INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Advanced Micro Devices Inc. beat Wall Street analysts’ estimates on revenue and profit in the third quarter, but investors were clearly hoping the good times would continue in the new quarter, as they knocked the chip maker’s stock back nearly 11 percent in after-hours trading.

“Wall Street had expected a bigger Q3 after a stellar Q2, even though the forecast was in alignment with 2017 guidance,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy. “I believe AMD is being conservative and will likely do better than forecasts based upon [Chief Executive] Lisa Su’s philosophy of ‘undercommit and overdeliver.'”

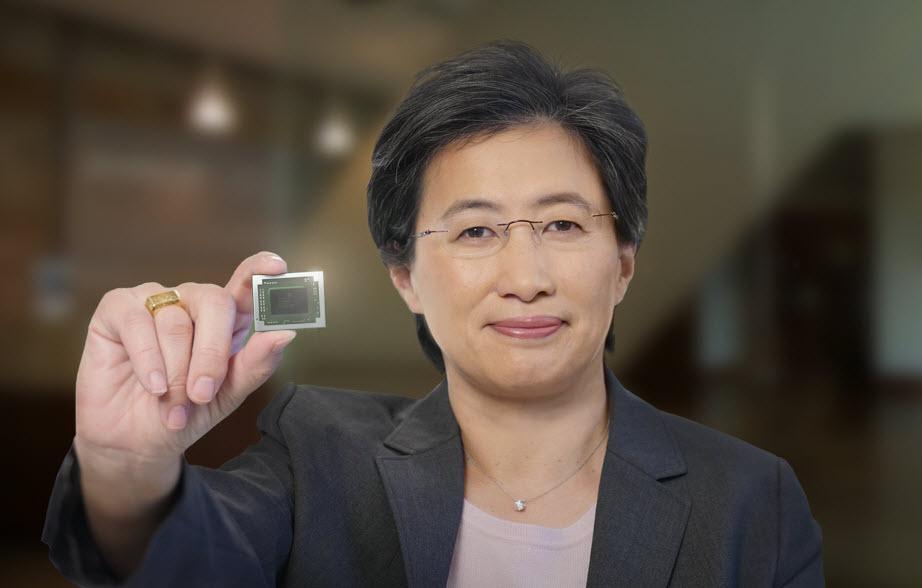

If AMD was disappointed with its results, that wasn’t evident in remarks by Su (pictured) on AMD’s analyst call. “This was a strong quarter, driven by high-performance products and strong strategy,” she said on an upbeat analyst call. “Throughout 2017, we have delivered significant margin growth and market expansion. Annual revenue growth is tracking above our previous estimates.”

Indeed, based on the performance indicators Wall Street usually cares about, all looked well, though AMD has a history of volatility following its earnings release. Gross margins and cash flow both increased year-over-year, and sales to high-end desktop and graphics markets were particularly strong, with the Radeon graphics chips and new Ryzen line of desktop processors leading a 74 percent increase in sales. The graphics processing unit business had its best quarter ever and Ryzen-based PCs reached 45 percent market share in the Intel Corp.-dominated business at some retailers, Su said.

Revenues of $1.64 billion rose nearly 26 percent from a year ago and came in 36 percent higher than the previous quarter. Operating income of $155 million more than doubled from a year ago. Both figures beat analysts’ expectations, too. Profit per share of 10 cents beat consensus estimates by 2 cents. Gross margins of 35 percent were up 4 percent year-over-year and earnings before interest, taxes, depreciation and amortization grew 85 percent, to $191 million. Cash rose 4 percent as well.

AMD’s business is seasonal, and the third quarter has historically been its best. For the fourth quarter, it forecast revenue to decline between 12 and 18 percent sequentially to between $1.34 billion and $1.44 billion. Analysts, expecting revenue of $1.34 billion, clearly were hoping for better.

This year has seen the strategies Su put into place when she became CEO three years ago finally bear fruit, said Charles King, president and principal analyst at Pund-IT Inc. “Rather than simply offering a ‘low-priced spread’ alternative to Intel’s buttery goodness, new solutions like Radeon RX Vega and Threadripper are competing on their own merits with often surprising results,” he said.

The company kept up a frantic pace of new product rollouts in the quarter, lead by the Ryzen Threadripper and Ryzen 3 central processing unit chips. AMD also expanded its graphics lineup with the Radeon RX Vega GPUs targeted primarily at gamers. However, AMD is also drafting on the popularity of GPUs for high-end commercial coprocessing tasks.

Originally developed for gaming applications, GPUs are increasingly being incorporated into servers as parallel processing engines for machine learning and other analytics applications. Amazon Web Services Inc. chose AMD Radeon Pro GPU technology for a new service that enables users to run graphics-accelerated applications in the cloud at a lower cost than on the desktop, Su said.

AMD has enjoyed a somewhat unexpected boost from the popularity of its chips for bitcoin mining, a practice in which people use special software to solve math problems in exchange for bitcoins. The popularity of mining has taken off as bitcoin prices rocketed above $5,000 this month, but AMD doesn’t track sales for that purpose. “The market is hard to size because it goes through some of the same channels as games,” Su said.

The first half of next year will put AMD’s new data center-oriented Epyc processors processors to the test. Sales are ramping up steadily, but Su sought to manage down expectations of the kind of blowout growth that’s more typical of desktop and mobile markets. “We are very pleased with how the revenue ramp is going in general on new [Epyc] products and we accelerated the business in the second half,” she said. Five of the top seven cloud vendors have adopted AMD enterprise processors within their data centers.

AMD stock has risen 26 percent so far this year before this afternoon’s earnings report. It’s now up about 12 percent.

The company’s long-term prospects are still difficult to figure, said Pund-IT’s King. “While it’s understandable to cheer an underdog, can a company with annual revenues that are about one-tenth that of Intel’s pose a significant threat?” he asked. “The company is more likely to be loved by speculative players than careful investors.”

THANK YOU