NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

EMC isn’t doing itself any favors in helping along its merger with Dell Inc.

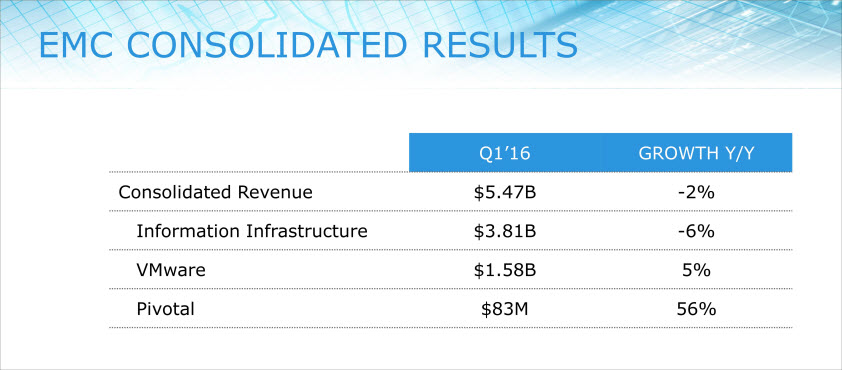

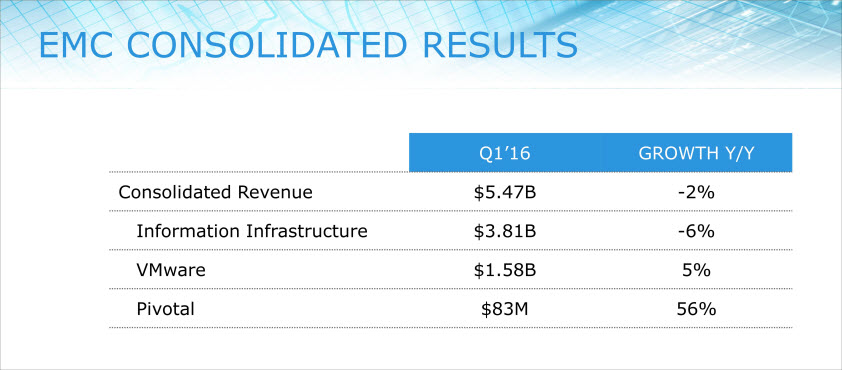

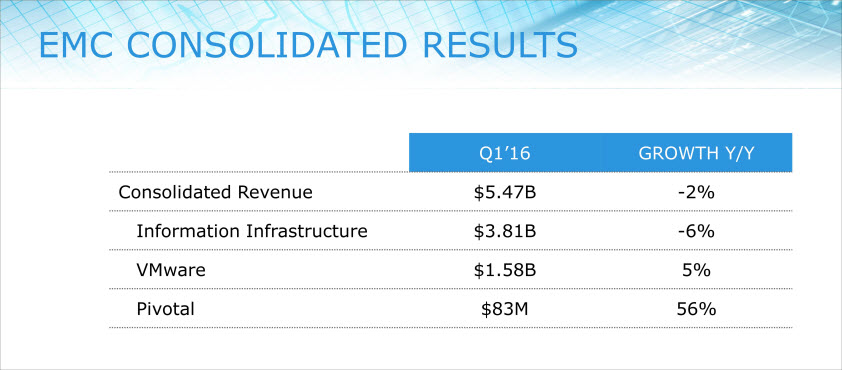

The storage giant reported weaker-than-expected earnings this morning, citing an “excess of unfulfilled orders.” Earnings per share were 31 cents, flat from a year ago and two cents below consensus analyst estimates. Revenue was down 2.5 percent to $5.48 billion, also below analyst estimates of $5.63 billion.

EMC Chairman and CEO Joe Tucci put a positive spin on the numbers, calling the first quarter “solid,” and “generally in line with our expectations.” Chief Financial Officer Denis Cashman blamed the $75 million in unshipped orders on “the timing of bookings within the quarter.” Adjusted for the order backlog, storage revenues were off two percent, which was in line with EMCs expectations, said David Goulden, CEO of EMC’s information infrastructure business.

He said operating expenses fell 8 percent in line with EMCs planned $850 million in cost reductions and “business transformation plans announced last year are on track.” Tucci reiterated that he’s comfortable with revenue and earnings projections for the year.

Investors appeared to take the disappointment in stride, bidding up EMC shares by about two percent in trading before the market opened. Their confidence is partially due to the strong results announced by VMware Inc. yesterday. EMC holds a controlling share in the virtualization company, and VMware accounts for about one third of EMCs total revenues.

Another bright spot in the EMC Federation is Pivotal Software Inc., which saw first-quarter revenue surge 56 percent over the same quarter last year. EMC said Pivotal’s annual recurring revenue was up over 200 percent year-over-year as customers warmed to its line of cloud and big data subscription software.

“We see several broad and secular IT trends reshaping our industry,” Tucci said, citing mobile devices, corporate digital transformations and the rise of hybrid clouds. “The secular trends are pretty much playing out as we expected,” and the company’s flash storage products are selling well. Goulden said EMC’s XtremIO flash array has 40 percent market share and the company is holding its market share as the market rapidly shifts to flash. “We believe 2016 is the year of all-flash for primary storage,” he said.

“EMC is succumbing what many of the enterprise giants are experiencing, and that’s a softness in enterprise driven by workloads moving to the public cloud,” said Patrick Moorhead (@PatrickMoorhead), president and principal analyst at Moor Insights & Strategy. “It’s not that enterprise vendors like EMC don’t have cloud offerings- they do, it’s just that EMC hasn’t been able to refill the cloud revenue bucket as fast as the enterprise bucket is shrinking.”

EMC’s share price is closely watched by investors because it directly impacts the value of its $67 billion merger with Dell. The value of that deal has fallen from about $33 a share when it was announced in October to less than $30 per share, in large part due to a fall in the value of VMware shares. Tucci said he’s confident that the Dell deal will close as planned. “We expect the transaction will close under the original terms and in the original timeframe,” he said on EMC’s earnings call.

Analyst Moorhead said that’s a good thing. “Dell runs leaner and meaner and there a ton of synergies between the two companies that make so much sense,” he said.

THANK YOU