AI

AI

AI

AI

AI

AI

Conventional wisdom says Microsoft Corp. is the big winner in the recent OpenAI saga. We don’t quite see it that way.

Both Microsoft and OpenAI are in a worse position today than last Thursday, prior to the firing of OpenAI Chief Executive Sam Altman and the ongoing public drama that ensued. Microsoft and OpenAI had a huge lead in market momentum, artificial intelligence adoption and feature acceleration, and were setting the narrative in AI.

Our discussions with customers and industry insiders leads us to conclude that the duo has put its substantial lead at risk. Although Microsoft CEO Satya Nadella is making lemonade from lemons, the window was just cracked open for the competition and it’s more clear than ever that one large language model will not rule them all.

In this Breaking Analysis, we weigh in on the impacts of the OpenAI meltdown with a deeper look at the customer perspective and how it alters the competitive landscape in the battle for AI supremacy. As well, the amazing data team at Enterprise Technology Research has run a quick survey of OpenAI Microsoft customers to gauge reactions and we’ll share that fresh data.

Before we get into that, let’s recap.

So much has been reported on this rapidly evolving story. But it’s worth reviewing the strange and curious structure that OpenAI has in place, which has led to a breakdown in communications, a governance failure and a PR disaster.

OpenAI was formed as a nonprofit in late 2015 with the commendable objective of building safe artificial general intelligence for the benefit of humanity. Often governments would be funding this type of initiative, but seeing no obvious public path, a number of private industry players decided a 501(c)(3) would best serve the mission. But it became clear that despite the initial $1 billion funding from its founders, the company wouldn’t be able to adequately fund its lofty goals.

