CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Cloud business software provider ServiceTitan Inc. today announced the launch of its initial public offering, with the company seeking to raise up to $502 million in an offering of 8.8 million shares priced between $52 and $57 each.

Founded in 2012, ServiceTitan provides a cloud-based platform tailored to the needs of service businesses such as heating, ventilation, air conditioning, plumbing and electrical contractors. The company modernizes and simplifies the management of home service companies and trades.

ServiceTitan offers a suite of tools designed to help service businesses streamline operations and improve efficiency. The tools include scheduling and dispatching, customer relationship management and real-time tracking of jobs. The platform also features integrated payment processing and marketing automation to allow users to manage their business operations from a single system.

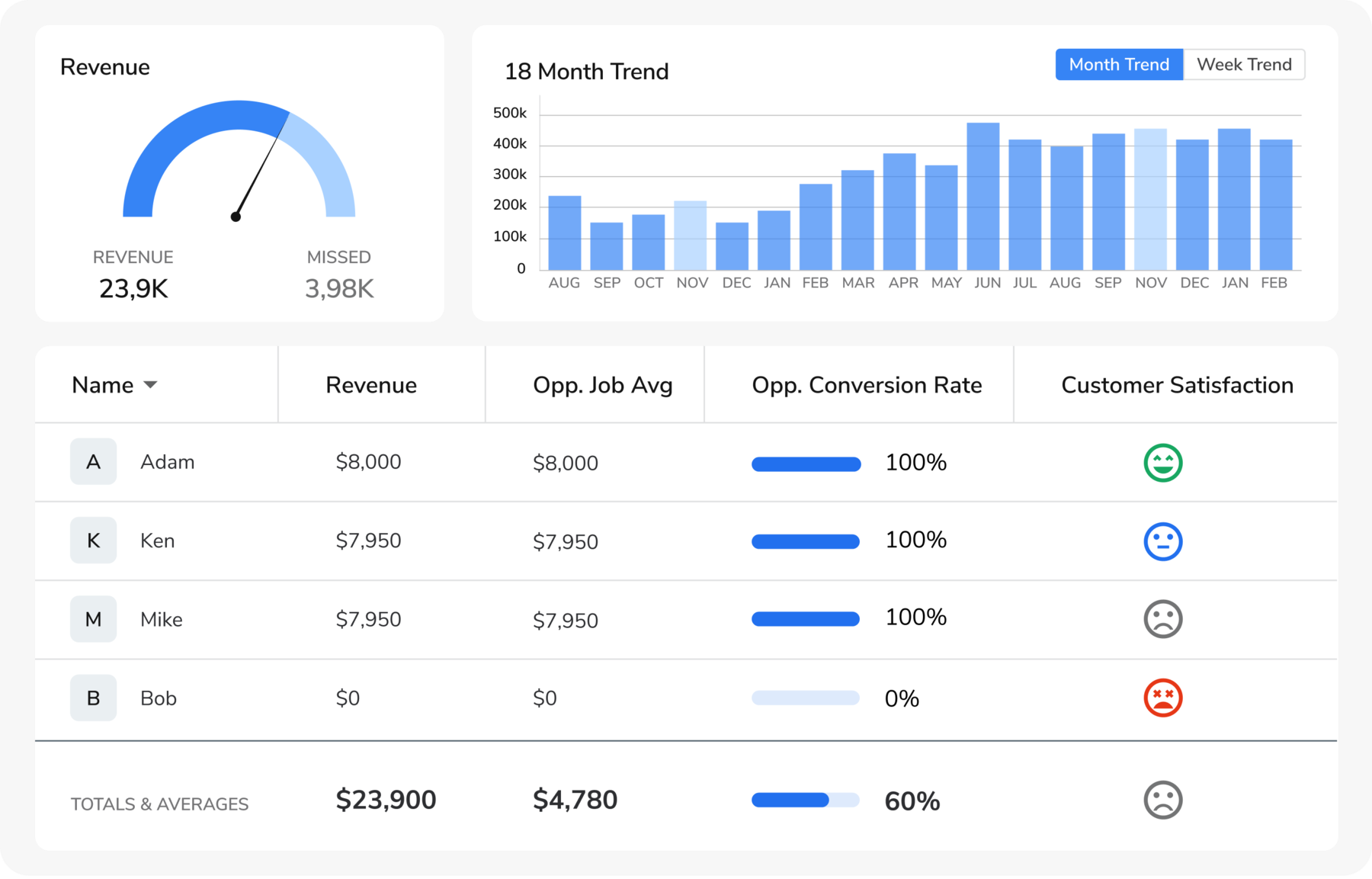

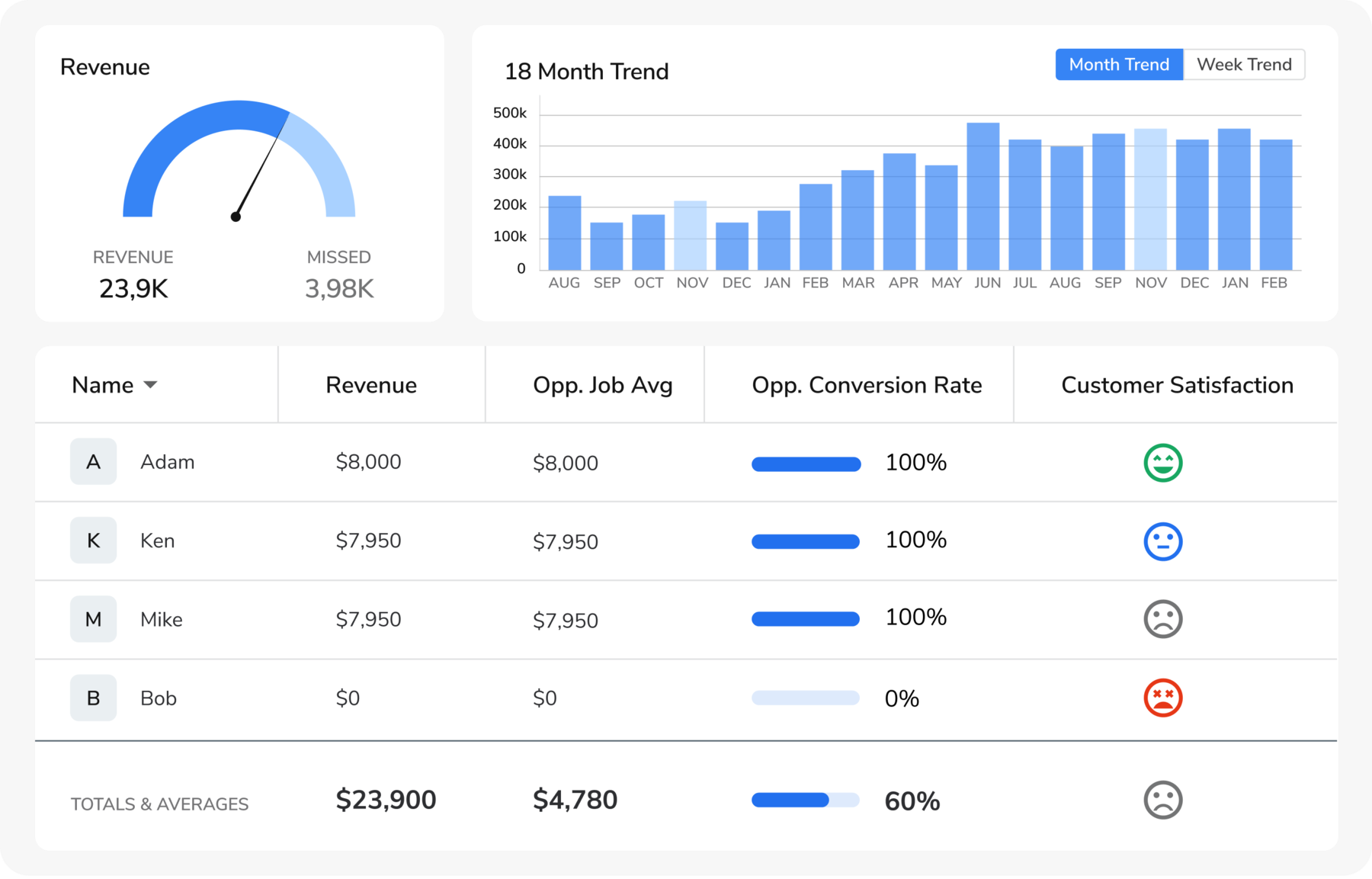

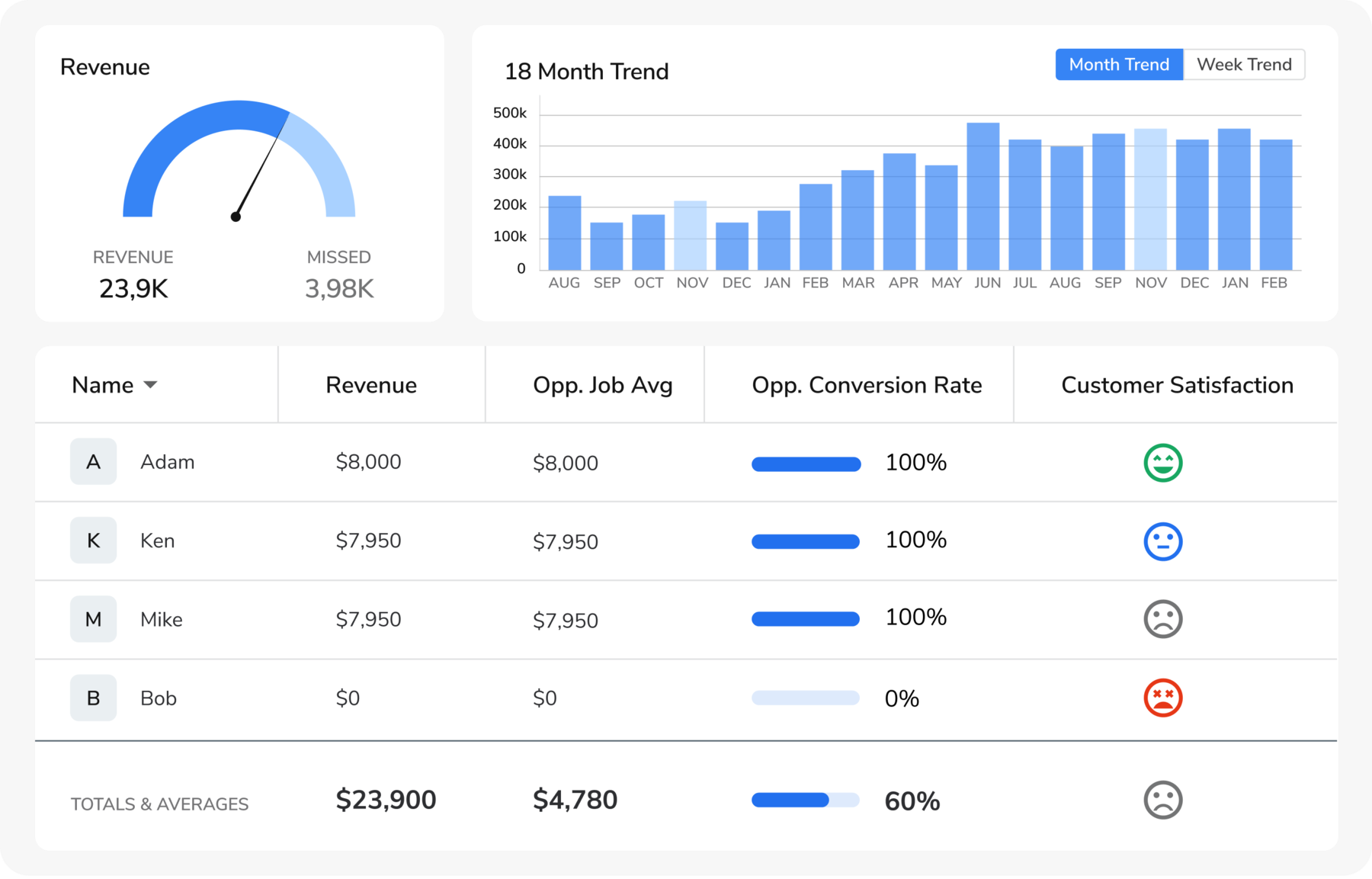

One key feature of ServiceTitan’s platform is reporting and analytics capabilities that provide businesses with insights into performance metrics such as revenue, technician productivity and customer satisfaction. The platform allows users to make informed decisions that drive growth and enhance profitability.

ServiceTitan is also strong on artificial intelligence, with the company announcing additions to its AI-powered technology for residential and commercial contractors, including a new AI assistant and new applications for sales and call centers, in October. The solutions, powered by Titan Intelligence, the company’s purpose-built AI solution for trades, are focused on empowering contractors to automate, predict and optimize their businesses.

Coming into its IPO, ServiceTitan has raised $1.1 billion in venture capital funding across eight rounds, including a round of $165 million in 2018. Investors in the company include Index Ventures LLP, Dragoneer Investment Group, T. Rowe Price Group Inc., Battery Ventures LP, Bessemer Venture Partners LP and Iconiq Growth.

ServiceTitan’s IPO, at the high point of the $52 to $57 per share being sought, would value ServiceTitan at up to $5.16 billion. The IPO also comes as tech companies going public continue in a roughly two-year-long drought that has seen far fewer tech firms going public compared to the period 2020 to 2022.

Notable tech IPOs this year include Astera Labs Inc. and Reddit Inc. in March, Rubrik Inc. raising $752 million in April, Ingram Micro Inc. raising $409.2 million in October and Pony AI ADR raising $413 million in November.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.