BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Shares in Robinhood Markets Inc. fell a fraction of a point in late trading today after the financial services company reported strong results but reported a slight shortfall in cryptocurrency revenue in its fiscal 2025 second quarter.

For the quarter that ended on June 30, Robinhood reported adjusted earnings per share of 42 cents, double the same quarter of 2024, on revenue of $989 million, up 45% year-over-year. Both figures were solidly ahead of the 30 cents per share and revenue of $908.32 million expected by analysts.

Transaction-based revenue in the quarter came in at $539 million, up 65% year-over-year, driven by options revenue of $265 million, up 46% year-over-year; equities revenue of $66 million, up 65%; and crypto trading revenue of $160 million, up 98% year-over-year. The only miss was on crypto revenue, as analysts had been expecting $169 million.

Robinhood saw its total number of funded customers grow 2.3 million, or 10% year-over-year, to 26.5 million and investment accounts were also up 10% year-over-year to 27.4 million. Total platform assets increased 99% year-over-year to $279 billion, driven by continued net deposits, acquired assets and higher equity and cryptocurrency valuations.

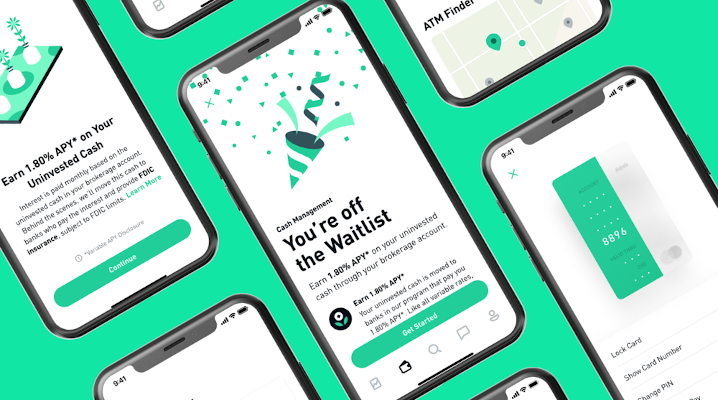

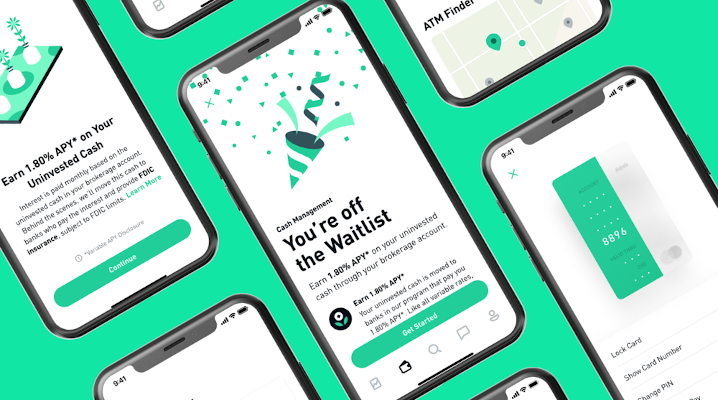

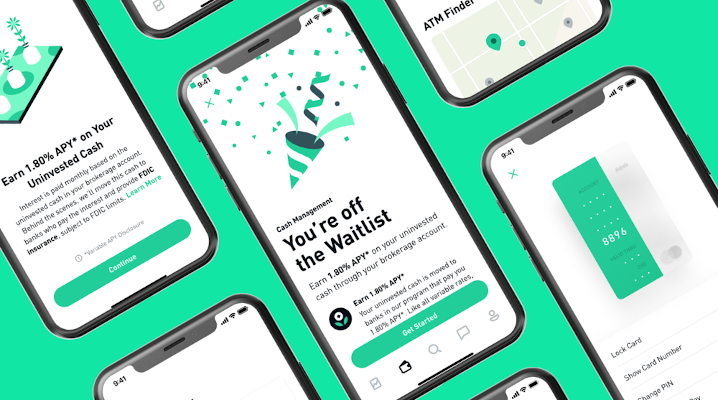

Business highlights in the quarter included Robinhood’s completion of its strategic acquisition of Bitstamp Ltd. in early June, significantly expanding its crypto footprint across Europe and institutional markets, marking one of its largest moves into global digital assets. The same month, the company also rolled out Robinhood Legend advanced charting tools on mobile, along with a simulated‑returns pre‑trade feature for options traders, bringing desktop‑grade trading capabilities into its mobile app.

The company headed to France for the “Robinhood Presents: To Catch a Token” event in Cannes where the company unveiled the launch of crypto and blockchain‑powered products in its European operations, including ETF tokens for more than 200 U.S. equities and ETFs.

The quarter also saw Robinhood acquire WonderFi Technologies Inc., a Canadian digital asset and cryptocurrency trading firm, for $179 million.

“Q2 was another great quarter as we drove market share gains, closed the acquisition of Bitstamp and remained disciplined on expenses,” Chief Financial Officer Jason Warnick said in the company’s earnings release. “And Q3 is off to a great start in July, as customers accelerated their net deposits to around $6 billion and leaned in with strong trading across categories.”

Given the volatile nature of the cryptocurrency market, Robinhood generally doesn’t provide outlooks and this quarter was no different. Instead, the company focused on updating its expense guidance to reflect the integration of Bitstamp and continued product investment.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.