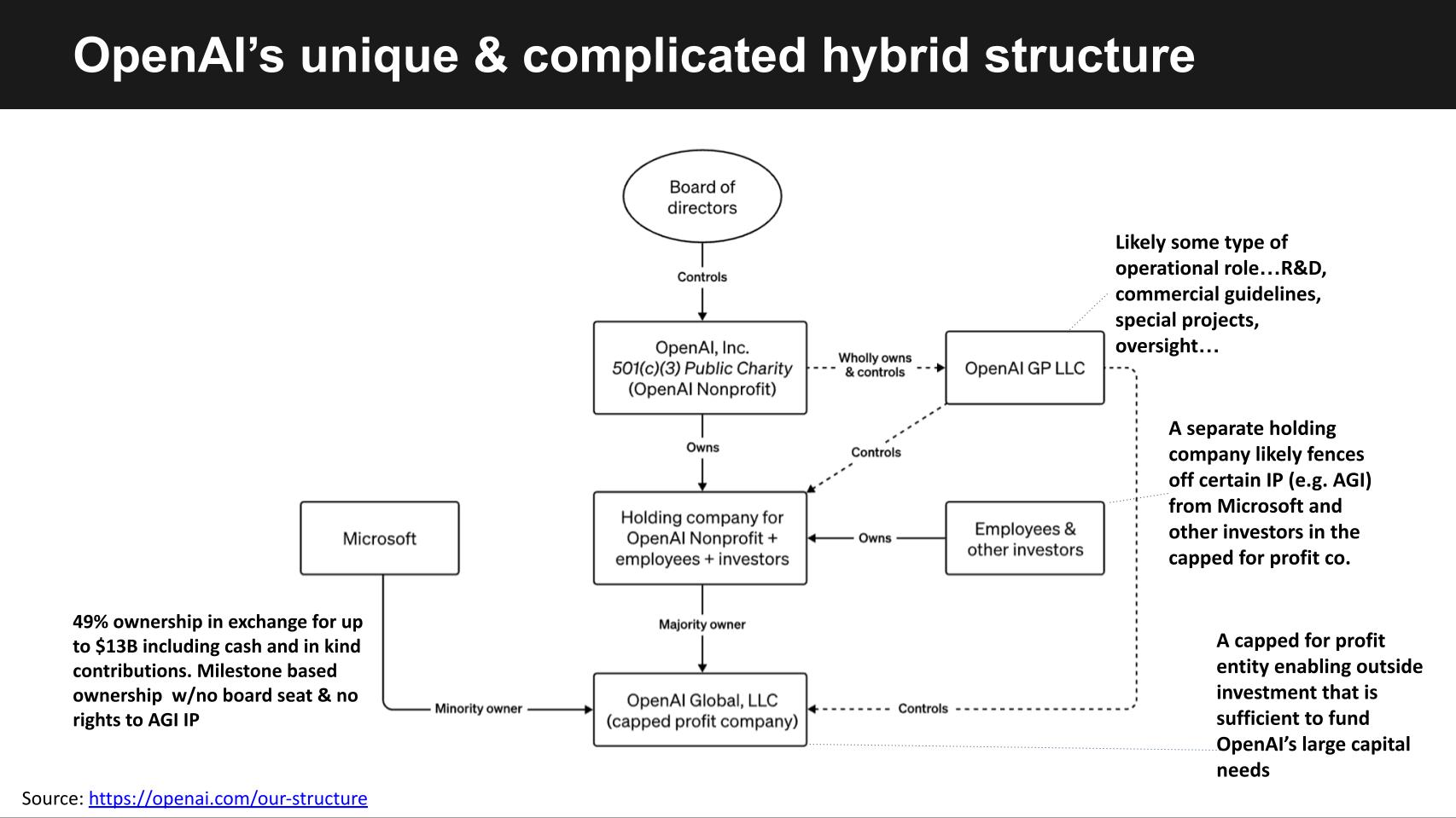

In 2019, OpenAI created a structure that allowed it to accelerate its outside investments including from its longtime partner, Microsoft, which began working with OpenAI back in 2016. As shown in this graphic, the structure expanded to include an LLC that appears to have some type of operational role and is owned by the nonprofit, which also owns a separate holding company that enabled OpenAI to take outside investments.

The big investor names you might be familiar with are Khosla Ventures, Tiger Global, Thrive Capital, Sequoia Capital and Andreessen Horowitz. OpenAI took about $1 billion from Microsoft around this time, but it’s unclear if that investment is in that middle box shown as the holding company on this graphic – or the one at the bottom, the capped-profit company in which Microsoft has a 49% stake.

So unpacking this structure a bit more. it’s likely that the holding company fences off certain assets, such as the artificial general intelligence intellectual capital — which as you probably know Microsoft doesn’t have access to. Microsoft’s 49% ownership of the capped-profit company is in exchange for up to $13 billion in cash and in-kind contributions — for example, Azure — and in my conversation with insiders, it’s structured in tranches and contingent upon OpenAI delivering on certain milestones.

It’s our understanding that Microsoft has the right to make derivative works from OpenAI intellectual property, for example bundling it with Bing and its other products and potentially more liberal IP usage. It likely also includes protections in the event that OpenAI goes insolvent.

Regardless, you end up with this complicated structure that has investors, which have rights to all the IP, including the AGI IP, and one giant investor, Microsoft that doesn’t. Microsoft shares the capped-profit LLC with OpenAI and its investors, which maintain a 51% owner in the form of the OpenAI holding company.

The point is, this structure has failed in a number of ways. Microsoft capitulated on having a say in how OpenAI is governed or just ignored the risks in exchange for exclusive access to OpenAI’s GPT 3.5 and GPT 4 technology. And that left the door open for a board of directors with incredibly poor judgment to try to oust its CEO, leading to a company that is now in disarray.

This post by co-founder and Chief Scientist Ilya Sutskever says it all:

I deeply regret my participation in the board's actions. I never intended to harm OpenAI. I love everything we've built together and I will do everything I can to reunite the company.

— Ilya Sutskever (@ilyasut) November 20, 2023

And as one person commented in Twitter, this turns Ilya from Barzini into Fredo, a reference to the movie “The Godfather.” Emilio Barzini, of course, was the mobster who double-crossed the Corleone family and Fredo was the sensitive and troubled son of Don Corleone who was the unsuspecting dupe in the drama. It’s unlikely, however, that Ilya’s fate mirror Fredo’s.

Let’s explore why this mess is so damaging and provide some context as to why the narrative that Microsoft is the big winner is not so definitive in our view.

Essentially, Microsoft is the commercial face of OpenAI. The two companies are joined at the hip. In other words, adoption of OpenAI tools directly benefits Microsoft because it’s the exclusive partner for OpenAI’s GPT tooling.

