INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Updated:

Nvidia Corp. is on an upswing again, at least with investors, after making its way through out a “turbulent close” to what had been a “great year” for the company, according to Chief Executive Jensen Huang.

The company, which makes graphics processing chips for gaming, artificial intelligence workloads and bitcoin miners, reported fourth-quarter results Thursday that beat forecasts following a downward revision of its expectations last month.

Nvidia’s earnings before certain costs such as stock compensation came to 80 cents per share, above Wall Street’s revised forecast of 75 cents. Revenue for the quarter fell 24 percent from a year ago, to $2.21 billion, but just above the $2.2 billion expected by analysts.

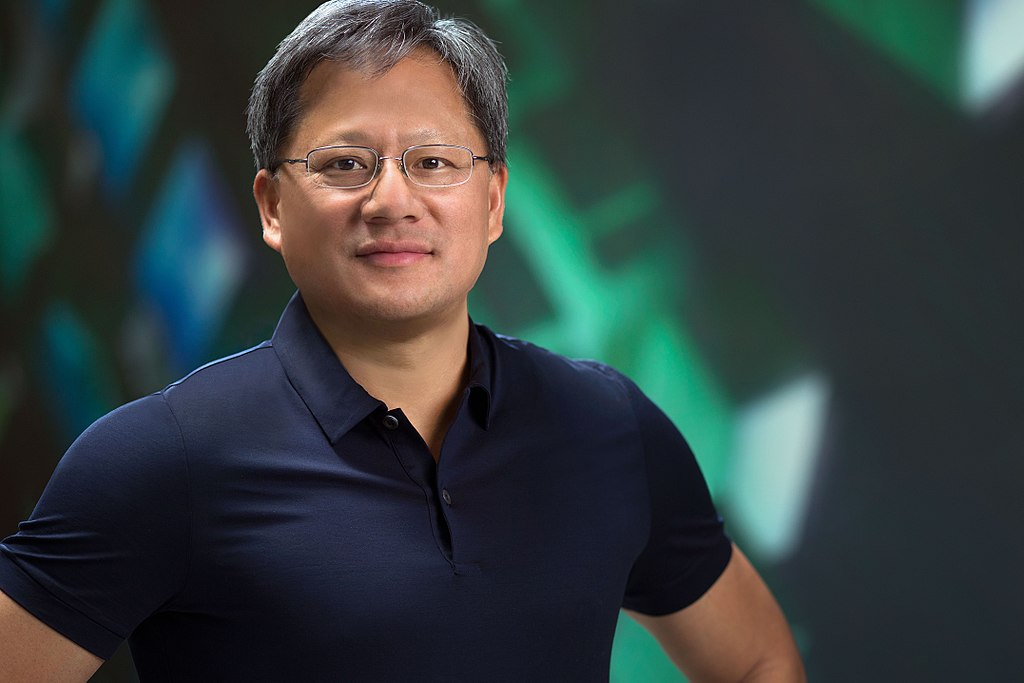

“The combination of post-crypto excess channel inventory and recent deteriorating end-market conditions drove a disappointing quarter,” Huang (pictured) said in a statement.

Nvidia had disclosed it had excess inventory in the previous quarter, and followed up in January by issuing a profit warning, saying it expected revenue of just $2.2 billion, down from its initial $2.7 billion projection. It said at the time it was revising its forecast because of slowing demand for graphics processing unit chips in the cloud and gaming industries and in China.

That warning led to a one-day 14 percent drop in Nvidia’s share price, but the slightly better-than-expected results today have helped to generate a bit more optimism. In the after-hours trading session today, Nvidia’s stock rose more than 6 percent. Update: After sleeping on it, investors pushed up shares only 1.8 percent Friday.

“The after-hours jump in the company’s shares is at least partly due to Nvidia delivering better results than last month’s lowered guidance suggested might be coming,” said Charles King, an analyst with Pund-IT Inc.

A quick breakdown of Nvidia’s latest numbers reveals where the slowdown in demand for its GPUs was most obvious. The company’s Gaming segment pulled in $954 million in revenue, down 45 percent from a year ago. Revenue from other manufacturers using its chips and intellectual property fell 36 percent, to $116 million. On the other hand, Data Center revenue rose 12 percent year-over-year, to $679 million, Professional Visualization revenue rose 15 percent, to $293 million, and Automotive revenue jumped 23 percent, to $163 million.

Nvidia’s full fiscal 2019 numbers came in better. The company reported full-year earnings before certain costs of $6.64 a share, up 35 percent from the previous year. Full-year revenue rose 21 percent, to $11.72 billion. The company said its Gaming, Datacenter, Professional Visualization and Automotive divisions all posted record revenues.

“Few companies can be down 20 percent for the quarter but up 20 percent for the year, but Nvidia is,” said Holger Mueller, principal analyst and vice president at Constellation Research Inc. “It shows that the company is on a bumpy transformation drive. While it benefits from the cloud for AI, the cloud is changing the gaming business and Nvidia is as much part of as it was in the past, when it was all about the gaming laptops.”

“Hyperscale and cloud purchases declined both sequentially and year-on-year as several customers paused at the end of the year,” Nvidia Chief Financial Officer Colette Kress said in a conference call. “We believe the pause is temporary.”

Kress’ optimism isn’t unfounded. In the call, she stressed that Nvidia’s GPUs are already being used by large public cloud providers such as Amazon Web Services Inc. and Microsoft Corp. to train AI models. And the company is also working closely to see that its software and GPUs are used as well for AI inference, which is the running of machine learning models.

There is evidence to suggest that claim is true. For example, last month when Google LLC announced it’s making Nvidia Corp.’s low-power Tesla T4 GPUs available on its cloud platform in beta test mode, it pointed out that those processors are ideal for inference workloads thanks to their low energy requirements.

“Many analysts believe the company’s problems are temporary,” King said. “For example, they believe that the excess inventory resulting from the collapse of cryptocurrency markets and macroeconomic pressures impacting sales in China will eventually subside. Those points make Nvidia attractive to significant numbers of investors.”

However, King said that Nvidia isn’t entirely in the clear just yet. He warned that its inventory issues are still a problem, that its troubles in China are far from resolved and that it could suffer if a recession that many economists are predicting rears its ugly head.

The company also announced the availability in the last quarter of its new GeForce RTX 2026 graphics card, which is suitable for both gaming and AI development.

“Nvidia capped off a great year with over 20 percent growth during a challenging fourth quarter that saw big declines in its gaming segment,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy. “I believe gaming has bottomed out and I like what I see in the future, with its enterprise machine learning, L2 auto capabilities and gaming laptop growth.”

As for the coming quarter, Nvidia said it’s forecasting $2.2 billion in revenue, which is just below Wall Street’s estimate of $2.28 billion.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.