BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

The big data explosion has created transformative innovation opportunities for technology, as well as businesses across industries. As consumers better understand their piece in that data puzzle and the market begins to find its footing in a data-driven digital landscape, companies must adopt a responsibility around transparency to maintain trust and efficiency.

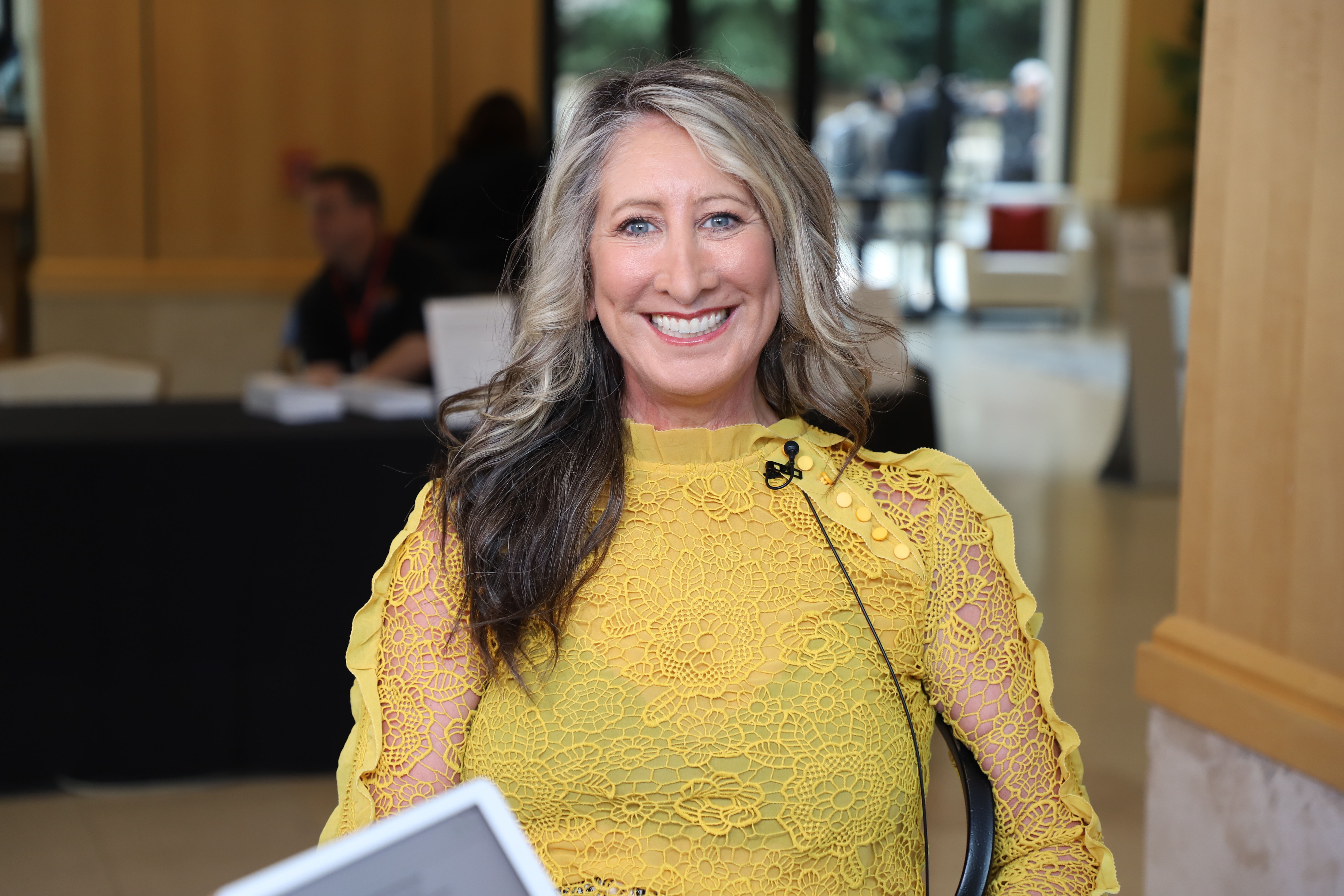

Greater visibility around data-driven processes can also lead to more comprehensive solutions through interdisciplinary collaboration, according to Kristina Draper (pictured), chief technology officer at Wells Fargo & Co.

Draper spoke with Lisa Martin (@LisaMartinTV), host of theCUBE, SiliconANGLE Media’s mobile livestreaming studio, during the Stanford Women in Data Science event in Stanford, California. They discussed the role data is playing in a new era of accountability at Wells Fargo, as well as how Draper is reaching beyond the financial industry for greater innovation opportunities.

[Editor’s note: The following answers have been condensed for clarity.]

Tell a little about your involvement in WiDS, as well as Wells Fargo’s involvement as a sponsor.

Draper: We believe so strongly that in the consumer bank space we have a tremendous opportunity and responsibility to understand how our customers interact with Wells Fargo, and that will require a discipline around data science. We had an opportunity this year to be an executive sponsor and jumped at it. I think we’ll continue to be at that sponsor level in future years.

You were recently named one of the 50 most powerful women in technology. What are some of the [ways] Wells Fargo is re-imagining data and trust? What have you seen of the evolution of females in technology and leadership roles?

Draper: The recognition [of] women in technology … is an opportunity to demonstrate that we should be very confident in the value that we bring as leaders, and that confidence as a woman is hard to come by. I think of my own personal career and the way that doors were opened for me along the way; often we are our own worst enemies. We second guess ourselves, we second guess our value, and we have to really work for that seat at the table.

My coming back to Wells was really … as a leader in technology. I felt I could make a real impact. When I think about what we can do as women leaders in technology and in data science, a lot of it is owning that accountability to leadership and paving the way for leaders behind us. There comes a part in a career, certainly mine, where you’re no longer thinking about the next job for yourself.

We’re in a consumer banking space and financial services, so there’s certainly a lot of places to innovate [and] think about how technology can help to serve a Wells Fargo customer. You need your bank throughout your entire life. Whether you are thinking about a home purchase, an auto purchase, college for your children, retirement, there’s so many big markers in life. And that’s where I get excited about not only the leadership role that I have now, but I have the opportunity to bring a team with me to contribute real value.

You have a pay-it-forward attitude. How are you using that to expand your team … to continue this big re-imagining that Wells Fargo as a business is undergoing?

Draper: WiDS is … a tremendous network opportunity. [I’m] so inspired about how they’re turning data science and really thinking about different problems [and] ways we can improve not only our lives, but the lives of future generations to come.

I come from a financial services background, but the problems that our future generations will face can’t be solved with just one lens. You can’t solve problems with just a financial services expertise or just a technical expertise. It’s the space in between art and science. It’s an ability to think across industry and apply solutions and innovation that have been brought forward through other industries, through other companies, through other academia, and thinking about how that could apply in solving the problems that we’re faced with in the financial services space.

If I turned some of the problems that we’re faced with upside down and thought about it with that perspective, and invited some collaboration to help solve problems, we might come up with a better answer.

How can financial services and the data that you deal with help customers?

Draper: I have a new leader, Jason Strle … and he talks about a vision where we are 100-percent transparent in our data with our customers. That’s really how we’re thinking about the transformation around technology, the investment that we’re going to make in data science ad AI and machine learning. Because if we’re a 100-percent transparent with every one of our customers, that establishes trust.

Watch the complete video interview below, and be sure to check out more of SiliconANGLE’s and theCUBE’s coverage of the Stanford Women in Data Science event.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.