CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

The VMworld 2019 information technology spending survey data shows that while customers continue to invest heavily in VMware Inc.’s products, organizations are doubling down on their public cloud commitments at the expense of incumbent on-premises infrastructure.

In addition, the battle for market share amongst enterprise tech companies is heating up as share gains are the most obvious way to offset tepid overall on-prem market growth. This dynamic is creating confusion in the marketplace as trends in cloud, containers, software-defined everything and so-called multicloud create both opportunities and risks for buyers.

Enterprise Technology Research is a primary technology market research firm. The company has 10 years of history capturing real-time spending intentions from a panel of more than 4,500 enterprise technology buyers, representing nearly $1 trillion dollars in spending power. ETR has provided SiliconANGLE access to its survey data and experts to help us better understand customer buying intentions. Our first collaboration related to IBM’s acquisition of Red Hat.

This current VMworld 2019 IT spending survey highlights key spending patterns within the VMware ecosystem. Ahead of VMworld 2019, and to mark theCUBE’s 10th year at VMworld, we partnered with ETR to provide data to critical questions on the minds’ of customers and technology players within our respective communities. We have analyzed ETR survey data over the past 42 months comprising 15 “Drilldown” surveys, each with many hundreds of respondents (693 in the latest survey in July), representing hundreds of billions of dollars in annual spending.

We explored the following six key questions for the VMworld 2019 IT spending survey:

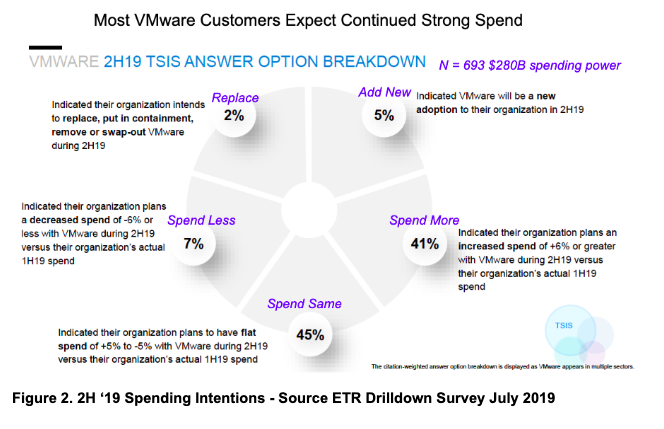

Figure 2 shows summary data from the VMworld 2019 IT spending survey for the second half of 2019. Respondents were asked if their second-half 2019 spending would increase decrease or stay flat, relative to the first half of 2019. The key takeaways are:

Note: This data is not unusual for an entrenched incumbent such as VMware. Customers are familiar with an incumbent’s technologies and switching costs are rarely warranted for such a leading platform.

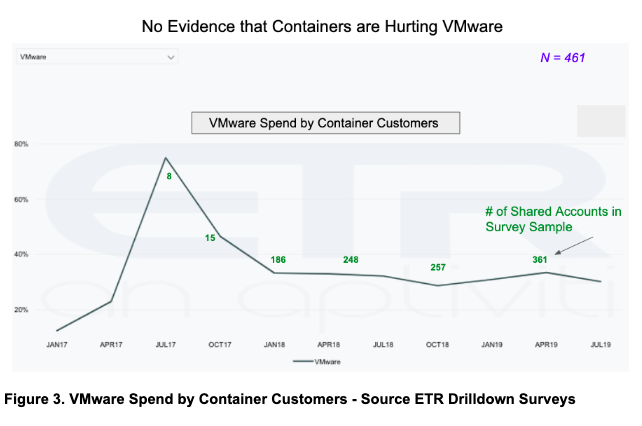

Figure 3 shows that customers with high container adoption continue to spend on VMware technologies across the board — that is, compute, storage, networking, EUC and the like. NSX and vSAN spending were particularly strong, affirming VMware’s public statements.

Of note in this data are the number of shared accounts between those heavily adopting containers and VMware buyers. Two years ago the number of shared accounts was minimal, but the more recent surveys allowed us to analyze several hundred shared accounts. The trend line shows that VMware spend remains strong despite predictions that containers will kill it.

Anecdotally, customers tell us that they deploy containers in a variety of use cases, some negative some positive for VMware — for example, both in bare metal deployments and on top of virtual machines. The acquisition of Pivotal gives VMware a strong incentive to further drive synergies with enterprise Kubernetes or PKS in support of VMware’s multicloud intentions.

