AI

AI

AI

AI

AI

AI

Thirty months into the generative artificial intelligence awakening, the jury is still out on how much enterprises are benefiting from investments in AI.

Though the vast majority of customers continue to spend on AI, reported returns are no greater than, and frankly lag those, typically associated with historical information technology initiatives such as enterprise resource planning, data warehousing and cloud computing. Let’s face it, the multihundred-billion-dollar annual capital expenditure outlay from hyperscalers and sovereign nations is fueling the euphoria and essentially supporting blind faith in the AI movement.

But ground truth returns from enterprise AI adoption remain opaque. This combined with geopolitical unrest, fluctuating public policy and GDP estimates in the low single digits, have buyers tempering expectations for tech spending relative to January of this year.

In this Breaking Analysis, we review the latest data on enterprise AI adoption in the context of overall IT spending. We’ll also drill into some of the dynamics of AI usage and give you a small glimpse of some leading-edge AI product research conducted by Enterprise Technology Research.

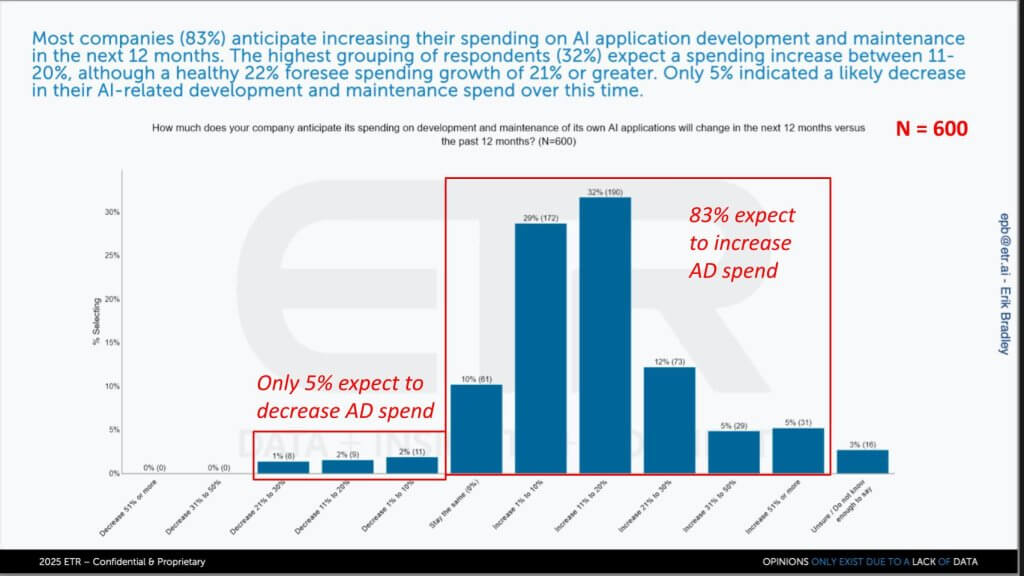

We believe the latest cut of ETR’s AI Product Series, shown below, confirms a decisive budget shift toward building in-house AI applications. The survey, fielded to 600 IT decision makers who are actively developing and maintaining proprietary AI applications, finds that 83% expect to raise spend in 2025, with most projecting double-digit increases. Only 5% foresee any pullback. ETR notes that a companion January survey of broader “buy-and-build” AI programs delivered a similarly bullish read (75% net-positive), underscoring that whether enterprises are purchasing software as a service or crafting code themselves, AI app/dev is a budget priority.

Nonetheless, in our opinion, the chart’s right-skewed distribution of responses illustrates a market that is still in acceleration mode and nowhere close to saturation. The implication is vendors supplying tooling, runtime platforms, and talent to in-house AI teams will likely see sustained tailwinds through 2026 and beyond.

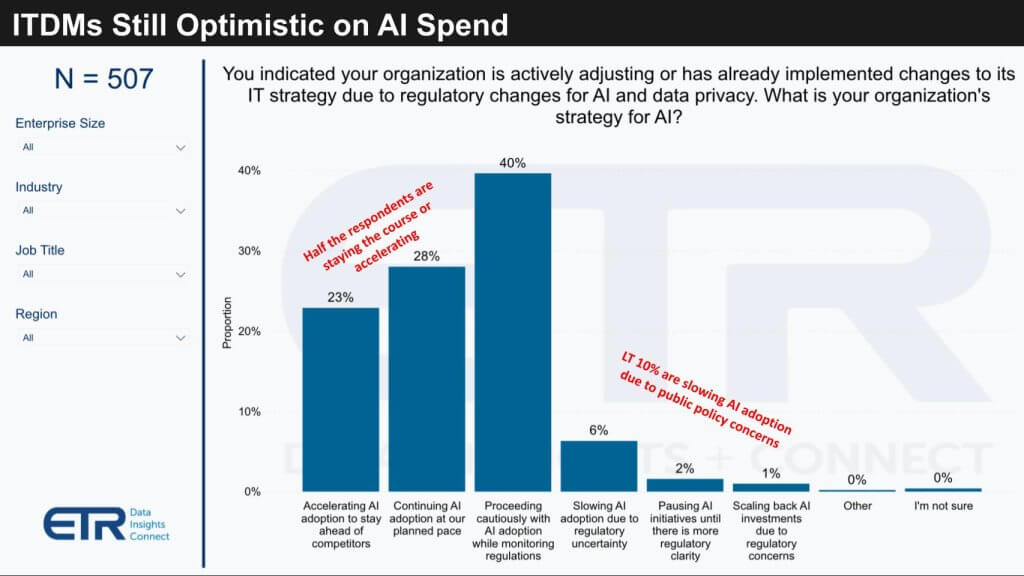

The chart below paints a picture suggesting geopolitical tension and shifting policy frameworks are not derailing enterprise AI agendas. In ETR’s April 2025 macro survey of 507 leaders, half report they are either holding steady or accelerating AI programs in spite of tightening policies. Only 10% are tapping the brakes.

