CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

There’s no doubt by now that Amazon Web Services Inc. won the first phase of cloud computing, the revolutionary disruption to traditional information technology that’s reshaping the entire technology landscape. Now it’s gunning to win the next phase, too.

Amazon.com Inc.’s cloud unit remains far out in front of rivals such as Microsoft Corp.’s Azure, Google Cloud Platform, IBM Cloud and Oracle Cloud, at least on the computing, storage and networking services that form the foundation of cloud computing. But all of those companies and more are now fully engaged and aiming to make headway against AWS.

In an exclusive two-hour interview with SiliconANGLE at Miller’s Guild restaurant on a recent, typically rainy Seattle morning, AWS Chief Executive Andy Jassy (pictured) exuded confidence, insisting he can keep AWS in the lead. Indeed, with more than a thousand new products and features this year, it’s clear AWS isn’t slowing down a bit. Jassy spoke ahead of Amazon’s annual AWS re:Invent conference that runs this week in Las Vegas, now the signature event of the cloud computing era.

Despite AWS’s current dominance, the next phase of cloud computing could present more challenges. It involves large enterprises looking to move more of their servers, storage, networks and software to data centers run by the likes of AWS, in contrast to the first phase in which startups such as Spotify AB went directly to the cloud, allowing them to grow very quickly. “We are seeing tremendous enterprise adoption of cloud,” said Dan Scholnick, a general partner at Trinity Ventures. And for now, he added, “Amazon is the 800-pound gorilla.”

But rivals such as Oracle and Microsoft are hoping to gain some ground against AWS, which started out helping startups small and large to go with the cloud from their founding, by attracting the large enterprises that are scrambling to the cloud. The tech stalwarts reckon they have the relationships and enterprise knowledge to steal a march on AWS.

Jassy dismisses that line of reasoning, citing AWS customers such as Capital One Financial Corp., Royal Dutch Shell plc and General Electric Co. that are already moving thousands of key applications to its cloud. “It’s kind of wacky these days to build a data center,” he said. “While I still characterize it as the early days of adoption, make no mistake: Enterprises are not just dabbling in the cloud. They are using AWS and the cloud in a very pervasive way.”

Peter Burris, chief research officer of Wikibon, the analyst group owned by SiliconANGLE Media, calls Jassy and Co.’s effort “AWS 2.0.” In his research about AWS’s multipronged moves to win more large enterprise customers migrating to the cloud, he said, “we encountered a thriving ecosystem that, while still relatively adolescent in its structure, is poised to make AWS an increasingly attractive option for even the most rigid, demanding shops.”

In this first of a three-part series, Jassy talks about how AWS is positioning itself to win more enterprise customers, how he views rivals and the ways he tries to reassure partners that AWS won’t crush them with its constant stream of new services. In parts two and three, which will run over the next couple of days, he dives deeper into the new technologies such as machine learning and the “internet of things” that AWS is embracing, as well as the company’s international ambitions and the unique ways it organizes itself to try to keep the innovation flywheel spinning. This interview is edited for clarity.

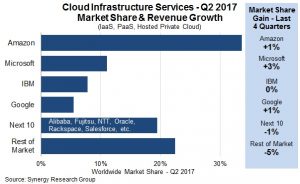

Source: Synergy Research Group

Q: How should people think about your growth versus Google, Microsoft and others that are currently growing faster in the cloud?

A: We have just a much larger business in this infrastructure, technology, cloud space than anybody else. If you look at estimates from folks like Gartner, they estimate that we have several times the size business than the next 14 providers combined. So it’s a pretty significant leadership position.

The last numbers we reported, it’s an $18 billion revenue run rate growing 42 percent year over year. When you look at respective growth rates, you can get confused if you look at percentages because they are very different bases. To be growing over 40 percent on an $18 billion revenue run rate is really unusual.

Q: The baseline matters.

A: In absolute dollar growth, you’re just seeing much more growth in AWS. The vast majority of startups continue to build their businesses on top of AWS. These are companies like Airbnb and Pinterest and Slack and Domo.

Q: So you have the cloud-native guys.

A: Yeah, but I think if you look at what’s happening in enterprise and the public sector over the last two to three years, the growth is exponential and dramatic in AWS. You can see it in really every imaginable vertical business segment — in financial services. You see Capital One is rebuilding their digital banking platform on AWS. Intuit is moving all their applications to AWS. FinRes is moving all into AWS. If you look at healthcare, Bristol-Myers Squibb, they’re making a huge move to AWS and the cloud, and Johnson & Johnson, Merck, Pfizer. Even if you look at media, Netflix and Disney and Fox and HBO and Turner and Discovery. You look in oil and gas, Shell and BP.

Q: They’re moving to the cloud.

