INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Positron AI, a builder of custom silicon and hardware for energy-efficient artificial intelligence inference, today announced it has raised an oversubscribed $230 million funding round at a $1 billion valuation.

The Series B round was co-led by Arena Private Wealth, Jump Trading and Unless, with participation from new and strategic investors Qatar Investment Authority, Arm and Helena. Existing investors joining the round included Valor Equity Partners, Atreides Management and DFJ Growth, among others.

“Energy availability has emerged as a key bottleneck for AI deployment,” said Chief Executive Mitesh Agrawal. “And our next-generation chip will deliver five times more tokens per watt in our core workloads versus Nvidia’s upcoming Rubin GPU.”

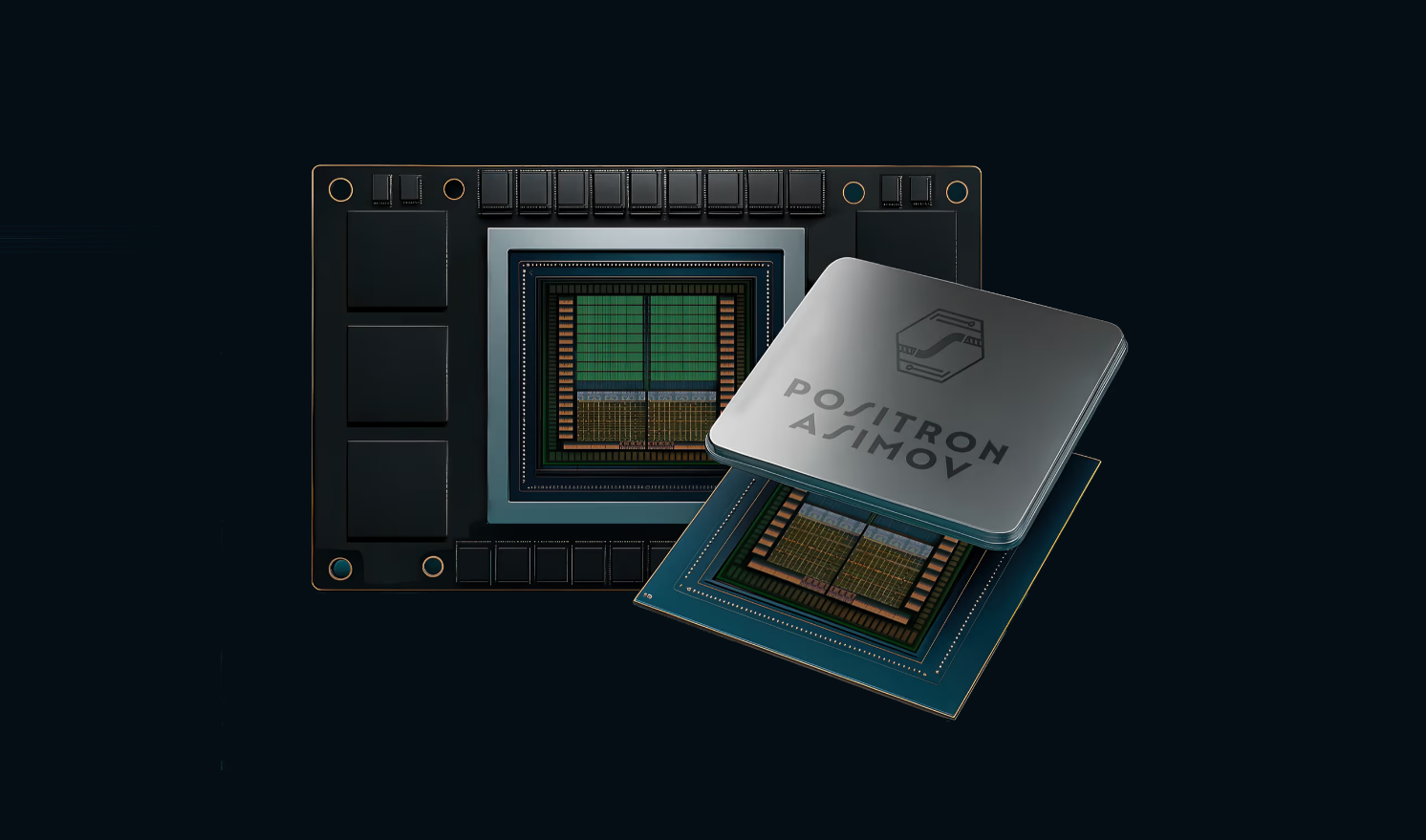

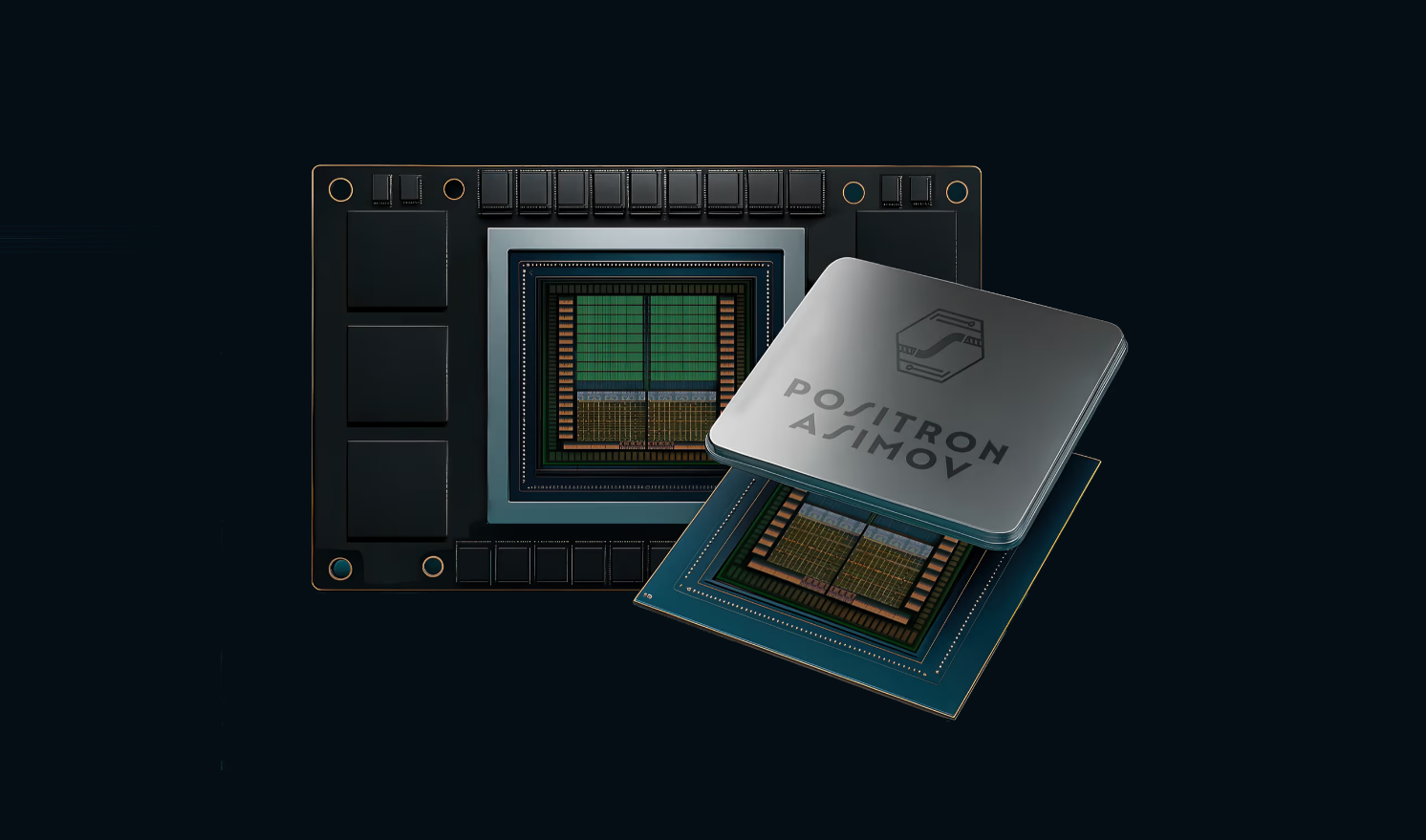

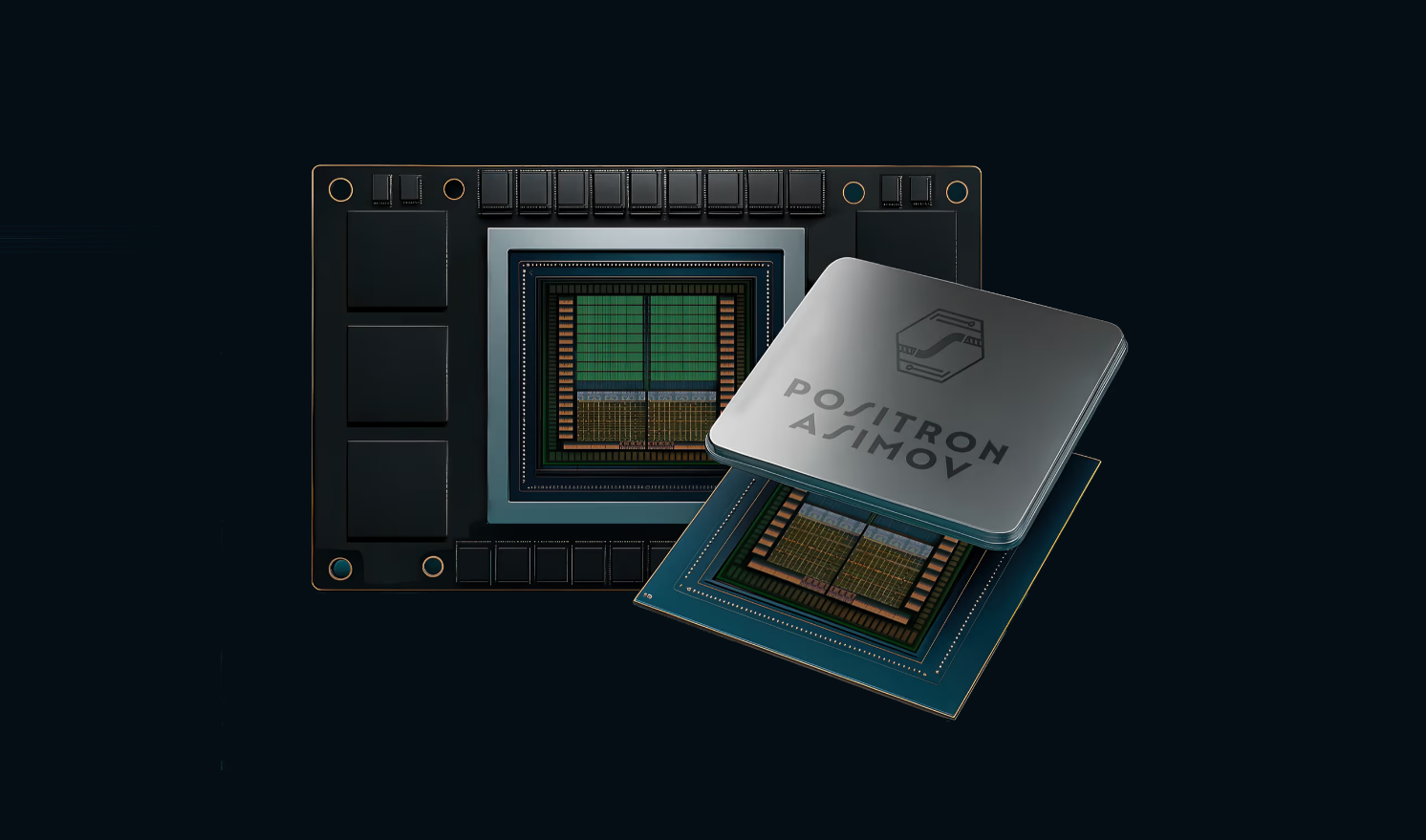

Continuing the comparison to AI chip and graphics processing unit, Nvidia Corp.’s Rubin, Agrawal said memory is the next bottleneck in inference. Asimov, the custom silicon developed by Positron, ships in early 2027 and will roll out with over 2,304 gigabytes of RAM per device compared to just 384 gigabytes on Rubin.

