BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

BLOCKCHAIN

Digital asset startup Bakkt LLC, the brainchild of New York Stock Exchange owner Intercontinental Exchange Inc. said today it has raised $300 million in new funding at a time cryptocurrency markets are tanking on coronavirus fears.

The Series B round included Intercontinental Exchange, Microsoft’s M12, PayU, Boston Consulting Group, Goldfinch Partners, CMT Digital and Pantera Capital.

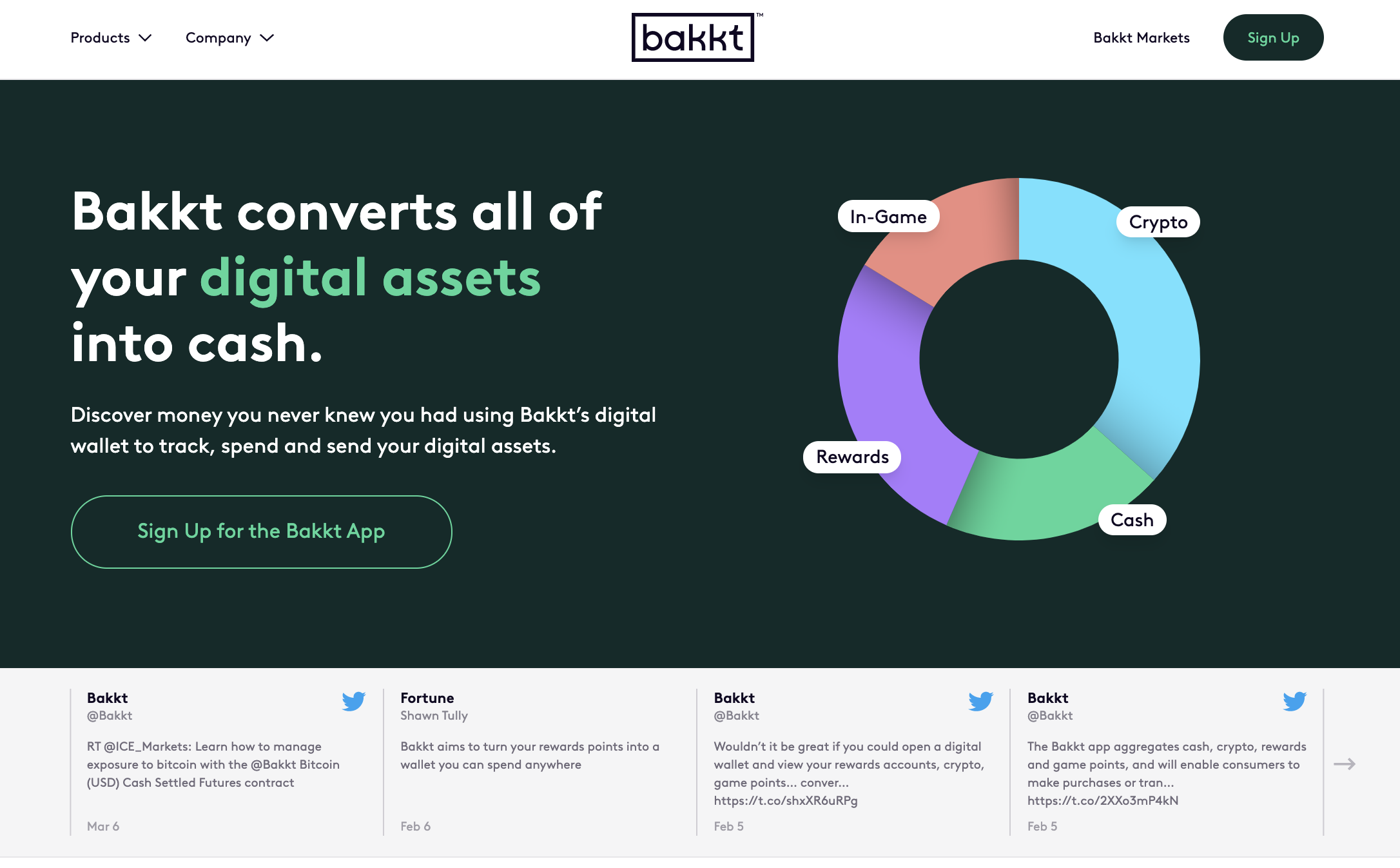

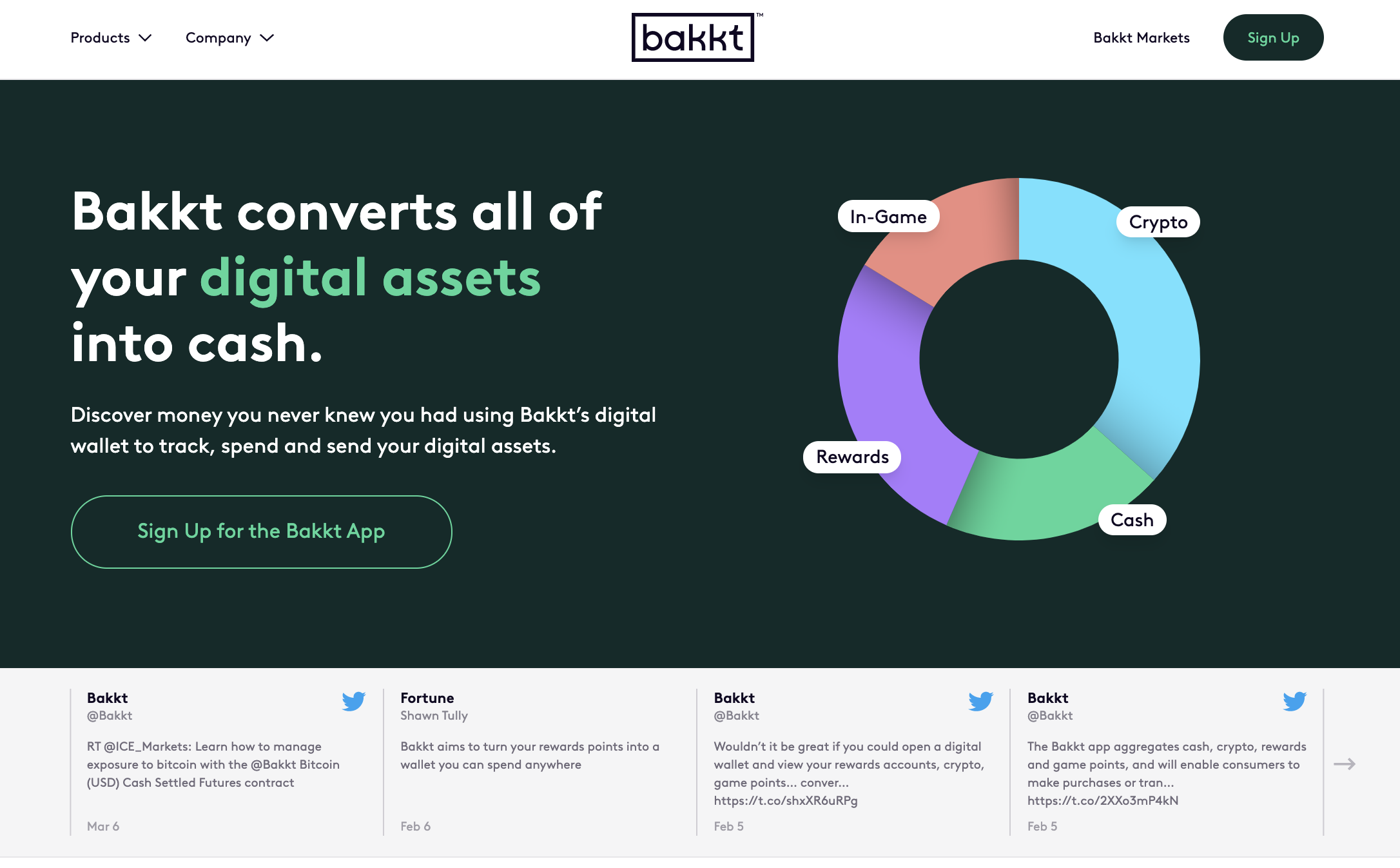

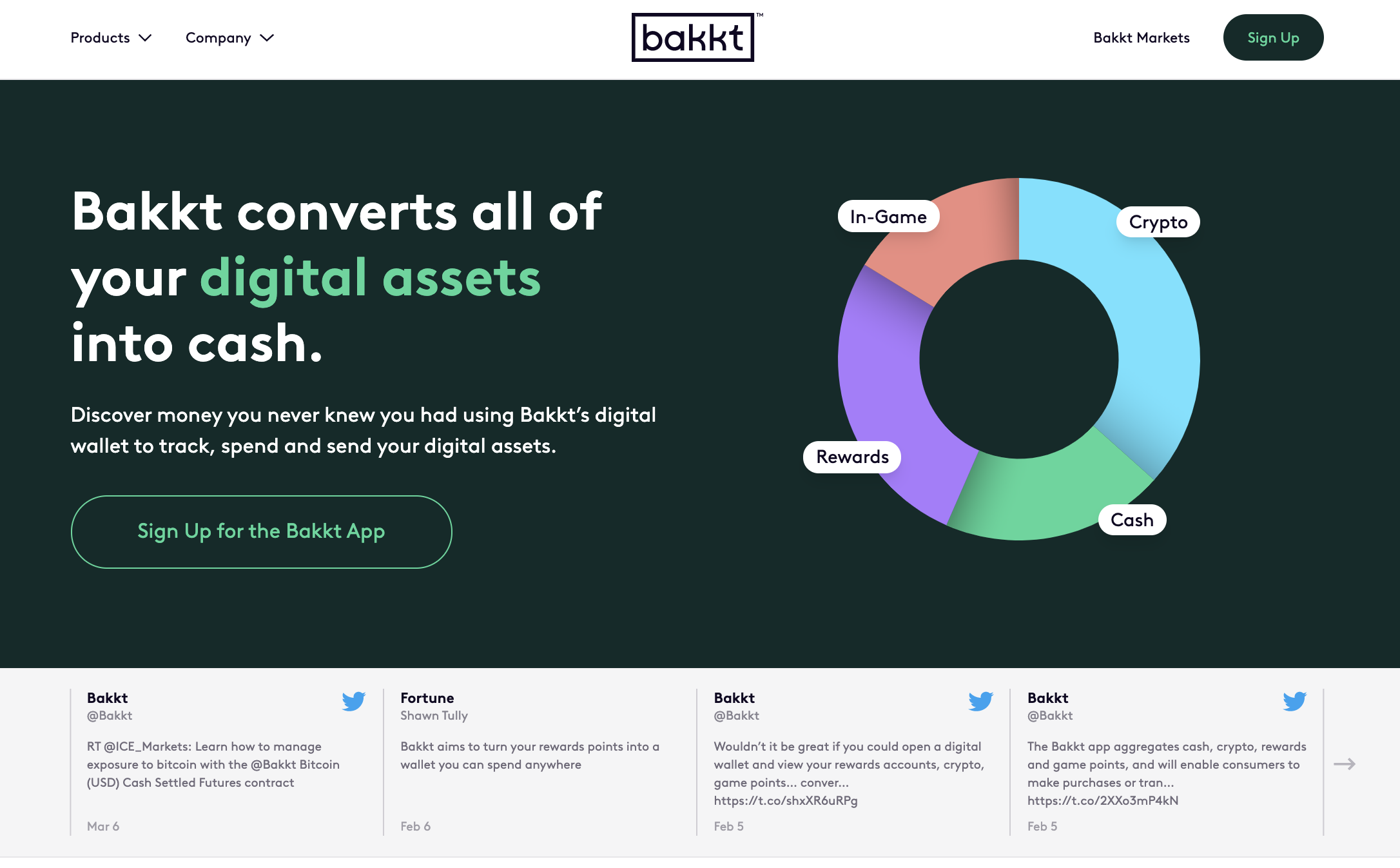

Founded in 2018, Bakkt has become a one-stop shop for managing digital assets. While best known for its cryptocurrency services, Bakkt also allows users to managed assets such as loyalty and rewards points as well as in-game assets.

On the cryptocurrency side, Bakkt offers an exchange service with support for bitcoin along with custodial and bitcoin futures products. Despite great promise, Bakkt’s bitcoin futures bombed on debut in September. The custodial service was launched in November after gaining regulatory approval.