The horizontal bars above depict three cohorts: 1) Enterprises accelerating AI adoption; 2) Enterprises staying the course; and 3) Those slowing adoption. The middle band, labeled “proceeding cautiously,” is the largest at roughly 40%, while the deceleration slice is under 10%. The leftmost bar representing acceleration widens materially when the data is filtered for IT-telco respondents, jumping from 24% to 40%, with a corresponding lift in the “continuing” category to 26%. In our view, the data reinforces the idea that digitally intensive sectors are doubling down, not hedging.

In our opinion, the chart’s asymmetry – that is, mostly “green” with a narrow “red band” cutting, signals that AI has earned prominent status in 2025 budgets. The prudent middle will either migrate toward acceleration as regulatory guardrails solidify; or stand pat if uncertainty persists. We caution that spending is fickle and often ebbs and flows with economic sentiment.

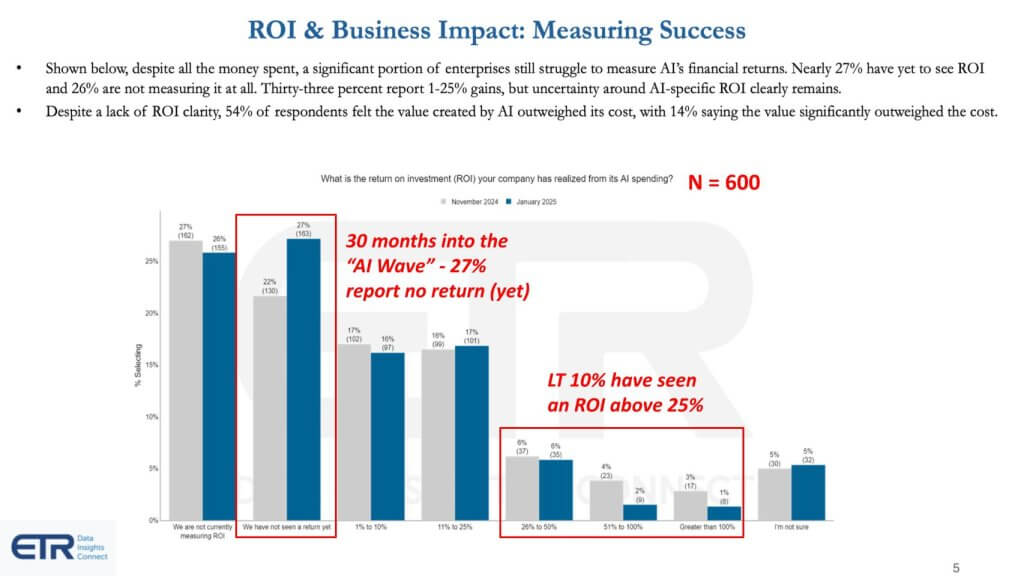

The chart below injects a cautionary note into the otherwise bullish narrative. Thirty months into the generative-AI wave, 27% of respondents acknowledge they have yet to see any tangible return on their AI spend. Fewer than 10% report an ROI north of 25%, the hurdle rate many CFOs use to green-light higher risk IT projects. Even more revealing is that more than one-quarter admit they are not tracking ROI at all.

The bar segments above show several ROI bands ranging from Not tracking, Negative/Zero, 0–10 %, 10–25 %, and three bands “>25 %.” The largest cohort are either not measuring or have yet to cross break-even. The data underscores a skew toward unproven or unmeasured outcomes.

Once again we see an asymmetry in the data – that is, a large cohort at “no return” while tapering sharply at “high return.” In our view this signals that AI remains an early-cycle investment story. The “proceed with caution” middle we highlighted earlier could flip positive once tangible benefits surface; conversely, it could sour if ROI continues to lag expectations or economic sentiment shifts. Either way, the next two survey waves will be pivotal in determining whether optimism converts into measurable economic value.