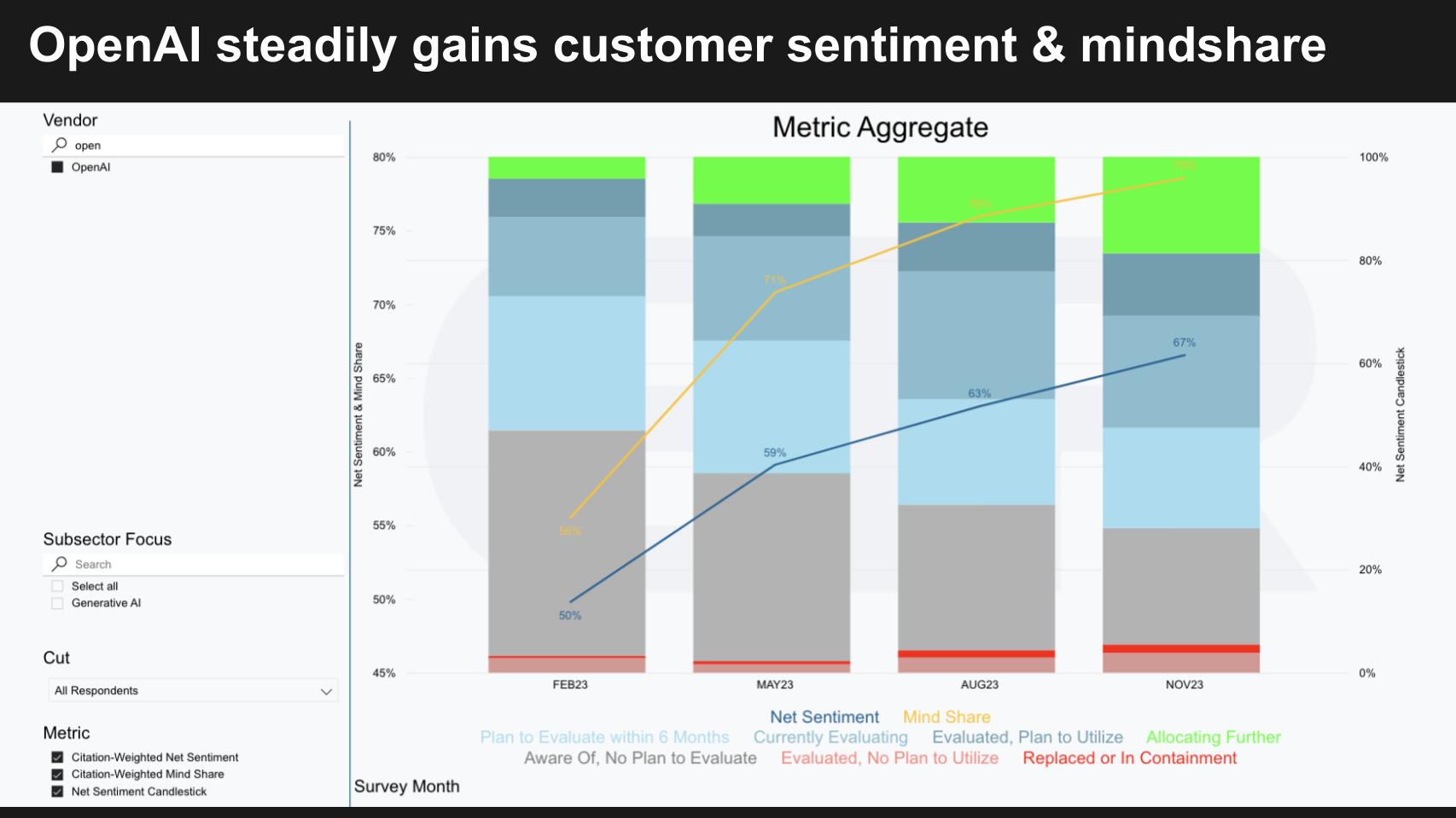

The success of OpenAI has been astounding. The data above from ETR’s Emerging Technology Survey of more than 1,500 information technology decision makers evaluates their use of technologies from nonpublic companies. In this survey, ETR measures Net Sentiment (the blue line) and Mind Share (the yellow line). OpenAI showed up in the February 2023 survey and has steadily increased on both dimensions — to levels we’ve not seen previously.

The green and blue bars are indicators of incremental adoption and the gray and red are indicators of no adoption. And the trend is clear – OpenAI steady progression is obvious.

