EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

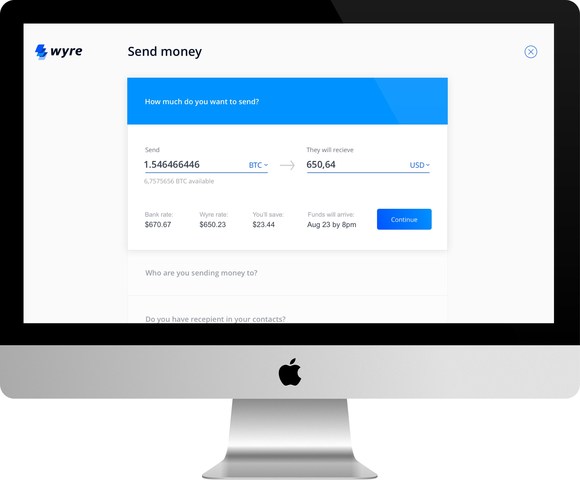

San Francisco-based blockchain technology startup Wyre Inc. wants to use the distributed ledger technology to allow cross-border bank payments in as little as an hour.

The San Francisco-based company announced the plans Thursday along with news that it has raised $5.8 million in Series A funding to vastly speed up money transfers, which currently take two to three days.

Amphora Capital and 9FBank lead this round and these two venture capital firms were joined by Draper Associates, Boost VC, Digital Currency Group and Seabed VC. To date, Wyre has raised a total of $7.5 million in investment funds.

The company’s services are currently available to customers in the United States and China. This ties directly into what the company hopes will become its proof-of-concept for cross-border bank transfers.

Using the current legacy systems for cross-border bank payments can take days due to a complex array of regulations, traditional considerations and lack of interoperability between financial institutions. Wyre thinks the blockchain can solve that.

“This is still Phase 1,” Michael Dunworth, chief executive and co-founder of Wyre, said in the announcement. “But at the moment, with the power of our technology, we’re able to move U.S. Dollars from your bank account in the US, to a bank account for a beneficiary in China in under one hour… a process that traditionally takes two to three days.”

At this time, the company estimates that a monthly volume of $35 million is being transferred in cross-border business payments via the blockchain and Wyre accounts for 90 percent of those transactions.

Using its blockchain-enabled application programming interface, Wyre has already connected with multiple companies to ease cross-border payments.

Those companies include RationalFX, a U.K.-based company helping businesses move money all over the world; Haitou360, a Bejing-based tech-focused asset investment platform company; and TangoCard, the largest digital rewards company in the world focused on e-gift cards.

Wyre’s plan is to use these investments is to establish itself as money-moving infrastructure for companies that need the ability to rapidly move money across borders.

To do this, the company intends to expand its customer base reach from U.S. and China to include Europe and Latin America. Participants in Wyre’s pre-launch private beta chest also included companies in Brazil. The company wants to spend 2017 consolidating its capabilities in those countries until they attain solid market penetration.

“We’re on a mission,” Dunworth wrote. “Piece by piece, we’ll connect the worlds local geographies together through the blockchain, and bank transfers as fast as email. It’s time for value to get the same speed of transmission as content.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.