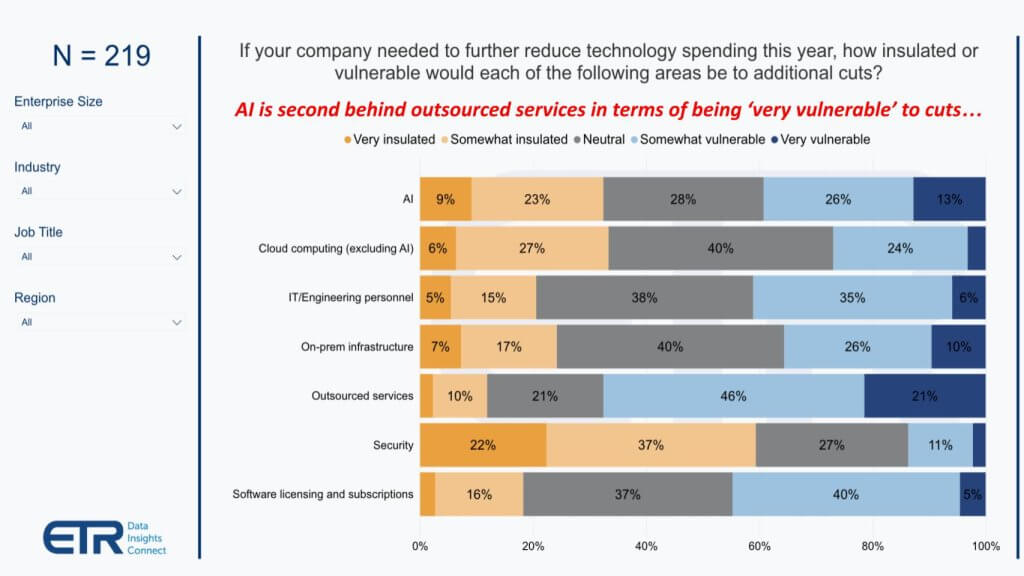

We believe the chart below offers an important reality check. When 219 C-suite executives were asked where they would pull dollars if macro conditions deteriorate further, AI initiatives rank as the second-most “very vulnerable” category — trailing only outsourced IT services and sitting behind security cloud, software as a service and core infrastructure.

The horizontal bars above rank seven IT domains by share of executives evaluating the vulnerability of each segment to incremental cuts. Outsourced IT services tops the list, followed by AI projects. Security anchors the group with the smallest exposure, while cloud computing, SaaS and foundational infrastructure occupy the middle ground, indicating to us that they are somewhat more insulated.

| Observation | Implication |

|---|---|

| One-third of C-level leaders now expect to reduce 2025 spend more than initially planned. | Discretionary programs will face triage, forcing AI teams to justify initiatives against clearer ROI benchmarks. |

| AI’s sandbox status makes it an expedient target. | Unlike cyber defenses or production workloads, AI pilots can be paused without jeopardizing day-to-day operations, making them a politically safe cut for CIOs. |

| Security remains most protected. | Our research indicates that compliance mandates and breach headlines continue to shield security budgets even in tightening cycles. |

| Cloud and infra enjoy middle-of-the-pack protection along with software. | These categories underpin revenue-bearing digital services; therefore, outright cuts risk revenue leakage. |

| Velocity can backfire. | The very speed at which AI spend has ramped invites scrutiny—controllers see an obvious lever when forced to contain cash burn. |

In our opinion, the data reminds investors and practitioners that AI hype does not equal budget immunity. While earlier data documented robust intent to invest, the C-suite view presented above highlights a Caveat. Specifically, if macro headwinds intensify, experimental AI funding could move to the front of the line for cutbacks.

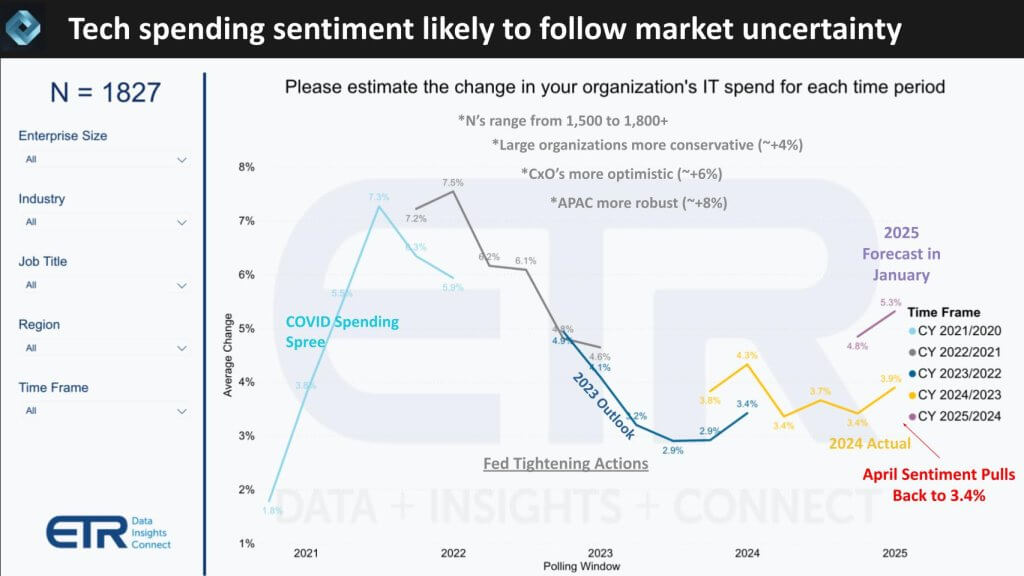

The data below captures one of the sharpest one quarter resets in enterprise tech spending since the initial COVID shock. ETR’s April macro pulse shows 2025 IT budget growth expectations plunging from 5.3% in January to 3.4%, a 190-basis-point drop which ETR characterizes as “the biggest drop we’ve ever recorded outside a crisis.”

