BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Coinbase Inc., the first cryptocurrency exchange to become a “unicorn,” is now multiple times bigger on paper, raising $300 million in new funding on an $8 billion valuation.

The Series E round announced today was led by Tiger Global Management and included Y Combinator Continuity, Wellington Management, Andreessen Horowitz, Polychain and unspecified others. The newly raised funds are being used to accelerate Coinbase’s global expansion and support for additional cryptocurrencies.

Rumors of the round emerged Oct. 2 when it was reported that it would include a buyout of some existing investors. It’s not clear whether that actually took place or whether this is simply a new equity round.

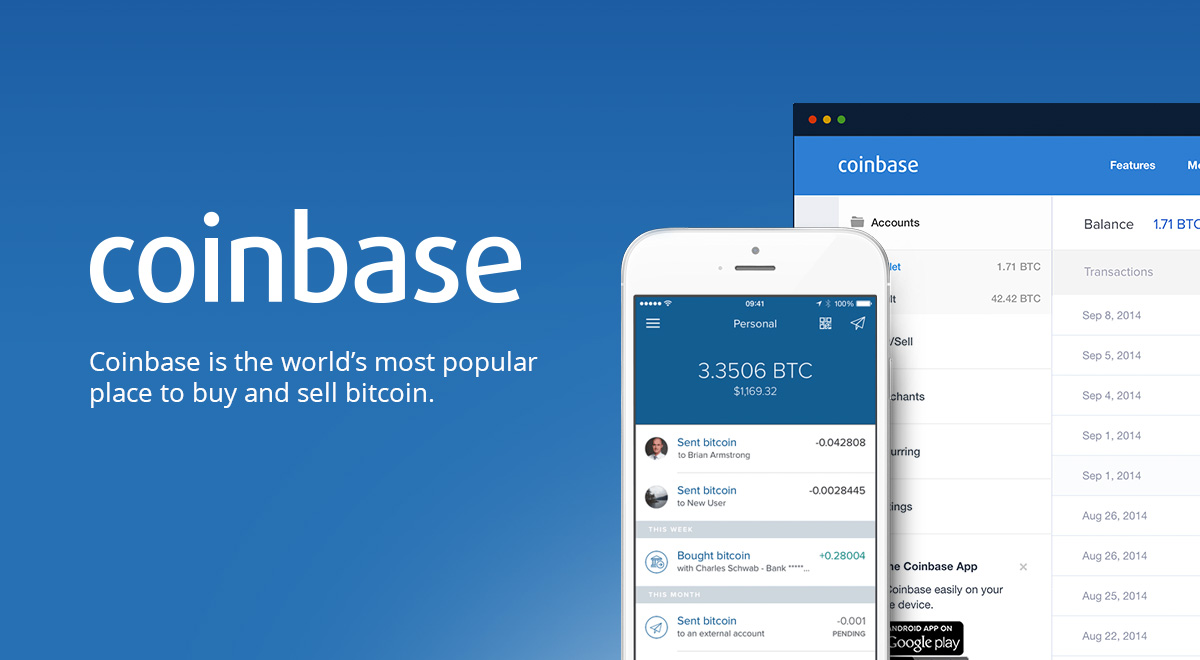

Founded in 2012, Coinbase allows merchants, consumers and traders to transact with bitcoin and other cryptocurrencies through a range of services including cryptocurrency wallets, and also offers the ability to buy and sell cryptocurrencies. Where it differs from others in the market is with a merchant payment processing platform that allows sites to accept cryptocurrencies as payment for goods and services sold.

“At Coinbase, we believe that cryptocurrencies and the technologies that power them represent a breakthrough in computer science that will change both the internet and the global financial system for the better,” Coinbase Chief Executive Officer Asiff Hirji said on Medium. “We see tremendous promise in crypto to build the next great phase of the internet (often referred to as Web 3), which has the power to put control back in the hands of consumers, unleash a new era of innovation, and offer greater access to economic opportunities to more people around the world.”

The $300 million round is Coinbase’s largest to date and follows from one for $10.5 million in July 2016 and another for $100 million in August 2017.

With the new round, Coinbase has raised $525.3 million to date. Previous investors include Section 32, Balyasny Asset Management, Draper Associates, Battery Ventures, Greylock Partners, Tusk Ventures, Spark Capital, Bank Of Tokyo, USAA, DFJ, BlockChain Capital, the New York Stock Exchange and about two dozen others.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.