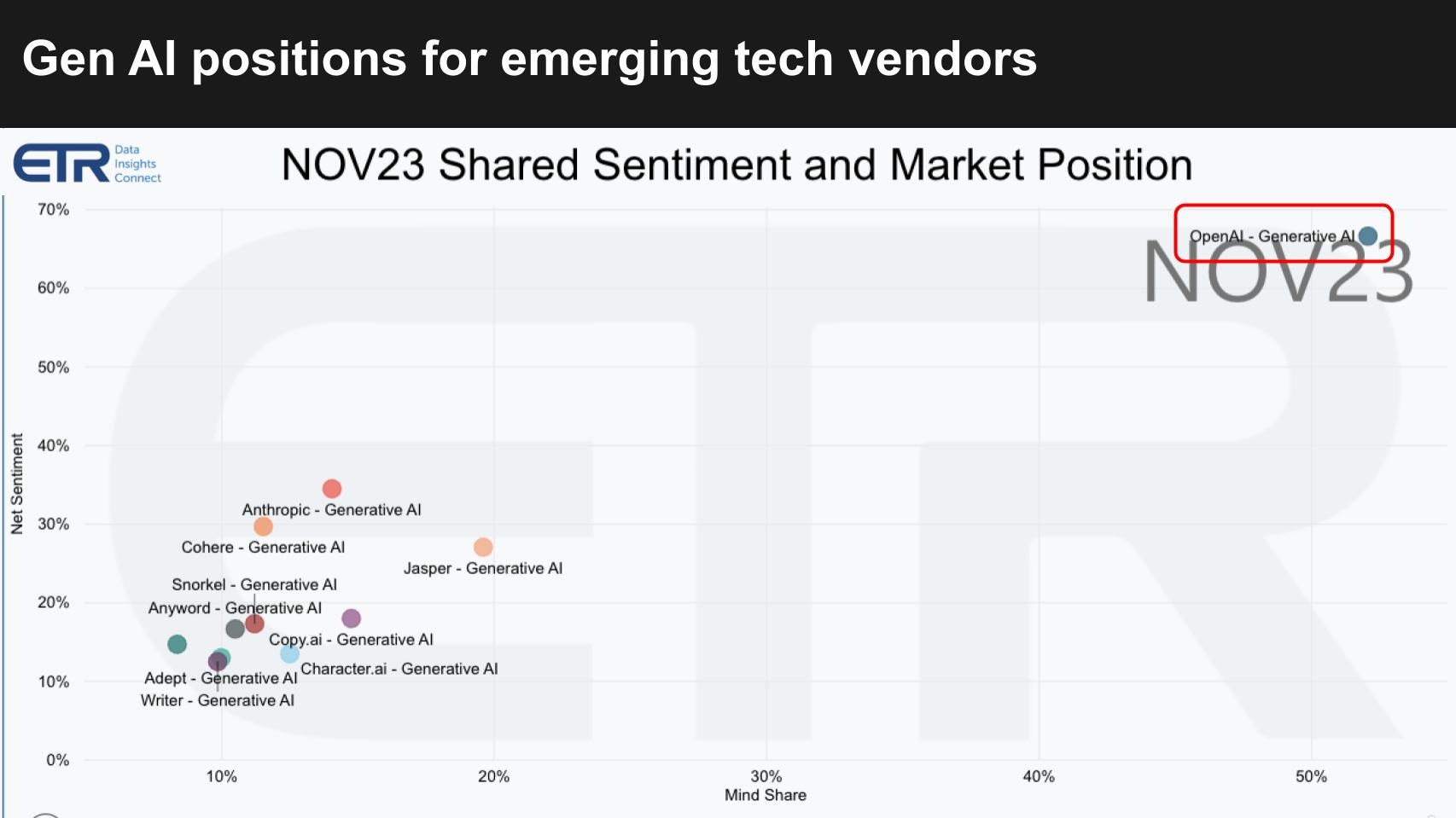

What’s striking is OpenAI’s market position relative to the competition.

The chart above shows data on two the same two dimensions: Net Sentiment (Y) and Mind Share (X) among Gen AI players. Look at the position of OpenAI. It is off the charts on both dimensions, blowing away the likes of Anthropic and Cohere, two prominent and well-funded LLM players.

OpenAI’s dominant position is directly a function of its Microsoft relationship and that company’s massive resources, software estate and cloud computing infrastructure.

