BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Amazon Web Services Inc. is targeting financial analysts with a new, purpose-built data analytics tool that it says will enable them to perform their jobs much more effectively than before.

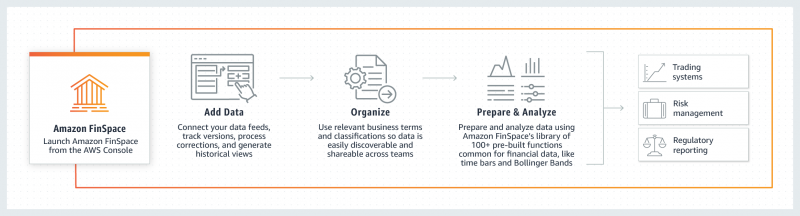

Amazon FinSpace is a new service announced today that works by aggregating, cataloging and then tagging data from a range of different sources, making it more easily searchable by anyone within the customer’s organization.

The tool is designed for analysts at hedge funds, asset management firms, insurance companies and the like. It gives them an easy way to perform analytics on demand across all of the data they have access too, including internal sources such as their portfolio management systems, order management systems and execution management systems, and also third-party data feeds such as high-volume historical equities pricing data, employment figures and earnings reports.

The cloud computing giant said Amazon FinSpace is needed because the task of discovering and preparing data for analysis is hugely complex and time-consuming. The data financial analysts rely on is typically distributed across numerous departments, it is often very specific.

Moreover, access to that data can be very tightly controlled. And once analysts have been granted access, analysts must then prepare the data for analysis by manually performing transformations needed to extract insights from it. Amazon FinSpace takes care of all of this legwork, making data available for analysis immediately, AWS said.

Amazon Developer Evangelist Sebastien Stormacq said in a blog post that the insights it delivers are superior too. Financial analysts often rely on technical indicators such as Bollinger Bands and Exponential Moving Averages to identify trends and patterns, but the traditional tools they use for doing this are not designed for computing heavy analysis at cloud-scale, he explained.

As a result, analysts often rely on smaller representative datasets that limit predictive ability, or else they manually break up the data into smaller subsets, transform them piecemeal and then manually recombine them. With Amazon FinSpace they can use much larger datasets, meaning more accurate insights overall, Stormacq said.

With Amazon FinSpace, data is ingested into the system either through the FinSpace application programming interface or a web application-based drag-and-drop interface. It’s then transformed and organized in such a way that it can easily found and shared. All analysts need to do is browse through a visual catalog or search using familiar business terms such as “options trades for the last three years” to access the information they need.

The service relies on the Apache Spark analytics engine to perform data transformations. In order to meet compliance requirements, users can define data access policies from directly within the service, and these will be enforced across data search, visualization and analysis. The service also tracks data usage and can generate compliance and activity reports showing who accessed a specific dataset and when.

Deloitte Touche Tohmatsu Ltd. Principal and Financial Services Data and Analytics Leader Jojy Mathew said his company is a big believer in the potential of cloud-based analytics as it makes it possible to answer questions that were unanswerable just a few years ago.

“When companies are building algorithmic, stochastic and predictive models, large data sets are key,” Mathew said. “Amazon FinSpace will allow users to process petabytes of data at the scale demanded. In addition, FinSpace enables ‘analytics sandboxes’ to be created quickly and brings advanced analytics capabilities to citizen data scientists.”

Constellation Research Inc. analyst Holger Mueller told SiliconANGLE that the public cloud is moving toward providing vertical services for specific industries, and that financial services with its high information technology spending is a key focus area.

“AWS is dedicating the entire month of May to the financial services space and logically it is starting with a solution that addresses the overabundant data sprawl that financial institutions struggle with,” Mueller said. “They need to overcome data latency, data gravity and data egress cost. With Amazon FinSpace, AWS is tackling many of the challenges, not only on the data management side, but also on the enablement side, where it wants to lower the bar for citizen data scientists.”

The Amazon FinSpace service is generally available now in the US East (N. Virginia), US East (Ohio), US West (Oregon), Canada (Central), and Europe (Ireland) regions, with wider availability coming soon. The service is priced based on the amount of data stored, users enabled and the compute power used to process and analyze that data.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.