AI

AI

AI

AI

AI

AI

The race to build new infrastructure to support the ongoing boom in artificial intelligence continued apace today with two new announcements involving deals with Nvidia Corp.

Elon Musk’s xAI Inc. and Nvidia are partnering on a large data center project in Saudi Arabia, and Brookfield Asset Management is launching a program that could scale to $100 billion for global AI infrastructure buildouts involving a huge number of Nvidia graphics processing units, the chips powering the current AI boom.

The announcements highlight expanding investment from both sovereign entities and institutional capital as demand for high-performance compute continues to accelerate.

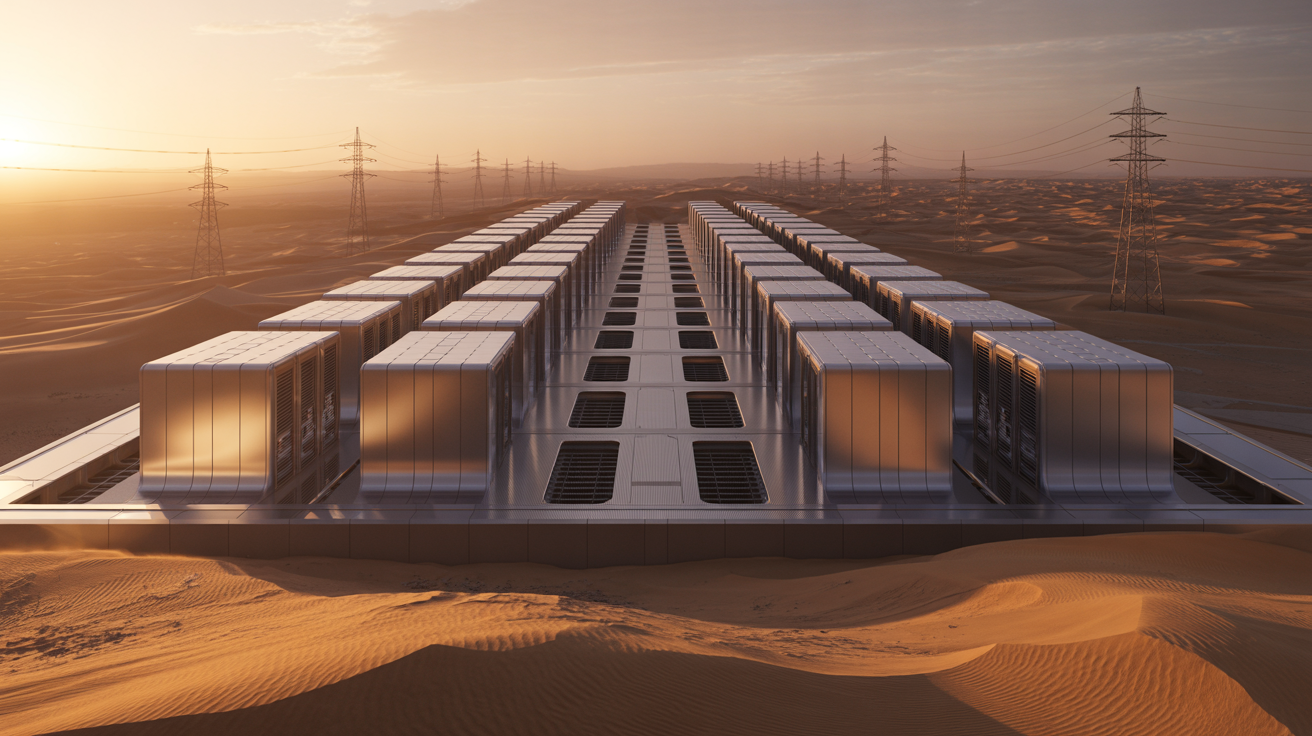

According to the Wall Street Journal, xAI will work with Saudi-backed Humain to develop a 500-megawatt facility equipped with hundreds of thousands of Nvidia GPUs. The project is part of Saudi Arabia’s wider push to secure domestic AI capabilities and reduce reliance on foreign cloud providers.

For xAI, priority access to a compute site of this scale will offer a strategic boost in GPU availability. The data center is expected to include about 600,000 Nvidia GPUs.

For Nvidia, its involvement reinforces its position as the dominant supplier of AI hardware as global demand strains supply chains. The partnership also expands the company’s footprint in sovereign AI initiatives, an area where many governments are now seeking long-term, guaranteed access to compute.

The deal also gives Saudi Arabia a significant asset as it pursues a national AI strategy.

Also announced today were plans by Brookfield Asset Management to build and finance up to $100 billion in AI infrastructure assets spanning land, power, data centers and compute. The effort includes a new fund targeting $10 billion in equity commitments, supported by Nvidia and the Kuwait Investment Authority.

Brookfield is treating AI compute capacity as core infrastructure similar to utilities and communications networks, which in 2025 is arguably a fair call.

The program is designed to accelerate global deployment of AI-ready facilities by combining institutional capital with technology-vendor partnerships. Nvidia will be both a hardware provider and a strategic collaborator in large-scale infrastructure financing and the involvement of Kuwait’s sovereign wealth fund is, like the xAI Saudi deal, another case of national investors playing a significant role in long-term economic planning.

The xAI-Saudi data center project and Brookfield’s global program are both indicative of AI leadership that is increasingly being tied to physical infrastructure rather than software alone. With all companies struggling to obtain compute capacity, the next phase of the AI market may well favor those with direct control over large, efficient compute assets instead of those relying solely on cloud-based capacity.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.