CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

CLOUD

Strategy management startup WorkBoard Inc. today said it has raised $30 million in new funding to boost marketing efforts, partnerships and development of core technology in areas such as data visualization and machine learning.

The Series C round was led by Andreessen Horowitz and included GGV Capital, M12 (previously Microsoft Ventures) and Workday Ventures. As part of the deal, Andreessen Horowitz General Partner David Ulevitch is joining WorkBoard’s board of directors.

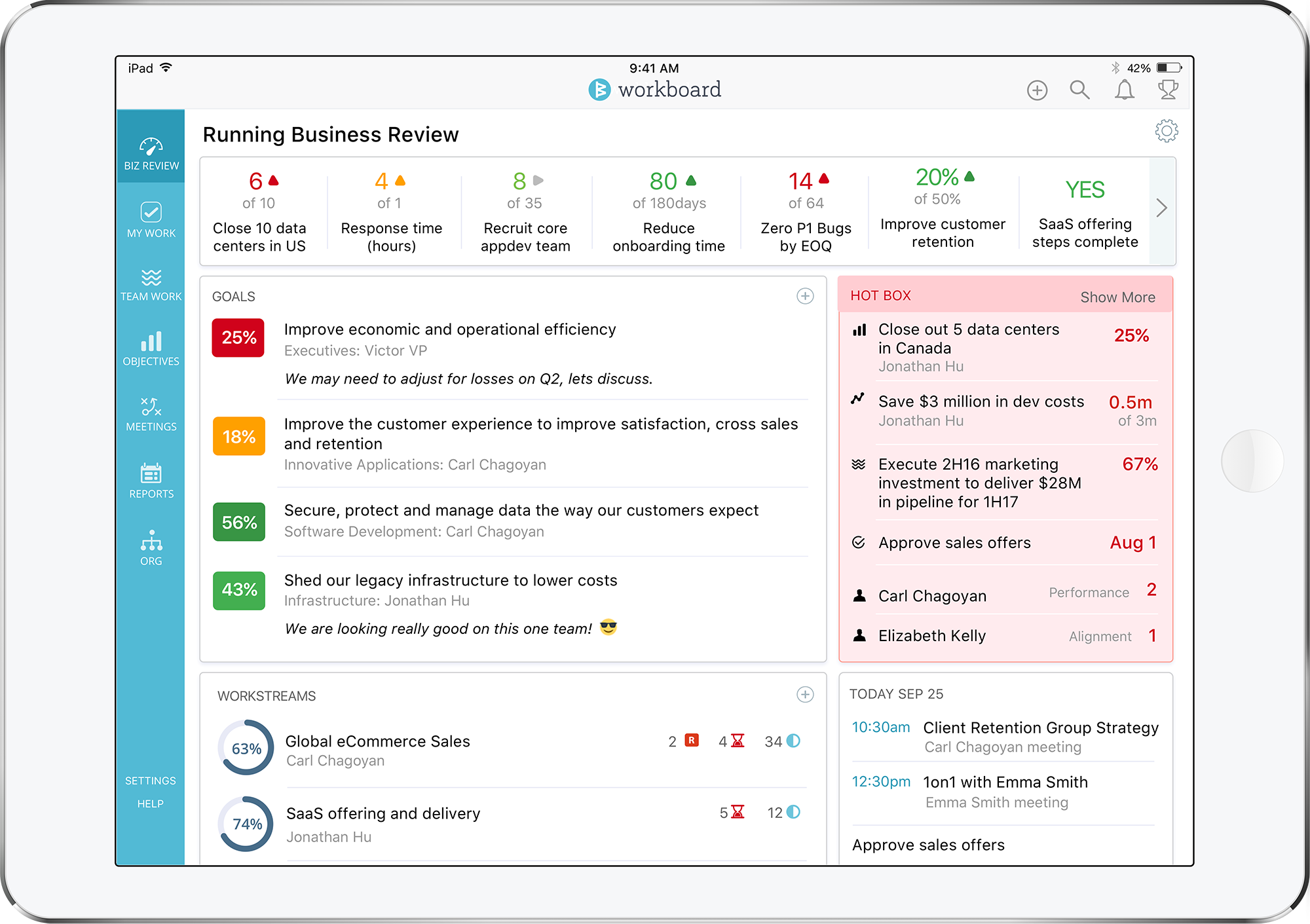

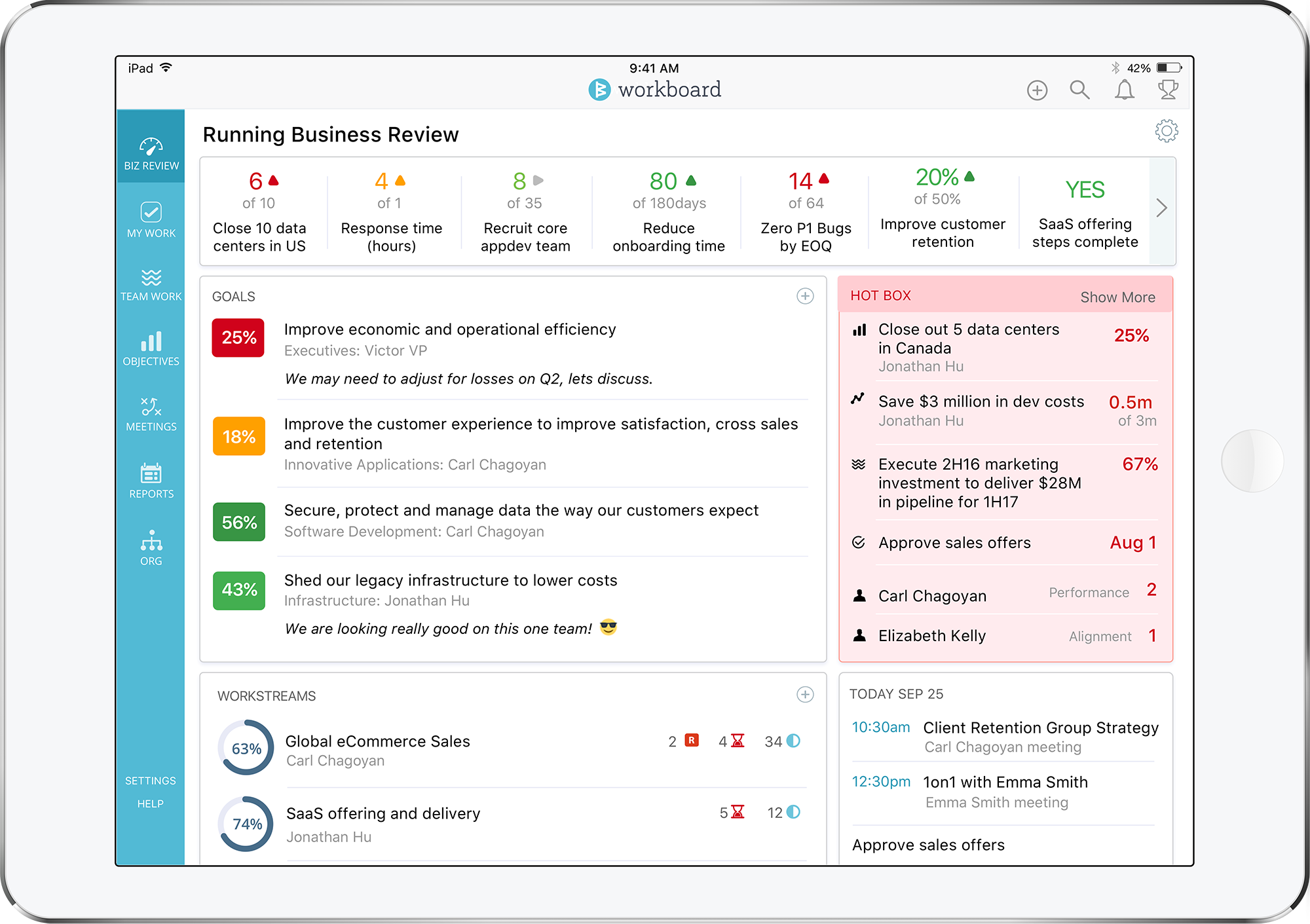

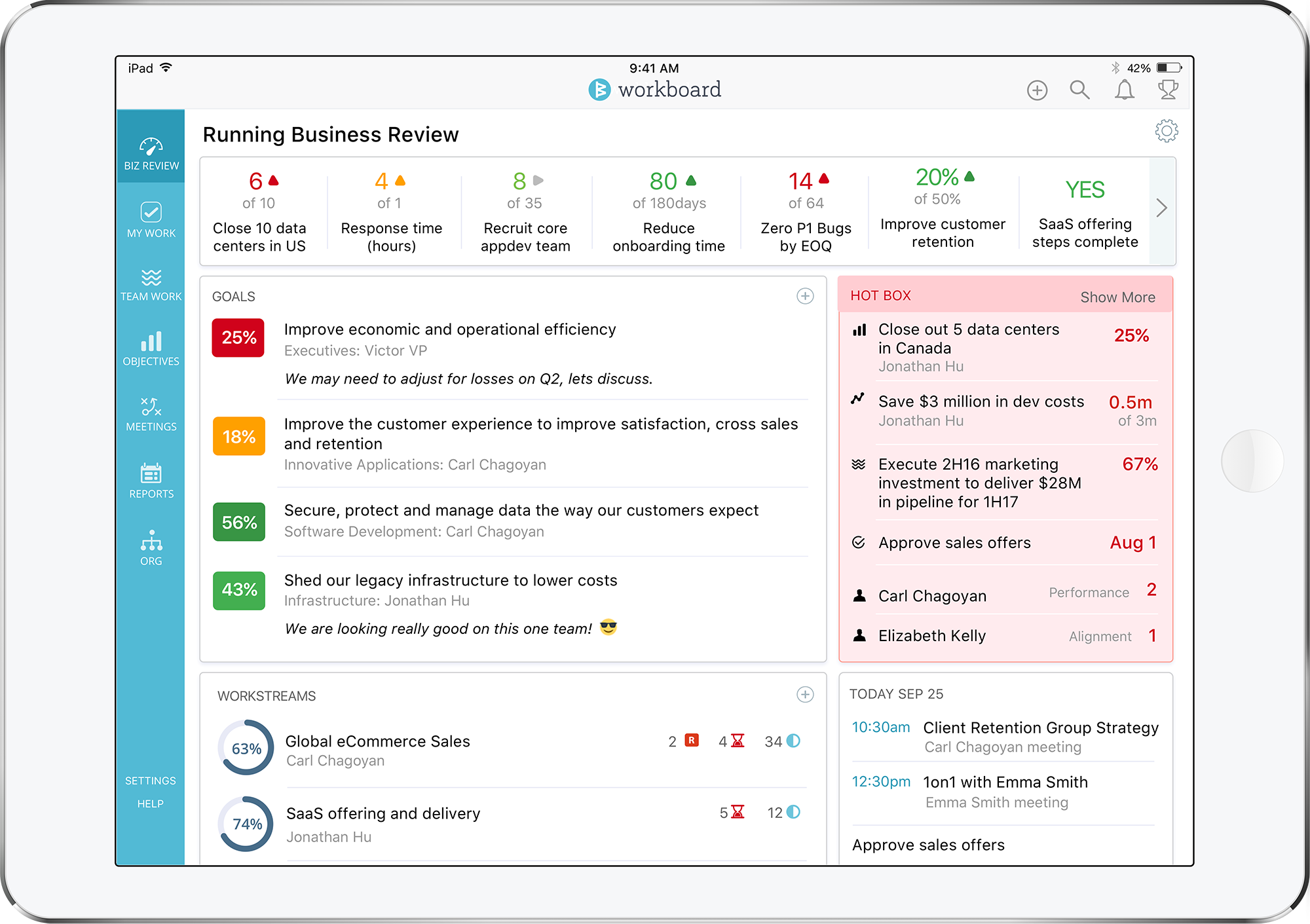

