EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

More changes are happening in Apple Inc.’s supply chain.

Finisar Corp., an iPhone supplier that makes lasers optimized for tasks such as facial recognition, is set to be acquired by another optical components producer called II-VI Inc. as part of a deal announced today. Publicly-traded II-VI is paying about $3.2 billion for the company, or $26 per share. That’s almost 38 percent higher than the Thursday closing price of Finisar’s stock.

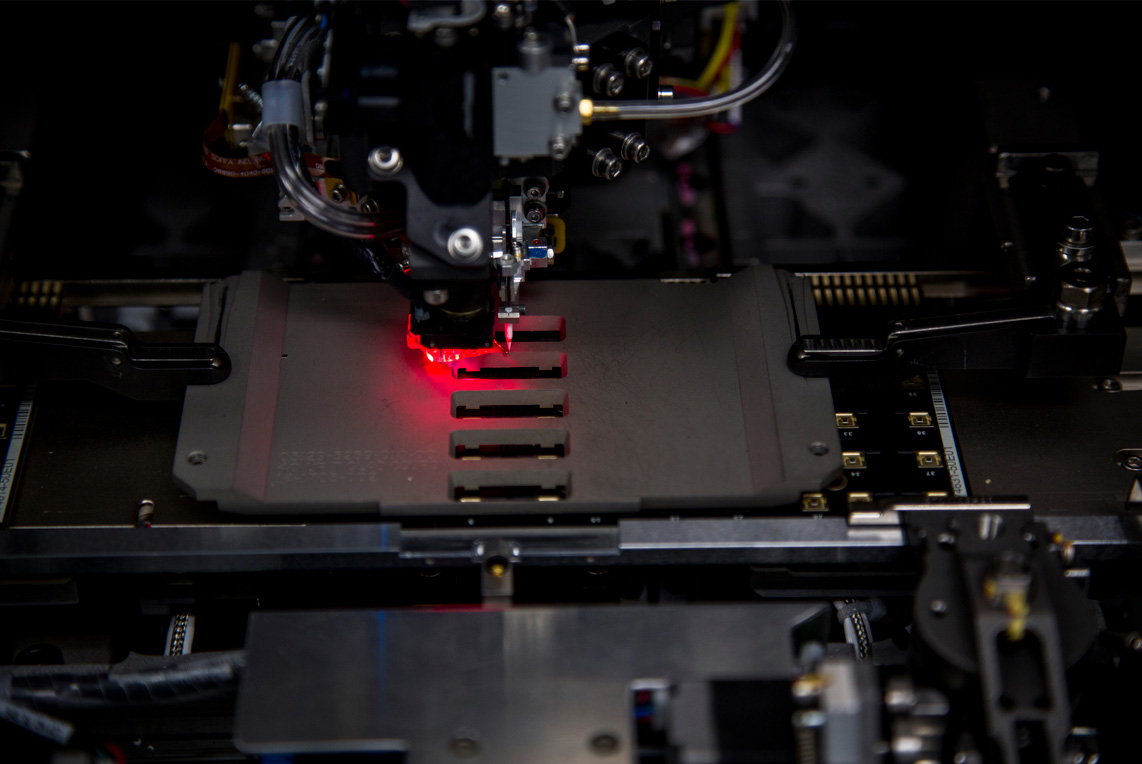

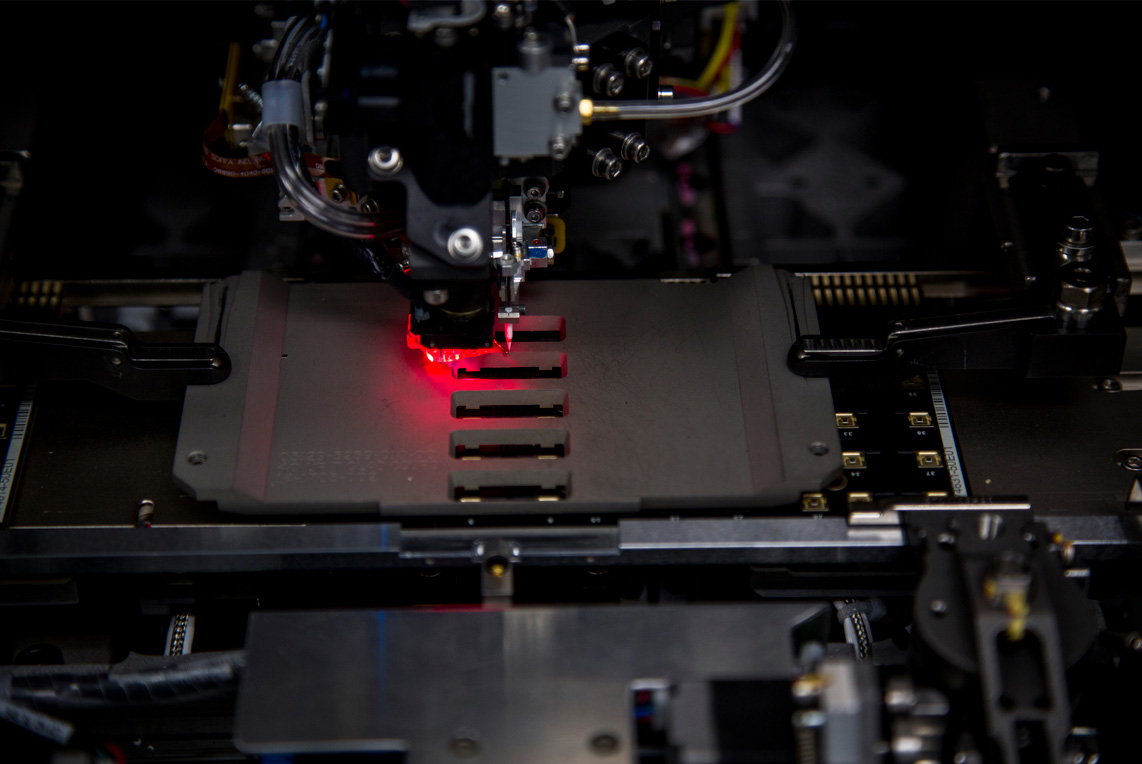

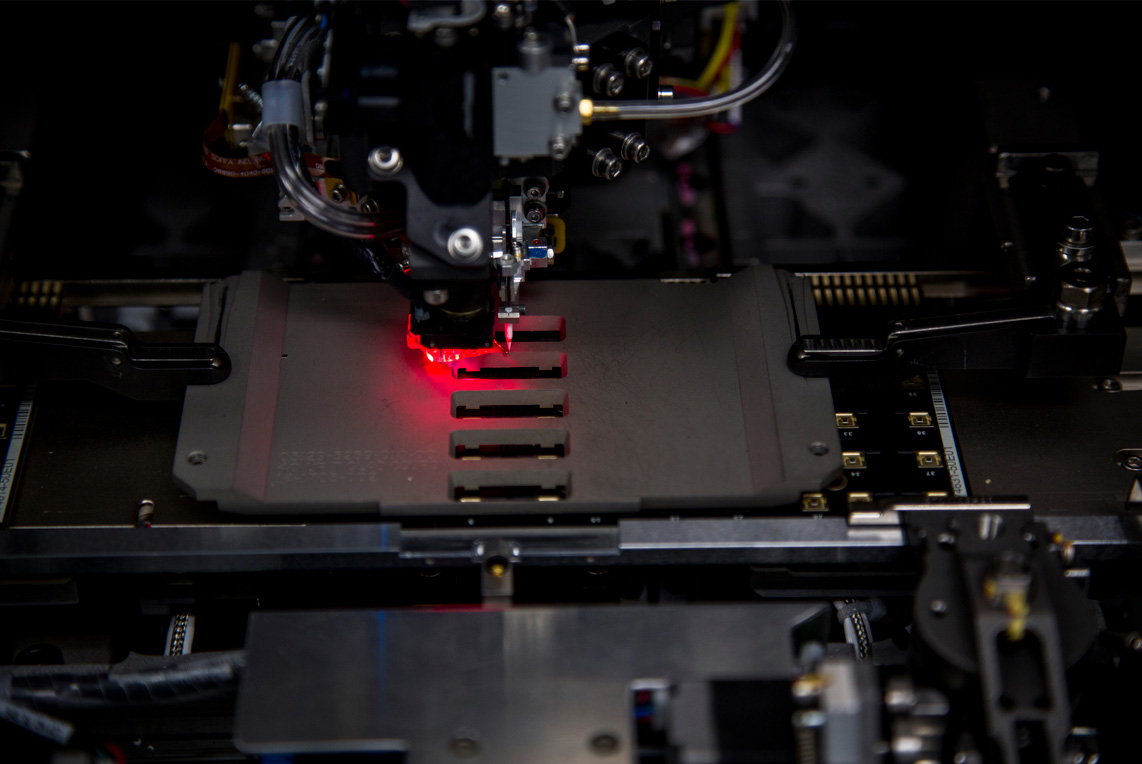

The steep premium reflects what II-VI Chief Executive Vincent Mattera described as the “huge” growth opportunities available to the companies. Finisar is a major producer of cutting-edge lasers known as VCSELs that power several of the iPhone’s features, including the Face ID login system. Last December, Apple said that it was on track to buy 10 times more VCSELs during the fourth quarter of 2017 than the total number manufactured worldwide a year earlier.

That demand stems from the fact that the technology has a wide range of useful applications. Besides facial recognition, Apple also relies on VCSELs to power the iPhone’s Portrait photography mode and the Animojis feature, which enables users to create augmented reality avatars of themselves. The iPhone maker is actively investing in expanding its AR capabilities, an effort that reportedly includes plans to bring a homegrown AR headset to market.

Apple last year gave Finisar a $390 million grant to help it ramp up production of VCSELs. The laser maker is using the capital to build a 700,000-square foot manufacturing facility in Sherman, Texas, that it said will turn the city into the “VCSEL capital of the world.”

Finisar’s relationship with Apple was no doubt a key driver behind II-VI’s acquisition offer, but the growth opportunities that Mattera cited in the announcement are not limited to the mobile industry. VCSELs are a key component of the LIDAR sensors used by self-driving cars to map out their surroundings and can be found in other devices as well, including certain networking equipment.

The acquisition is expected to bump II-VI’s annual revenues to about $2.5 billion. On top of that, the company expects to achieve “run-rate cost synergies” of $150 million within three years of the deal’s completion, which is expected to take place in the middle of 2019.

The acquisition marks the second major shakeup of Apple’s supply chain in a month. Last month, the company inked a $600 million deal to acquire key technology and assets from a British firm called Dialog Semiconductor PLC that produces power management chips for the iPhone.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.