EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

EMERGING TECH

The market for robotic process automation is one of the hottest in tech right now, rapidly gaining traction as larger enterprises look to speed up their business processes by automating mundane office tasks.

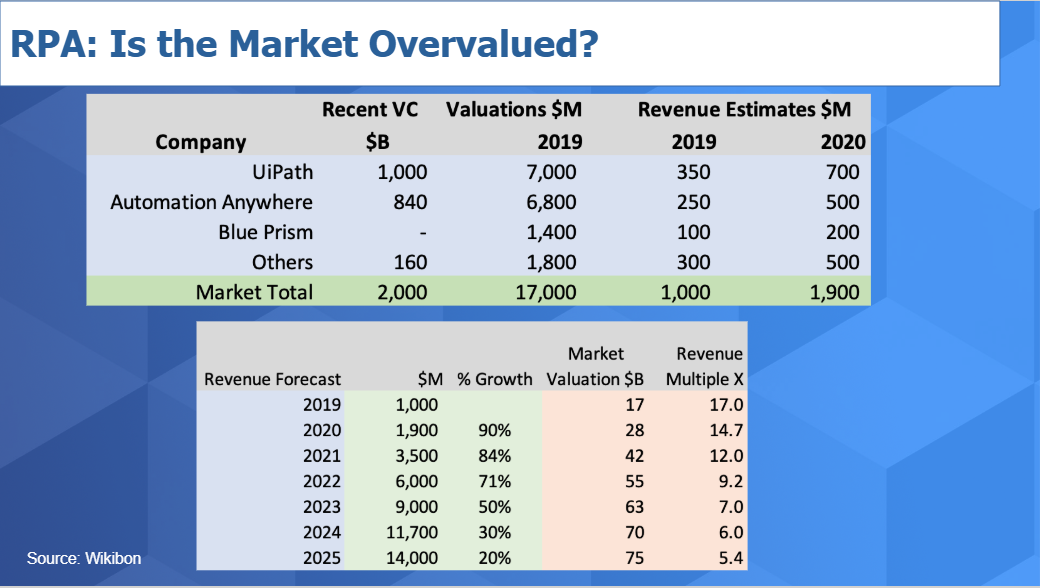

A lot of the buzz around RPA comes from the massive amounts of money being injected into the market. The two biggest players in RPA right now, Automation Anywhere Inc. and UiPath Inc., are both startups that have raised almost $1 billion between them, sharing a combined market value of nearly $14 billion. Meanwhile, the market generated revenue of around $1 billion in 2019, almost double a year ago.

With so much money being thrown around, Dave Vellante, chief analyst at SiliconANGLE sister market research firm Wikibon and co-host of SiliconANGLE’s video studio theCUBE, took a deeper look at the RPA space in his latest Breaking Analysis video in order to ascertain just how big it could grow.

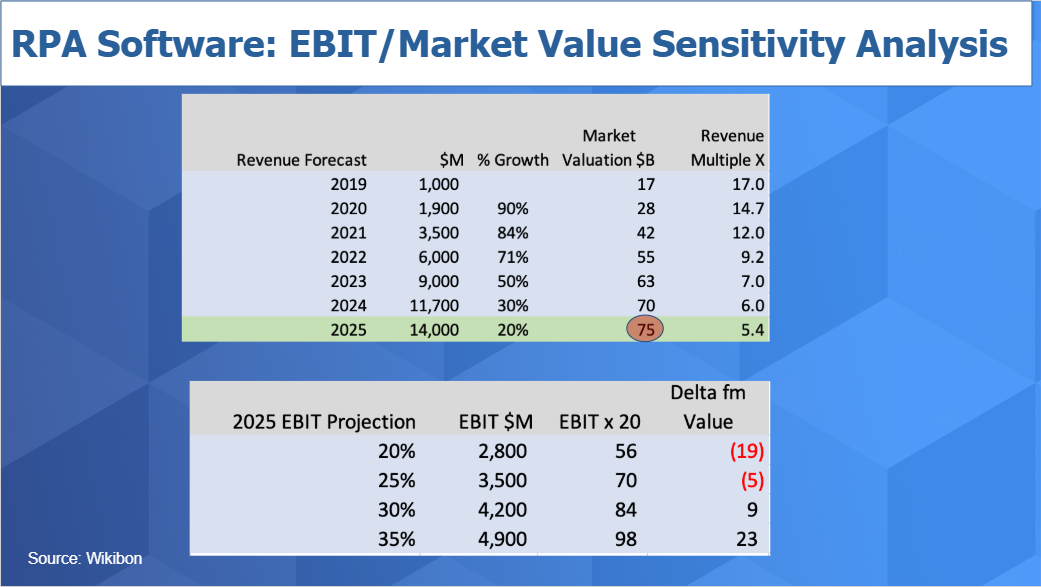

One of the most important questions to address is whether the RPA market is overvalued, and at first glance that does appear to be the case. Wikibon’s data shows the RPA market is trading at around 15 to 17 times revenue, which is a very high multiple. But Wikibon’s forecasts show that growth in the RPA market is expected to slow to 20% a year by 2025, by which time it will also start throwing off some profits, at least for the leading players.