“This will be a critical differentiator in workloads including video, trading, multitrillion-parameter models and anything requiring an enormous context window,” Agrawal said. He added that he expected Positron’s custom silicon to beat Rubin in performance per dollar for specific memory-intensive workloads.

Nvidia unveiled its most recent flagship GPU chip, Rubin, at CES 2026, built with 336 billion transistors, which can provide about 50 petaflops of performance when processing NVFP4 data.

Positron said it’s building an infrastructure layer to make AI useful at scale by lowering the cost and power required to run models. The company’s current product is Atlas, an inference system for rapid deployment and scaling built entirely in American-fabricated systems.

“Memory bandwidth and capacity are two of the key limiters for scaling AI inference workloads for next-generation models,” said Dylan Patel, founder and CEO of SemiAnalysis LLC, an adviser and investor in Positron.

The company said Asimov is designed around a reality of AI models: They depend more heavily on memory bandwidth than sheer compute. Asimov aims to support 2 terabytes of memory per accelerator and 8 terabytes of memory per Titan system at a similar realized bandwidth compared to Rubin GPUs.

In the GPU and AI chip market, Nvidia is the company to beat. According to market reports, although the company is facing competition, Nvidia currently holds a market share of aabout 85% with competitors such as Advanced Micro Devices Inc. and Qualcomm Inc. As the next closest rival, AMD holds only 7% of the market, and grew 0.8% in the third quarter of 2025, showing how much weight Nvidia currently throws around.

Positron AI builds purpose-built AI hardware and software to dramatically reduce energy costs for inference. The company said it expects its roadmap with Asimov will position it as one of the fastest-growing companies and give it strong commercial traction, which it has already seen working with multiple “frontier customers” across cloud, advanced computing and performance-sensitive industries.

Additionally, the company said it’s building its platform with an ecosystem with industry leaders, including Arm Holdings plc, Super Micro Computer, Inc. and other key technology and supply-chain partners.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.