Moving forward, Bakkt plans to launch a new app in the northern summer to allow users to aggregate their digital assets into a single digital wallet.

Bakkt Chief Executive Officer Mike Blandina wrote on Medium that Bakkt now has 350 employees and powers the loyalty redemption programs for seven of the top 10 financial institutions and more than 4,500 loyalty and incentive programs, including two of the largest US airlines. “We have the unique opportunity to leverage the technology, infrastructure and partners across our businesses to bring innovative new products to market and in doing so expand access to the global economy,” Blandina said.

That Bakkt operates in markets that are not related to cryptocurrency alone spreads its potential risk, although likewise having major airlines as clients during a global pandemic won’t be of help given that the airline industry is in deep trouble thanks to the coronavirus-related downturn in travel. Earlier today U.S. airlines asked the federal government for a $50 billion aid package.

On the cryptocurrency side, the roller coaster continues. After crashing to below $4,000 March 12 during the coronavirus market chaos, bitcoin has recovered slightly but the market is still massively down over the last week. Bitcoin was trading at $5,148.01 at 9:15 p.m EDT, down from nearly $8,000 at the same time last week.

Support our mission to keep content open and free by engaging with theCUBE community. Join theCUBE’s Alumni Trust Network, where technology leaders connect, share intelligence and create opportunities.

Founded by tech visionaries John Furrier and Dave Vellante, SiliconANGLE Media has built a dynamic ecosystem of industry-leading digital media brands that reach 15+ million elite tech professionals. Our new proprietary theCUBE AI Video Cloud is breaking ground in audience interaction, leveraging theCUBEai.com neural network to help technology companies make data-driven decisions and stay at the forefront of industry conversations.