BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

BIG DATA

Machine learning is proving increasingly essential for business intelligence providers’ efforts to improve the productivity of their users. Birst Inc. joined the fray today by launching a new version of its embedded analytics platform.

It employs the technology to streamline several key parts of the data lifecycle, starting with the initial task of importing records for processing. The software can now suggest what information sources a worker should use for a given project based on their colleagues’ activity. As a result, users have to spend less energy sifting through the countless spreadsheets, business documents and other files in their companies’ networks. The company says feature could potentially save a lot of time in a large company with multiple analytics teams.

After a business intelligence analyst has identified the data they require, he or she can use Birst’s built-in connectors to import it from the source system. The startup says that its newly added machine learning algorithms automatically configure each connector to reduce the amount of manual work involved in the process. Then once the information is ready for processing, a revamped data preparation console makes it possible to quickly start uncovering patterns.

Birst logs every change that users make to ensure that issues discovered later down the line can be traced back to the source. This metadata is accessible through a “semantic layer” that doubles as a way for teams to share key findings with one another. An analyst tasked with assessing their company’s sales performance, for example, could employ the feature to pull reports created by their peers and produce a more complete view of operations.

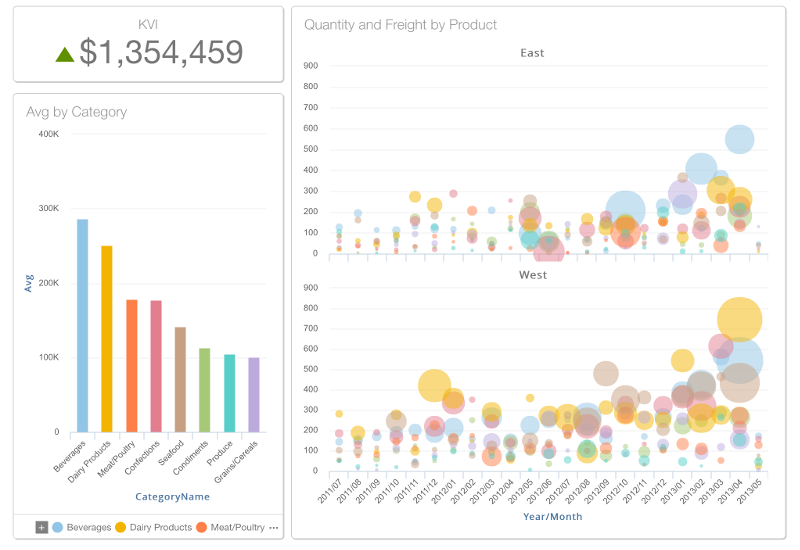

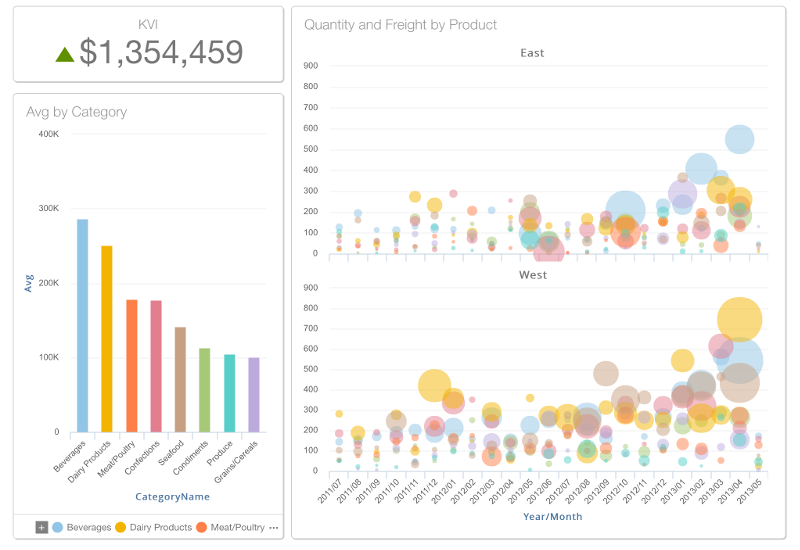

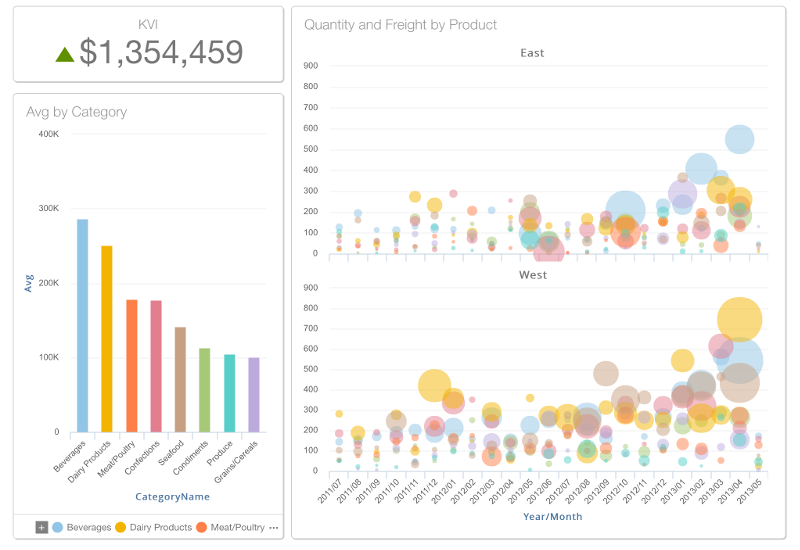

The new features complement the visualization engine that Birst introduced as part of the previous major update to its platform. The startup has been investing heavily in feature development since its $65 million funding round last May, which was led by Wellington Management Company LLP. The investment giant was joined by all of Birst’s existing backers including Silicon Valley heavyweight Sequoia Capital, Hummer Winblad, DAG Ventures and Northgate Capital.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.