INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Confirming recent industry chatter about its acquisition plans, Nvidia Corp. today announced that it has inked a deal to buy data center networking specialist Mellanox Technologies Ltd. for $6.9 billion.

The all-cash transaction is the chipmaker’s largest to date by a wide margin. Its $6.9 billion offer breaks down to $125 per Mellanox share, 14 percent higher than the Friday closing price of the company’s stock.

That’s a significant premium given how the stock has risen 66 percent since rumors about a potential sale surfaced in October. And its shares were rising more than 8 percent today, to about $118.50 a share. Nvidia investors liked the news as well, its shares rising more than 7 percent in today’s trading.

Intel Corp. and fellow chipmaker Xilinx Inc. were among the bidders that reportedly sought to acquire Israel-based Mellanox, which develops specialized processors for data center networking systems. The company also provides a variety of related products ranging from switches to cables for connecting servers with storage gear.

Mellanox counts major data center hardware makers such as Dell Technologies Inc. and several infrastructure-as-a-service providers as customers. Microsoft Corp., which uses the company’s networking products in its Azure cloud platform, was floated as a potential buyer at one point.

Another market where Mellanox has a significant presence is the high-performance computing segment. The company’s products power more than half of the world’s 500 most powerful supercomputers, including the top two on the list, Sierra and Summit, which are operated by the U.S. Department of Energy. The two systems also incorporate graphic processing units from Nvidia.

All three markets where Mellanox operates — the enterprise data center, public cloud and supercomputing segments — are major focus areas for Nvidia. The deal could provide a significant boost for the chipmaker’s growth efforts in these segments.

“Nvidia’s acquisition of Mellanox should be a synergistic move between the two companies,” Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, told SiliconANGLE. “Both Nvidia and Mellanox are big in the high-performance computing, machine learning, automotive, public cloud and enterprise datacenter markets, which could bring even more value to customers when combined.”