The line graph above tracks sequential quarterly revisions to aggregate IT budget growth, with call-outs for key segments. All three curves slope steeply downward between Q1 and Q2. The mainline average falls to 3.4 percent, while the Fortune 500 and Global 2000 are even less optimistic, looking for 2.4% and 2.2%, respectively. One footnote is the survey closed one day after reciprocal tariffs were announced, meaning the data miss the subsequent equity market sell-off that likely would have driven estimates even lower. The sample also was taken before the v-shaped rebound that ensued when tariffs were put on temporary hold.

| Observation | Implication |

|---|---|

| Largest quarterly downgrade since early 2020. | Our research indicates sentiment has turned decisively cautious as GDP forecasts slip below 1 percent and rate cuts remain elusive. |

| Scale amplifies pain. | Big enterprises—historically the mainspring of IT demand, are trimming the deepest, underscoring a broad-based belt-tightening rather than isolated project delays. |

| Correlation with GDP is alive and well. | Contrary to notions of tech spending decoupling from macro cycles, the data reinforce a tight linkage between business outlook and IT outlays. |

| Security stays sticky, AI ok (for now). | As we noted in Section 4, experimental AI remains vulnerable, whereas keep-the-lights-on categories (security, SaaS and core infra) enjoy relative protection. |

| Watch the July read-out. | A modest market rebound could buoy the next survey, but we believe CFOs will demand clearer ROI articulation before restoring budgets to 5%-plus growth trajectories. |

In our opinion, the data’s pronounced downward inflection delivers two messages. First, the post-COVID era of “high-single-digit baseline” IT growth is over for now; budgets have snapped back to pre-pandemic norms. Second, the gravity of macro sentiment is palpable. If GDP stays sub-1%, we expect CFOs will continue to recalibrate spend to 2% to 3% territory, forcing AI champions to prove value faster or risk funding erosion.

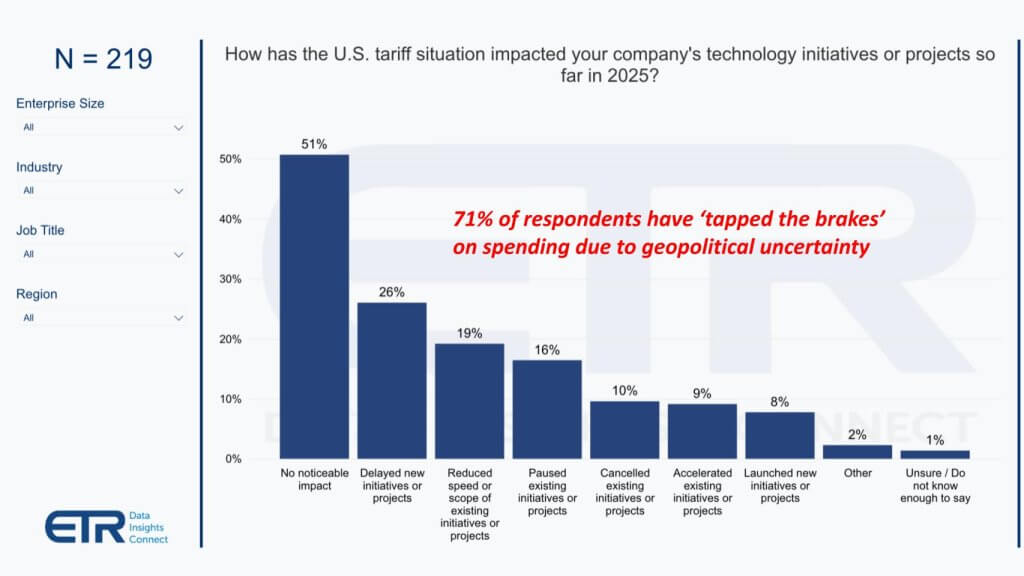

The data below is the clearest signal yet that political and trade turbulence is starting to seep into executive decision making. In a flash response cut of 219 C-level executives, 71% acknowledge some form of pullback, whether delaying, reducing scope, pausing or outright canceling AI initiatives, while only 27% say uncertainty pushed them to accelerate or green-light new projects.

| Observation | Implication |

|---|---|

| Impact is real at the top. Nearly half of C-suite respondents link policy volatility to action, and three-quarters of those actions are defensive. | Our premise is that unless and until ROI become more clear, enterprise AI enthusiasm is subject to board-level gating if the external environment turns negative. |

| Delay outpaces cancellation. Most executives are hitting pause, not “stop,” implying pent-up demand could rebound if clarity emerges. | Vendors should prepare for an air-pocket in deal closures Q2–Q3, with a potential catch-up surge late in the year. |

| Back-loaded budgets. Consistent with previous analysis, spending expectations are drifting to the fourth quarter, mirroring IPO market hesitancy. | We believe forecasting models should weight Q4 more heavily than historical seasonality would suggest. |

| Sandbox perception persists. Experimental AI remains easier to shelve than revenue-bearing workloads, reinforcing the previous section’s points on AI vulnerability. | Teams should reframe pilots as cost-savers or revenue enablers to escape “nice-to-have” status. |

In our opinion, the chart’s lopsided distribution toward delay and down-scoping underscores an emerging tension between boardroom optimism about AI’s transformative potential versus CFO caution in an unsettled macro climate. The next survey wave will reveal whether today’s pause becomes tomorrow’s cancel, or merely a coiled spring set to release once policy headwinds subside.

