BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Clari Inc., a startup that helps some of the biggest names in enterprise software forecast their revenues, has closed a $150 million funding round led by Silver Lake.

Announced today, the funding round follows a $60 million investment raised by the startup in 2019. Clari is now worth at $1.6 billion.

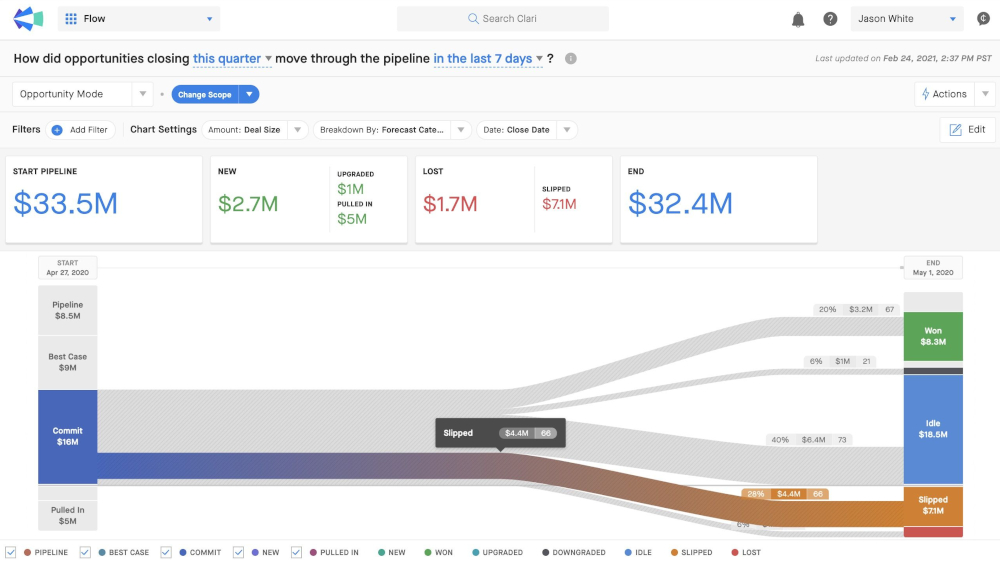

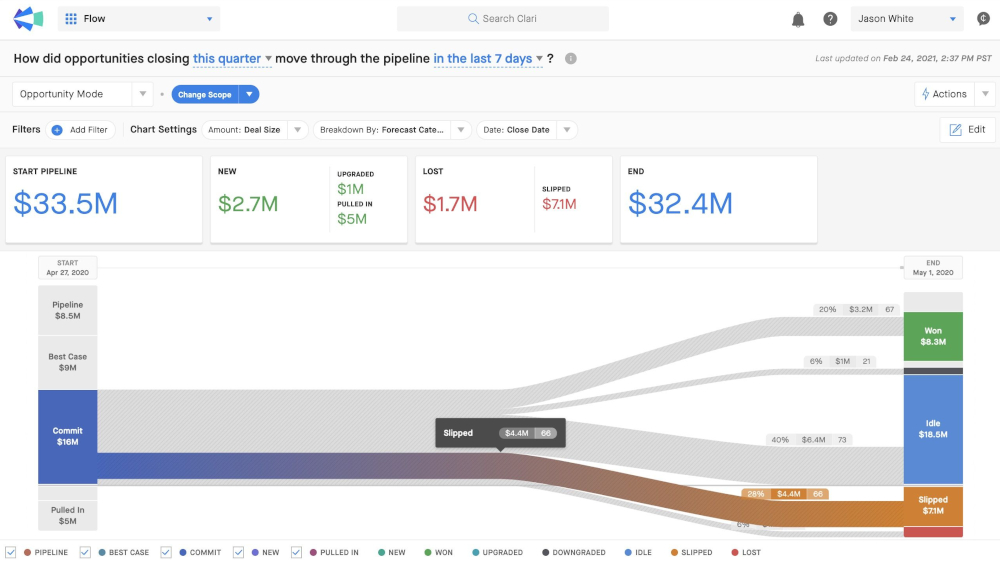

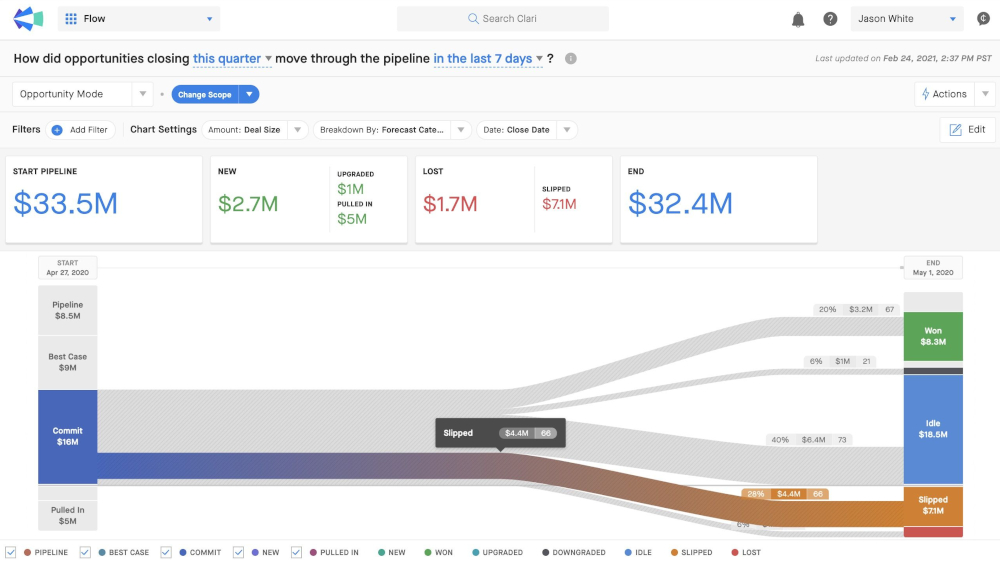

Sunnyvale, California-based Clari provides a cloud service that enables companies to estimate how much revenues they’ll generate in future months and quarters. It uses artificial intelligence to turn data such as Salesforce customer records into sales forecasts. Executives can consult Clari’s forecasts to see where their company is headed and make plans accordingly.

A software-as-a-service provider, for instance, might set a goal of growing revenues from new deals and existing contract renewals by a certain percentage. If Clari’s algorithms anticipate that customers will renew existing contracts at a slower rate than the leadership team is hoping for, the sales department could adjust its roadmap to more heavily focus on that part of the business.

Clari also provides other kinds of revenue-related insights. The service automatically ranks deal opportunities by importance to help sales teams prioritize their work more effectively. It can show how many more contracts they need to win to meet the current quarter’s revenue goals, as well as how sales compare with previous quarters.

Clari managed to outperform its own internal revenue plan for the past year by 110%, Chief Executive Officer Andy Byrne told TechCrunch without sharing specific numbers. That startup’s growth has been fueled in part by strong demand from the tech industry.

Clari says its service is used by robotic process automation giant UiPath Inc., Databricks Inc., HashiCorp Inc. and a long list of other prominent technology firms. Overall, the startup claims, its customers have raised private and public capital in 2020 at an aggregate valuation that exceeds $100 billion.

“Total executive time spent in Clari increased 50% as usage soared among C-level executives seeking more forward visibility into their revenue process,” Byrne elaborated in a blog post. “Forecast usage nearly doubled year-over-year.”

Clari will use its latest funding round to step up product development activities, establish more partnerships and expand internationally. Lead investor Silver Lake was joined in the round by B Capital Group, along with a half-dozen returning Clari backers: Sequoia Capital, Bain Capital Ventures, Sapphire Ventures, Madrona Ventures, Thomvest and Tenaya Capital.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.