AI

AI

AI

AI

AI

AI

IBM Corp. is at a turning point. After strong earnings and a rapid rise in stock price, it’s clear that Chief Executive Arvind Krishna’s long-term strategy is paying off.

We’ve been following IBM closely — we’ve seen Krishna’s vision firsthand, attended analyst meetings, had one-on-one discussions with executives, and covered its artificial intelligence and hybrid cloud playbook extensively on theCUBE. This week, I was in New York City and IBM held its first Investor Day in years, coinciding with its stock price reaching an all-time high.

Here, I’ll break down its presentation on AI momentum and the key drivers behind it — because this is what’s fueling IBM’s business growth and stock price acceleration. The numbers don’t lie: IBM is delivering growth across software, consulting and infrastructure, and the market is rewarding its execution.

IBM has been sharpening the saw, positioning itself as an integrator and a “picks and shovels” provider in the AI wave. It has the installed base — a massive, enterprise-heavy footprint — which is critical to winning in this AI transformation. We always say on theCUBE: You win in transitions. Right now, IBM is in a transition alongside the entire industry, and it’s executing on Krishna’s strategy.

The question now is: How does IBM extend its dominance into AI’s next era?

IBM has long lived in open source, and its Red Hat unit is the de facto standard for hybrid cloud and open-source enterprise solutions. That’s why for DeepSeek is an example in AI innovation. For many including IBM, it wasn’t a disruptive event, but an iterative, efficient AI innovation model that delivered fast, cost-effective AI advancements that complements their approach to how they have been building their AI strategy and offerings.

DeepSeek proved that speed, learning and execution matter more than raw scale. IBM and Red Hat know this game inside and out.”Opensource is where IBM and RedHat lives”, says Matt Hicks CEO of RedHat. IBM gets this. They’ve always known how to commercialize open-source in the enterprise, and now they have a chance to take that DeepSeek-style model and scale it into their AI and hybrid cloud strategy.

DeepSeek grabbed attention because of its low-cost AI innovation model, but the real story was how it pulled it off:

The takeaway? AI software and algorithm efficiency beats raw compute power. And IBM’s AI playbook aligns perfectly with this shift — leaner, more optimized models, cost-effective training and a hybrid cloud infrastructure that can integrate AI at enterprise scale.

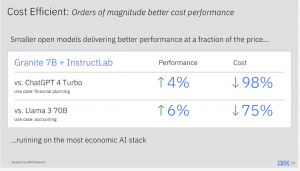

IBM’s Granite models are already proving that they can compete on both cost and performance. Here’s where IBM’s AI advantage comes into play:

This isn’t just a pricing advantage — it’s a structural advantage. IBM isn’t trying to outspend OpenAI or Google LLC on massive foundation models. Instead, it’s focusing on highly efficient, purpose-built AI models that deliver enterprise-grade reliability at a small fraction of the cost.

And this is exactly what Red Hat knows how to do — scaling open-source innovation in the enterprise. IBM’s hybrid cloud and AI stack is now positioned to drive cost-effective, high-performance AI adoption, just as DeepSeek demonstrated with its optimized approach.

IBM’s biggest opportunity isn’t just building AI models. It’s brokering access to the next generation of AI-driven enterprise solutions for developers and startups.

Developers and startups want to sell into IBM’s installed base, and big incumbents such as IBM, Dell Technologies Inc. and Salesforce Inc. aren’t trying to force developers to code on their platforms anymore. Instead, they’re shifting to an integration model — getting developers to build into their AI and hybrid cloud stack.

This shift is huge because it means that developers and the enterprise customers don’t have to change their tools. They just plug into IBM’s AI software and infrastructure. This is a winning strategy for IBM because:

People often think that IBM and other established incumbents are “the old guard,” but here’s the reality: They aren’t going anywhere. IBM isn’t just a legacy player — it’s positioning itself as the AI integrator, the broker of enterprise AI adoption.

The real game-changer in AI isn’t just the models. It’s the software innovations behind them.

DeepSeek sparked controversy, but the real story wasn’t the headlines. It was the model efficiency, the precision in training and the software-first innovation. It didn’t brute-force its way to a big AI breakthrough; it engineered their models to be faster, leaner and smarter.

That’s exactly where IBM and Red Hat can dominate. The future of AI isn’t just about training larger models. It’s about making AI work at scale, efficiently, and at a lower cost.

DeepSeek showed that low-cost, high-performance AI is possible with smarter engineering. IBM and Red Hat have the skills, the enterprise presence and the hybrid cloud stack to take that same approach and make it enterprise-ready at scale.

The AI ecosystem is shifting from massive, high-cost AI models to more efficient, optimized solutions.

IBM has developed a clear roadmap:

IBM’s play isn’t just about building AI models. It’s about creating the ecosystem where AI innovation happens efficiently. The DeepSeek model is proof that AI efficiency beats raw compute — and IBM is perfectly positioned to capitalize on that trend.

I’m bullish on IBM here. If it executes on this AI-driven, open-source playbook the way it did with hybrid cloud, this could be one of the biggest enterprise AI success stories of the next five years.

THANK YOU