INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Buoyed by the success of its Ryzen line of Intel Corp. x86-compatible processors and initial favorable reviews of its new Epyc line of chips for the data center, Advanced Micro Devices Inc. knocked its second-quarter results out of the park.

Results topped analysts’ expectations on revenue and profit, and AMD raised its outlook for full-year revenue growth. That sent its shares up more than 10 percent in after-hours trading. AMD said it now expects annual revenue to increase by a mid- to high teens percentage rate compared with earlier guidance of low double-digit percentage growth.

Second-quarter revenues of $1.22 billion rose 24 percent from a year earlier. Operating income before certain costs such as stock compensation was $49 million, compared with a $6 million loss in the second quarter of 2016. Analysts had expected $1.16 billion in sales and break-even earnings.

The results are a turnaround from first-quarter earnings that disappointed investors thanks to weak server sales, but AMD said a new and refreshed product family that includes Epyc, Ryzen and new Radeon RX Vega graphics cards should put the bad news behind it. Epyc is considered a pivotal product in the company’s turnaround, with AMD claiming up to 47 percent better performance than comparable chips from Intel.

“AMD has a lot to look forward to, as none of its numbers incorporates sales of Epyc server parts, only limited sales of the new Radeon Vega and none of the Ryzen notebook parts,” said Patrick Moorhead, president and principal analyst at Moor Insights & Strategy.

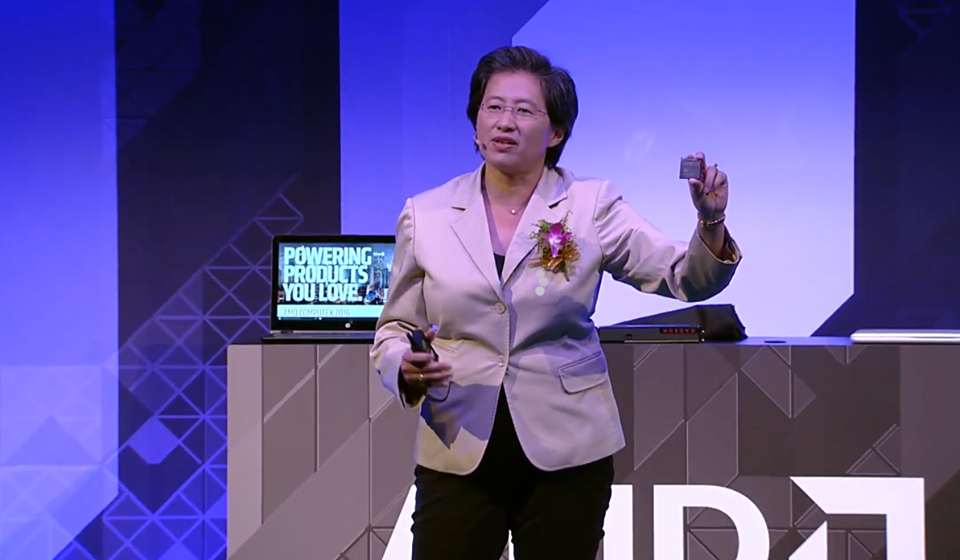

Although Epyc sales barely figured into this quarter’s results, early indications are that they will be an increasingly strong part of the company’s growth going forward, said Chief Executive Lisa Su (pictured). AMD has received endorsements and initial orders from several major cloud and data center infrastructure providers, including Hewlett Packard Enterprise Co., Dell Technologies Inc. and Microsoft Corp., and cloud providers, in particular, are climbing on board. “We are on track to re-enter the data center market in a major way,” Su said during an upbeat conference call.

Epyc is seeing faster-than-expected adoption by cloud providers in particular, Su said. “The cloud guys are making up a bigger piece of the market and they tend to move faster,” than enterprises, Su said. Although enterprise sales cycles are slower, AMD expects them to ramp up over the rest of the year and to be a more consistent source of business than the cloud market. “Both enterprise and cloud are important, though cloud is a little lumpier” in buying patterns, Su said.

Better-than-expected sales of graphics processing unit chips and the new Radeon RX Vega consumer graphics cards, which began shipping this month, also lifted results. GPUs, which are primarily used in gaming consoles but are increasingly finding their way into machine learning and blockchain applications, look to be a bigger part of AMD’s overall sales picture going forward. “We see strong demand for graphics in the third quarter,” when gaming consoles see seasonally stronger sales, Su said. “I think we understand the market better. The products are significantly stronger.”

However, the CEO appeared to back off somewhat from AMD’s earlier claims that it would target Nvidia Corp. in machine learning applications, saying that gaming would be the core of its GPU business for the foreseeable future.

AMD’s research and development investments are focused on growth areas like data center, GPU and machine learning, and the company is doubling down in its horse race with Intel and others to move to 7-nanometer manufacturing technology. In that area AMD believes it has an edge, Su said. “That project is progressing well. We expect [7 nm] will give us a strong competitive roadmap for several generations.”

THANK YOU