EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

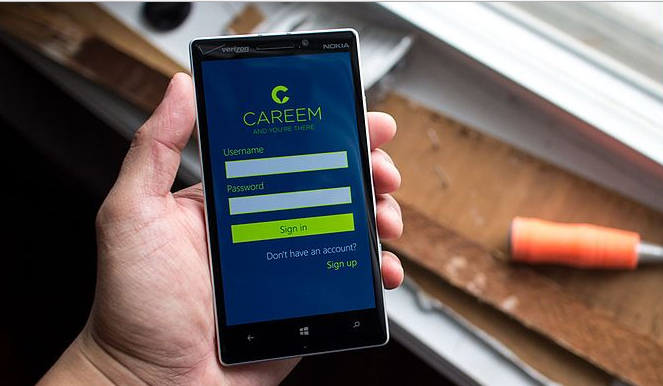

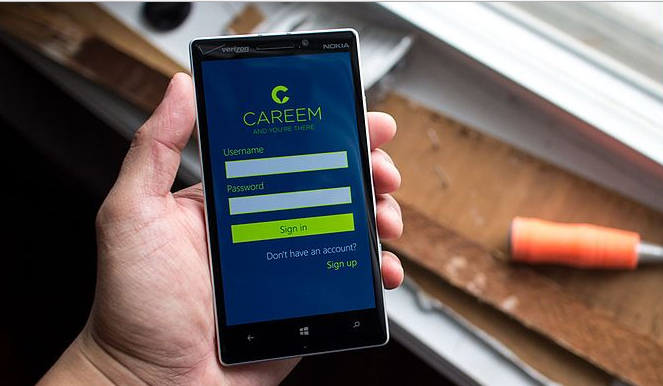

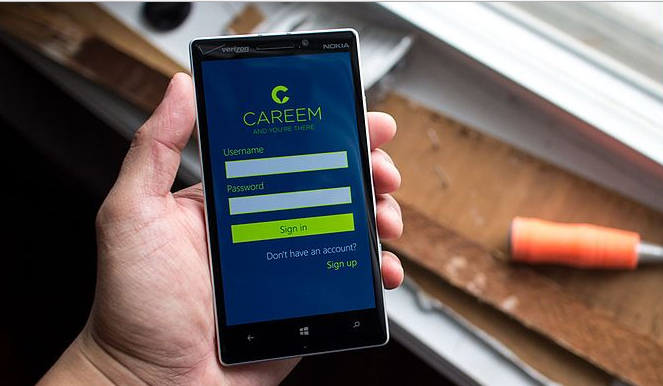

Uber Technologies Inc. will announce that it has acquired Middle Eastern ride-hailing startup Careem Networks FZ this week, according to a report published Sunday.

Bloomberg, quoting sources, said Uber will pay $1.4 billion in cash and $1.7 billion in convertible notes for Careem. The notes will be convertible into Uber shares at a price equal to $55 per share.

Rumors that Uber was in talks to acquire Careem first circulated in July. As of Feb. 28, the negotiations between the two companies for a deal were said to be advanced but with nothing signed.

Founded in Dubai in 2012, Careem has rapidly expanded across the Middle East, North Africa and South Asia. The company operates in 120 cities across 13 countries with 1 million drivers and about 25 million customers.

Careem’s market share is difficult to pin down. Although it’s unquestionably the largest player in the region given its presence in more markets, it’s unknown how it competes directly in the 20 markets Uber operates in within the region.

In buying Careem, Uber has changed its strategy in markets it doesn’t dominate. Previously, Uber has exited markets where local providers were dominant. Uber sold its Chinese business to Didi Chuxing Technology Co. in return for a 20 percent stake in August 2016, followed by its business in Russia and a number of former Soviet republics to Yandex Europe AG in return for a 36.6 percent stake in July 2017. In March last year, Uber sold its Southeast Asian business to Grab Taxi Pte. Ltd. in return for a 27.5 percent stake.

The acquisition comes as Uber cleans house ahead of its long-awaited initial public offering.

In the lead-up to its IPO, expected to be mid-April on the New York Exchange, Uber has settled two long-running driver lawsuits for $20 million as well as attempting to spin off a share of its loss-making self-driving car division for $1 billion.

With the company reporting slowing growth in the fourth quarter, the addition of Careem to its business in a market that offers high growth opportunities can only help in its IPO sale pitch.

Careem has raised $771.1 million and had a valuation of $1.2 billion in 2017, the last time it raised venture capital funding. Investors include Rakuten, Daimler, DCM Ventures and Coatue Management.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.