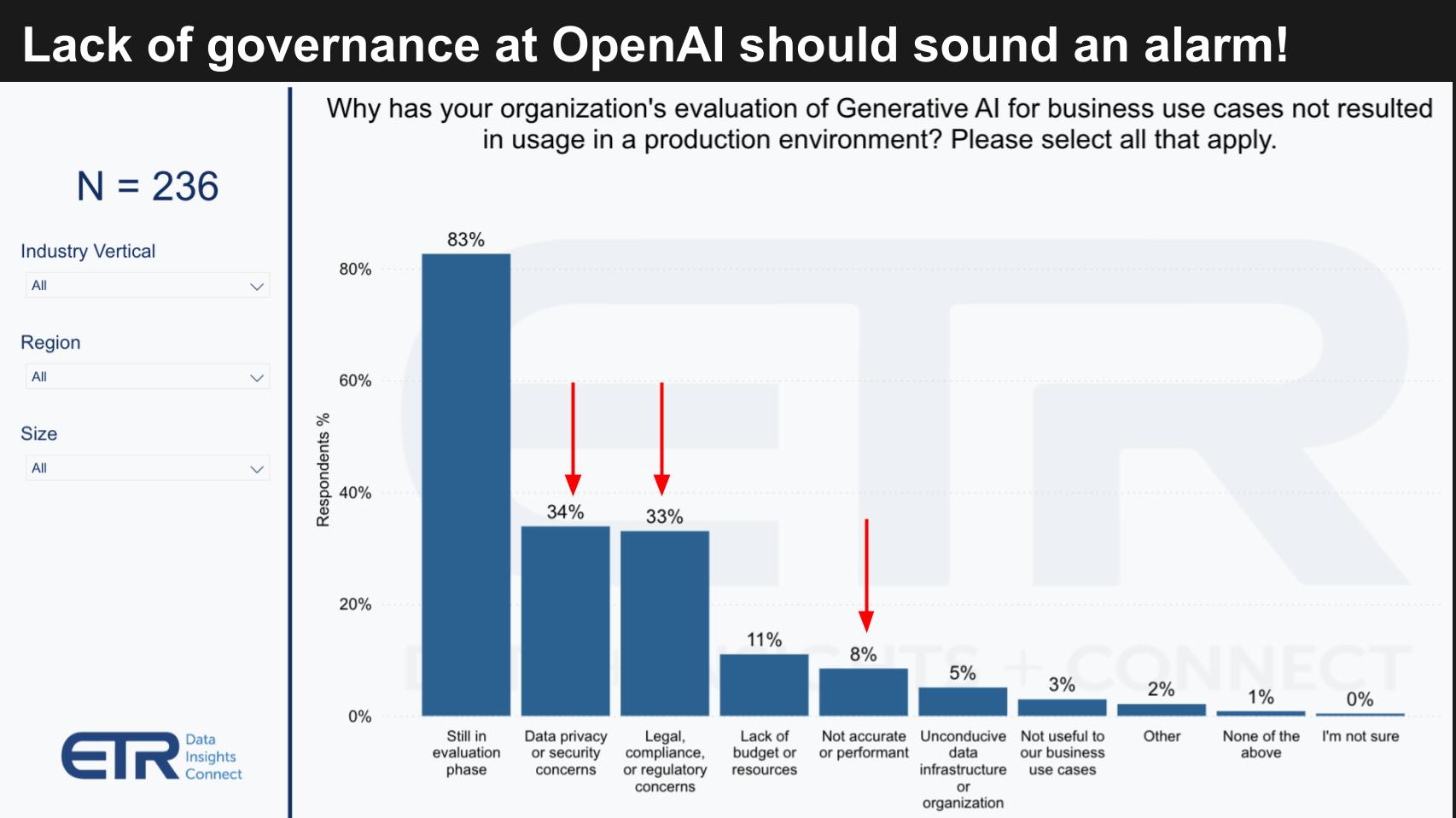

The reason this PR mess is so concerning for customers is that the top challenges they report in putting generative AI into production are concerns related to all the sticky-wicket legal and compliance issues: privacy, security, legal compliance, regulatory concerns, lack of accuracy and unexpected results and hallucinations. These issues as shown by the arrows in the chart below dominate the barriers to adoption.

Coming off an impressive Ignite conference, Nadella spent his weekend trying to save the day. And he has spent this week doing damage control. Here’s what he said to Kara Swisher:

…one thing I’ll be very, very clear [about] is, we’re never going to get back to into a situation where we get surprised like this ever again. That’s done…

This raises a credibility issue for Microsoft. If you’re a customer, you’re going to take pause and question this disaster. If Microsoft essentially ignored the governance risks on a potentially $13 billion investment, and OpenAI has a completely dysfunctional board and structure, would you trust them with your data and potentially the future technology roadmap of your company?

You most certainly wouldn’t trust OpenAI. Whether Microsoft can adequately address customer concerns remains to be seen.