A: Actually, not just moving. Netflix runs everything on top of AWS. Capital One is a good part of the way in building their digital banking platform on top of AWS. GE is moving 9,000 applications to AWS. They’ve already moved a few thousand. So it’s not like these enterprises are running just a couple applications. It’s an $18 billion revenue run rate — you don’t have a business that big just on startups. Our enterprise business is really large and growing really fast. And we’re just at the beginning, in my opinion, of the heart of mainstream enterprise mass-migration to the cloud.

Q: Four years ago you said to me, “Everyone’s eventually going to be in the cloud.” Do you stand by that prediction?

A: I feel even more strongly about it today than I did four years ago. We were seeing it in our business, and I think you’re seeing it in all the other companies who are moving as fast as they can to try and build a cloud presence. They wouldn’t be doing that if things were moving slowly from the enterprise to the cloud.

There are a number of older-guard technology companies who either genuinely believe or are hoping people will believe that companies aren’t going to move to the cloud that quickly or that a very large amount of workloads will remain on-premises forever. I don’t believe that. And I don’t think any of the data shows that’s happening. There’s a reason why AWS is growing so fast. And there’s a reason why every large technology company in the world is moving as quickly as they can to try to grow a replica of what AWS is doing and have a cloud offering.

Q: What are the important market metrics to be watching when you look at the cloud?

A: Look at the growth of the active number of customers in the cloud. Look at the revenue run rates of cloud businesses. And make sure that you ask which are really cloud and which are the ones where people are attaching word cloud, but it’s really kind of the old model.

AWS CEO Andy Jassy (left) and VMware CEO Pat Gelsinger (Photo: Seth MacMillan)

Q: What does cloud mean today, when you have hybrid cloud, VMware running on-premises and the like?

A: We don’t get too focused on trying to find exactly what counts as cloud and what doesn’t count as cloud. The reason that people are so excited about the cloud is because it lowers your cost meaningfully. You get to turn capital expense to variable expense. You only pay for what you use. And then you get real elasticity where you don’t have to provision ahead of what you need. And then it allows you to move much more quickly because you don’t have to provision servers and you can use our 100-plus services. And then it lets you take your scarce resources or engineers, and instead of having them work on the undifferentiated heavy lifting of infrastructure, they get to work on the things that really differentiate their applications.

When I look at enterprises that are operating their own data centers alongside AWS and the cloud, I consider that a hybrid mode. But the on-premises piece doesn’t have any of the benefits that I was talking about. Lots of enterprises for the next five to 10 years will operate in this hybrid mode where they have data centers that they’re not yet ready to retire for whatever reasons. But I really do believe it’s a transitional state. Where a lot of these enterprises might start off 90 percent on-premises and 10 percent in the cloud, I believe that equation flipped and it’s happening in the next five years or so.

Q: You’re throwing off a lot of profit. Maybe you’re getting called into Jeff’s office and he’s saying, “Hey, you’re making too much money. Lower the profit number, invest more.” That’s the operating ethos of Amazon: Ship faster, lower prices, and that applies to AWS. But when you’re throwing up a ton of profit, that kind of goes above Jeff’s mandate, “Your margin is my opportunity.”

A: I know he gets credit for saying it. I don’t think he thinks about the world that way. In fact, as you know, I’ve worked with Amazon for over 20 years, and I’ve reported Jeff now for about 15 or 16 of them. And I’ve never once heard him say that. We’ve never once talked about that as a team.

We think about things really in terms of customer experience. What is the customer experience that we’re trying to go solve? What’s wrong with it? How can we make it better, and how can we think about building a sustainable business out of it that’s good for customers and good for us?

In all these areas, we’re trying to build a business and thinking about the business in the long-term. What the operating margins are at any one time is just a moment in time. It’s going to change. It’s easy to lower prices. But it’s actually much harder to be able to afford to lower prices. We won’t lower prices if we can’t afford to lower prices. So every single one of our teams takes goals every year on taking its cost down. That’s why you see us lowering prices multiple times every year.

Q: What are the new cloud economics? Is it like marginal software economics? It’s certainly different from retail economics.

A: Our business is really different than our retail business. If you look at cash characteristics, we have to lay out large amounts of capital upfront to build data centers and then to buy servers, networking gear ahead of filling it up. So it’s a super capital-intensive business. And then in many ways, what’s different about our business too is that the faster we grow, the more capital we have to lay out in advance. It’s part of why I think it’s hard at the scale that we’re operating at it’s hard for others to start from scratch and pursue it.

We don’t have software gross margins. It’s a very different type of business. It’s a services model. In all the businesses we pursue at Amazon, we care a lot more about growth and pervasiveness and being able to help as many customers as possible and then ultimately, absolute margin dollars versus margin percentage. We believe that if we build the right service with the right security, the right operation performance and the right ability to allow builders to [invent] quickly, they’ll use it over a sustained period of time to be able to make that capital investment back.

