NEWS

NEWS

NEWS

NEWS

NEWS

NEWS

Plastc vs Apple Pay – Who Will Win?

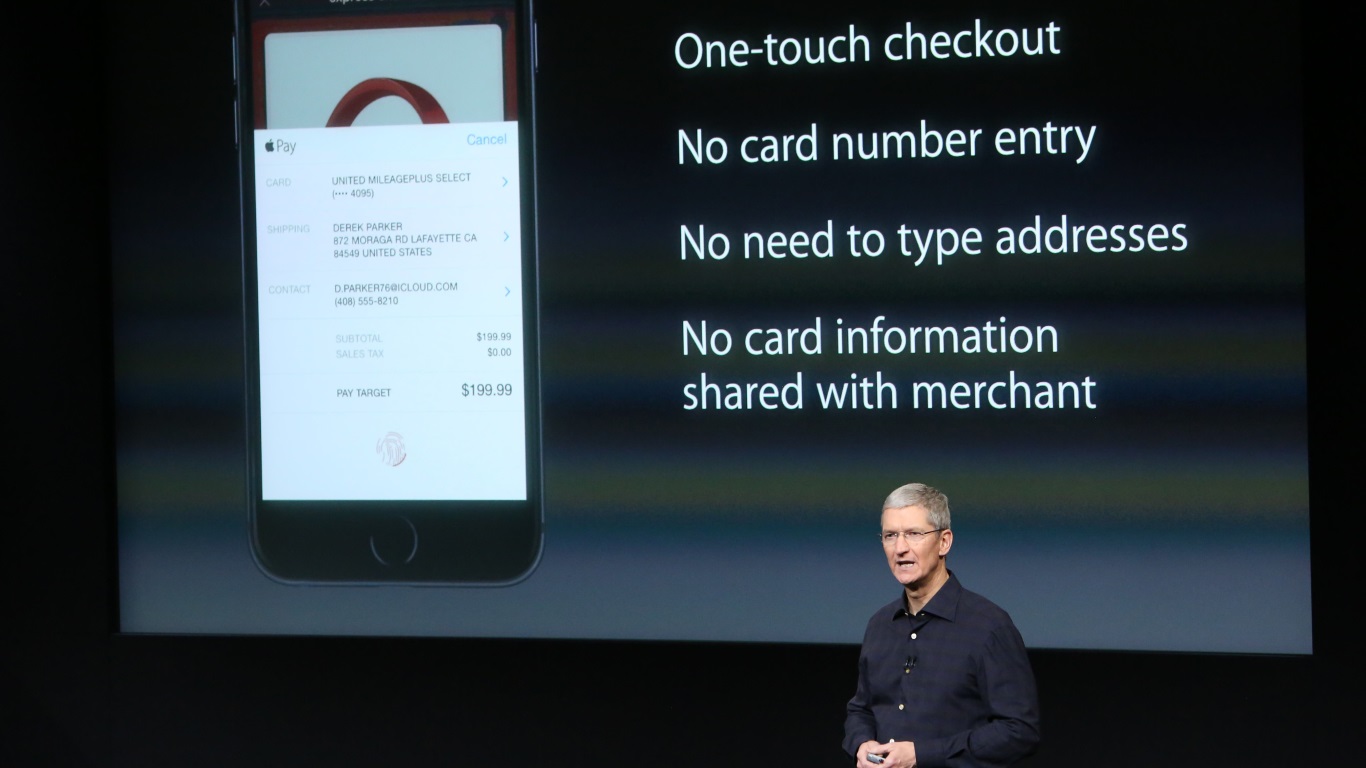

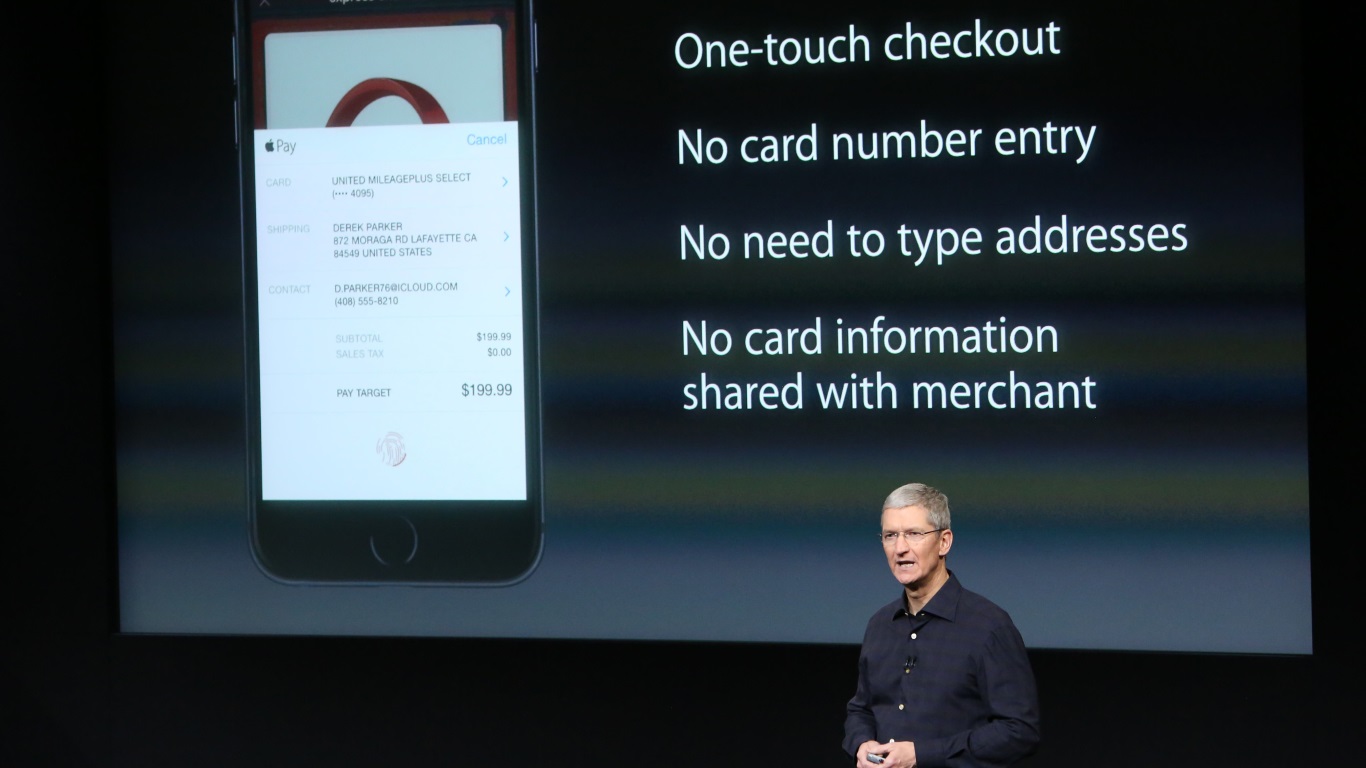

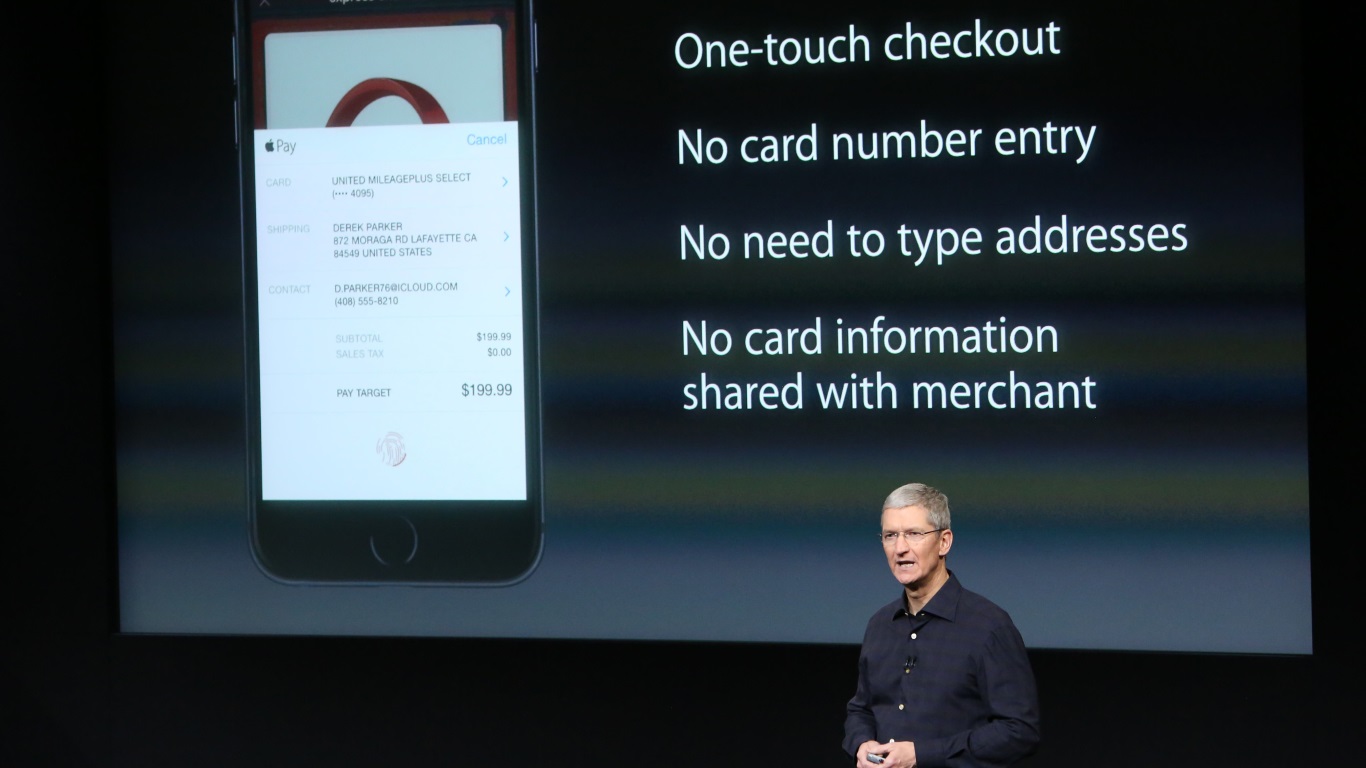

Apple Inc. wants to revolutionize the retail buying experience with its contactless, iPhone-based, Apple Pay service. Plastc Inc. has introduced a competing payment solution that doesn’t reinvent the wheel, which might actually be an advantage. Plastc looks just like a traditional credit card, but it packs an unprecedented amount of technology and features into the small, familiar form factor. Here are the top five reasons it will prove to be a more popular payment solution than Apple Pay, or any of the other NFC smartphone payment solutions.

.1) Plastc does everything Apple Pay does, but in a way you’re already used to.

Humans are creatures of habit. Something has to be truly remarkable to get people to deviate from their routines. A blind search comparison study found that people preferred Bing to Google, but that fact hasn’t affected Google’s search dominance. Using credit cards, just like pulling up Google to perform a search, is a habit. Plastc provides all the technological innovations of Apple Pay, with the payment style that has been used since the 1960s.

2) Plastc doesn’t require a smartphone at all times.

While Plastc does require a smartphone to store, manage, and sync cards to the device, it doesn’t require the phone to be present when making purchases. Users can specify how long the card will continue to work once it’s out of range of the smartphone it’s linked to. The PIN code requirement ensures that no unauthorized charges can be processed. Proximity alerts can notify users when they get too far away from their card. You can set it to send a notification to your phone as soon as you leave the house, if your card isn’t with you.

