EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

Initial coin offerings are becoming the funding mechanism of choice for the fast-emerging distributed ledger technology known as blockchain, bolting past corporate and venture investors — but also raising the specter of a bubble and potential mismanagement by startups suddenly flush with a huge amount of funding.

Those are some of the key findings from a new report released today by the market analysis and reporting firm CB Insights on the blockchain technology market.

In the report, CBI outlined how blockchain companies have introduced a startup funding apparatus, called initial coin offerings, that have begun to close in on venture capital seed funding. The report also broke down the burgeoning industry across categorical lines that help outline how startups and corporate interests are approaching the use of blockchains to create platforms for logistics, food safety and financial services.

Blockchain technology is an emerging market and industry with its roots in the emergence of the bitcoin network in 2009 developed by pseudonymous creator Satoshi Nakamoto. The initial purpose of the bitcoin blockchain was to be the foundation for a type of electronic cash, but since then the capability of blockchains to produce tokens that can be trusted with value and provably traded has become the foundation of an entire nascent and now growing industry.

According to the CBI report, the estimated market capitalization of blockchain currencies currently hovers around $150 billion, not least because a single bitcoin is now trading upwards of $5,000.

ICOs, which are a crowdfunding effort using an internal token or currency to fund a startup’s platform development or launch, have become extremely popular in 2017 and are set to exceed $2 billion this year alone. But the report also noted that ICOs exist in a sort of legal limbo because they produce tradable “tokens” that can be exchanged on cryptocurrency markets for other tokens and can be valued similar to a security — and thus fall under the purview of securities regulations.

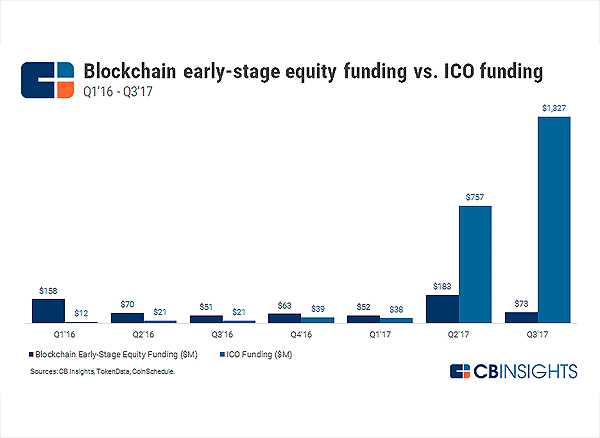

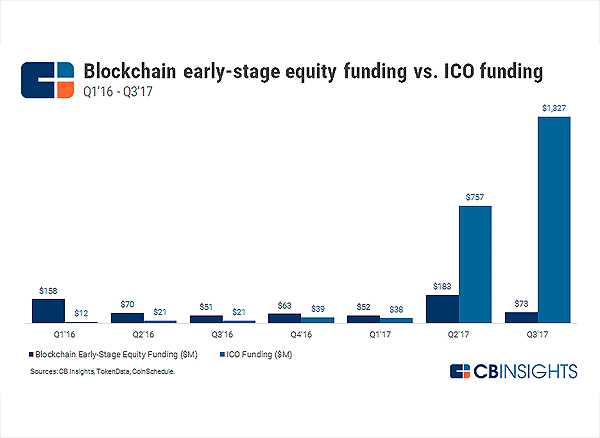

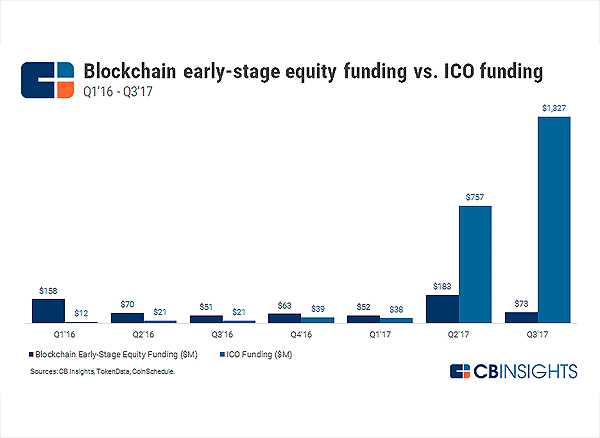

“More than 250 ICOs have taken place since January 2016, with total ICO deals and funding increasing at a faster clip than traditional equity deals and dollars,” the report said. In fact, it looks as if ICOs are set to remain the financing method of choice for startups going forward. In the second quarter, ICOs have surpassed total funds raised via traditional equity financing for the first time.