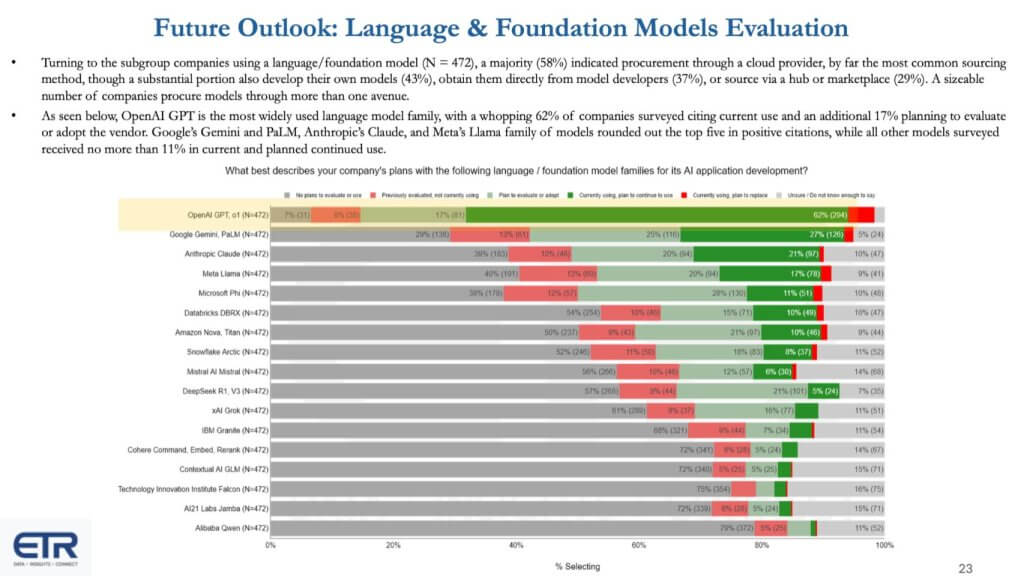

The inaugural ETR snapshot of which foundation model families enterprises plan to incorporate into their own code bases provides an early but telling signal — that is, OpenAI’s GPT commands unprecedented mindshare, with roughly 62% of builders already using or planning to use the model. No rival cracks the 35% line, underscoring GPT’s first-mover momentum and Microsoft’s distribution advantage through Azure OpenAI Service.

The horizontal bar chart shows more than a dozen model families from highest to lowest “currently using/plan to use” share. GPT’s bar stretches almost two-thirds of the way across the graphic, colored solid green for active use and patterned green for near-term intent. Meanwhile the next cluster (Gemini, Anthropic Claude, Llama and so on) hovers in the high 20% to low 30% range. A tapering long tail follows with Databricks’ DBRX, Amazon’s Nova, Snowflake Arctic, DeepSeek, Grok, IBM Granite, and Cohere each registering lower but notable interest.

| App/dev signal | Why it matters |

|---|---|

| 62% gravitate to GPT | Our research indicates the combination of brand, perceived quality, and seamless Azure access gives OpenAI a wide funnel of enterprise proofs-of-concept. |

| Mid-tier is crowded but viable | Gemini, Claude, and Llama demonstrate that quality alternatives already attract a meaningful minority, especially where data-sovereignty, openness requirements or cost constraints apply. |

| Data-platform natives make the list | Databricks and Snowflake hit the leader board despite launching later, validating the thesis that proximity to governed data can offset model-scale disadvantages. |

| Specialists remain niche—for now | DeepSeek, Grok, Cohere, and IBM Granite collectively sit well below the leaders today, but each targets white-space such as RAG optimization, private deployment or vertical fine-tuning. |

| Differentiation perceived as thin | Seventy-two percent of respondents see “only minor” quality gaps between models, suggesting price, governance, and ecosystem tooling will dictate the next share shift. |

In our opinion, the chart’s steep drop-off from GPT to “everyone else” confirms that distribution and developer experience matter as much as raw model performance in the enterprise race. Yet the presence of nine alternative families, many embedded directly inside data platforms, signals a coming phase of fragmentation and price competition once baseline accuracy converges.

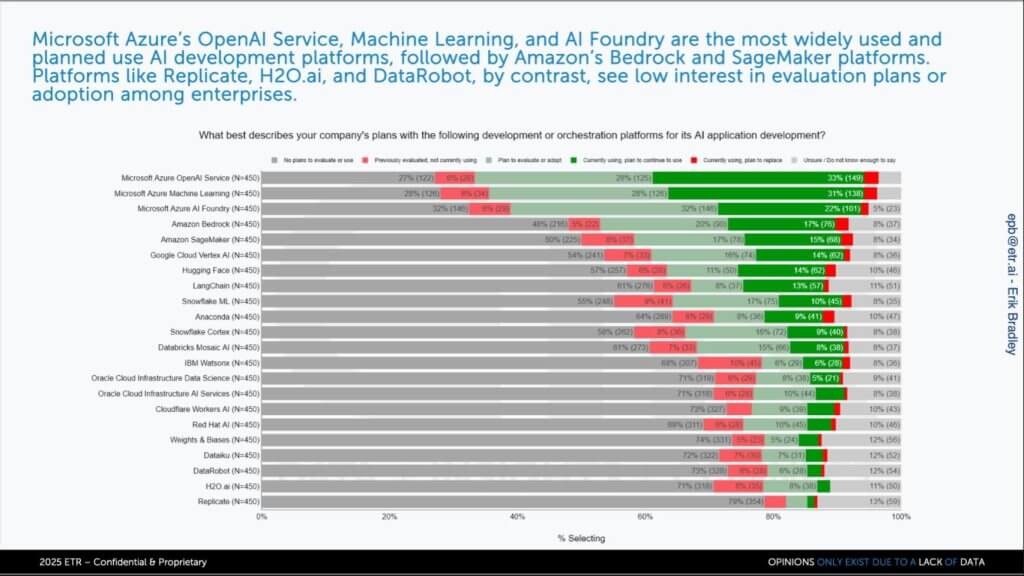

We believe the data below illustrates a familiar pattern — that is, the farther enterprises move up the AI stack, the more dominant Microsoft becomes. When respondents were asked which development platforms they are using or plan to use for building AI applications, three Azure offerings occupy the top three positions.

