THOUGHT LEADERSHIP

THOUGHT LEADERSHIP

THOUGHT LEADERSHIP

THOUGHT LEADERSHIP

THOUGHT LEADERSHIP

THOUGHT LEADERSHIP

If David Siegel, chief executive officer of the Pillar Project and author of “The Token Handbook,” ran the National Science Foundation, projects would be funded on a much different basis than they are today. Taking a page from what he’s learned as a businessman and corporate adviser, Siegel would be in favor of having science initiatives supported based on people who chose to essentially bet on their success. It’s known as having skin in the game.

“We do science pretty badly; it’s whoever can get budget for whatever wacky project,” Siegel said. “If the crowd is right about a project, the winners will take money from the losers. ‘Skin in the game’ tokens: It’s what’s coming next.”

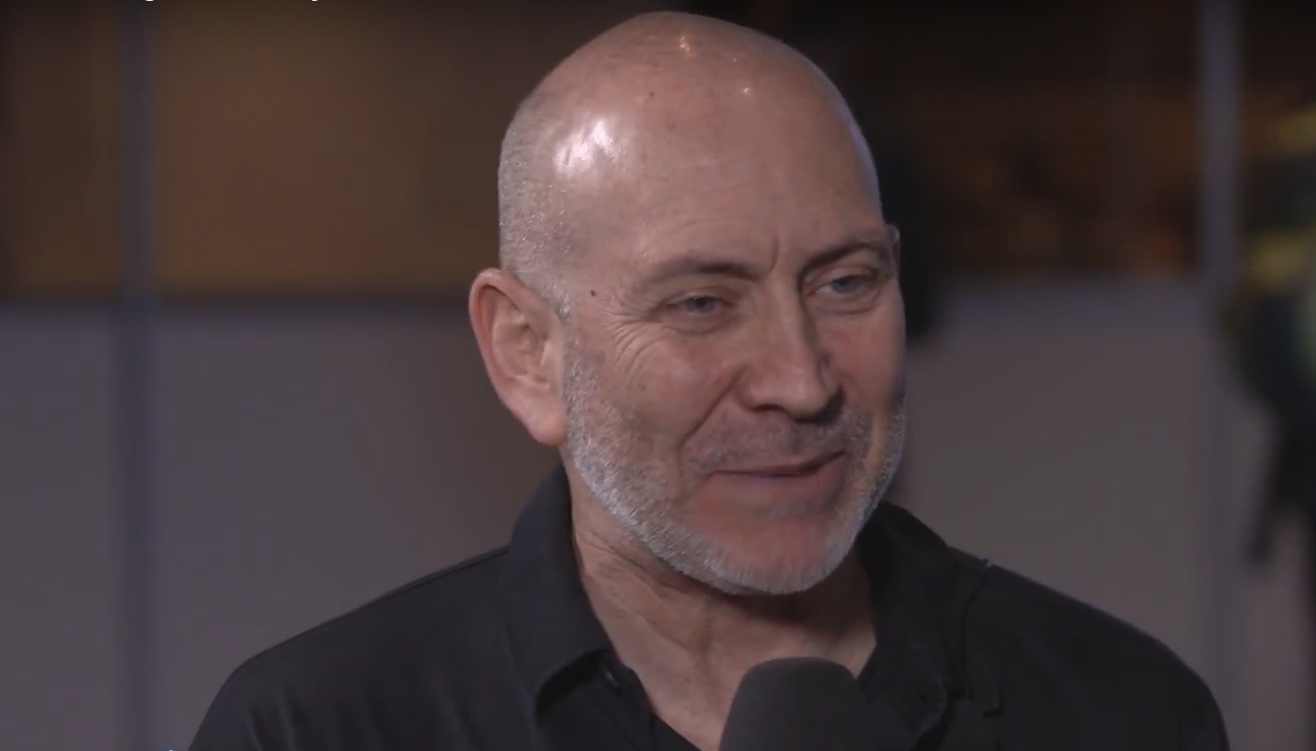

Siegel (pictured) spoke with John Furrier, host of theCUBE, SiliconANGLE Media’s mobile livestreaming studio, during the Blockchain Week event in New York City. They discussed the work of Siegel’s foundation, enterprise engagement in the cryptocurrency world, and a lack of action to date by regulatory agencies.

The cryptocurrency entrepreneur is spearheading the Pillar Project, a nonprofit foundation based in Switzerland that is creating a smart wallet for crypto assets. The presence of multinational tech companies at conferences such as Blockchain Week may signal large enterprise interest, but Siegel would rather see more engagement with the cryptocurrency community.

“They’re on the path of commercializing [the blockchain], but they’re not part of us; they’ll never be crypto-anarchists,” said Siegel, who encouraged enterprises to take bolder risks with blockchain technology. “It’s time for experiments. There’s no way you’re going to blockchain your whole company, your whole supply chain.”

Siegel also expressed frustration with the Securities and Exchange Commission, which has so far declined to issue clear regulatory guidance on initial coin offerings. The author recently published his views on the subject in an excerpt from his handbook.

The fact that tokens are issued in limited numbers creates a scarcity-based, speculative market that has made it difficult for the SEC to provide guidance. “You have both natural buyers and speculators coming into a system,” Siegel said. “This is what’s giving the SEC a hard time because they can’t see whether it’s a security or a gym membership.”

Watch the complete video interview below, and be sure to check out more of SiliconANGLE’s and theCUBE’s coverage of Blockchain Week NYC.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.