NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

IBM beat first-quarter revenue expectations and matched profits forecasts but did little to alleviate concerns about the company’s long contraction.

Revenue for the quarter was $18.68 billion, down 4.6 percent from $19.59 billion one year ago but slightly ahead of analyst expectations of $18.29 billion. It was IBM’s 16th straight quarter of revenue decline.

Earnings fell 13% to $2.01 billion, or $2.09 a share. That’s exactly what analysts had expected, according to a survey by Thomson Reuters cited by The Wall Street Journal. IBM also confirmed the lowered earnings guidance it announced last quarter. IBM stock was down about five percent in after-hours trading immediately following the announcement.

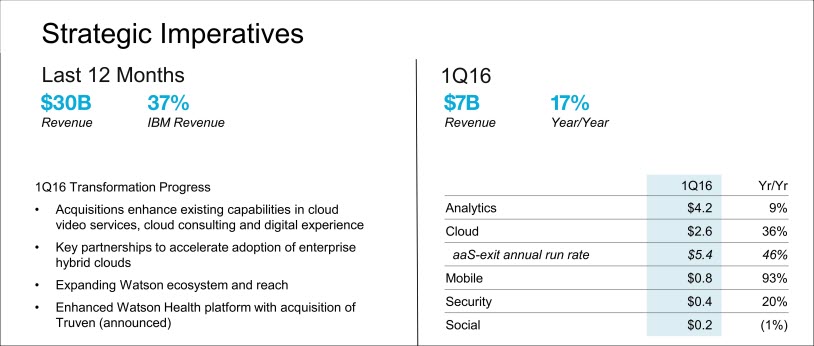

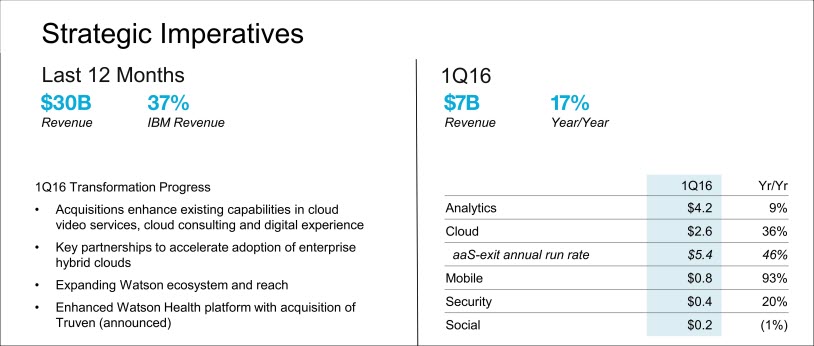

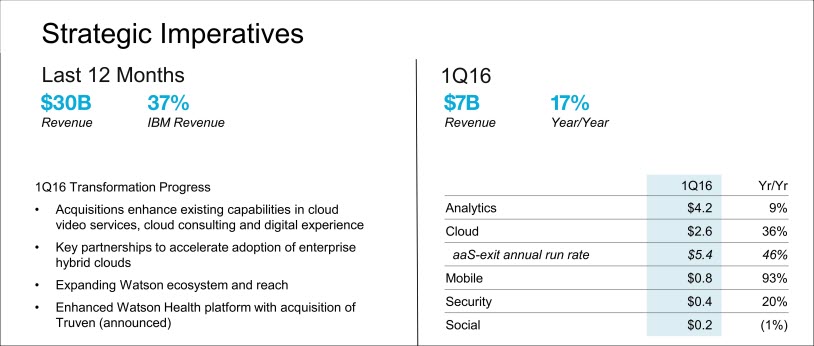

IBM said that the new businesses it considers “strategic” – including cloud computing, business analytics and cognitive computing – grew 17 percent in the latest quarter and now make up 37 percent of total revenue. Cloud revenues rose 36 percent and totaled $10.8 billion over the last 12 months. But server revenues were down nearly 22 percent to $1.7 billion, dramatizing the rapid decline of enterprise interest in new servers in the face of cloud alternatives.

IBM also said it has hired tens of thousands of new employees in strategic businesses, even as it as it has been laying off aggressively elsewhere, a process it characterized as “transforming the workforce.” Analysts are optimistic that revenues from the more than 20 businesses IBM has bought in the past year will also soon begin to show up on the bottom line.

But overall revenues are shrinking faster than new businesses are growing, and the company has yet to reassure investors and customers that it has reached the bottom.

IBM executives gave an upbeat earnings call, emphasizing acquisitions, growth in strategic businesses and a stable financial foundation. “In the first quarter we got done what we said we would get done,” said Martin Schroeter, senior vice president and chief financial officer. “We continue be very well positioned to support our long-term growth strategy.”

IBM broke out cognitive computing as a segment for the first time this quarter, but revenues aren’t yet showing growth. Cognitive solutions, which include security, analytics and Watson solutions, produced $4 billion in revenue, up slightly compared to last year. IBM particularly emphasized its investments in security, where it hired 1,000 people last year and claims to lead the market in four out of six segments. “We believe we have the largest enterprise security-as-a-service business,” Schroeter said.

IBM also stressed the promise of its initiatives in health care, led by the Watson Health platform and acquisition of Truven Health Analytics Inc.

The company’s Global Business Services (GBS) segment was down two percent, but Schroeter emphasized that there was growth across cloud, analytics, mobility and security practices, with cloud revenues up 55 percent in GBS alone. IBM has also aggressively invested in marketing and sales automation through its IBM Interactive Experience and acquisition of Bluewolf Consulting LLC.

On the systems side, storage hardware revenue was down six percent, but IBM said it’s well positioned to capture the momentum in flash and object storage. Power-based Linux systems now make about 10 percent of the overall systems revenue base.

Total software revenue was down less than one percent, compared to a six percent decline the previous quarter. Software had been a closely watched business this quarter following the retirement of software chief and 42-year veteran Steve Mills in January. The improvement was due to a two percent improvement in annuity revenue from software-as-a-service offerings, offset by a six percent drop in license fees. This would indicate that IBM is successfully negotiating the conversion of what it said is “100 percent of relevant IBM software,” to a cloud deployment model, as well as double-digit growth in its SoftLayer cloud platform.

IBM made six acquisitions totaling $2.5 billion in the quarter, led by the Weather Company.

THANK YOU