Some examples this year include $35 million raised by web browser startup Brave, created by former Mozilla Foundation Chief Executive Officer Brendan Eich, $5.2 million raised by financial services blockchain company Humaniq and a record-breaking $230 million raised by blockchain startup Tezos in July.

Although hugely popular, ICOs still exist in a sort of legal twilight and have seen some friction across various nations. That includes in the United States, where the Securities and Exchange Commission warned that ICOs may fall under regulatory laws regarding traded securities, and both China and South Korea, where the governments banned ICOs.

If this has led to concerns from startups about using ICOs as a method to raise money, it does not seem to have slowed them down much in recent months. But companies need to be careful going forward to avoid regulatory issues, according to Grant Fondo, a partner in the law firm Goodwin LLP.

The potential pitfalls of ICOs and the rising interest of regulatory bodies have also given rise to the Token Alliance, an industry-led initiative led by the Chamber of Digital Commerce to help promote and shape the responsible growth of token and digital asset sales in the wake of regulatory interest. One concern cited in the report is that “many of these companies could run the risk of mismanagement after receiving such large sums in such a short time.”

This upsurge in ICOs to fund startups has not stopped traditional venture capitalists such as Andreessen Horowitz, Sequoia Capital and Union Square Ventures, although it has slowed somewhat, according to the report. “At the current run rate, 2017 is on pace for 188 equity deals worth $830 million, up from 138 and $545 million in 2016,” said the CBI report. “Mega-deals have substantially boosted this year’s numbers, with R3CEV LLC’s $107 million Series A and Coinbase Inc.’s $100 million Series D leading the pack.”

However, with the rise in popularity and use of ICOs to fund startups, more investment appears to be turning to cryptocurrency hedge funds and the tokens produced by ICOs themselves.

The venture-funded blockchain startups run a gamut of financial services and blockchain platform services. Exchanges, cryptocurrency wallet companies and mobile payments platforms hold the top of the pile, with Coinbase Inc. at $217 million in traditional funding to date, followed by Circle Internet Financial Ltd. with $136 million and Blockchain Luxembourg SA with $71 million. In the blockchain platform services industry, Bitfury Group raised $90 million, Blockstream Inc. raised $76 million and hardware maker Bitmain Technologies raised $50 million.

As for the blockchain corporate investment ecosystem, the CBI report showed that since 2012 there have been more than 140 equity investments nearing $1.2 billion in various groups. Among those investments include Coinbase and Circle as well as 21 Inc., an “internet of things” company that sought at one time to put “a bitcoin mining toaster” in every kitchen.

Corporations have focused primarily on the production of private blockchains, also known as permissioned blockchains, designed for specialized use. For example, there’s IBM Corp.’s use of the Linux Foundation’s Hyperledger project that has seen expansions into food safety alongside Walmart, Unilever, Nestlé, Dole and others. IBM and JP Morgan Chase & Co. also committed venture capital into Digital Asset Holdings LLC for the development of a financial services blockchain, one of many coming onto the market.

Cooperation between corporate interests has also given rise to what the report calls “consortia,” or where competing companies come together to develop a blockchain platform that performs some sort of useful task for all involved. The report identifies four major consortia that exist today: Hyperledger, the Enterprise Ethereum Alliance, Ripple and R3.

As for the future of blockchain technology, the CBI report said the technology and the industry are still in the beginning stages. One of the biggest drawbacks, seen with the rise of ICO funding, is that startups using ICOs have yet to fully embrace collaboration with regulators. Even with law firms, financial services and the newly formed Token Alliance, the nature and structure of future regulatory legislation regarding ICOs is still looming on the horizon.

“Judging from the data presented in this report, though, the future seems bright, as investments in blockchain technology evolves in new and innovative ways,” the CBI report said. “As the landscape evolves, the future of investment in the space will likely take on forms yet to be imagined.”

The report concluded that although there are some regulatory bumps ahead for the ICO-led parts of the industry, venture investors and corporate interests continue to fund startups and run trials of blockchain technology seeking practical applications.

THANK YOU