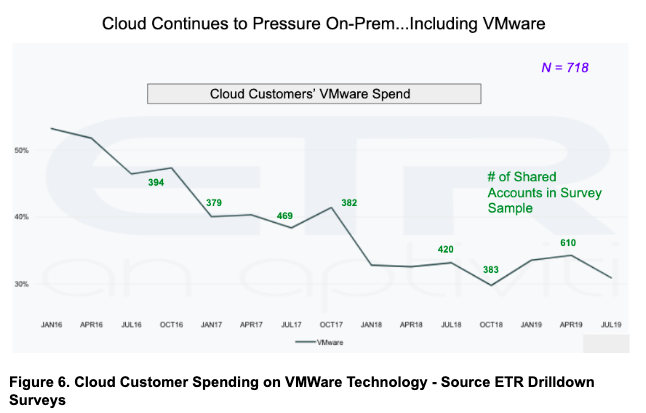

One caveat: As shown later in Figure 6, cloud is a major threat to on-prem suppliers, including VMware. As containers are deployed in the cloud and used in software-as-a-service offerings, the impact to VMware could be downward pressure. Why? Because the leading SaaS players are generally not building on top of VMware and increasingly they’re moving to the public cloud.

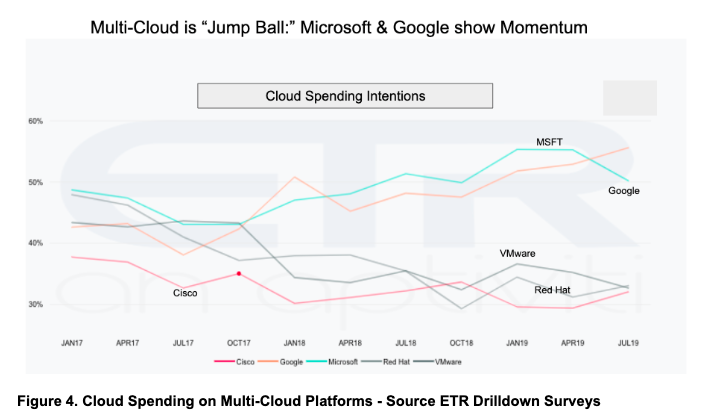

Note: Figure 4 is nuanced. We chose the five companies for the VMworld 2019 IT spending survey that we considered to be potential leaders in so-called multicloud. We then cut the data by assessing cloud-related spending on those top platforms as a proxy for multicloud.

Both Microsoft and Google show strength here. We attribute this to Microsoft’s strong position in public cloud, on-prem and software apps. Increased interest generally in Google Cloud as a hedge to AWS is likely providing momentum for Google along with Google Anthos, the company’s recently announced multicloud offering.

Notably, VMware (data center OS), IBM Red Hat (OpenShift + IBM Global Services) and Cisco (strength in networking and security) are bunching up as the on-prem leaders. We did not include AWS in this analysis because it doesn’t publicly acknowledge intentions to compete in multicloud. However we believe at some point, if the market asks for it, AWS will be a major player here.

Based on the approach we took, we have to be careful about the conclusions we draw. After all, what is multicloud? We believe that the term really is aspirational today and reflects the state of bespoke multicloud choices — that is, multi-vendor — rather than a coherent customer strategy.

In other words, customers have chosen multiple clouds for different use cases and different reasons, such as shadow IT, different corporate divisions and developer preferences. These clouds are disaggregated and loosely coupled at best, each with its own homegrown orchestration and automation software often born of an open-source fork that’s now proprietary. Today, integration with on-prem systems is lightweight or nonexistent.

The vision of true multicloud implies a massively scalable distributed system comprised of multiple public clouds and on-prem applications. These systems have tightly integrated control and data planes. Wikibon, SiliconANGLE’s sister market research firm, asserts that to conform to the vision of true multi-cloud, the system must incorporate hybrid architectures:

“Any application or application service can run on any node of the hybrid cloud without rewriting, re-compiling or retesting. True Hybrid Cloud architectures have a consistent set of hardware, software, services, APIs, with integrated network, security data and control planes that are native to and display the characteristics of public cloud infrastructure-as-a-service. These attributes can be identically resident on other hybrid nodes independent of location, for example including on public clouds, on premises or at the edge.”

It’s safe to say that this strict definition of multicloud doesn’t exist today and perhaps may never become a reality. To achieve this vision, buyers are more likely in the near term to deploy a highly homogenous infrastructure stack such as AWS Outposts, Azure Stack and Oracle Cloud at Customer. But that will not really comprise multiple public clouds and will be highly proprietary in nature.