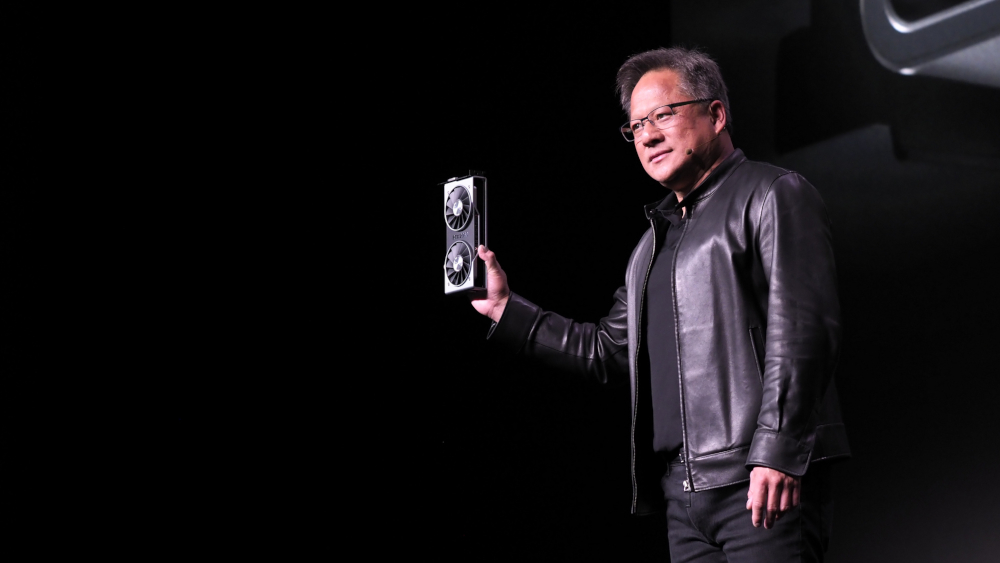

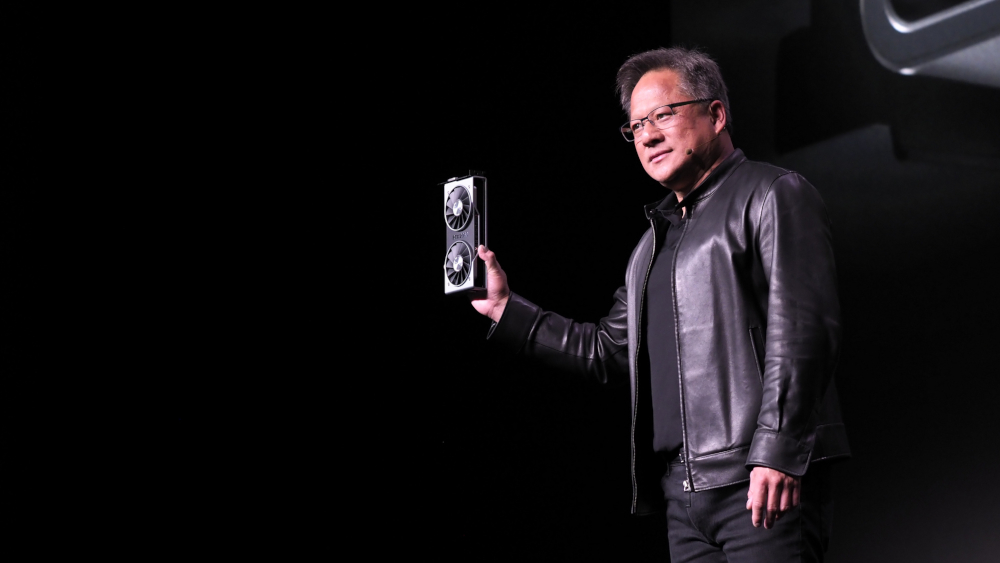

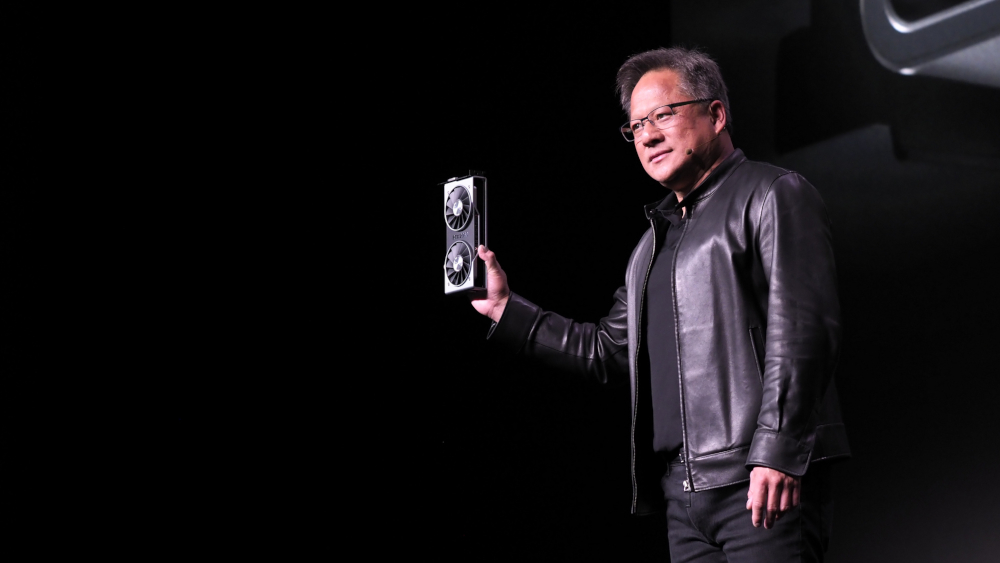

Nvidia Chief Executive Jensen Huang (pictured) outlined his vision for the acquisition in a press call this morning. “The strategy behind it is basically doubling down on data centers,” he told reporters. “With AI, data analytics and data science, data centers will be built like high-performance computers.”

Elaborating, Huang added that the “the data center will become a giant compute engine. The compute will extend into the network, and the network itself will become part of the computing fabric.” The CEO sees Mellanox playing a big role in enabling this new model because “the connectivity needed to allow these computers to work together is becoming more and more important.”

Another factor behind the $6.9 billion buyout price is that Mellanox will bring a significant source of revenue growth for Nvidia. The Israeli firm increased revenue 26 percent in 2018 to more than $1 billion thanks partially to the strong performance of its Ethernet business. Demand for Mellanox’s Ethernet switches rose 70 percent year-over-year, with the company expecting this growth to accelerate in 2019.

The fact Intel sought to acquire Mellanox likely also contributed to Nvidia making such a generous offer. The chip giant, one of Nvidia’s main competitors, is actively working to expand its presence in the data center connectivity business. Just this morning, Intel introduced new technology for linking accelerator chips such as GPUs to servers’ central processing units.

Nvidia expects the acquisition to close by the end of the year. In the press call, Huang said that “our business model won’t change” even as the chipmaker expands its focus beyond GPUs to become what the CEO described as a systems architecture company.

With reporting from Robert Hof

Support our open free content by sharing and engaging with our content and community.

Where Technology Leaders Connect, Share Intelligence & Create Opportunities

SiliconANGLE Media is a recognized leader in digital media innovation serving innovative audiences and brands, bringing together cutting-edge technology, influential content, strategic insights and real-time audience engagement. As the parent company of SiliconANGLE, theCUBE Network, theCUBE Research, CUBE365, theCUBE AI and theCUBE SuperStudios — such as those established in Silicon Valley and the New York Stock Exchange (NYSE) — SiliconANGLE Media operates at the intersection of media, technology, and AI. .

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a powerful ecosystem of industry-leading digital media brands, with a reach of 15+ million elite tech professionals. The company’s new, proprietary theCUBE AI Video cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.