| Rank | Platform | “Using / Plan to Use” Share | Comment |

|---|---|---|---|

| 1 | Azure OpenAI Service | Low 60s% | Direct pipeline to GPT fuels rapid PoCs |

| 2 | Azure Machine Learning | High 50s% | Deep Databricks integration, automated MLOps |

| 3 | Azure AI Studio | Mid 50s% | Low-code glue for vision, speech and RAG |

Following Microsoft’s dominant adoption, the chart below shows Amazon’s Bedrock (mid 30%) and SageMaker (low 30%) form the second tier, followed by Google Vertex AI in the 30% range. A mixed long tail rounds out the chart, including Hugging Face, LangChain, Databricks Mosaic AI, Snowflake ML/Cortex, IBM watsonx, Oracle AI, Cloudflare Workers AI, Red Hat OpenShift AI and H2O.ai.

In our opinion, the data underscores a two-fold conclusion: 1) Microsoft’s end-to-end positioning from model to tooling is paying off; yet 2) The market is far from winner-take-all because data-sovereignty, latency and existing platform commitments compel a diversified toolkit. Vendors that can meet customers where their data already lives — while abstracting away model orchestration complexity will gain outsized leverage as the AI stack evolves.

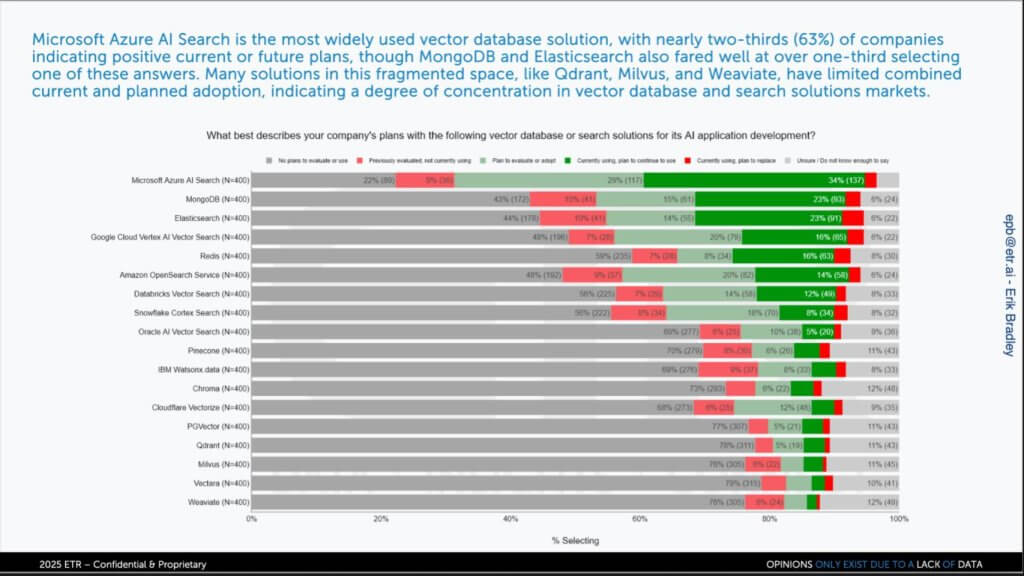

We believe the data below demonstrates how rapidly vector search has moved from headline innovation to checkbox feature – and how that shift has splintered adoption across a surprisingly wide set of vendors. When asked which vector-search engines they are currently using or plan to use, respondents placed Microsoft’s Azure AI Search narrowly in front, followed by MongoDB’s native Atlas Vector Search and an almost dead-heat between Elasticsearch and Redis. A second cluster comprising Google’s Vertex AI, Amazon Kendra, Databricks’ Vector Store, Snowflake Arctic Vector and Oracle’s OCI AI Search, occupies the mid-teens, followed by IBM watsonx.data (IBM uses Milvus) and specialist standalone offerings such as Pinecone, Milvus and Cloudflare Workers AI round out a long tail of single-digit intent.

| Signal | Implication |

|---|---|

| Feature-ization of vector search. | The technology is now table stakes; differentiation shifts to latency, scale and integration with data governance. |

| Microsoft tops the chart, but barely. | The date indicates enterprises default to Azure AI Search when already committed to GPT/Azure, yet the margin is slim, evidence of low switching friction. |

| MongoDB’s document-plus-vector model resonates. | Early (pre-GA) reviews translated into strong intent, validating that proximity to operational data trumps specialized point solutions for many workloads. |

| Redis is the stealth climber. | Redis’ high ranking surprised many, suggesting that in-memory performance for real-time personalization is a compelling niche. |

| Elastic maintains relevance through unified search. | Elasticsearch’s observability footprint gives it a built-in vector use case for log analytics and security telemetry. |

| Specialists must prove value. | Pinecone, Milvus, and Cloudflare attract experimentation but must differentiate on multi-tenant isolation, hybrid deployment or cost efficiency to climb the stack. |

In our opinion, the data confirms that vector search has crossed the chasm into “must-have” territory, yet remains far from winner-take-all. Enterprises still evaluate options by asking, Which engine fits my existing data topology and latency SLAs? rather than defaulting to a single cloud offering. We expect consolidation to follow two paths: 1) A deeper embedding of vector indexes inside mainstream databases; and 2) Specialist engines targeting high-throughput, cross-region retrieval-augmented-generation or RAG at lower cost.