We do believe that managing and orchestrating a consistent set of services across multiple cloud and on-prem domains will be a requirement, particularly with regard to security, compliance and infrastructure deployment. The reality is that this will be a journey for customers and will take many years to achieve.

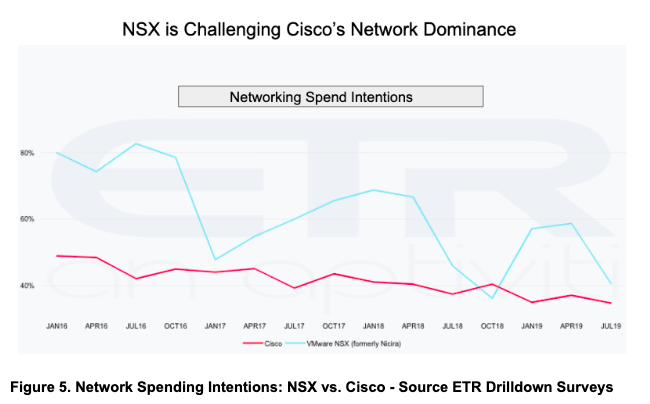

ETR survey data show that on balance, the networking sector is being pressured by public cloud, which accounts for some of the downtrend shown in Figure 5. Nonetheless, the data show that VMware’s Nicira acquisition and its strong SDDC marketing are having an effect on the spending intentions of Cisco’s customers. VMware has stated that it wants to do to networking (and storage) what it has done to compute.

And we don’t think that’s good news for Cisco and other infrastructure providers. This shows up in that data above as since early 2016, spending intentions on Cisco networking gear has steadily waned, while interest in NSX has bounced above the trend line.

Cisco has countered with its own software-defined vision and has aggressively launched efforts to make its infrastructure programmable with the DevNet group. ETR data shows that Cisco customers continue to be loyal and spend heavily on Cisco infrastructure.

Figure 6 shows the three-plus-year trend on VMware spending intentions over 15 drill-down surveys. The data clearly show that cloud customers are shifting their priorities and despite the strength of VMware, public cloud continues to grow at the expense of on-prem infrastructure. VMware is not shielded from this megawave.

To counter that effect, VMware has cut deals with all the major cloud players, AWS being the most prominent. But we believe VMware sees multicloud management and orchestration as a way to offset that pressure and create new TAM opportunities — hence its aggressive acquisition posture and moves to create a leading multicloud offering in the marketplace.

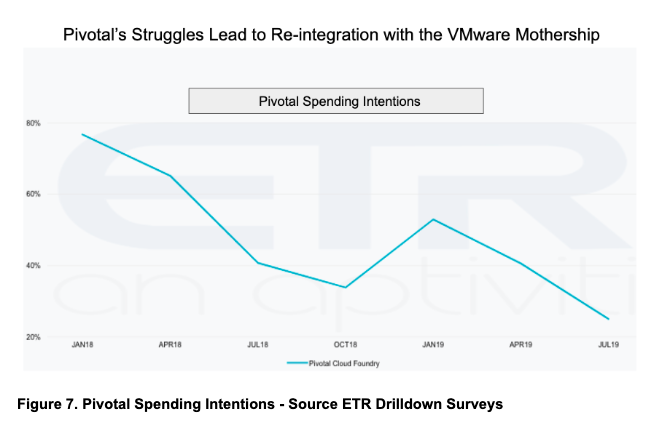

Figure 7 shows the 18-month trend line for spending intentions on Pivotal technologies. The downward trajectory is meaningful and mirrors Pivotal’s struggling stock price since its IPO. We believe the deal to be acquired by VMware was driven by three primary factors:

For a detailed analysis of the deal structure and its implications, check out this video.

Along with Pivotal, VMware is acquiring Carbon Black, a Waltham, Massachusetts-based security company with a large portion of its revenue, almost 40%, derived from SaaS. Currently VMware’s SaaS business represents about 12% of company revenues. The acquisitions of Pivotal and Carbon Black are expected to add roughly $1 billion in SaaS revenue in the first year and $3 billion by year two.

We believe that, combined with several other acquisitions in the security and hybrid cloud space, VMware has a sense of urgency to stem the cloud threat shown in Figure 6 and break out from the multicloud pack.

This summary, with heavy contribution from ETR, barely scratches the surface and there are many more powerful cuts on the data. As always, please don’t hesitate to get in touch if you have questions or comments.

We’ll be covering these and many other issues celebrating our 10th year at VMworld with theCUBE, in the lobby of Moscone North in San Francisco.

Here’s a video we did this week with a cliplist summarizing the VMworld 2019 IT spending survey and the key questions we addressed:

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.