APPS

APPS

APPS

APPS

APPS

APPS

Videoconferencing firm Zoom Video Communications Inc. has priced its shares for its initial public offering next week on the Nasdaq exchange.

The company, which filed to go public in March, today priced its shares at between $28 and $32 each, which would raise $348.1 million at the high end from the sale of 10.9 million Class A shares. At the high end, the IPO will see Zoom valued at $8.7 billion, eight times higher than as of its last venture capital round in January 2017, according to TechCrunch.

The San Jose, California-based company comes into its float with a somewhat unusual feature for a tech company going public it 2019: It’s actually profitable. For the year ending Jan. 31, Zoom booked $330.5 million in revenue with a net profit of $7.6 million.

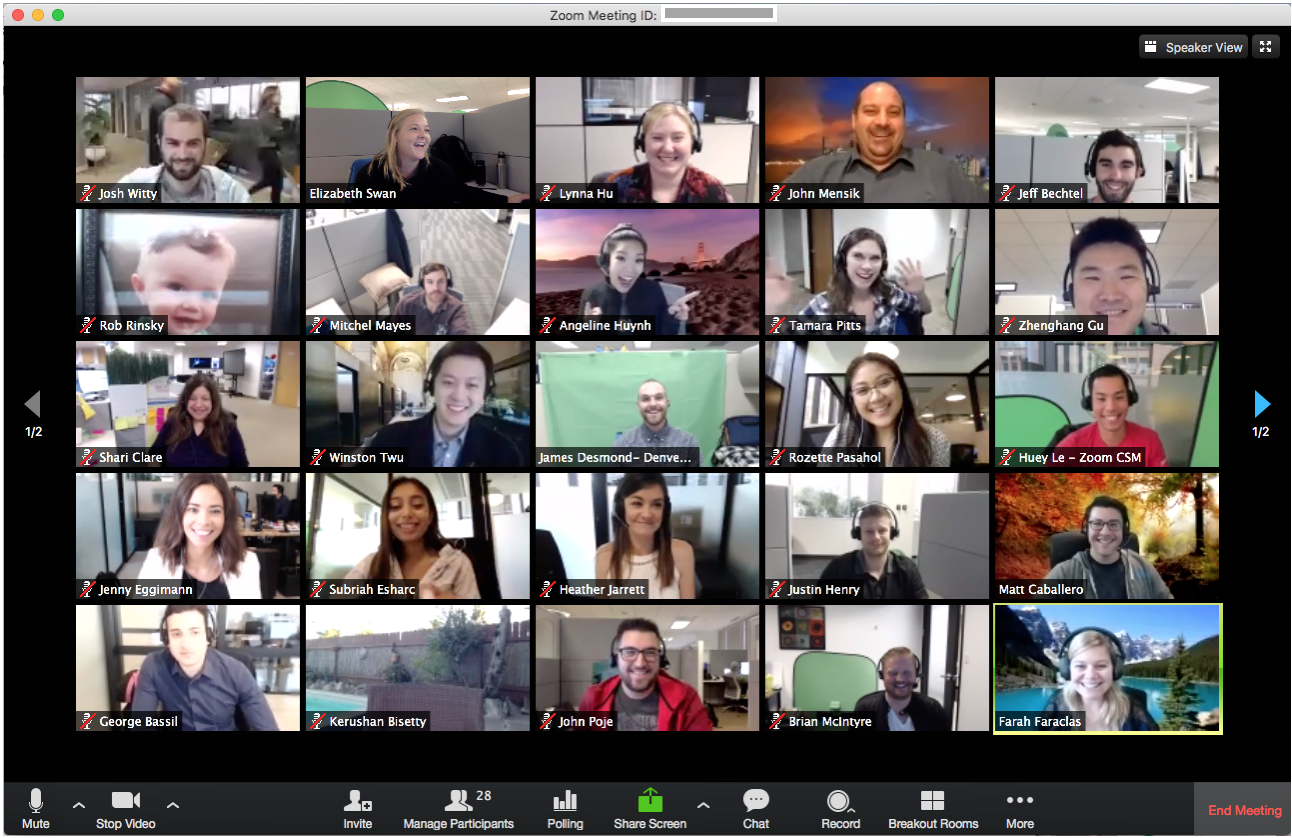

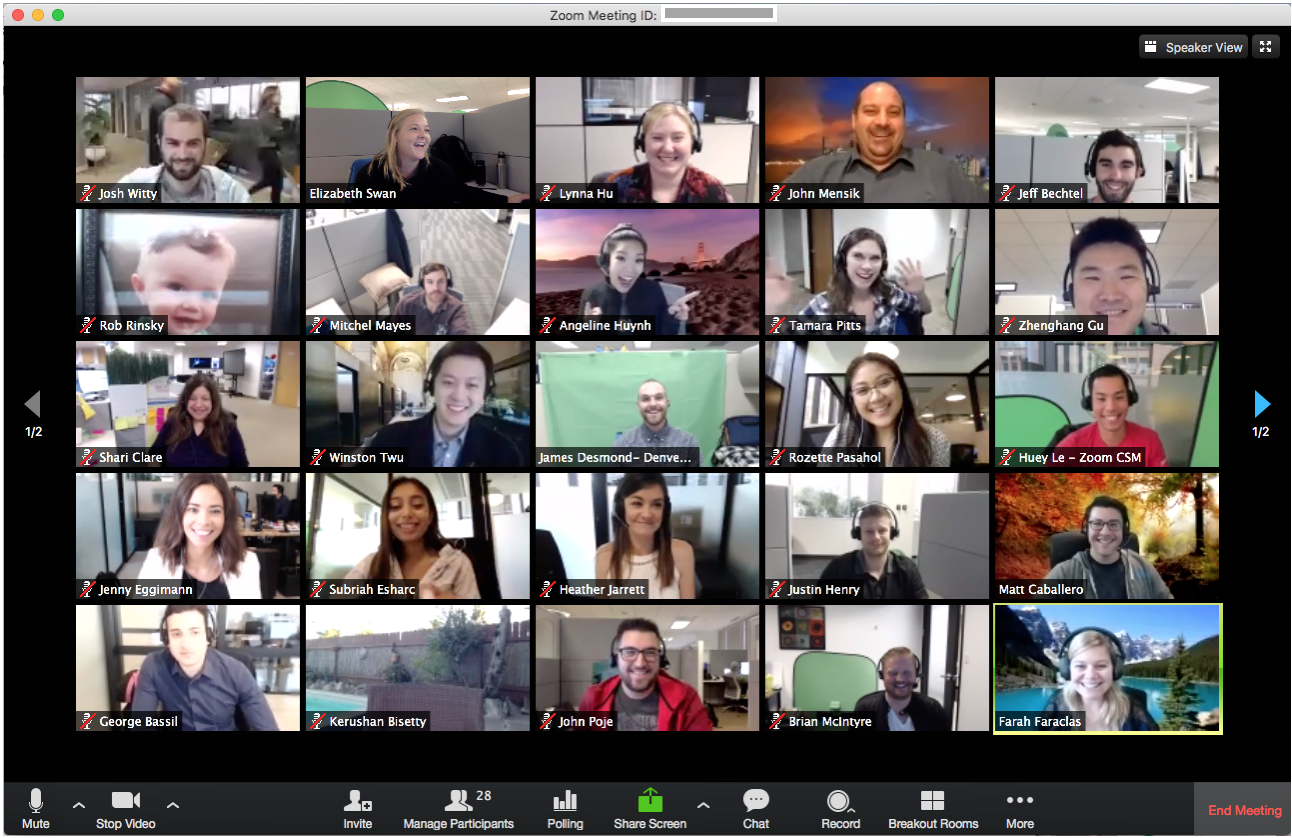

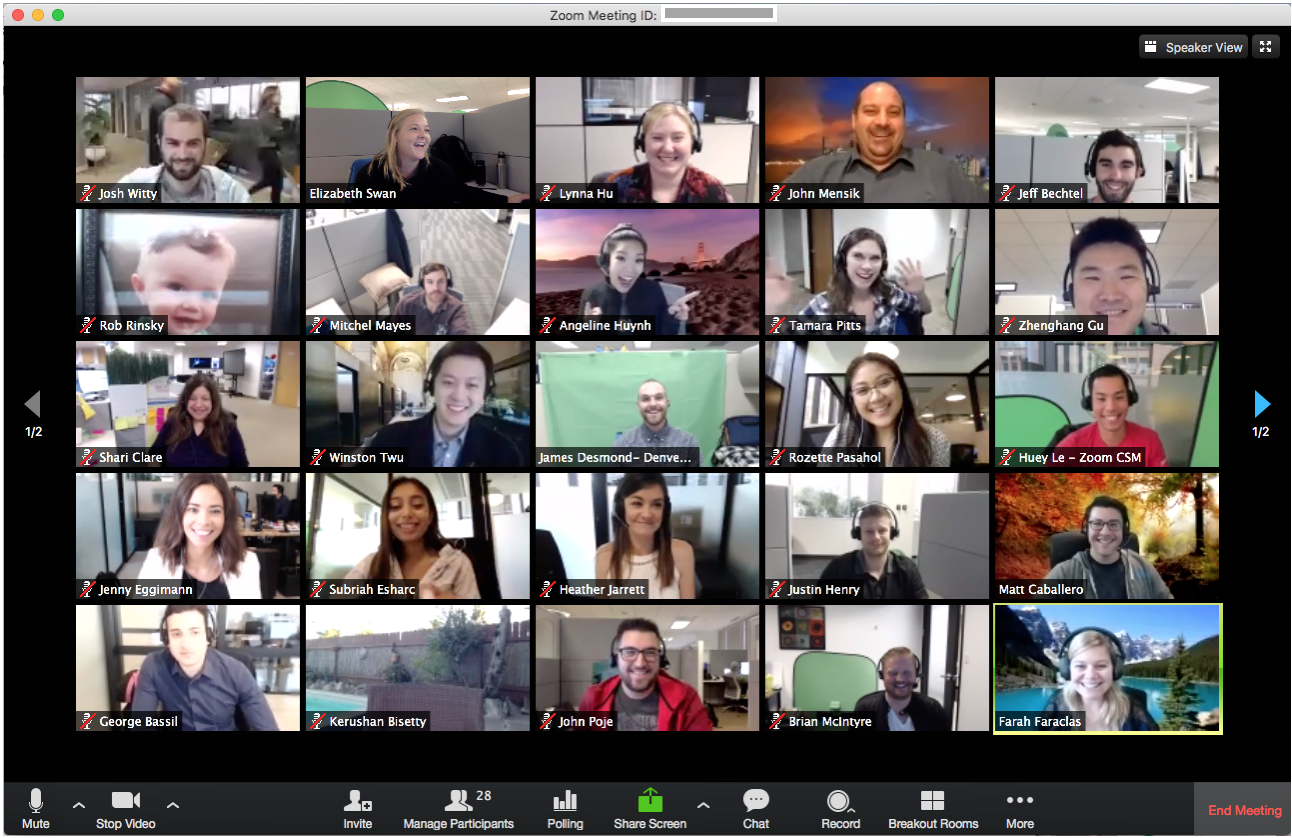