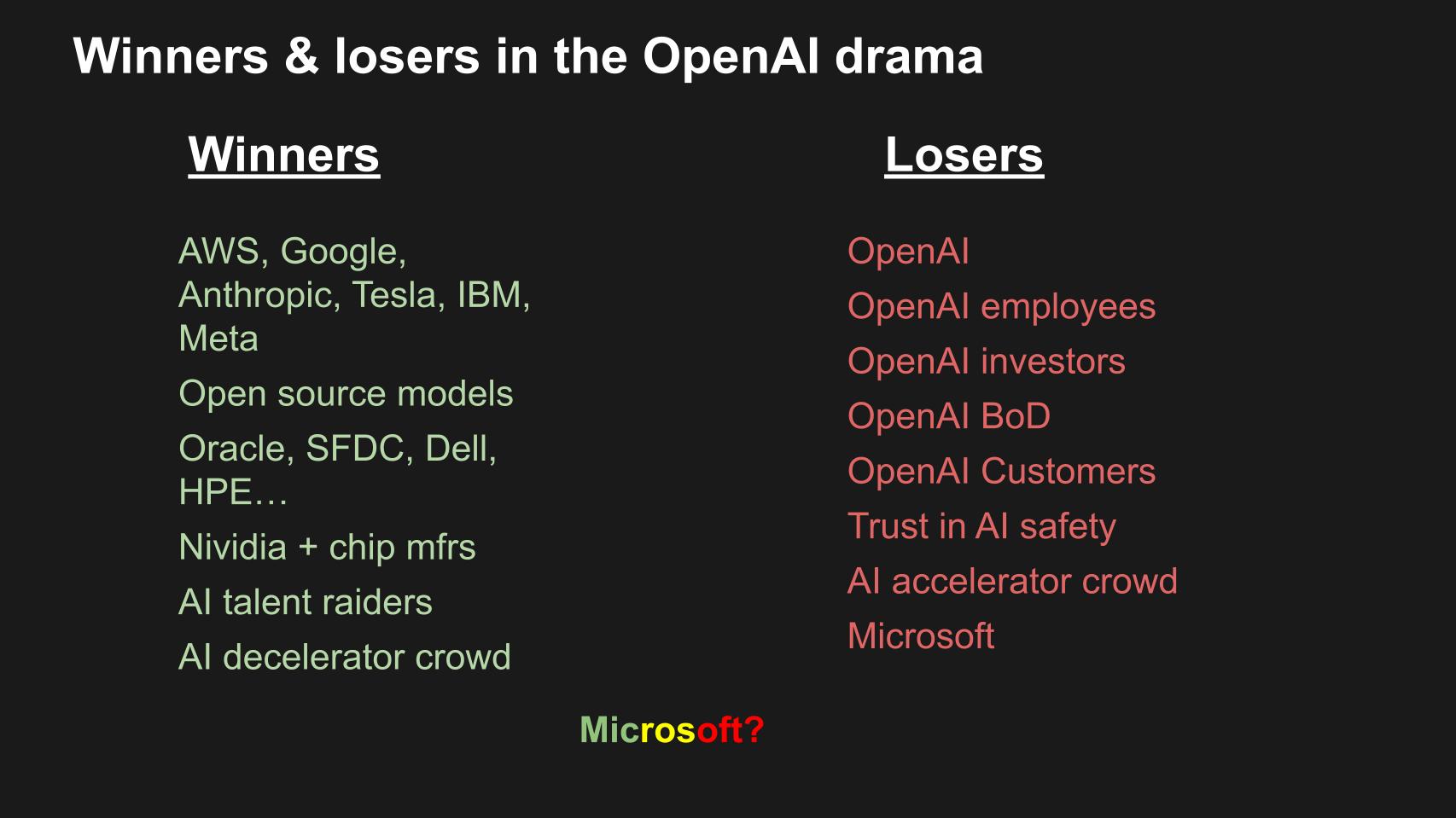

Who wins and who loses from this failure of the OpenAI board?

All the folks chasing OpenAI and Microsoft just got a little reprieve. Amazon Web Services Inc. is readying to have the last word of 2023 at re:Invent next week, Google LLC is playing catch-up with Vertex AI and, though Anthropic is now going to get a stress test from its investors, if it passes, it’s good. Tesla Inc., IBM Corp. with Granite, Meta Platforms Inc. with Llama 2, other open-source models…

Companies in the mix include Oracle Corp. and Salesforce Inc., while Dell Technologies Inc. and Hewlett Packard Enterprise try to bring generative AI on-premises where much of the data still lives. Nvidia Corp. and other chip manufacturers want a level customer playing field, so they win. AI talent hounds – we saw Salesforce CEO Marc Benioff and others offering jobs.

Generally the AI crowd that wants to decelerate the pace is happy about this fail and these names stand to benefit at least in the near term.

