INFRA

INFRA

INFRA

INFRA

INFRA

INFRA

Arm Holdings Ltd., whose computer chip designs are best known for powering consumer devices from smartphones and smartwatches to televisions and printers, has been worming its way into data center equipment such as network switches and computer servers for years. Now, it’s getting serious.

Today at its TechCon conference in San Jose, California, the British semiconductor design company announced a new vision for a series of processor platforms due in coming years. Dubbed Neoverse, it’s aimed not only at data centers that collectively drive cloud computing services but also at next-generation computing likely to be done at the edges of the internet and corporate networks.

It’s a bold move. Chipmaking giant Intel Corp. still dominates mainstream servers and related data-center gear, not to mention personal computers. It appears Neoverse is aimed at one-upping Intel for the next generation of cloud and edge computing — not just servers but storage arrays, 5G network gear and more.

“We’re moving toward a world where there’s a computer in everything,” Arm Chief Executive Simon Segars (pictured) said at the conference this morning, outlining a fifth wave of computing driven by huge amounts of data. “When it comes to the data center, Arm is all in.”

Neoverse, the umbrella brand for a new set of processor platforms, was designed for what Arm describes as a coming world of 1 trillion intelligent devices by 2035 that all need to be connected and managed. According to the company, the chip designs will include higher levels of performance in silicon, software and systems than its existing Cortex line of higher-end chips.

Arm, which is owned by Japan’s Softbank Group Corp., isn’t really new to powering infrastructure. Indeed, it claims that based on numbers from International Data Corp., it has the biggest market share in infrastructure at 30 percent — if you include backend gear such as network switches, cellular base stations, corporate network routers and servers. “Almost all the chips inside of storage ports, solid-state drives, SSD, network ports, et cetera are Arm-designed,” Floyer noted.

But the company is clearly looking to become a leader in mainstream and next-generation data center equipment as well. It contends that infrastructure that’s now optimized for distribution of content such as video to smartphones and other devices will need to change to handle movement of data among devices at the network edge, requiring more distributed computing where the data reside.

“We are uniquely positioned as a company because we’re in discussions with every major company in the world trying to build these systems,” everything from smart devices to smart-city infrastructure to transportation, Drew Henry (pictured below), Arm’s senior vice president of infrastructure, said in a briefing.

David Floyer, chief technology officer at SiliconANGLE sister market research company Wikibon, said Arm is mounting a three-pronged attack on Intel and other chip providers: “Surround with lower cost, match performance with better cost and power, and dominate emerging matrix workloads with better performance and quicker time to market.”

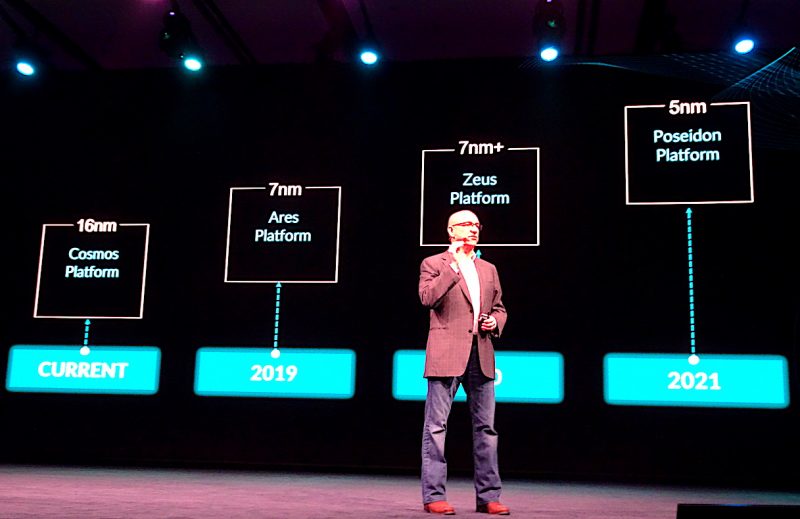

Arm also announced a roadmap for Neoverse chips that span from today’s Cosmos platform for cloud application processing to an Ares platform of chips coming in 2019, a Zeus platform in 2020 and a Poseidon platform in 2021. Each one, the company said, will be 30 percent faster than the previous platform and sport more infrastructure-specific features.

“Arm is increasing its investment in the infrastructure space with Neoverse by creating licensable and complete ‘big’ cores with higher bandwidth,” Patrick Moorhead, president and principal analyst at Moor Insights & Strategy, told SiliconANGLE. “This is a big change and step-up to previously offering an instruction-set license requiring chip customers to create their own big cores.”

Besides those chip cores, new features will high-performance and secure architectures “purpose-built” for cloud-native and networked computing workloads. Arm is also marshaling an ecosystem of partners.

They include Microsoft Corp.’s Azure cloud, Baidu Inc., Tencent Holdings Ltd., Alibaba Group Holding Ltd. and Amazon Web Services Inc.’s Annapurna Labs in cloud computing, a wide array of silicon manufacturers such as Broadcom Ltd., Qualcomm Inc., Marvell Technology Group Ltd., systems makers such as Cisco Systems Inc., Hewlett Packard Enterprise Co., Ericsson Inc. and ZTE Corp. and carriers SoftBank, Sprint, BT Group unit EE, Orange Group and Vodafone Group PLC.

Also onboard with Neoverse are a wide variety of companies providing operating systems, software container and virtualization, programming languages and libraries, development tools and open-source project groups such as the Cloud Native Computing Foundation.

Moorhead said it’s difficult to gauge the potential impact of the chips before they exist, in particular against those from Intel and others. “Intel has done a good job so far playing whack-a-mole by investing in server systems-on-chip, smaller cores and fabrics,” he said. “What I can say is that I believe Neoverse-based chips will deliver significantly higher CPU performance than any Arm server chip before it.”

Arm hinted that its effort in infrastructure will take some time to play out. “It’s a journey that will take a product generation or two,” said Brian Jeff, an Arm senior director of product management. “But there’s a hunger for a different design approach particularly as we move toward the cloud.”

It’s clearly a tough market, made all the more apparent by a report in May that Qualcomm was considering an exit from the data center market. Qualcomm President Cristiano Amon said in June that it wasn’t abandoning the effort, though he conceded there would be staff cuts amid a narrower focus on large internet companies in the U.S. and China.

Today’s announcement follows other Arm moves into new markets. Late last month, it introduced a new chip series for autonomous cars. And earlier this year, it revealed a machine learning initiative called Project Trillium to provide AI capabilities for less power than rivals Intel, Qualcomm, Nvidia Corp. and Xilinx Inc.

The range of high-volume chips in which its designs are used gives Arm a wedge against Intel and its iconic x86 line of processors, Floyer said.

“Arm will use the same strategy as Intel used to migrate workloads from RISC processors to x86,” he said. “Arm will use consumer volume to lower cost and dominate performance, and inexorably move workloads as new software is written.” The result, he predicts: By 2028, x86 will have less than 10 percent of enterprise and cloud provider processor spending.

THANK YOU