Q: Has your total addressable market changed now that you are trying to attract more enterprise customers, and around the world?

A: Conceptually, the total addressable market is very consistent with what we believed in the past. What’s different is with every successive year, as we launch a thousand-plus features and services, we just have the capabilities to make it easier for the rest of the market to use us. So we’ve expanded our total addressable market with what we’ve made available to customers.

This happens with every big technology innovation. When you make something much more cost-effective and much faster to get done, people spend less per unit of technology, but they consume absolutely more, because people have insatiable amount of ideas. So I think the total addressable market for the areas that we touch, which is infrastructure, software, hardware and datacenter services, is trillions of dollars.

Q: What do you attribute to the growth in your enterprise deals to?

A: Charles Phillips, the CEO of Infor, one of our significant database PARTNERS?[unintelligible], says, “Friends don’t let friends build data centers.” It’s kind of wacky these days to build a datacenter. While I still characterize it as the early days of the need of adoption, make no mistake: Enterprises are not just dabbling in the cloud. They are using AWS and the cloud in a very pervasive way.

Q: What are the reasons for that?

A: First of all, typically when there’s a big, new shift in a medium, like the cloud is — which I think is the biggest technology shift in our generation — typically you find startups who have lesser alternatives and fewer choices to leverage are the first to make that big shift. But enterprises always follow if there’s value there, and there’s so much value in the cloud, from a cost perspective, from an agility perspective, from an efficient allocation of resources perspective, from an ability to get global with your applications, to have lower latency and better data sovereignty in the countries you operate in.

The reason so many of them are choosing AWS is just we have a pretty significant market segment leadership position, in part because we have a lot more capability than anybody else by a large amount, and we’re iterating faster, so that gap is widening when you really study it. And then we just have a much broader ecosystem.

But most independent software vendors and software-as-a-service providers will adapt their platform on one technology [infrastructure platform], some will do two, and very few will do three. They all start with AWS because of our market segment leadership position and the customer ecosystem. We have so many more customers that use our platform than anywhere else that not only is there comfort in seeing other peer companies moving to that platform, but … you’re getting the benefit of all of the other feedback and delivery that’s spurred from all those other customers.

Q: How do you see the migration going on on the business side?

A: Well, you always have to look, at any one time, at what customers who are trying to solve problems most want. And in the enterprise, while there’s a large number of enterprises that are building altogether brand-new applications on top of AWS. The majority of enterprises are trying to figure out how to plan a mass migration as quickly as they can safely do so. And so migration capabilities have become a really big part of our roadmap and our delivery over the last couple years. And you see the things like our Database Migration Service and our Migration Hub, which makes it much simpler to be able to migrate.

Q: Are we going to see more VMwarelike announcements at re:Invent?

A: We have a lot that we’re going to announce at re:Invent. [You’ll] hear some announcements about customers and partners. But I would say that I don’t expect something like VMware to be announced anytime soon. You don’t do five partnerships like the VMware partnership. That’s a really strategic, important partnership and relationship that we spent multiple years building with them.

Q: How’s it going?

A: It’s going really well. I said this when I was on stage with Pat at VMworld: If you know anything about AWS and about our team, we’re not really an optics place. I think there are a lot of companies where you see lots of vapor and optical types of announcements. But we just don’t care for those. We don’t think they add anything for customers. And I think they’re misleading, which we don’t like to do to customers.

And so we wouldn’t be pursuing this partnership with VMware if we weren’t really serious about it being great for customers. The teams are selling together. Enterprises are really excited about it. You can use it to run your data centers for a long time, but be able to extend that to being able to run it in the cloud on AWS is very appealing to people.

Q: You’ve done some big deals with big software companies such as VMware. But then you have small startups that might be fearful of being gobbled up because Amazon comes out with a competing product. How do you make them confident about essentially putting their business on AWS?

A: Our ecosystem has always been an incredibly important, strategic part of AWS’s business from the very start. I think the partner ecosystem that works with us understands that. If you look at some of the areas that we’ve built things where there are ecosystem partners who also have offerings, it’s really primarily because our customers say, “Look, it’s not okay for you not to have an offering there or here.”

When we launched EC2 in 2006, it was one instance size, and one instance family, and one availability zone, Linux only, no Windows, no monitoring, no load balancing, no auto-scaling, no persistent storage. That’s it. And we had really animated debates about whether we could do that or not do that, but we somewhat naively hoped that we wouldn’t have to build some of those things, that the ecosystem would do it and people would be OK with that.

When we launched EC2 in 2006, it was one instance size, and one instance family, and one availability zone, Linux only, no Windows, no monitoring, no load balancing, no auto-scaling, no persistent storage. That’s it. And we had really animated debates about whether we could do that or not do that, but we somewhat naively hoped that we wouldn’t have to build some of those things, that the ecosystem would do it and people would be OK with that.

