NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Toyota Motor Corp. has invested in San Francisco-based peer-to-peer car sharing service Getaround Inc. through its Mirai Creation Investment Limited Partnership, in a Series C round believed to be $10 million.

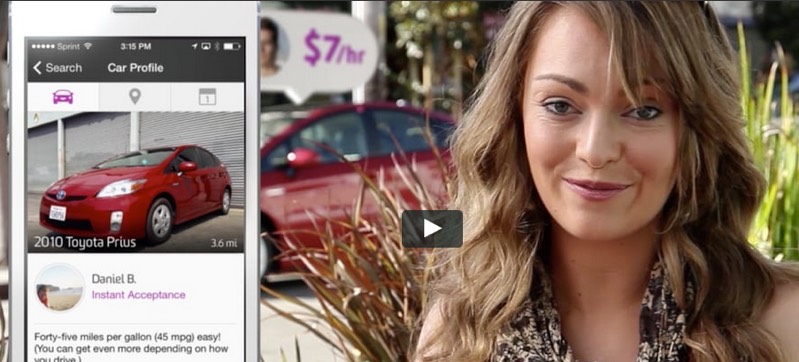

Founded in 2009, the company calls itself an “on-demand carsharing community” that allows users to “share” their cars to other users who are able to rent, unlock and drive those vehicles using their smartphones. Rates start at $5 an hour including insurance and no membership fees, while car owners who contribute their cars are said to be able to earn between $500 to $1,000 a month.

It should be noted that while some compare the service to Zipcar Inc., Getaround does not own any of the vehicles used in their service, which is said to have 200,000 members. Car ownership remains in the hands of the members who contribute their cars to the sharing.

As cars are becoming more expensive to own, it’s predicted that car ownership will continue to decline. That’s particularly likely in cities which, aside from parking costs and road congestion, also offer more affordable alternatives such as Uber Inc. and Lyft Inc.

Toyota is hedging its bets on which way the market will go. It invested in Uber in May in a deal that included special leasing deals for Uber drivers.

The Japanese auto giant is far from the only carmaker interested in this space. General Motors Co. operates its own Zipcar-like service called Maven, and BMW is running a similar service called ReachNow. Tesla Motors Inc. plans on launching a potential Uber competitor that would allow people who buy its cars to accept rides, but with the twist that once those vehicles become fully autonomous, they could collect rides by themselves, that is without a human being behind the steering wheel.

Including the new round, Getaround has raised at least $58 million to date, having previously taken money from Acequia Capital, A-Grade Investments, Collaborative Fund, Cox Automotive Series, General Catalyst Partners, Innovation Endeavors, Menlo Ventures, Morado Venture Partners, PeopleFund, Redpoint, Signatures Capital Seed and a number of individual investors, including Yahoo Chief Executive Officer Marissa Mayer.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.