APPS

APPS

APPS

APPS

APPS

APPS

Ramp Business Corp. today announced that it has closed a $300 million funding round at a $32 billion valuation, double what it was worth in June.

The raise is the company’s third in five months. Returning investor Lightspeed Venture Partners led the financing. It was joined by nearly 30 other institutional backers, six of which invested for the first time: Alpha Wave Global, Bessemer Venture Partners, Robinhood Ventures, 1789 Capital, Epicenter Capital and Coral Capital.

The strong investor participation in the raise was likely motivated at least party by Ramp’s strong financials. The company disclosed today that it’s generating more than $1 billion in annualized revenue and has a positive free cash flow. The same time a year ago, Ramp’s annualized revenue stood at $500 million.

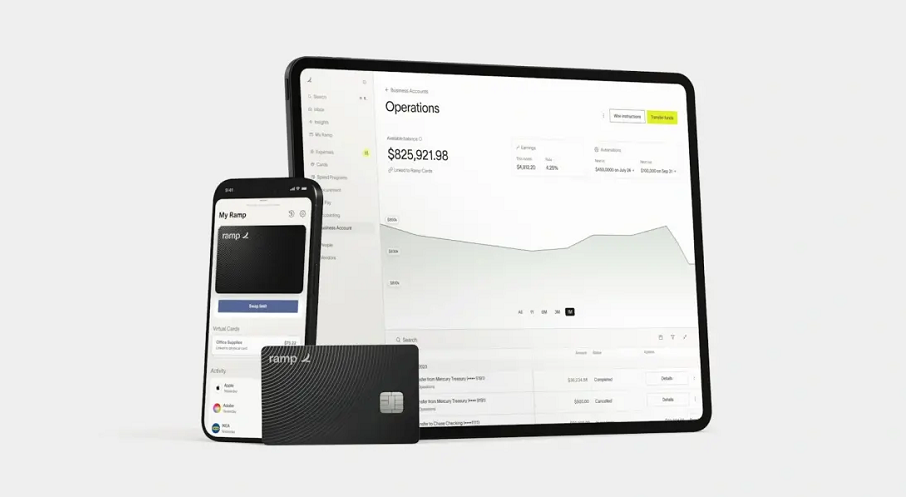

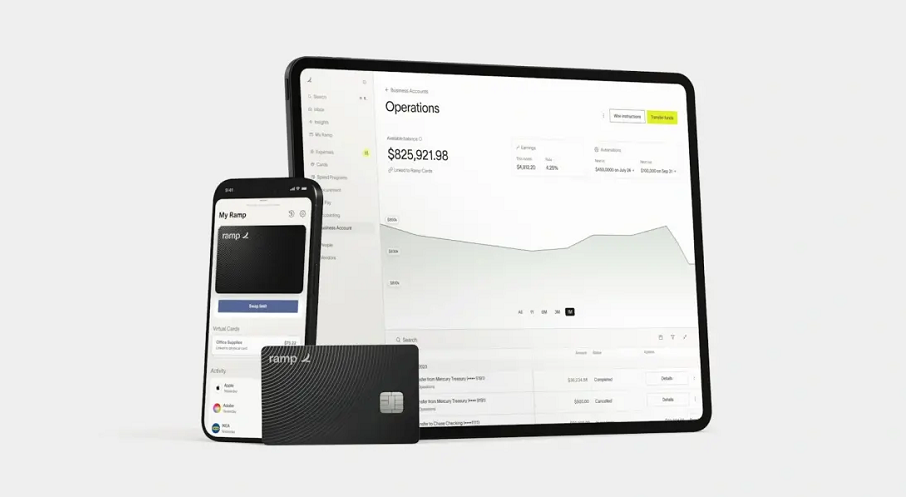

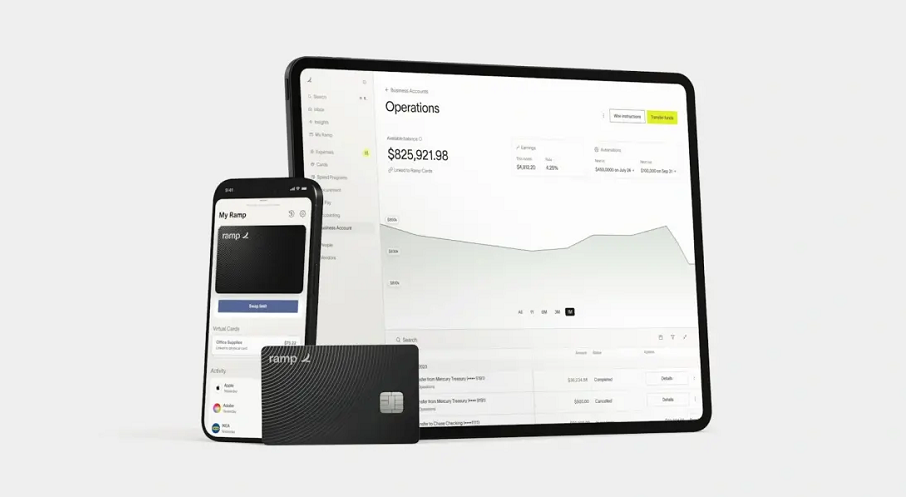

The startup’s flagship offering is a service that companies use to issue corporate credit cards to their employees. Accounting teams can set spending rules to block unnecessary expenses. A finance professional could, for example, specify the maximum sum that a department may spend on software subscriptions per month.

Ramp’s cards also save money in other ways. Users have access to a cashback program along with a feature that blocks transactions involving questionable suppliers.

The company offers its corporate credit cards alongside a bank bank account service, Treasury, that it says provides higher interest rates than standard checking accounts. The company also provides a tool for processing supplier invoices. According to Ramp, the tool speeds up tasks such as loading purchase details into an organization’s accounting application.

Last month, Ramp introduced Agents for AP, a set of artificial intelligence features it says can partly automate the invoice processing workflow. When a company receives a new supplier bill, Agents for AP analyzes it to find potential signs of fraud. If the invoice is legitimate, the AI adds in explanatory metadata and routes it to an executive for approval.

Agents for AP rolled out a few weeks after another set of automation features dubbed Agents for Controllers. According to Ramp, the latter module can approve most expenses automatically by comparing them against a company’s internal spending policies. Additionally, it scans past transaction approvals to find policy exceptions.

“Our goal is to make every customer more profitable,” said co-founder and Chief Executive Officer Eric Glyman. “On average, companies that switch to Ramp spend 5% less and grow 12% faster.”

Ramp disclosed today that its platform’s automation features have saved customers 27.5 million hours of manual work to date. The company’s customer base includes more than 5,000 organizations. About 2,200 of those organizations spend at least $100,000 per year on its platform, a 133% increase from last year.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.