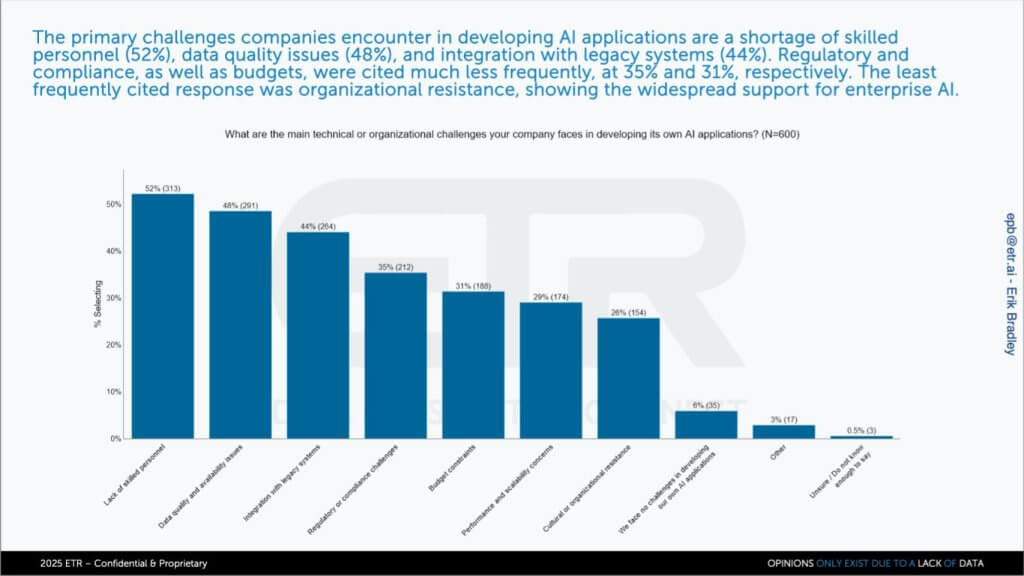

A vertical bar chart ranks these hurdles left to right. The first three bars — skills, data quality, legacy integration — tower over the rest, followed by a mid-pack of compliance, budget and scaling, then a taper toward soft factors such as culture.

The data underscores why large enterprises find do-it-yourself AI far harder than the marketing demos imply. In a 600-respondent data cut focused on organizations building their own apps, several obstacles jump out as shown below, led by skills, data quality and integration challenges.

In our opinion, the data underscores a clear truth – that is, AI’s limiting factors are less about technological breakthroughs and more about enterprise plumbing. Solving for data hygiene, skills acquisition and legacy connectivity will matter more to adoption velocity than squeezing a few extra tokens per dollar out of the next model release.

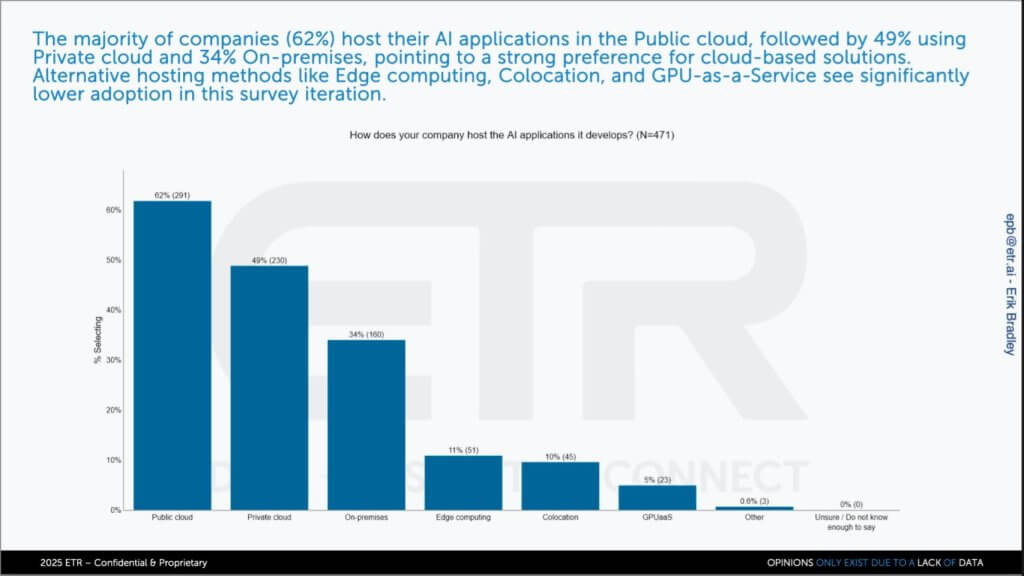

We believe the data below validates a core theme running through this research note – that is, that most enterprises are bifurcating their AI estates, keeping sensitive workloads close to the data while offloading everything else to the public cloud.

