NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Information technology services will see greater investment in cyber security than any other segment this year, reaching $73.6 billion, according to a new survey from International Data Corp. released this week.

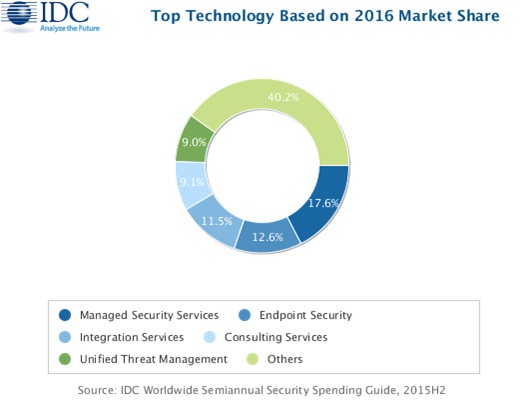

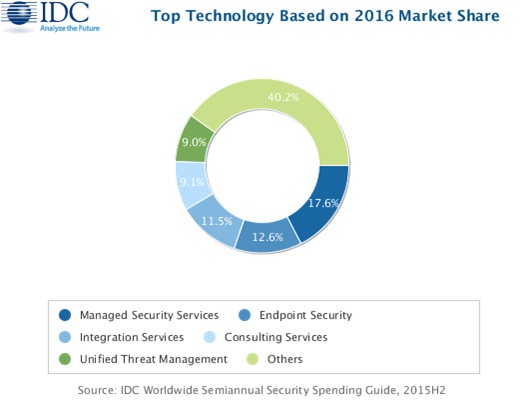

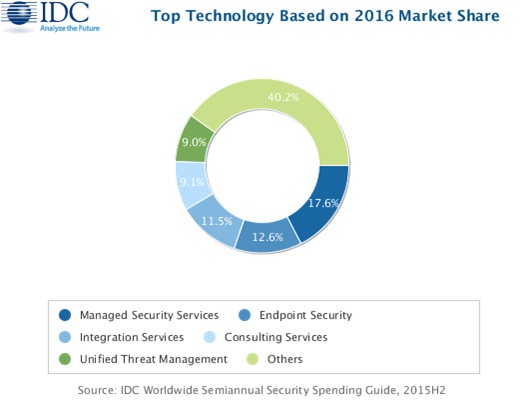

The finding comes from IDC’s newly released “Worldwide Semiannual Security Spending Guide“, which says that services will represent almost 45 percent of global cyber security spending this year. The largest subset in the services category will be managed security services, which will pull in $13 billion in revenues in 2016.

Software will be the second-biggest category for cyber security spending this year, with 75 percent of revenues in this segment coming from endpoint security, identity and access management and security and vulnerability management software, IDC said. Meanwhile, hardware is the third-largest category, and will see spending hit $14 billion by the end of this year, driven chiefly by demand for unified threat management systems.

“Today’s security climate is such that enterprises fear becoming victims of the next major cyber attack or cyber extortion,” Sean Pike, program vice president of security products at IDC, said in a statement. “As a result, security has become heavily scrutinized by boards of directors demanding that security budgets are used wisely and solutions operate at peak efficiency.”

Not surprisingly, banks will be the largest buyer of security technology this year, investing some $8.6 billion in protection for their systems. Banking is followed by the discrete manufacturing, federal and central government and process manufacturing industries, IDC said. These four verticals will account for a combined 37 percent of all global cyber security spend in 2016, and will remain the top four verticals through 2020, IDC said.

However, it’s the healthcare sector that’s recording the fastest growth in cyber security technology spend. The industry’s investment will grow at a Compound Annual Growth Rate of 10.3 percent between now and 2020, IDC said. Other fast-growing industries include telecommunications, utilities, state and local government, and securities and investment services, which will all see growth rates at above 9 percent through to 2020.

This is in line with the forecast for the overall global cyber security market, which IDC expects expects to grow at a CAGR of 8.3 percent between now and 2020, rising from $73.6 billion this year to $101.6 billion by 2020.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.