“What we show here is a sensitivity analysis assuming 20%, 25%, 30% and 35% earnings before interest and taxes for the market,” Vellante said. “And we show a 20-times EBIT multiple, which for a market growing this fast is reasonable, considering that tech overall will typically have a multiple of 10% to 15%.”

Wikibon’s forecasts assume a market valuation of around $75 billion a year by 2025, which suggests the RPA market is actually more likely to be undervalued at this time. As for RPA’s total available market, it could easily end up exceeding $30 billion globally, supporting a higher implied valuation multiple.

Of course that means there’s a lot at stake for those trying to carve out a piece of that pie, but who is currently sitting at the table?

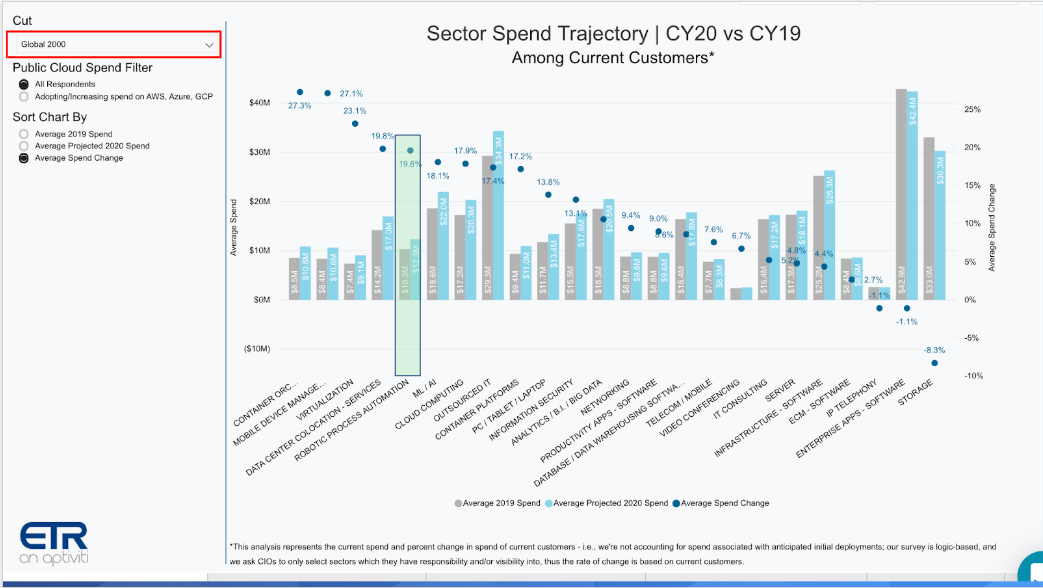

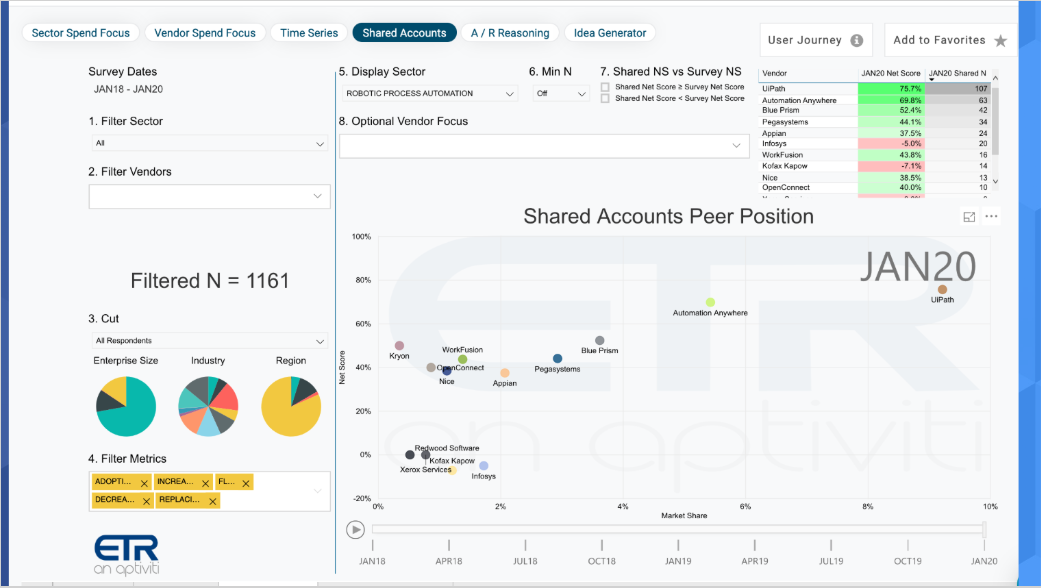

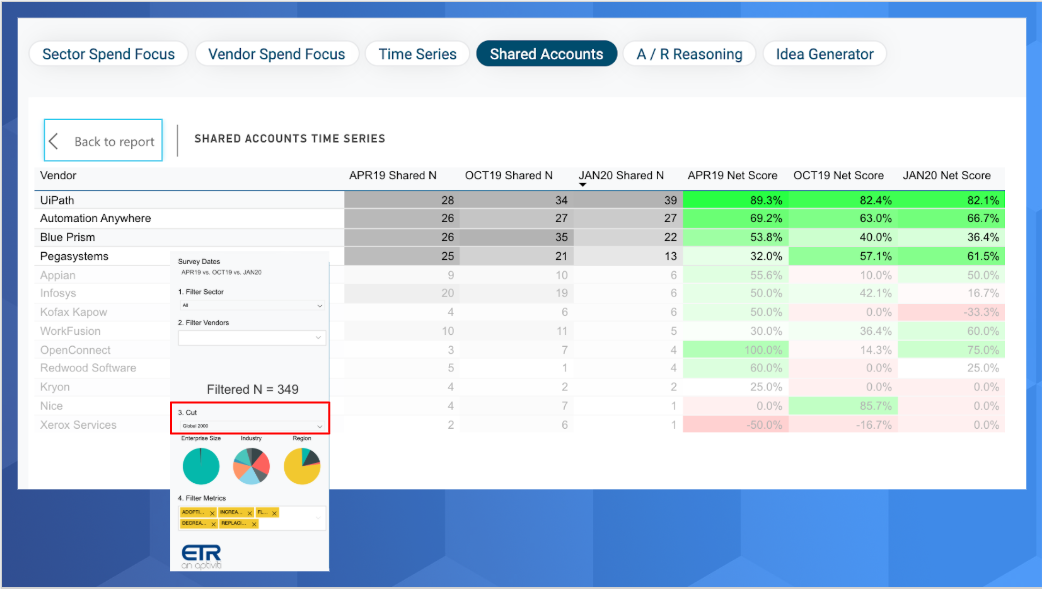

To answer that question, we looked at the latest spending data from Enterprise Technology Research, which shows that RPA is one of the fastest-growing segments in technology right now, especially when it comes to larger enterprises. The sector has a very strong “net score” compared with other technology segments. ETR’s net score is a measure of spending velocity that takes into account whether a customer is planning to spend more or less on a particular provider, based on surveys dating back to January 2017.

ETR’s data shows that RPA is truly on the enterprise agenda, and that UiPath and Automation Anywhere not only have the largest market share of the market, but are also putting some distance between themselves and their rivals.

That’s not to say there isn’t room for any other players. ETR’s data shows the likes of Blue Prism Ltd., Pegasystems Inc. and WorkFusion Inc. are also enjoying some good traction in the space with some strong net scores of their own.

The picture changes when we narrow things down to the biggest enterprises in ETR’s surveys, though. Suddenly, UiPath’s net score jumps to 80% while Pegasystems also has more of a presence. But Automation Anywhere records a slight dip, and Blue Prism also declines.