In our opinion, the chart crystallizes the emerging “bring AI to the data” narrative. Public-cloud agility remains unmatched for rapid prototyping, yet sovereignty-minded sectors refuse to copy/move exabytes of sensitive data into someone else’s region. Vendors that can deliver a cloud-like experiences everywhere (supercloud) – for example, public region, colocation cage, data-center row or factory floor – will capture the next tranche of enterprise spend. The race is on to make on-prem AI as turnkey as SaaS while preserving the governance guarantees boards now demand.

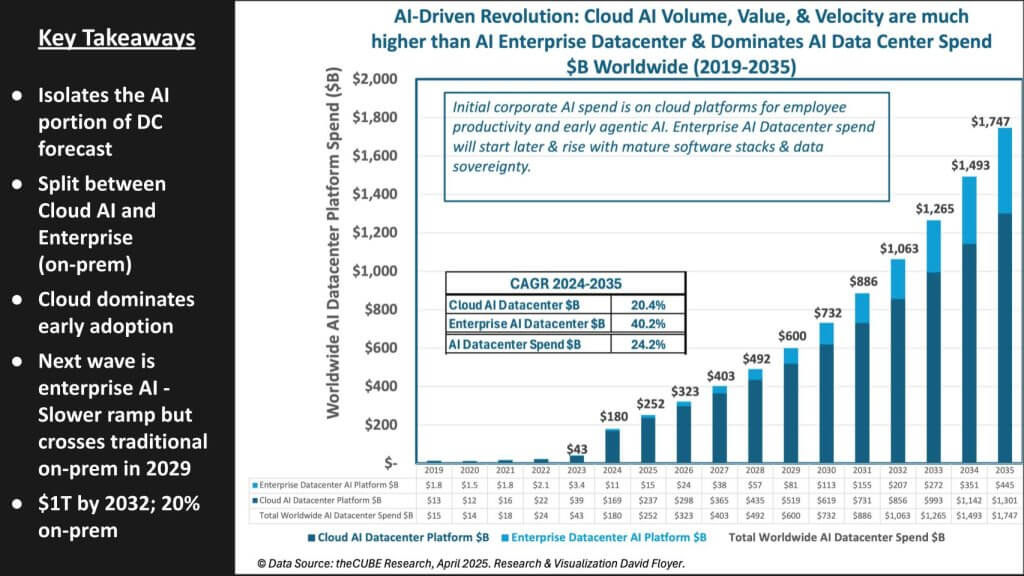

We believe the data below confirms that generative AI has ignited the largest single-purpose infrastructure boom since the client-server era. The stacked area forecast — split into dark-blue “AI in the cloud” and light-blue “AI on-prem in the enterprise” — shows aggregate AI-only data-center spend (compute, storage, networking, power and cooling) vaulting from roughly $43 billion in 2023 to $180 billion in 2024, surpassing $250 billion in 2025 and kicking off what we’ve called a data center super-cycle.

Our model projects a 24% 10-year CAGR for AI data center buildouts through 2034, but an even faster 40% CAGR for enterprise on-prem deployments. By 2030, we estimate on-prem AI data center infrastructure will eclipse $100 billion, overtaking today’s entire footprint of general-purpose data-center gear and carving out a market that rivals early hyperscale spend profiles. Importantly, this view excludes SaaS consumption, underscoring just how massive the physical-infrastructure TAM is before a single subscription dollar is counted.

| Observation | Implication |

|---|---|

| $180B step-function in 2024 was propelled by Nvidia-driven GPU clusters, ancillary power/cooling, networking and storage. | Our research indicates extreme-parallel processing (EPP) shifted from “tens of billions” to “hundreds” virtually overnight, validating the super-cycle narrative. |

| Cloud remains dominant today, but the slope of enterprise spend is steeper. | Data-gravity, latency and sovereignty are forcing banks, insurers, and manufacturers to replicate AI factories behind their own firewalls. Look to Dell, HPE and Supermicro as major suppliers of gear. |

| Build and buy coexist — for now. | Enterprises are simultaneously licensing agentic SaaS (for example, Salesforce Agentforce, ServiceNow Now Assist) while building bespoke models; both flows ultimately land on hyperscaler infrastructure and inflate the dark-blue area. |

| Decision point looms. | ETR notes CFOs will eventually choose between perpetual SaaS fees and self-operated stacks once models stabilize and ROI crystallizes. |

| GPU-aaS and colocation emerge as swing factors. | CoreWeave-style utilities enable burst capacity without full capex, blurring lines between public cloud and private DC economics. |

| Robotics wave is still off-chart. | Jensen Huang’s third vector – AI in physical robots and far edge – lies beyond this forecast model, implying additional upside not yet modeled. |

In our view, the chart’s widening light-blue band crystallizes the “bring AI to the data” thesis. On-prem estates may have ceded generic workloads to hyperscalers, but they will reclaim budget as organizations embed AI next to proprietary datasets that can’t, or won’t, move. Vendors that deliver turnkey AI factories with cloud-like control planes, rich data-stack partnerships, and ecosystem breadth will be positioned to capture the next $100 billion wave.

How do you see it? Where are you putting your AI bets? Let us know and thanks for reading.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.