What about the losers? OpenAI, its employees, investors and board of directors was staring at a $90 billion valuation that they just threw away. This asset is going to get marked down. Its customers are caught in the crossfire and the whole argument around accelerating AI and letting the tech industry adjudicate trust in AI safety just got torpedoed.

Despite the diving catch in the end zone by Nadella, Microsoft can’t be happy with the situation. Everyone is saying it’s a big winner because of the chess moves Nadella made. But it was the AI puppet master coming out of Ignite and now it’s trying to put Humpty Dumpty back together.

What happens if Sam Altman gets lured back to OpenAI? Is all suddenly good? No lost productivity? No slowing down to put controls put in place? And what if he ends up at Microsoft? How many OpenAI employees go with him and how long does it take for Microsoft to ramp up? Is the latter scenario better or the former?

Hard to say.

In following this saga, we haven’t heard much if anything about what customers are thinking.

Let’s take a look at that. ETR snapped into real-time action to capture the customer sentiment from OpenAI/Microsoft customers. The comments are anecdotal but the overall assessment is that Microsoft is embedded deeply into many customers’ processes and many will give it a pass. But there is real cause for concern in the data.

Here are some verbatims from several IT decision makers, including senior directors of architecture, a senior director of IT and a cybersecurity practitioner. All are from large organizations within financial services, insurance and a large nonprofit.

OpenAI is dead from my point of view, three CEOs in three days isn’t a good signal, and Microsoft is taking advantage of that.

Having proper governance, controls and security is very critical to our business, and we are partnering with Microsoft for successful solutions.

I think the lack of transparency from OpenAI around the decision clouds my confidence in either side.

This news makes me skeptical of both OpenAI and Microsoft, and the easiest solution might be to just avoid both in lieu of other platforms until things settle or truth behind the rapid changes is clarified.

This basically means we need to hedge against multiple companies. We are using both OpenAI and Google extensively as well as startups. There is no clear winner yet and the space is evolving too quickly to bet the farm on one player.

It adds to the overall skepticism around AI and related risks. I believe it will raise awareness throughout tech and government, and inevitably lead to more attempts to regulate the platforms.

This last point underscores not only the failure of OpenAI’s governance, but it affects the entire technology ecosystem in a way that could stifle innovation. But policy makers wanting to regulate AI now have a much stronger hand to play.

