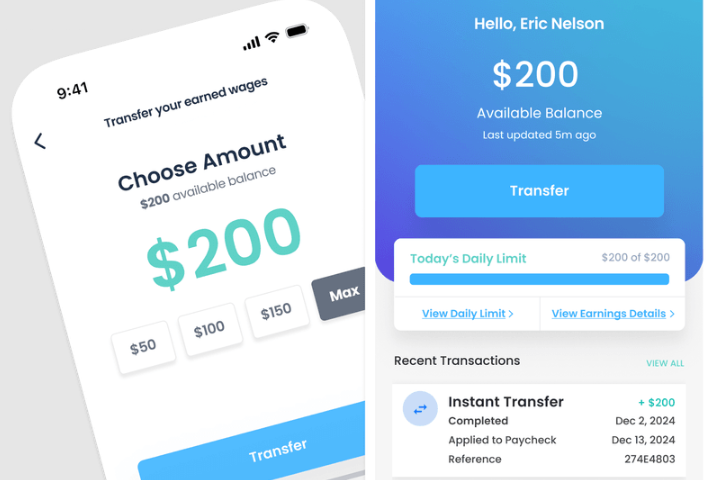

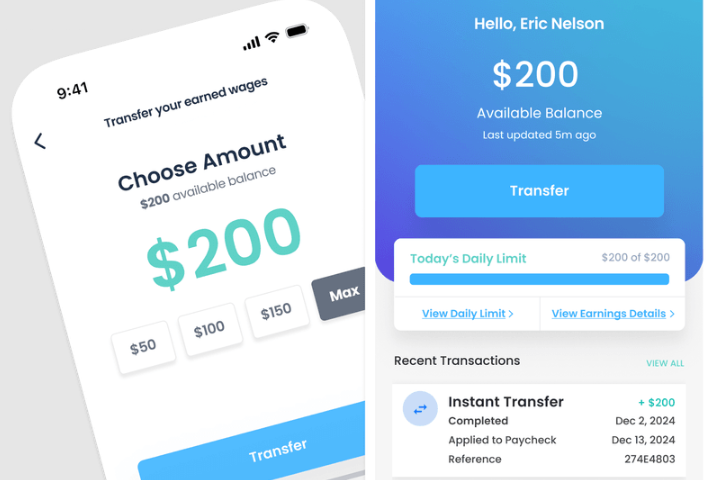

Tapcheck, founded in 2019, provides a service that provides employees with early access to wages they’ve already earned, allowing them to obtain that money immediately, before payday arrives. It says it’s trying to address people’s financial difficulties, which stem from traditional pay cycles. Simply put, as soon as employees have completed their latest shift, they can pay a small fee to Tapcheck to get those wages deposited straight into their account, in cases where they need quick access to some cash.

The startup says employers can offer its services as an “on-demand pay benefit” and insists it’s a beneficial perk for both them and their employees, helping to improve the morale and increase the productivity of their workers by relieving any financial stresses they might have.

As well as having the money deposited directly into their bank accounts, employees can apply for a Tapcheck debit card, which allows them to spend already-earned wages at any business that accepts Mastercard, as an alternative to the traditional banking system. Employers who integrate Tapcheck’s services can obtain a stack of payroll cards that can be handed out to new employees when they first start working.

According to Tapcheck, its on-demand pay platform integrates with almost 300 payroll and timekeeping systems, ensuring it can be offered by virtually any business almost instantly. It uses a proprietary “earned wage access engine” to calculate how much money has been earned by each employee, so it knows exactly how much cash they’re eligible to receive. While employees pay a small fee to access their wages early, there are no costs for employers. All of the upfront cash paid to employees comes from Tapcheck, rather than the employer. Tapcheck only gets paid when payday comes around.

The startup says its service has proven to be extremely popular. Since its launch, it has facilitated more than $1 billion worth of early wage payments at more than 12,000 businesses. Its clients include Hilton Worldwide Holdings Inc., Planet Fitness Inc., Taco Bell Corp., Jiffy Lube International and McDonald’s Corp. For the latter company, its services have already been used by more than 112,000 employees, earning more than $160 million worth of wages to be accessed early.

Jack Freeman of PeakSpan Capital said he’s happy to renew his backing of the company after seeing it grow its revenue by more than 20-times in the last three years. “They’ve done so while tripling down on user experience, payroll accuracy, integrations and onboarding,” he added.

Looking forward, Tapcheck said the fresh funding will help it to accelerate product development and expand its nascent artificial intelligence capabilities.

“This infusion of capital will further strengthen our capacity to empower employees nationwide and alleviate financial pressure by granting access to earned wages ahead of traditional pay schedules,” said Tapcheck Chief Executive Ron Gaver.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.