Founded in 2011, Zoom has gained popularity with an easy-to-use service that works across all sorts of different devices without the need for special software or equipment. It does so by using cloud-based software to enable users to connect to meetings via video from anywhere using customized backgrounds to make it appear they’re sitting in a corporate conference room.

Speaking to SiliconANGLE’s video studio theCUBE in March, Zoom Chief Information Officer Harry Moseley discussed the rapid change of the technology involved, saying that “the things that we can actually do today, we only dreamed about them a year ago” and that “the pace of change is just growing exponentially.”

Zoom is yet another unicorn, or company with a billion-dollar valuation, entering public markets in 2019 as many older startups with massive valuations finally go public. Ride-hailing provider Lyft Inc. went public March 28 with drama following April 1 as its price dropped below its IPO list price. Although there has been an accusation of market manipulation and Lyft’s share price has since recovered, there is certainly volatility in markets as investors try to value unicorns.

The king of unicorns, Uber Technologies Inc., is expected to go public as soon as next week and, like Lyft, it will test investor appetite for big tech IPOs.

Zoom has the advantage over both of being profitable, which may see it do well since on paper it’s a far safer bet. At the same time, the question is whether investors believe a valuation of about $8 billion is justified for the company.

However the markets receive the IPO, the winners will be its investors, who invested $145 million. They include Emergence Capital with a 12.2% pre-IPO stake, Sequoia Capital with 11.1% and Digital Mobile Venture with an 8.5% stake.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.