A number of folks put really great monitoring solutions and capabilities on top of the platform, but our customers said, “Look, that’s great, but I expect the platform to have monitoring,” which in retrospect is blindingly obvious. So we built CloudWatch, which was our monitoring service. When we built CloudWatch, it didn’t mean it was the end for New Relic. They’ve continued to prosper and succeed.

These are the types of stories where it’s very juicy to say, “Oh, if Amazon is coming out with a service, that means it’s the end for other guys.” Another example: We built Elastic MapReduce. Cloudera and Hortonworks still seem to do very well on top of our platform. When we built DynamoDB, because our customers really wanted us to have a native, nonrelational database offering, but MongoDB continues to kick butt on top of AWS. Splunk didn’t have a problem when we launched CloudWatch Logs. You know, we’ve been voted the top partner for Splunk a couple years in a row. I think partners that are building real value on top of the platform find that their businesses are not negatively impacted.

Q: If everyone is gunning for you, how are you competing now? Because now you’ve got, essentially, some hot competition on paper – Microsoft Azure. And Oracle maybe, but I don’t even put them in the top three. Or Google. All have different attributes, but everyone is gunning for AWS.

A: It’s not new that many large technology companies are pursuing this space. I think it will be an evergreen question. I think people will be very aggressively pursuing this space for many years. There’s not going to be only one company that’s successful or that’s pursuing it. The biggest surprise to me is just it took so long. In my wildest dreams, I just never thought it would take that long.

We have experience with everybody trying to build a replica of what we’re doing. There’s lots of noise, and there’s lots of wild hand-waving and claims. But at the end of the day, in this space particularly, people vote with their workloads. You can see it in the absolute numbers. Nobody else releases their apples-to-apples numbers on the infrastructure technology space, but you can see it in the growth of the AWS business in what we share every quarter.

Q: So you don’t look in the rear-view mirror. Full steam ahead.

A: I learned this lesson early in my career at Amazon from Jeff. A few weeks before Barnes & Noble was going to launch Barnesandnoble.com, everybody was predicting that it was going to be the end of Amazon. Of course, it’s not what happens. If you built really significant value and have been good to your customers, just because someone else [big] launches something doesn’t mean your customers run away.

I remember when I was first there. We were a young company, with young people, and only a couple hundred or so of us. People were talking a lot about Barnes & Noble, and Jeff said at a company meeting, “Look, you guys should not go to bed at night fearing Barnes & Noble or any of your competitors. You should go to bed at night fearing whether or not we’re doing right for the customers, because if we do that right over a long period of time, good things will follow for the business.”

We’ve employed the same strategy in AWS, where if we had tried to shadow-box over the last 10 years, with all the rumors and all the crazy claims, and thinking about what this competitor said they’re going to do or is rumored to do, we would’ve wasted a lot of energy and time that we have instead spent on trying to listen to what customers care about, and really inventing and iterating on their behalf.

Q: So you really don’t worry about what other people are doing?

A: You can’t control what other people are going to do, but you can control listening to what customers care about, making sure that you hear what they’re saying, prioritizing things that matter, and then building a team who really wants to invent and change the customer experience and then deliver it. Those things you can control.

Q: But there’s Microsoft and Oracle. You can’t really say that they’re not listening to customers. Maybe they approach it differently than Barnes & Nobles.

Andy: Well, I think it’s a lot easier to say you’re going to listen to customers than to do it. I don’t meet with customers who think that Oracle is listening to them. I don’t meet with customers who aren’t trying to flee Oracle. I wouldn’t call that customer-focused commentary. I think that most of the other companies you’re talking about tend to be competitor-focused or sometimes product-focused. In the competitor-focused model, you kind of see what your competitors are doing and then you say: “OK, that’s what we need to do.” Some of the companies you mentioned are more historically following a competitor-focused [strategy].

I think there are some companies that are product-focused, who say: “Look, it’s great that you, Mr. and Mrs. Customer, have an opinion on what the product should be. But leave that to the experts.” Those are different approaches. You can say you’re listening to customers because you’re having dialogues with customers, but that’s different than really listening to what customers are telling you is bothering them about either your offering or their own situation or what they’re trying to get done and they can’t get done. And then going back to the teams and really talking about “How do we solve that problem and delivering?”

Q: How have you tried to keep that customer focus?

A: Our organization structure really helps us in this case because we’re so distributed. We have such a decentralized model and we’re so distributed, and those teams have all these feedback loops into what customers think. When that feedback comes from the field, it doesn’t have to go through three or four or five filters that then maybe or maybe not get back to the product teams. We have mechanisms where the feedback from customers gets right to those teams. And if you’re driving your roadmap based on what you hear customers telling you, you can just act much more quickly.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.