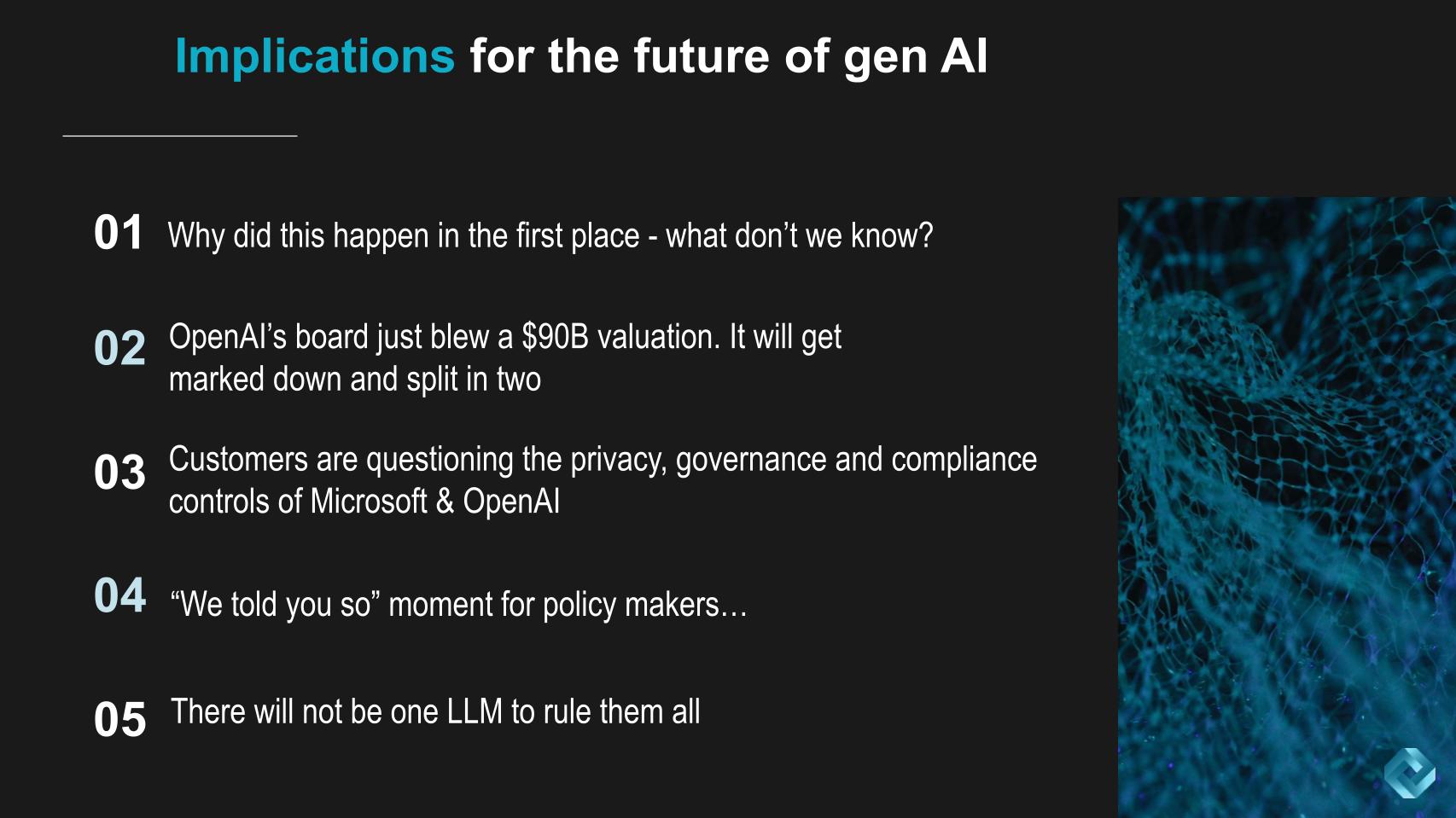

Why did this happen? Emmett Shear, the interim CEO from Twitch, tweeted when he accepted the job that he had good visibility on the whole situation and there was nothing amiss regarding Sam Altman… no big deal. Now he’s saying he’s not going to stay on until he finds out exactly why the board removed him.

Which is it?

OpenAI’s valuation just got crushed — possibly cut in half or worse. Our initial data shows that many customers are hitting the pause button and questioning everything right now to understand where they might have blind spots.

This is a huge “we told you so” moment for the AI policy makers who want to regulate AI. It’s not ideal from an innovation standpoint. It’s also a massive black eye on the tech industry in terms of being able to self-govern. Let’s face it: Tech doesn’t have the same lobbying skills as banks and this is a bad look.

Finally, the bottom line as we’ve been saying since early in this cycle, there will not be one large language model to rule them all. Choice and flexibility are going to be the operative models and that is the one thing we’re pretty certain about in this uncertain world of gen AI.

Supercloud 5: The Battle for AI Supremacy kicks off next week. It’s live from our Palo Alto studio with John Furrier and myself in Las Vegas reporting from re:Invent, along with SiliconANGLE writers Rob Hof and Mark Albertson, as well as Lisa Martin and Savannah Peterson in the studio, and Rob Strechay with Rebecca Knight reporting from Barcelona at HPE Discover. Coverage starts Tuesday, Nov. 28, so check that out.

Many thanks to George Gilbert and Sarbjeet Johal for the help this week. Thanks to Alex Myerson and Ken Shifman on production, podcasts and media workflows for Breaking Analysis. Special thanks to Kristen Martin and Cheryl Knight, who help us keep our community informed and get the word out, and to Rob Hof, our editor in chief at SiliconANGLE.

Remember we publish each week on Wikibon and SiliconANGLE. These episodes are all available as podcasts wherever you listen.

Email david.vellante@siliconangle.com, DM @dvellante on Twitter and comment on our LinkedIn posts.

Also, check out this ETR Tutorial we created, which explains the spending methodology in more detail. Note: ETR is a separate company from Wikibon and SiliconANGLE. If you would like to cite or republish any of the company’s data, or inquire about its services, please contact ETR at legal@etr.ai.

Here’s the full video analysis:

All statements made regarding companies or securities are strictly beliefs, points of view and opinions held by SiliconANGLE Media, Enterprise Technology Research, other guests on theCUBE and guest writers. Such statements are not recommendations by these individuals to buy, sell or hold any security. The content presented does not constitute investment advice and should not be used as the basis for any investment decision. You and only you are responsible for your investment decisions.

Disclosure: Many of the companies cited in Breaking Analysis are sponsors of theCUBE and/or clients of Wikibon. None of these firms or other companies have any editorial control over or advanced viewing of what’s published in Breaking Analysis.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.