INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Networking company Cisco Systems Inc. delivered a strong fiscal third-quarter performanc today, beating Wall Street’s expectations despite seeing its revenue decline from the same period one year ago.

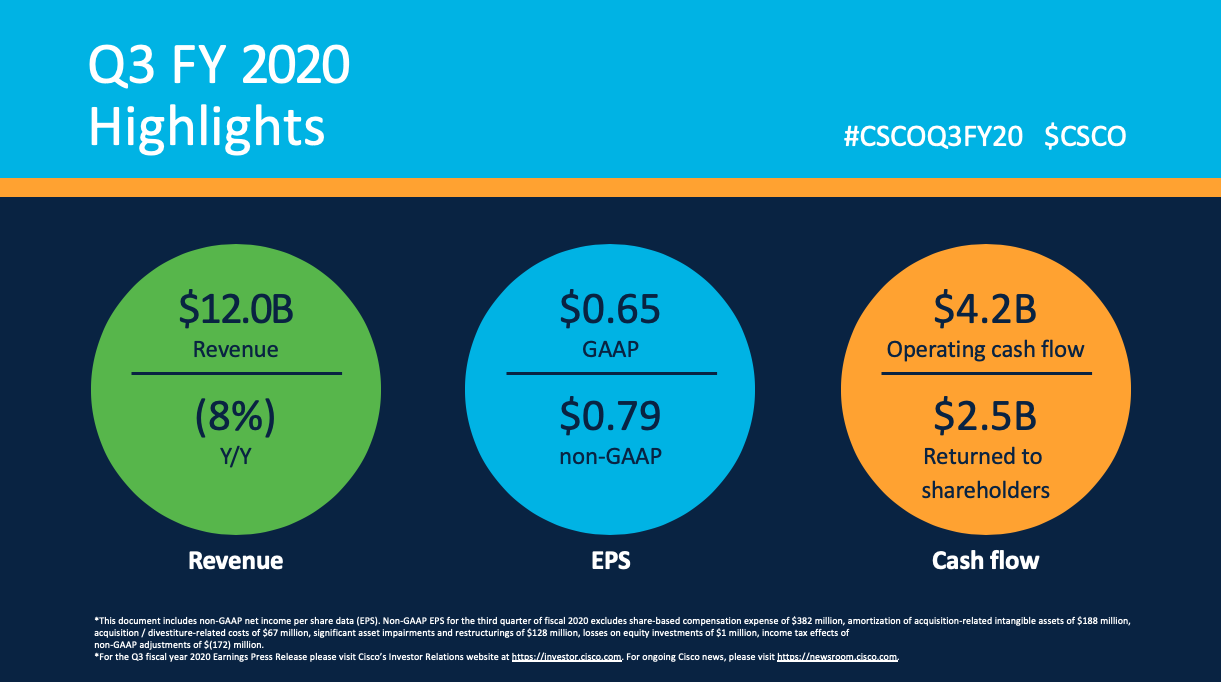

The company reported a profit before certain costs such as stock compensation of 79 cents per share on revenue of $12 billion, down 8% from a year ago.

Analysts had forecast earnings of 71 cents per share on revenue of $11.88 billion, though comparing results with estimates is no longer so straightforward because of the unpredictable impact of the coronavirus during the quarter.

Cisco’s stock rose more than 2% in after-hours trading.

“We executed well in Q3 in a very challenging environment, delivering strong margins and non-GAAP EPS growth,” said Kelly Kramer, chief financial officer at Cisco. “The resiliency that we have been building into our business model is paying off, with software subscriptions now at 74% of our software revenue, up 9 points year over year. We are focused on driving long-term profitable growth while delivering shareholder value.”

Cisco’s largest business unit, Infrastructure Platforms, which sells routers and network switches for corporate data centers, produced $6.43 billion in revenue, down 15% from a year ago and below estimates.

Kramer told analysts that Cisco experienced some “manufacturing challenges and component constraints” during the quarter, and that the pace of product orders slowed down in April.

Cisco’s Applications unit, which includes its Webex video calling service, generated an additional $1.36 billion in revenue, but that was down 5% year over year and below the $1.43 billion analyst consensus.

Investors might have hoped the Applications unit would get a boost from the coronavirus pandemic, which has resulted in more people working from home. That didn’t happen, but Cisco Chief Executive Chuck Robbins (pictured) said on the earnings call that the company “added many new prospects through free WebEx trials that we anticipate converting to revenue in the future.”

Elsewhere, Cisco reported Services revenue of $3.38 billion, up 5% from a year ago, and Security revenue rose 6%, to $776 million.

“All things considered, Cisco had a good third quarter,” said analyst Patrick Moorhead of Moor Insights & Strategy. “The product lines you would have expected to be up given COVID-19, like WenEx, subscriptions and security, were up. As you would imagine, the ability to install any non-critical networking gear inside enterprises will be challenged.”

Wikibon analyst Dave Vellante said the quarter shows that Cisco faces challenges, but added that many parts of its portfolio can provide a buffer. “Cisco has a large presence and better momentum across its portfolio than most legacy players,” he said.

Cisco’s performance this quarter underscores the value of being able to deliver products and services that everyone suddenly needs more than ever due to the coronavirus pandemic, said another analyst, Charles King of Pund-IT Inc.

“In this case, that is the enterprise grade Cisco switches and other networking gear that service providers are using to support massive upsurges in online traffic, and the company’s investments in communications applications, such as WebEx,” King said. “So long as current working from home and distance learning practices continue or even accelerate, Cisco is likely to do pretty well.”

As for the next quarter, Cisco forecast earnings of 72 to 74 cents per share and a revenue decline of 8.5% to 11.5%. Wall Street earlier forecast fiscal fourth-quarter earnings of 69 cents per share on revenue of $11.82 billion, which implies a 12% decline.

Robbins told investors that Cisco was expecting to see more business from companies that operate large data centers.

“I guess the good news is that the success we’ve seen in the webscale space the last two quarters hasn’t even seen the impact of the 8000 [router line] yet, so it’s in trials in lots of customers still,” Robbins said. “They have very extended evaluation periods before they deploy, but I will tell you it’s doing incredibly well in those trials.”

During the quarter, Cisco announced it would be allowing deferrals of payments on new orders to help customers who may have cash flow problems because of COVID-19. The company also announced its plans to acquire wireless backhaul system provider Fluidmesh Networks LLC, to boost its “internet of things” business.

“I was impressed at what the company had done to protect its employees and support its customers, including a $300 million response commitment and an additional $2.5 billion in business financing,” Moorhead said. “Longer-term, I believe the company is well-positioned to take advantage of opportunities in collaboration, edge networking, security, high-speed networking/internetworking and hybrid cloud.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.