“The other key point on this chart is that 85% of UiPath customers and 70% of Automation Anywhere customers plan to spend more this year than last year, and that is pretty impressive,” Vellante said.

The future of the RPA market will be defined by its ability to break into more use cases with deeper business integration. There’s a real opportunity to “cross the chasm” and deliver useful, low-code systems to subject matter experts in business areas that have strong potential to drive change.

“This idea of hyper-automation is buzz wordy but it has meaning,” Vellante said. “Companies that bring RPA together with process mining and machine intelligence that drives process analytics have great potential, so long as organizational stove pipes can be broken down. Put process data and analytics at the core to drive decision-making and change.”

In other words, whoever can break out and hit escape velocity in the RPA market is likely to have a very bright future. But there’s unlikely to be room for everyone at the table, since the market is still fairly small compared with larger markets such as cloud computing.

“This is more of a winner-take-all market, it’s not a trillion-dollar TAM,” Vellante said. “It’s tens of billions of dollars and maybe north of $30 billion, but it’s somewhat of a zero-sum game market, in my opinion.”

And the winners are most likely to be those companies that have already carved out an early lead. Indeed, there’s not even much room for big software players such as Microsoft Corp. and SAP SE, which have both made moves into the market. The problem is that Microsoft and SAP both have an incremental view of the market, and bundle RPA as a checkoff item rather than give it a higher priority.

“Organizations that really want to benefit from so-called hyper-automation will be leaning heavily on software from specialists who have the vision, resources, culture and focus to drive digital process transformation,” Vellante said. “No. 1 will make a lot of money. No. 2 will do OK, and everyone else will struggle for profits.”

Here’s the full video analysis:

THANK YOU