Apple Pay requires an iPhone, but it also requires the Touch ID fingerprint scanner. Apple released an iOS update recently that inadvertently broke Touch ID. If Apple Pay had been live at the time, users wouldn’t have been able to use it. If the Touch ID sensor is damaged, or disabled for any reason, Apple Pay is no longer an option.

3) Plastc works everywhere. Apple Pay does not.

Plastc has a magnetic stripe, just like traditional credit cards. You can swipe it in any credit card terminal or ATM. Many merchants have older credit card terminals that aren’t capable of reading anything other than that magnetic stripe. Apple Pay is of no use at those retail locations.

American retailers who wish not to be held responsible for fraudulent charges made at their locations will soon be upgrading to credit card terminals that support cards with EMV chips. Unlike the previously announced Coin smart card, Plastc cards come equipped with EMV chips. Apple Pay is of no use at the upgraded terminals EMV credit card terminals. Apple Pay only works with the premium NFC capable terminals. These top of the line credit card readers will become more and more common, but there’s no telling when, if ever, it will achieve 100 percent retail adoption. A Plastc card holder who is running low on gas in a rural town has nothing to fear. An Apple Pay user, on the other hand, could be in for an unpleasant surprise when attempting to pay at rural gas stations, or other small retailers.

4) Plastc is family-friendly.

Parents sometimes allow their children to use their credit cards. “You need new shoes? I’m in the middle of making dinner. Here’s my card. Don’t spend more than $100. And come right back. Dinner will be ready soon.” That doesn’t work with Apple Pay, but it’s no problem with Plastc. As long as you give them the PIN code, they’re in business.

5) Plastc is small, and waterproof.

If you’re going to the beach, or to a water park, or to the lake, or anywhere you might get drenched with water or wet with perspiration from activities, it might not be convenient to take your iPhone. It’s big and delicate. Your attention will likely be divided between the actual activity, and protecting your iPhone. If it accidentally gets wet, it’s game over. You don’t have to worry about Plastc. Put it in your pocket, and forget it. No need to freak out if you fall in the lake. Your Plastc card is still good to go.

6) Bonus features.

Plastc supports radio frequency identification (RFID), so it can replace security ID cards. The E-ink display can show you the available balance on your cards, so you can avoid embarrassing “card declined” situations. You can recharge it by simply putting your wallet on the Plastc charging mat. And finally, a solution that doesn’t require you to swear allegiance to iOS or Android, the way Apple Pay and Google Wallet do. Feel free to switch phones without fear of having to rescan all your credit cards and learn a new system.

Plastc is shaping up to be a real Apple Pay killer. It can be pre-ordered for $155, and it’s expected to ship next Summer.

.

THANK YOU