AI

AI

AI

AI

AI

AI

Since launching a massive data lake earlier this year to support its analytics, application development and artificial intelligence use cases around the globe, TransUnion LLC has begun to realize the benefits of deploying artificial intelligence models in back-office cases – and they’re not necessarily what you would expect.

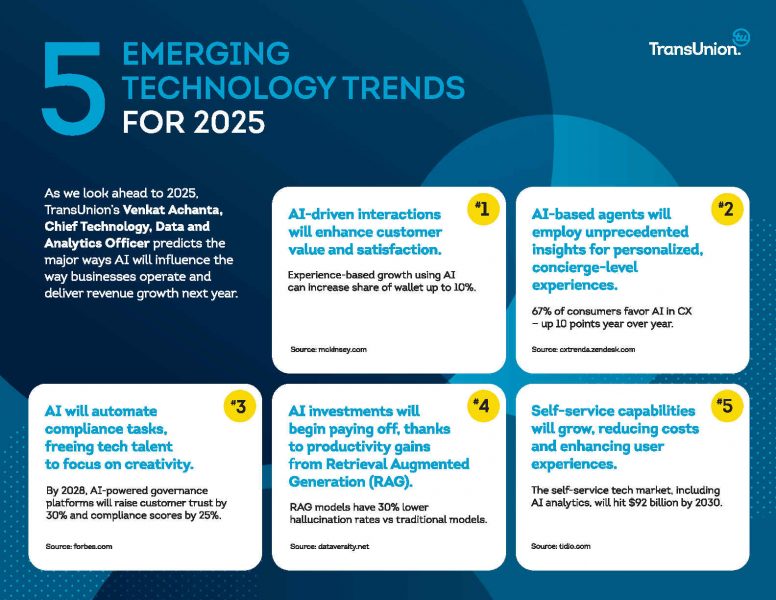

Self-service AI models for data preparation are helping to break down silos that had formed around areas of expertise. Instead of throwing problems over the wall to be resolved by specialists, human analysts now turn to AI for solutions. That’s breaking workflow logjams and making work more meaningful, according to Venkat Achanta (pictured), TransUnion’s chief technology, data and analytics officer.

“Users can now orchestrate end-to-end processes and break down silos,” he said. “What they used to have to ask another group to do they can now do themselves. One person enabled by AI can accomplish a much more complex set of tasks.”

The result is that skills inventories are moving up the stack. “People who weren’t able to do data analysis are now becoming super-analysts,” he said. “Data analysts are climbing the data ladder to become modelers and taking on higher-order tasks. It’s pushing everyone up the ladder.”

As a highly regulated company, TransUnion’s AI has focused most of its early AI deployments on internal functions such as reducing fraud, loading data and improving developer productivity. The results have been positive overall and, in some cases, dramatic.

Large language models have enhanced fraud detection by simulating investigative tasks that used to require human agents.

“Agents need to understand the grammar of fraud,” Achanta said. “A certain sequence of steps may mean something, and a pause between steps may mean something else. If you think about how LLMs work, you can create a deep learning model tuned for specific cases of financial fraud, and we’re seeing some of these techniques translate very well.”

AI has yielded a 40% improvement in fraud detection accuracy and reduced false fraud alerts by over half. “Those two factors work as a force multiplier,” Achanta said.

AI is also proving to be a worthy data onboarding partner by making decisions that previously required human scrutiny. Routine tasks such as data validation can be dispatched faster and more accurately by machine. “It recognizes data elements, tags them and applies the conformity rules you have so you don’t have users having to sit there and map each one,” he said.

For example, a model can be instructed to generate an alert for a phone number without an area code but pass a four-digit Social Security number because “that’s all we need in a privacy-preserving world,” he said. “What it can do on the front end is amazing. Doing these data quality checks after the fact is very expensive.”

In software development, LLM-powered code assistants are helping out on a large modernization program to convert aging .NET code to Java. “There are orders of magnitude advantages in code conversion when you apply AI,” Achanta said.

Jobs are changing as a result of automation, which naturally creates some apprehension. Easing people’s fears “is a work in progress,” Achanta said. One of the most effective ways he has found to address anxiety is to focus on work quality.

“For a developer, that means generating the task case rather than writing the code for the task case,” he said. “These are mundane things that developers don’t want to do. People get more meaning from doing more creative tasks.”

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.