Founded in 2013, WorkBoard offers an active strategy management software as a cloud service. At its core, the company offers a dashboard that enables executives to keep track of how important business initiatives are coming along.

WorkBoard displays items one atop another in easy-to-access columns while also including a progress bar. Users can click on a goal to bring up a more detailed breakdown of what they are trying to achieve.

In one example, a company seeking to attract early adopters to a new software product could pull installation data into WorkBoard to show executives how many customers have come aboard so far. The service also visualizes records in the form of straightforward graphs to make them easily understandable.

Customers include Cisco Systems Inc., Cision Ltd., Comcast Corp., Microsoft Corp., Malwarebytes Inc., IBM Corp., Juniper Networks Inc., Workday Inc., Secureworks Inc., Seismic Software Inc., Reliance Industries Ltd. and Zuora Inc.

“Getting the organization aligned, engaged and executing on the strategy is the most important job of leaders, but in the past they lacked a systematic, data-driven and transparent way to do it,” Deidre Paknad, co-founder and chief executive officer of WorkBoard, said in a statement. “We started addressing the problem – and its resulting drag on growth – several years ago. Today, savvy leaders know they can’t grow fast if they manage slow.”

Including the new round, WorkBoard has raised $65 million to date. Previous investors include Floodgate, Opus Capital, Rock Creek Capital and Cherry Tree Investments.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.