NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Let the battle begin.

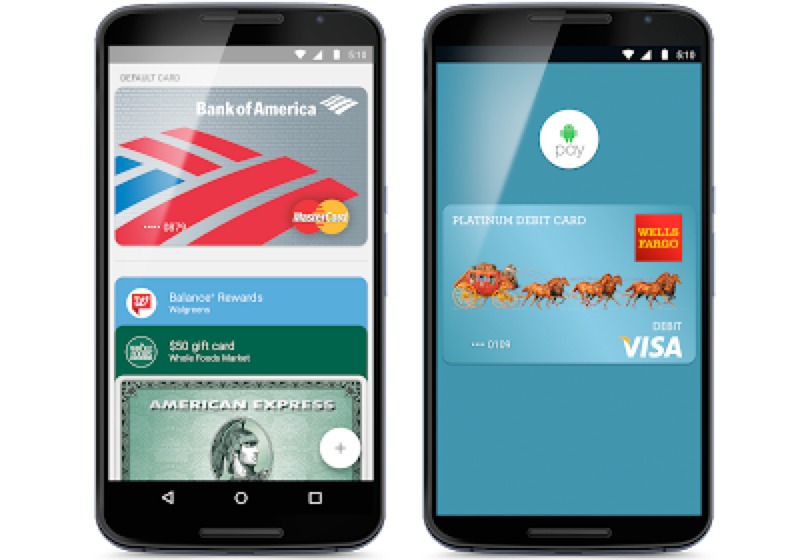

Google has re-entered the war for mobile payment services with the rollout of their new Android Pay service in the United States Thursday.

First announced at the Google I/O conference back in May, the new payment service allows users with Android phones with Near Field Communications (NFC) support to pay using their phone at over one million locations across the US.

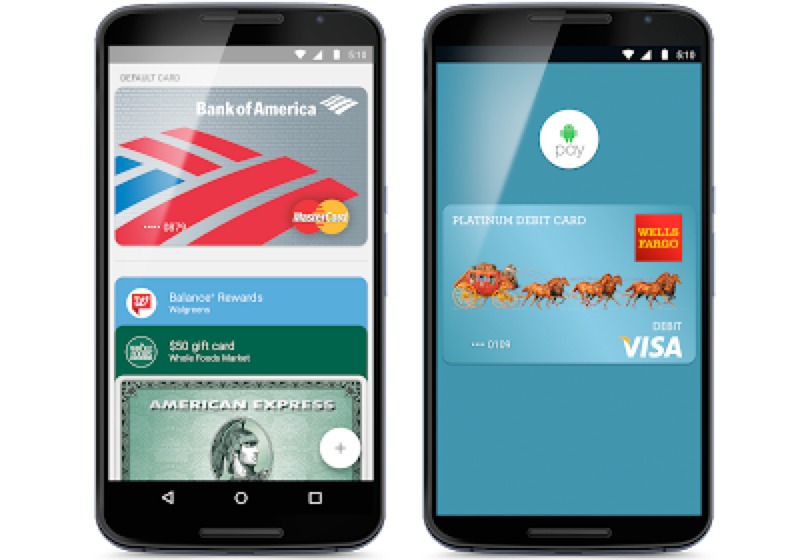

Along with support for American Express, Discover, MasterCard and Visa cards (both credit and debit), the service also supports gift cards, loyalty cards, and special offers as well.

Cards issued by Bank of America, Navy Federal Credit Union, PNC, Regions Bank, USAA, and U.S. Bank are supported by the service at launch, with support for Wells Fargo said to be “available in the next few days,” and support for accounts from Capital One and Citi “coming soon.”

One concern most will have with mobile payments is ample security, and Google hasn’t been remiss with Android Pay, adding on top of industry standard tokenization the use of a virtual account numbers at the point of transaction, along with payment confirmations that shows the user where a given transaction happened, so in theory according to Google “it’s easy to catch any suspicious activity.”

In the event that a user loses their phone or has it stolen, they are able to use Android Device Manager to lock the phone, or even wipe the phone clean of any personal information.

Interestingly, despite promising to launch with app support back in May, Android Pay launches with none at all, with Google simply that app support, which will allow users to use Android Pay to make in app purchases, will be coming “later this year.”

All competition is a good thing, and from the jump the new Android Pay service does look competitive, particularly with its broad scale support for multiple payment providers, along with its utilization of existing NFC point of sales points (often referred to a tap-n-go and similar).

The problem though with the service still remains that adaptation of NFC payment points still lags in the United States compared to Europe and Australia, limiting the potential places a user can utilize the service, however this is gradually changing and the rise of services such as Android Pay should put pressure on more retailers to make the upgrade to POS terminals that support these types of payments.

To grab Android Pay visit the Google Play store noting that it’s only available on phones running Android KitKat 4.4 or higher; the 5 people who previously used the Google Wallet app simply need to run an update to be transferred across.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.